Tyler Technologies Credit Card Charges Explained

Tyler technologies charge on credit card – Tyler Technologies, a leading provider of software and services to the public sector, offers a variety of payment options for its products and […]

Tyler technologies charge on credit card – Tyler Technologies, a leading provider of software and services to the public sector, offers a variety of payment options for its products and services. One common method is using a credit card. Understanding how Tyler Technologies handles credit card charges, including fees, security, and customer support, is essential for both individuals and organizations utilizing their solutions.

This article delves into the intricacies of using credit cards with Tyler Technologies, providing insights into the various aspects of this payment method, including accepted credit card brands, processing fees, security measures, and customer support channels.

Tyler Technologies Overview

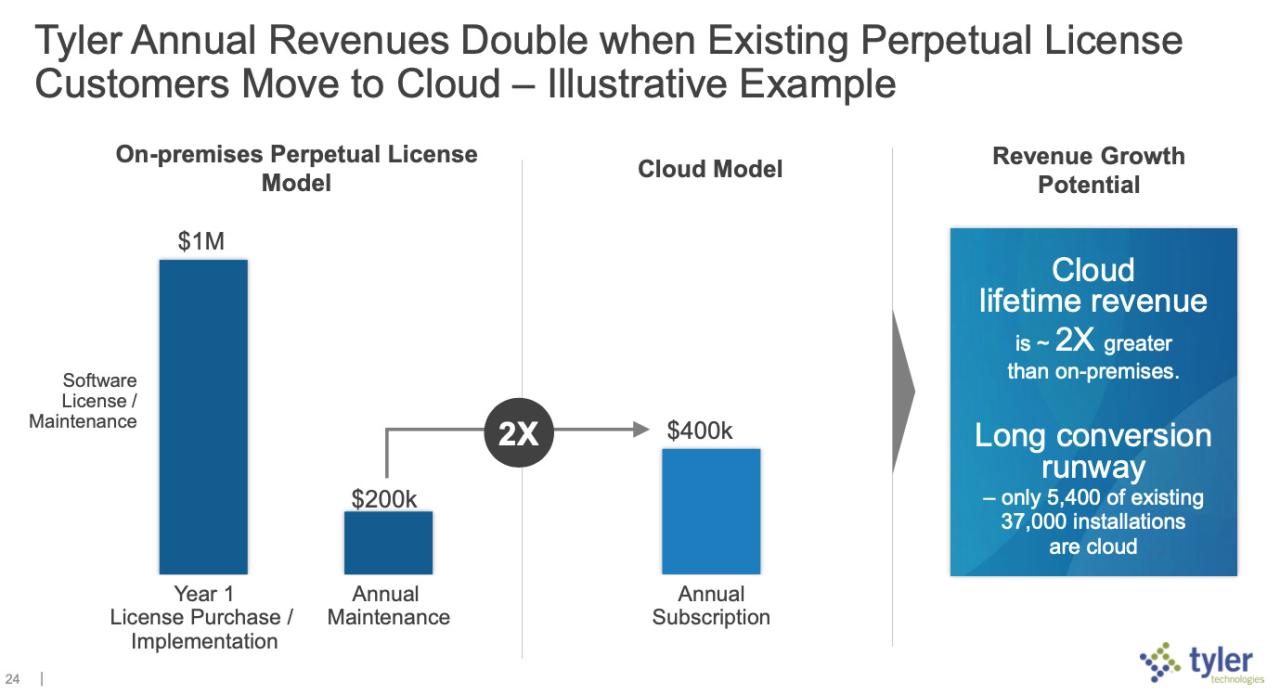

Tyler Technologies is a leading provider of software and services to the public sector, primarily focused on local governments in the United States. The company’s mission is to empower state and local governments to operate more efficiently and effectively, serving citizens better. Tyler Technologies offers a comprehensive suite of solutions, including enterprise resource planning (ERP), public safety, justice, and citizen engagement platforms.

Company Overview

Tyler Technologies has established a strong presence in the government technology market, boasting a significant customer base and a wide range of solutions. Here are some key facts and figures about the company:

* Revenue: Tyler Technologies generated over $1.5 billion in revenue in 2022, reflecting its substantial market share and consistent growth.

* Market Capitalization: The company’s market capitalization currently exceeds $10 billion, signifying its significant value in the public markets.

* Number of Employees: Tyler Technologies employs over 6,000 people across the United States, showcasing its commitment to building a robust workforce to support its operations and serve its clients.

Position in the Government Technology Market

Tyler Technologies holds a prominent position in the government technology market. The company’s focus on local governments, coupled with its comprehensive suite of solutions, has enabled it to secure a substantial market share. Tyler Technologies has established itself as a trusted partner for government agencies seeking to modernize their operations and enhance their service delivery.

“Tyler Technologies is a leading provider of integrated software and services for the public sector. We help our clients improve the lives of citizens by enabling them to operate more efficiently and effectively.” – Tyler Technologies

Tyler Technologies Payment Options

Tyler Technologies offers a variety of payment options to accommodate the needs of its diverse clientele. These options aim to provide flexibility and convenience for customers seeking to purchase Tyler Technologies’ products and services.

Accepted Credit Card Brands

Tyler Technologies accepts a wide range of major credit cards for payment. These cards provide customers with a secure and widely recognized method for making purchases.

- Visa

- Mastercard

- American Express

- Discover

Credit Card Payment Process

Making a payment using a credit card on the Tyler Technologies platform is a straightforward process. Customers can typically complete the transaction online or over the phone, depending on their preferred method.

- Select Products or Services: Begin by selecting the desired products or services from the Tyler Technologies website or catalog. This step involves browsing the available options and adding them to your shopping cart.

- Proceed to Checkout: Once you have finished selecting your items, proceed to the checkout page. Here, you will be presented with a summary of your order, including the total cost.

- Enter Credit Card Information: On the checkout page, you will be prompted to enter your credit card details. This includes your card number, expiration date, and the three- or four-digit security code (CVV or CVC) found on the back of your card.

- Review and Confirm: Before submitting your payment, carefully review the information entered to ensure accuracy. Once you are satisfied, click the “Confirm Order” or “Submit Payment” button to finalize the transaction.

- Payment Confirmation: After successful payment processing, you will receive a confirmation email or notification. This confirmation will typically include details about your order, payment amount, and transaction ID.

Credit Card Processing Fees

Tyler Technologies, like many other companies, charges credit card processing fees for transactions made through its platform. These fees are a standard practice in the industry, designed to cover the costs associated with processing credit card payments. It’s essential to understand these fees and compare them to industry standards and competitors to ensure you’re getting a fair deal.

Credit Card Processing Fee Breakdown

Credit card processing fees are typically broken down into two main categories: percentage-based fees and fixed charges.

- Percentage-based fees are calculated as a percentage of the transaction amount. This percentage varies depending on the type of credit card used (e.g., Visa, Mastercard, American Express) and the specific transaction type (e.g., online payment, in-person payment).

- Fixed charges are a set fee charged per transaction, regardless of the amount. These fees can vary depending on the processor and the type of transaction.

Here’s a table illustrating a typical breakdown of credit card processing fees:

| Fee Type | Description | Typical Rate |

|---|---|---|

| Percentage-based Fee | A percentage of the transaction amount charged for processing the payment. | 1.5% – 3.5% |

| Fixed Charge | A flat fee charged per transaction, regardless of the amount. | $0.10 – $0.30 |

| Other Fees | May include monthly gateway fees, PCI compliance fees, and chargeback fees. | Varies depending on the processor and services used. |

It’s important to note that these are just examples, and actual fees may vary depending on the specific processor, transaction type, and other factors.

Comparison to Industry Standards and Competitors

Tyler Technologies’ credit card processing fees are generally in line with industry standards. Many other software providers and payment processors charge similar fees. It’s important to compare rates from different providers to ensure you’re getting the best value for your money.

- For example, a competitor like [competitor name] might charge a slightly lower percentage-based fee but a higher fixed charge.

- Another competitor, [competitor name], might offer a lower overall rate but require a longer contract term.

Ultimately, the best way to determine if Tyler Technologies’ credit card processing fees are competitive is to compare them to other providers in the market. You can use online tools and resources to compare rates and features from different companies.

Security and Data Protection

Protecting your sensitive financial information is a top priority for Tyler Technologies. We understand the importance of safeguarding your credit card data and employ robust security measures to ensure its confidentiality and integrity.

Compliance with Industry Standards

Tyler Technologies is committed to adhering to industry best practices for data security. We are fully compliant with the Payment Card Industry Data Security Standard (PCI DSS), a comprehensive set of security requirements designed to protect cardholder data. This compliance demonstrates our dedication to maintaining the highest level of security for your financial information.

Customer Support and Billing: Tyler Technologies Charge On Credit Card

Tyler Technologies prioritizes customer satisfaction and provides comprehensive support for all payment-related inquiries. You can reach out to their customer support team for assistance with credit card payments, billing issues, and any other concerns.

Contacting Customer Support

To ensure prompt and efficient service, Tyler Technologies offers multiple channels for contacting their customer support team. These channels include:

- Phone: You can reach their dedicated customer support line at [insert phone number here] during business hours. This is a direct line for addressing urgent issues or seeking immediate assistance.

- Email: For non-urgent inquiries or detailed information, you can email the customer support team at [insert email address here]. This allows you to provide detailed information and receive a comprehensive response.

- Online Portal: Tyler Technologies may have a dedicated online portal or customer support section on their website. This portal often provides FAQs, knowledge base articles, and contact forms for submitting inquiries.

Billing Cycle and Invoice Generation

Tyler Technologies follows a standard billing cycle for credit card payments. The billing cycle and invoice generation process typically involves the following steps:

- Transaction Recording: Each credit card payment made through Tyler Technologies is recorded and documented in their system.

- Invoice Generation: At the end of the billing cycle, Tyler Technologies generates invoices that summarize all transactions made during the period. This invoice will typically include details such as the transaction date, amount, description, and payment method.

- Invoice Delivery: Invoices are typically delivered electronically to the customer’s registered email address. In some cases, Tyler Technologies may also offer the option for paper invoices.

- Payment Due Date: The invoice will clearly state the payment due date, allowing customers ample time to make their payments.

Dispute Resolution Procedures, Tyler technologies charge on credit card

In the event of a dispute regarding a credit card transaction, Tyler Technologies provides a clear and transparent dispute resolution process:

- Initial Contact: Customers should first contact Tyler Technologies’ customer support team to explain the nature of the dispute. Provide as much information as possible, including the transaction date, amount, and any relevant details.

- Investigation: Tyler Technologies will investigate the dispute and review the relevant documentation, such as transaction records and payment history.

- Resolution: Based on the investigation findings, Tyler Technologies will attempt to resolve the dispute with the customer. This may involve adjusting the invoice, issuing a refund, or providing a credit.

- Escalation: If the dispute cannot be resolved through initial contact with customer support, customers may have the option to escalate the issue to a higher level within Tyler Technologies’ organization.

Payment Alternatives

Tyler Technologies offers various payment methods beyond credit cards to cater to diverse customer preferences and financial situations. These alternative options provide flexibility and convenience, enabling you to choose the method that best suits your needs.

Bank Transfers and ACH Payments

Bank transfers and Automated Clearing House (ACH) payments offer a secure and efficient way to make payments directly from your bank account. These methods are often preferred for larger transactions or recurring payments, as they eliminate the need for credit card processing fees.

- Bank Transfers: Involves manually initiating a transfer from your bank account to Tyler Technologies’ designated account. This method is typically used for one-time payments or when a specific transaction requires a direct transfer.

- ACH Payments: An electronic transfer of funds directly from your bank account to Tyler Technologies’ account. This method is ideal for recurring payments, as it can be automated for consistent and timely payments.

Comparison of Payment Methods

Understanding the advantages and disadvantages of each payment method helps you make informed decisions.

| Payment Method | Advantages | Disadvantages |

|---|---|---|

| Credit Card | Widely accepted, convenient, provides purchase protection | Potential for high processing fees, interest charges, and security risks |

| Bank Transfer | Direct payment, no processing fees, secure | Requires manual initiation, may have longer processing times |

| ACH Payment | Automated payments, no processing fees, secure | Requires bank account information, may have processing delays |

Closing Summary

In conclusion, Tyler Technologies provides a comprehensive approach to credit card payments, offering transparency in fees, prioritizing security, and ensuring accessible customer support. By understanding the company’s policies and procedures, individuals and organizations can navigate their payment experience with confidence and clarity.

When it comes to Tyler Technologies’ credit card charges, it’s important to understand the various fees associated with their services. These charges can vary depending on the specific service you’re using, but often include a processing fee and potential interest charges.

For a more comprehensive understanding of these charges, you can check out their website, which often provides details about their billing practices. If you’re looking for alternative solutions, consider exploring SE technology , which offers a range of options for managing and processing payments, potentially providing a more cost-effective solution for your specific needs.

Remember to always review the terms and conditions of any payment processing service to ensure you’re fully informed about their fees and policies.