Technology Private Equity: Investing in the Future

Technology private equity has emerged as a dominant force in the investment landscape, fueling innovation and growth across the digital world. From its humble beginnings, this sector has witnessed a […]

Technology private equity has emerged as a dominant force in the investment landscape, fueling innovation and growth across the digital world. From its humble beginnings, this sector has witnessed a meteoric rise, driven by technological advancements, surging venture capital, and the disruptive power of digital transformation.

Technology private equity firms are actively seeking opportunities in a vast array of sectors, including software, artificial intelligence, cybersecurity, and e-commerce. These investments play a crucial role in shaping the future of technology, driving companies to new heights and fostering groundbreaking advancements.

The Rise of Technology Private Equity

Technology private equity has emerged as a dominant force in the investment landscape, transforming the way businesses are built and scaled. Its evolution reflects the dynamic nature of the technology sector, where innovation and disruption are constant.

Key Drivers of Growth

The growth of technology private equity is fueled by a confluence of factors, each contributing to its increasing prominence.

- Technological Advancements: Rapid advancements in areas like artificial intelligence, cloud computing, and biotechnology have created new opportunities for growth and innovation, attracting significant private equity investment. The rise of these technologies has led to the emergence of new industries and business models, creating a fertile ground for private equity to invest in and capitalize on.

- Increasing Venture Capital Investment: The surge in venture capital investment in technology startups has created a pipeline of promising companies for private equity firms to acquire and scale. As venture-backed companies mature and seek to expand their operations, private equity provides the capital and expertise to fuel their growth.

- Digital Disruption: The rise of digital technologies has disrupted traditional industries, creating opportunities for new entrants and challenging established players. Private equity firms have been quick to capitalize on these disruptions, investing in companies that are transforming industries through technology. Examples include the rise of online retailers like Amazon and the disruption of traditional media by streaming services like Netflix.

Successful Technology Private Equity Investments

Technology private equity has yielded significant returns for investors, with several notable examples showcasing its impact on the industry.

- Vista Equity Partners’ Investment in Software AG: In 2018, Vista Equity Partners acquired Software AG, a leading provider of enterprise software solutions, for $4.3 billion. Vista’s investment helped Software AG accelerate its growth strategy, focusing on cloud-based solutions and expanding its global reach. This investment highlights the role of private equity in supporting the strategic transformation of technology companies.

- KKR’s Investment in Cloudera: In 2017, KKR acquired Cloudera, a leading provider of big data analytics solutions, for $5.3 billion. KKR’s investment helped Cloudera streamline its operations, expand its product offerings, and achieve profitability. This investment demonstrates the ability of private equity to unlock value in complex technology companies.

- Silver Lake’s Investment in Dell Technologies: In 2013, Silver Lake partnered with Michael Dell to take Dell private in a $24.9 billion deal. This investment enabled Dell to focus on its core business, streamline operations, and invest in new technologies. The subsequent public offering of Dell Technologies in 2018 highlighted the successful execution of the private equity strategy.

Investment Strategies in Technology Private Equity

Technology private equity firms employ a range of investment strategies to capitalize on the rapid growth and innovation within the tech sector. These strategies vary in terms of their risk profiles, return expectations, and the stage of development of the target companies.

Growth Equity

Growth equity investments typically target established technology companies that are already generating revenue and demonstrating strong growth potential. These firms seek to provide capital and strategic support to help these companies scale their operations, expand into new markets, or acquire complementary businesses.

- Focus: Mature companies with established revenue streams and growth potential.

- Investment Size: Typically larger than venture capital investments, ranging from tens of millions to hundreds of millions of dollars.

- Risk Profile: Lower risk compared to venture capital, as companies have a proven track record.

- Return Expectations: Moderate returns, typically in the range of 15-25% per year.

- Examples: Salesforce, Zoom, and Snowflake have all received growth equity investments from private equity firms.

Buyout, Technology private equity

Buyout investments involve acquiring a controlling interest in a technology company, often with the goal of taking the company private. These investments typically target mature companies with stable cash flows and a proven business model. Private equity firms often leverage debt financing to acquire these companies, and they may implement operational improvements or pursue strategic acquisitions to enhance the company’s value.

- Focus: Mature companies with stable cash flows and a proven business model.

- Investment Size: Can be very large, often exceeding billions of dollars.

- Risk Profile: Lower risk than venture capital or growth equity, as companies have a proven track record and stable cash flows.

- Return Expectations: Moderate to high returns, typically in the range of 15-30% per year.

- Examples: The acquisition of Dell by private equity firms in 2013 and the acquisition of BMC Software by KKR in 2018 are examples of technology buyouts.

Venture Capital

Venture capital investments target early-stage technology companies that are still developing their products or services. These investments are highly speculative, as the success of these companies is uncertain. Venture capital firms provide capital and mentorship to help these companies navigate the early stages of their development.

- Focus: Early-stage companies with high growth potential but limited revenue.

- Investment Size: Typically smaller than growth equity or buyout investments, ranging from tens of thousands to millions of dollars.

- Risk Profile: High risk, as the success of these companies is uncertain.

- Return Expectations: High returns, with the potential for significant upside, but also the risk of complete loss.

- Examples: Companies like Airbnb, Uber, and Spotify all received venture capital funding in their early stages.

Sectors Attracting Private Equity Investment

Within the technology sector, several sub-sectors have consistently attracted significant private equity investment.

- Software: This sector remains a hotbed for private equity activity, driven by the increasing adoption of cloud-based software solutions and the growing demand for enterprise software applications. Examples include Salesforce, Workday, and Adobe.

- Artificial Intelligence (AI): AI is rapidly transforming industries, creating opportunities for private equity firms to invest in companies developing AI-powered solutions for various applications, such as automation, data analytics, and customer service. Examples include UiPath, C3.ai, and DataRobot.

- Cybersecurity: As cyberattacks become more sophisticated, the demand for cybersecurity solutions is growing rapidly. Private equity firms are investing in companies that provide cybersecurity services, software, and hardware. Examples include CrowdStrike, Palo Alto Networks, and Fortinet.

- E-commerce: The rise of online shopping has fueled significant growth in the e-commerce sector. Private equity firms are investing in companies that operate online marketplaces, provide logistics services, and develop e-commerce platforms. Examples include Shopify, Amazon, and Alibaba.

The Future of Technology Private Equity

The technology private equity industry is poised for continued growth, driven by the rapid pace of innovation and the increasing digitization of the global economy. However, several trends and challenges are shaping the future of this sector, requiring investors to adapt their strategies and approach.

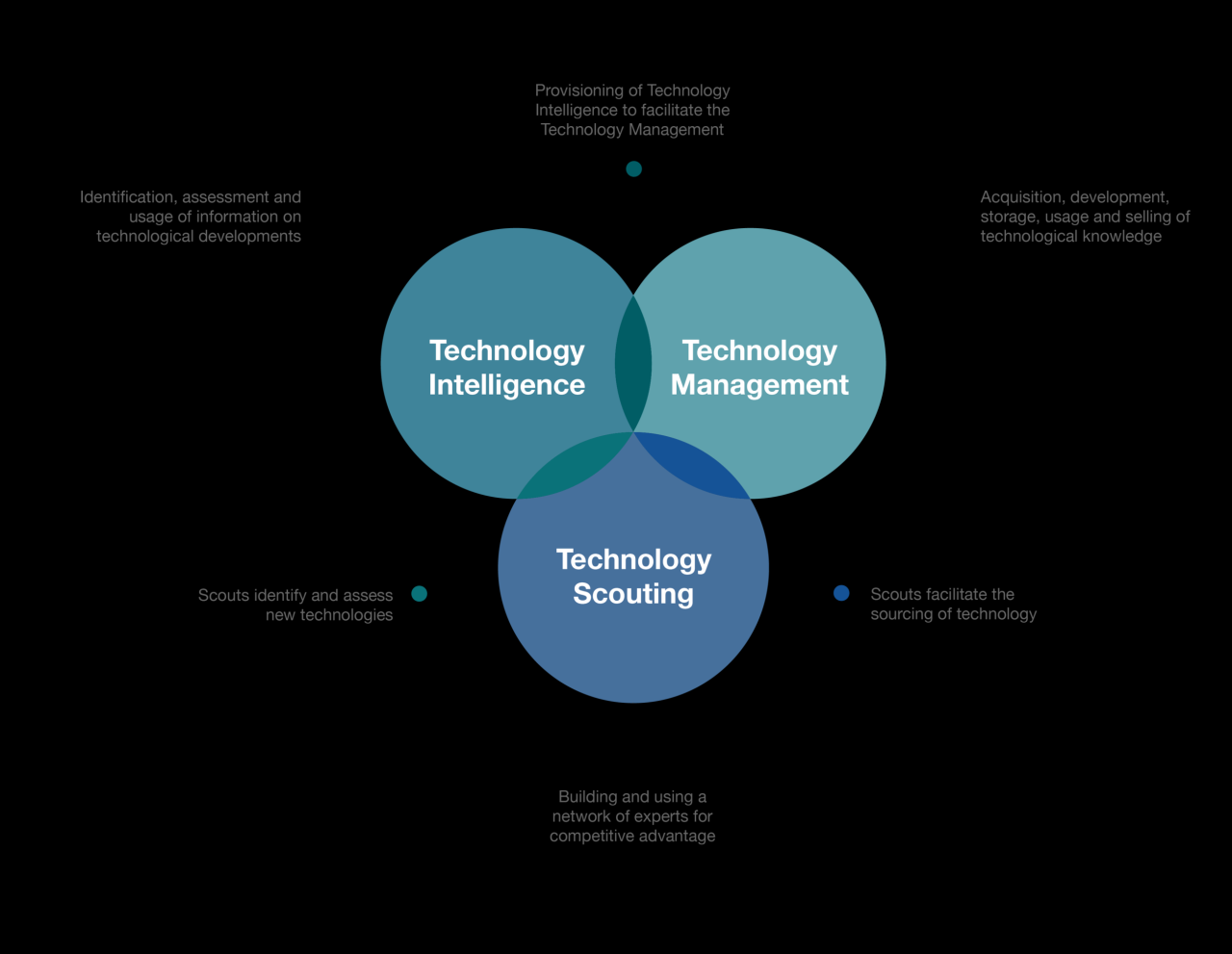

Emerging Technologies and Investment Opportunities

Emerging technologies such as artificial intelligence (AI), blockchain, and the Internet of Things (IoT) are creating new investment opportunities across various sectors. AI is revolutionizing industries like healthcare, finance, and manufacturing, while blockchain is transforming supply chain management, financial services, and digital identity. The IoT is connecting devices and systems, creating new opportunities for data analysis and automation.

- AI: AI-powered solutions are transforming industries, creating opportunities for investments in companies developing advanced AI algorithms, machine learning platforms, and data analytics tools. For example, investments in healthcare AI companies are growing rapidly, as these companies develop AI-powered diagnostic tools, drug discovery platforms, and personalized treatment plans.

- Blockchain: Blockchain technology is disrupting traditional industries, creating opportunities for investments in companies developing blockchain-based solutions for supply chain management, financial services, and digital identity. For example, investments in blockchain-based supply chain management companies are growing, as these companies develop solutions for tracking goods and improving transparency.

- IoT: The IoT is connecting devices and systems, creating opportunities for investments in companies developing IoT hardware, software, and data analytics platforms. For example, investments in smart home companies are growing, as these companies develop IoT-enabled devices for home automation and security.

ESG Considerations in Technology Private Equity

ESG (environmental, social, and governance) considerations are becoming increasingly important in technology private equity investments. Investors are increasingly looking for companies with strong ESG practices, as these practices can enhance long-term value creation and reduce investment risks.

“ESG factors are becoming increasingly important for investors as they seek to align their investments with their values and contribute to a more sustainable future.” – [Source: Global Sustainable Investment Alliance (GSIA)]

- Environmental: Investors are focusing on companies that are reducing their environmental impact, such as those developing clean energy solutions, promoting sustainable practices, and reducing carbon emissions.

- Social: Investors are looking for companies that are promoting social responsibility, such as those promoting diversity and inclusion, supporting ethical labor practices, and addressing social issues.

- Governance: Investors are emphasizing good corporate governance, such as transparency, accountability, and ethical business practices.

Ultimate Conclusion: Technology Private Equity

As technology continues to evolve at an unprecedented pace, technology private equity will remain a critical engine for innovation and growth. The industry’s ability to identify and nurture promising startups, while leveraging its expertise to guide established companies, will continue to be a driving force in shaping the future of the digital world. With its focus on emerging technologies, ESG considerations, and strategic partnerships, technology private equity is poised to play an even more significant role in the years to come.

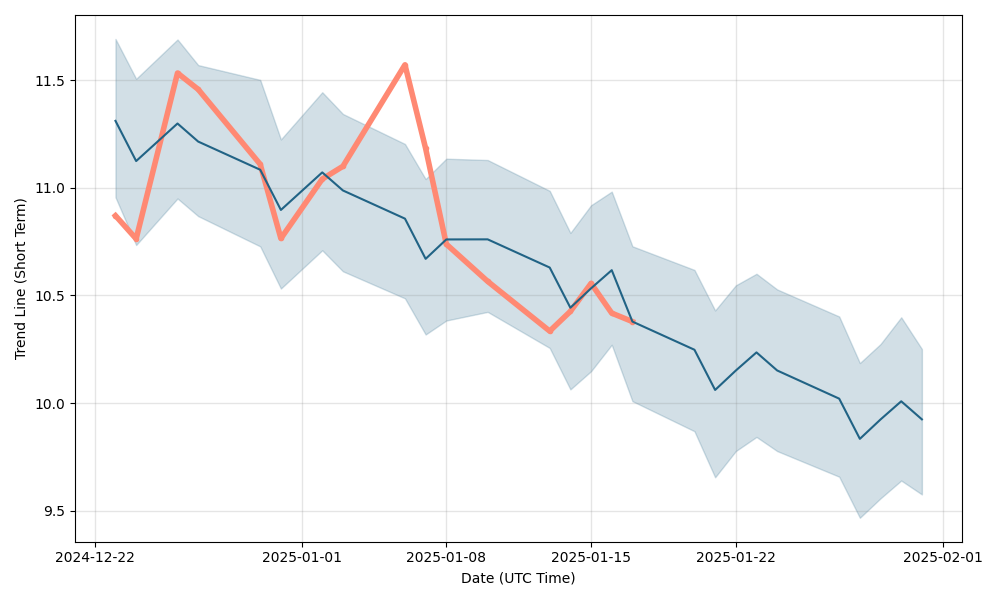

Technology private equity firms are constantly seeking innovative companies that can disrupt the market. One such area of interest is the trading technologies space, which is rapidly evolving with the advent of new platforms and algorithms. To understand the landscape, it’s crucial to explore the trading technologies pricing strategies and how they impact the value proposition of these companies.

This understanding is essential for private equity firms to identify promising investments and capitalize on the potential of these transformative technologies.