Technology Insurance Company Inc: Workers Compensation Innovation

Technology insurance company inc workers compensation – Technology Insurance Company Inc: Workers’ Compensation Innovation, is a fascinating area where technology is revolutionizing the way workers’ compensation insurance is handled. This […]

Technology insurance company inc workers compensation – Technology Insurance Company Inc: Workers’ Compensation Innovation, is a fascinating area where technology is revolutionizing the way workers’ compensation insurance is handled. This is not just about updating systems, but about creating a more efficient, effective, and humane experience for everyone involved.

From using artificial intelligence (AI) to analyze risk and detect fraud, to implementing telemedicine for faster diagnosis and treatment, technology is changing the landscape of workers’ compensation. Insurance companies are leveraging data analytics, wearable devices, and other cutting-edge solutions to streamline claims processing, reduce costs, and improve customer service. The impact extends beyond efficiency, as technology can also enhance employee engagement and safety initiatives.

The Role of Technology in Workers’ Compensation Insurance

Technology is revolutionizing the workers’ compensation insurance industry, making it more efficient, cost-effective, and customer-centric. By leveraging advanced technologies, insurers are streamlining processes, enhancing risk management, and improving the overall experience for both employers and employees.

The Use of Artificial Intelligence (AI) and Machine Learning (ML) in Workers’ Compensation

AI and ML are transforming various aspects of the workers’ compensation industry, leading to significant improvements in risk assessment, claims processing, and fraud detection.

- Risk Assessment: AI-powered algorithms analyze vast amounts of data, including historical claims data, industry trends, and workplace safety records, to identify potential risks and predict future claims. This allows insurers to proactively assess risk, tailor coverage, and recommend preventive measures, ultimately reducing the likelihood and severity of workplace injuries.

- Claims Processing: AI and ML are automating many aspects of claims processing, from initial claim intake to case management and settlement. AI-powered chatbots can provide instant responses to employee inquiries, while ML algorithms can automate data entry, document review, and claims validation. This results in faster claim processing times, reduced administrative costs, and improved customer satisfaction.

- Fraud Detection: AI algorithms can detect patterns and anomalies in claims data that may indicate fraudulent activity. By analyzing factors like claim frequency, claim amounts, and medical billing patterns, AI can identify suspicious claims and flag them for further investigation. This helps insurers prevent fraudulent claims, protect their financial interests, and ensure fair compensation for legitimate claims.

Benefits of Technology for Workers’ Compensation Companies

The integration of technology into workers’ compensation operations offers numerous benefits, ranging from increased efficiency and cost reduction to enhanced customer service and improved risk management. Technology enables workers’ compensation companies to streamline processes, optimize resource allocation, and ultimately, provide a more efficient and effective service to their clients.

Streamlined Claims Processing

Technology significantly streamlines the claims processing workflow, reducing administrative burden and improving efficiency.

- Automated Claims Intake: Online portals and mobile applications allow employees to report claims quickly and conveniently, reducing manual data entry and paperwork.

- Automated Claim Assessment: Artificial intelligence (AI) and machine learning algorithms can analyze claims data to identify potential fraud, assess the severity of injuries, and estimate claim costs, leading to faster and more accurate claim processing.

- Real-Time Claim Tracking: Technology enables real-time tracking of claim status, allowing both employees and employers to access updates on claim progress, facilitating communication and transparency.

Reduced Administrative Burden

Technology automates many administrative tasks, freeing up staff to focus on more strategic activities and enhancing overall efficiency.

- Electronic Document Management: Cloud-based platforms enable secure storage and easy access to claim documents, eliminating the need for physical files and improving information retrieval.

- Automated Reporting and Analytics: Technology generates reports and dashboards, providing insights into claims trends, risk areas, and operational performance, enabling data-driven decision-making.

- Workflow Automation: Automating routine tasks, such as claim assignment, document routing, and communication, reduces manual effort and ensures consistency.

Enhanced Customer Service

Technology empowers workers’ compensation companies to provide a more personalized and responsive customer service experience.

- Self-Service Portals: Online portals allow policyholders to access information, submit claims, track progress, and manage their accounts 24/7, reducing the need for phone calls and improving accessibility.

- Personalized Communication: Technology facilitates personalized communication through email, text messaging, and mobile applications, enabling workers’ compensation companies to provide timely updates and answer questions.

- Improved Communication Channels: Technology provides multiple communication channels, allowing policyholders to choose the method that best suits their needs, enhancing customer satisfaction.

Improved Risk Management

Technology plays a vital role in proactive risk management, helping workers’ compensation companies identify and mitigate potential hazards.

- Data Analytics for Risk Assessment: Technology analyzes historical claims data to identify high-risk areas and predict future claims, enabling targeted prevention programs and risk mitigation strategies.

- Real-Time Safety Monitoring: Wearable technology and sensors can monitor employee activity in real-time, identifying unsafe practices and providing feedback for improvement.

- Predictive Modeling: Advanced algorithms can analyze various factors, including industry trends, employee demographics, and environmental conditions, to predict future claims and develop preventive measures.

Technology-Driven Solutions for Workers’ Compensation Claims

The realm of workers’ compensation has undergone a dramatic transformation with the advent of technology, leading to more efficient and streamlined claims management processes. Technology has revolutionized how claims are filed, processed, and resolved, ultimately benefiting both employees and employers.

Technology Tools for Claims Management

Technology plays a crucial role in optimizing the workers’ compensation claims process. Various tools have been developed to facilitate efficient and effective claim management, enhancing the overall experience for all stakeholders.

- Online Portals: Online portals provide a convenient platform for employees to file claims, track their progress, and access relevant information. Employers can also utilize these portals to manage claims, communicate with employees, and access reports. For example, a company might use an online portal to allow employees to submit claim forms electronically, upload supporting documentation, and track the status of their claim.

- Mobile Apps: Mobile apps offer employees and employers on-the-go access to workers’ compensation services. Employees can use apps to file claims, access medical records, and communicate with case managers. Employers can utilize apps to monitor claims, receive notifications, and manage their workers’ compensation program. A mobile app could allow employees to submit photos of injuries, receive real-time updates on their claim status, and access contact information for medical providers.

- Automated Claim Processing Systems: Automated claim processing systems leverage artificial intelligence (AI) and machine learning to streamline the claims process. These systems can automatically verify eligibility, assess claims, and route them to the appropriate parties, significantly reducing processing time and human error. For instance, an automated system could analyze claim data to identify potential fraud or inconsistencies, leading to faster claim resolution and reduced costs.

- Digital Evidence Capture Solutions: Digital evidence capture solutions facilitate the collection and management of evidence related to workers’ compensation claims. These solutions allow for the secure storage and sharing of digital evidence, such as photos, videos, and documents. Digital evidence capture can help to support claims, prevent fraud, and expedite the claims process. An example could be using a digital evidence capture solution to record a video of an accident scene, ensuring that all relevant details are documented for later review.

Benefits and Drawbacks of Technology-Based Claims Management

Technology-based claims management approaches offer several benefits, but they also come with certain drawbacks. It’s important to weigh these factors carefully when implementing technology solutions.

- Benefits:

- Improved Efficiency: Technology can automate many tasks, reducing manual processing time and increasing efficiency. This can lead to faster claim processing and reduced costs.

- Enhanced Communication: Online portals and mobile apps facilitate seamless communication between employees, employers, and case managers. This can improve transparency and ensure that all parties are kept informed.

- Reduced Costs: Technology can help reduce administrative costs by automating tasks and minimizing human error. This can lead to lower overall workers’ compensation costs for employers.

- Improved Data Analytics: Technology allows for the collection and analysis of vast amounts of data related to workers’ compensation claims. This data can be used to identify trends, improve risk management, and develop more effective prevention strategies.

- Drawbacks:

- Security Concerns: Storing sensitive information online requires robust security measures to protect against data breaches.

- Privacy Issues: The use of technology to collect and analyze data raises concerns about employee privacy.

- Technical Challenges: Implementing and maintaining technology solutions can be complex and require technical expertise.

- Lack of Personal Touch: Overreliance on technology can sometimes lead to a lack of personal touch in claim management, which can be frustrating for employees.

Challenges and Considerations for Technology Adoption: Technology Insurance Company Inc Workers Compensation

While technology offers immense potential to revolutionize workers’ compensation, its implementation isn’t without its hurdles. This section delves into the challenges and considerations that workers’ compensation companies must address to ensure successful technology adoption.

Data Security Concerns, Technology insurance company inc workers compensation

Data security is paramount in the workers’ compensation industry, where sensitive personal and medical information is handled. Implementing new technologies introduces potential vulnerabilities that must be addressed.

- Data breaches: The risk of data breaches increases with the use of technology, especially with the increasing prevalence of cyberattacks. Sensitive information such as medical records, Social Security numbers, and financial data could be compromised, leading to legal liabilities and reputational damage.

- Compliance with regulations: Workers’ compensation companies must comply with stringent data privacy regulations like HIPAA (Health Insurance Portability and Accountability Act) and GDPR (General Data Protection Regulation). Failure to comply can result in hefty fines and penalties.

- Data encryption and access control: Robust data encryption and access control measures are crucial to protect sensitive information. Implementing strong passwords, multi-factor authentication, and data masking can significantly mitigate data security risks.

System Integration Issues

Integrating new technologies with existing systems can pose significant challenges, particularly for companies with legacy systems.

- Data compatibility: Data formats and structures may not be compatible between legacy systems and new technologies, requiring data migration and transformation processes. This can be complex and time-consuming, potentially leading to data loss or errors.

- Interoperability: Ensuring seamless communication and data exchange between different systems is essential. Lack of interoperability can lead to data silos, inefficient workflows, and increased manual processes.

- Testing and validation: Thorough testing and validation are crucial to ensure that integrated systems function correctly and deliver accurate results. This can be a time-consuming and resource-intensive process.

Resistance to Change

Introducing new technologies can encounter resistance from employees who are accustomed to traditional methods.

- Fear of job displacement: Some employees may fear that technology will automate their jobs, leading to job losses. It’s essential to address these concerns and emphasize that technology is meant to enhance efficiency and create new opportunities.

- Lack of training and support: Employees may resist new technologies if they lack adequate training and support. Providing comprehensive training programs and ongoing support can help employees adapt to new systems and workflows.

- Cultural barriers: Some companies may have a culture that is resistant to change. Building a culture of innovation and continuous improvement can encourage the adoption of new technologies.

Closure

The future of workers’ compensation is bright with the potential for further technological advancements. Blockchain, predictive analytics, and virtual reality (VR) are just a few of the exciting innovations on the horizon. These technologies promise to further personalize risk assessments, optimize rehabilitation programs, and automate claim settlements, creating a more efficient and equitable system for all. Technology is not simply a tool for insurance companies; it is a powerful force that can create a safer, healthier, and more secure workplace for everyone.

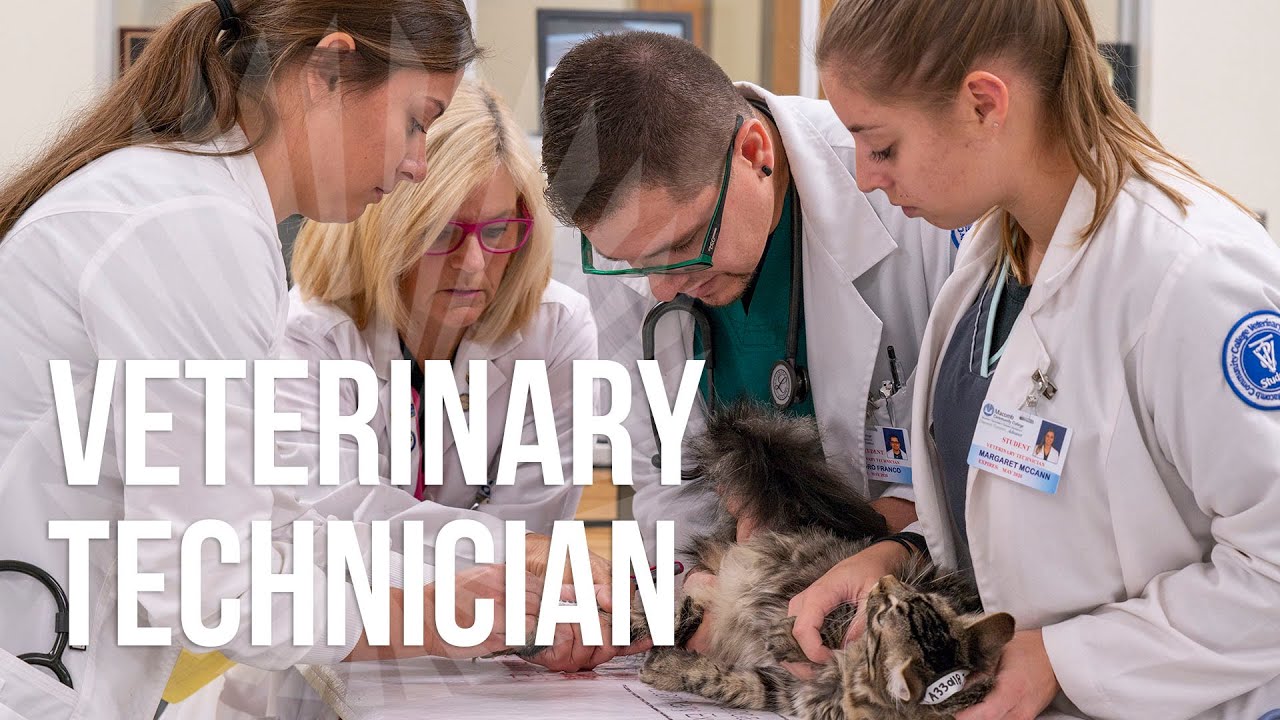

Technology Insurance Company Inc. understands the importance of protecting your workforce. When it comes to workers’ compensation, it’s crucial to have access to the latest medical technologies for accurate diagnoses and effective treatment. That’s why we often recommend partnering with companies like the richard shulman medical technologies group , known for their expertise in providing cutting-edge equipment and solutions.

This collaboration allows us to ensure that your employees receive the best possible care, minimizing downtime and promoting a safe and healthy work environment.