Technology Insurance Company Inc Phone Number: Your Guide to Contact

Technology Insurance Company Inc Phone Number sets the stage for this informative guide, offering readers a comprehensive overview of finding and contacting technology insurance providers. This guide provides a clear […]

Technology Insurance Company Inc Phone Number sets the stage for this informative guide, offering readers a comprehensive overview of finding and contacting technology insurance providers. This guide provides a clear roadmap to navigating the world of technology insurance, helping you understand the different types of coverage available, the benefits of seeking professional advice, and the essential steps involved in finding the right insurance company for your needs.

The guide delves into the various situations where contacting a technology insurance company is crucial, including obtaining quotes, filing claims, and seeking expert advice. It provides practical tips on utilizing online resources, company websites, and industry directories to locate phone numbers, ensuring you can connect with the right insurance provider quickly and efficiently.

Understanding Technology Insurance: Technology Insurance Company Inc Phone Number

Technology insurance is a crucial aspect of safeguarding your business and personal technology investments in today’s digital world. This type of insurance provides financial protection against various risks associated with your technological assets, offering peace of mind and mitigating potential financial losses.

Types of Technology Insurance

Technology insurance encompasses various types, each tailored to specific needs and risks. Here’s a breakdown of some common types:

- Cyber Liability Insurance: This coverage protects businesses from financial losses due to cyberattacks, data breaches, and other cyber-related incidents. It covers expenses related to data recovery, legal fees, regulatory fines, and notification costs.

- Equipment Breakdown Insurance: This type of insurance covers the cost of repairing or replacing electronic equipment, such as computers, servers, and networking devices, that suffer sudden and accidental breakdowns. It’s essential for businesses relying heavily on technology for operations.

- Data Breach Insurance: This specialized coverage focuses on mitigating the financial impact of data breaches, including expenses related to credit monitoring, identity theft protection, and legal costs. It helps businesses manage the aftermath of a breach and protect their reputation.

- Hardware and Software Insurance: This insurance covers the cost of repairing or replacing hardware and software due to accidental damage, theft, or natural disasters. It provides peace of mind for individuals and businesses that rely on their technology for work, entertainment, and communication.

- Extended Warranty Insurance: While not strictly technology insurance, extended warranties offer additional protection beyond the manufacturer’s warranty period. They cover repairs or replacements for malfunctions or defects, providing an extra layer of security for expensive devices.

Key Features and Benefits

Technology insurance offers numerous benefits, including:

- Financial Protection: It covers the costs of repairing or replacing damaged or stolen equipment, mitigating financial losses due to technology-related incidents.

- Business Continuity: It ensures business operations continue smoothly by providing funds to replace damaged equipment or systems, minimizing downtime and disruptions.

- Data Security: It covers expenses related to data recovery and protection, safeguarding sensitive information and protecting against reputational damage from breaches.

- Peace of Mind: It provides peace of mind knowing that you’re financially protected against unexpected technology-related risks, allowing you to focus on your business or personal life.

Common Technology Risks Covered

Technology insurance can cover a wide range of risks, including:

- Cyberattacks: This includes ransomware attacks, data breaches, and other malicious activities that can compromise data security and disrupt business operations.

- Natural Disasters: Floods, earthquakes, fires, and other natural disasters can damage or destroy technological equipment, leading to significant financial losses.

- Accidental Damage: Spills, drops, and other accidents can damage electronics, requiring costly repairs or replacements.

- Theft: Technology equipment is a common target for thieves, and insurance can cover the cost of replacement or recovery.

- Power Surges: Sudden power fluctuations can damage sensitive electronic equipment, and insurance can cover the costs of repair or replacement.

Obtaining a Phone Number for a Technology Insurance Company

Finding the phone number of a specific technology insurance company is a crucial step in contacting them for inquiries, claims, or general information. Several resources and strategies can be employed to locate this vital contact information.

Utilizing Online Resources

Online resources are a convenient and efficient way to find the phone number of a technology insurance company. Many websites offer comprehensive business directories and contact information.

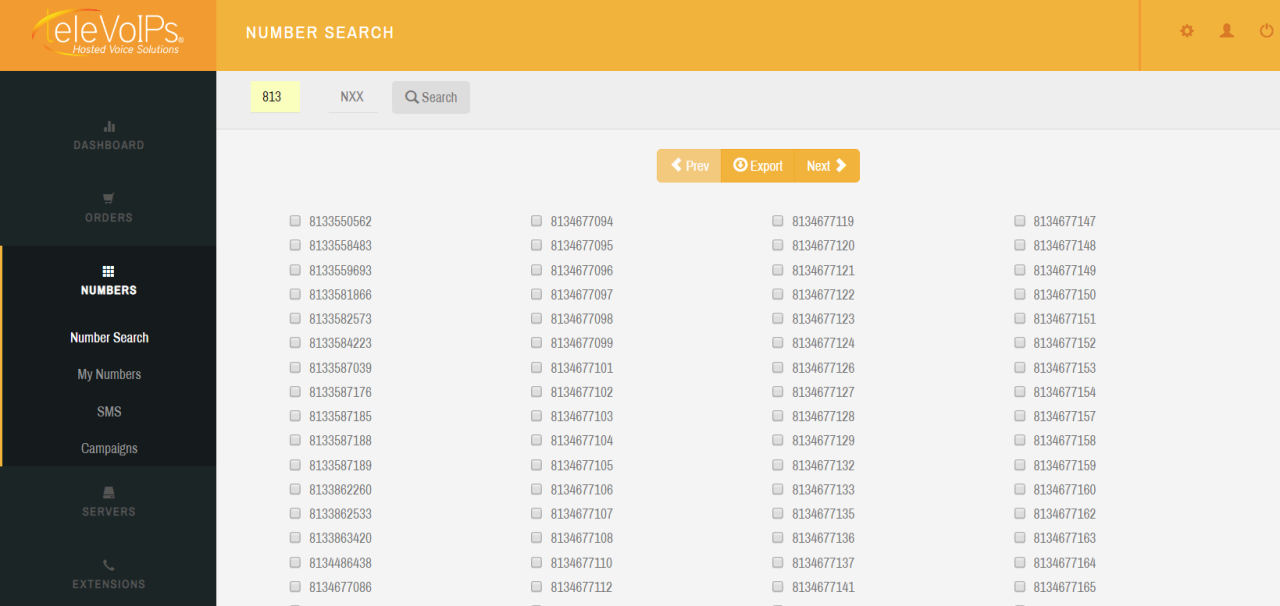

- Search Engines: Popular search engines like Google, Bing, and Yahoo! can be used to search for the company’s name and “phone number.” Results often include the company’s website and contact information, including phone numbers.

- Business Directories: Online business directories such as Yelp, Yellow Pages, and Manta provide extensive listings of businesses, including their phone numbers. You can search for the company’s name or browse through industry categories.

- Social Media: Companies often maintain active profiles on social media platforms like LinkedIn, Facebook, and Twitter. These profiles may include contact information, including phone numbers.

Leveraging Company Websites, Technology insurance company inc phone number

Most technology insurance companies have dedicated websites that provide comprehensive information about their services, contact details, and customer support.

- “Contact Us” Page: Most websites have a dedicated “Contact Us” or “About Us” page that displays contact information, including phone numbers, email addresses, and mailing addresses.

- Website Search Bar: If you can’t find the phone number on the website’s main pages, use the website’s search bar to search for “phone number” or “contact us.” This will often lead you to the relevant page.

Consulting Industry Directories

Industry-specific directories offer detailed information about companies operating within a particular sector. These directories can be valuable resources for finding phone numbers of technology insurance companies.

- Insurance Industry Directories: Organizations like the National Association of Insurance Commissioners (NAIC) and the Insurance Information Institute (III) maintain directories of insurance companies, including contact information.

- Technology Industry Directories: Directories specific to the technology industry, such as the Gartner Magic Quadrant and the IDC MarketScape, may also include contact information for technology insurance companies.

Common Phone Number Formats

Technology insurance companies often follow standard phone number formats and conventions.

- Area Code: The area code typically represents the geographic location of the company’s headquarters or main office. For example, a company based in New York City may have an area code of (212) or (646).

- Prefix: The prefix is the three-digit number following the area code. It can vary based on the company’s size and location.

- Line Number: The line number is the last four digits of the phone number. It may be assigned to a specific department, individual, or general customer service line.

Closure

In conclusion, understanding the importance of contacting a technology insurance company directly is paramount. By utilizing the strategies Artikeld in this guide, you can confidently navigate the process of finding the right insurance company and ensuring your technology assets are adequately protected. Whether you’re seeking quotes, filing claims, or simply seeking expert advice, having access to the correct phone number is essential. So, equip yourself with the knowledge and tools to connect with a technology insurance company, and rest assured that your valuable technology investments are in safe hands.

Finding the right technology insurance company can be a challenge, especially when navigating the complex world of modern business. To effectively manage your technology investments, you need to understand the latest trends in management technologies , such as cloud computing and data analytics.

This knowledge will help you choose the right insurance coverage and ensure your technology assets are protected from unforeseen risks.