S Bond Technologies: Shaping the Future of Finance

S Bond Technologies are revolutionizing the financial landscape, offering innovative solutions that are transforming the way investors, issuers, and market participants interact. These technologies, encompassing a wide range of tools […]

S Bond Technologies are revolutionizing the financial landscape, offering innovative solutions that are transforming the way investors, issuers, and market participants interact. These technologies, encompassing a wide range of tools and platforms, are designed to streamline bond trading, enhance risk management, and optimize investment strategies.

From sophisticated analytics platforms to cutting-edge blockchain applications, S Bond Technologies are driving efficiency, transparency, and accessibility within the bond market. By leveraging the power of technology, investors can access a wider range of opportunities, while issuers can tap into new sources of capital with greater ease.

Introduction to Bond Technologies

Bond technologies are a vital component of modern finance, revolutionizing the way bonds are issued, traded, and managed. They encompass a range of tools and platforms that streamline bond market operations, enhancing efficiency, transparency, and accessibility.

Bond technologies are crucial for facilitating the issuance, trading, and management of bonds. They enable market participants to access and analyze vast amounts of data, automate complex processes, and execute transactions more efficiently.

Types of Bond Technologies

Bond technologies encompass a diverse range of tools and platforms, each serving a specific purpose in the bond market. Some of the key types of bond technologies include:

- Electronic Trading Platforms: These platforms facilitate the buying and selling of bonds electronically, providing real-time pricing information and order execution capabilities. Examples include Bloomberg Tradebook, MarketAxess, and Tradeweb.

- Bond Information Systems: These systems provide comprehensive data on bond issuers, securities, and market trends, enabling investors to make informed decisions. Examples include Bloomberg Terminal, Refinitiv, and FactSet.

- Bond Analytics and Valuation Tools: These tools help investors assess the risk and return of bonds, providing sophisticated analytics and valuation models. Examples include BlackRock Aladdin, Moody’s Analytics, and S&P Global Market Intelligence.

- Bond Portfolio Management Systems: These systems help investors manage their bond portfolios, tracking performance, risk exposure, and compliance requirements. Examples include SimCorp Dimension, Avaloq, and Temenos.

- Blockchain Technology: Blockchain technology is increasingly being explored for its potential to enhance bond market efficiency and transparency. It offers a secure and decentralized platform for recording and verifying bond transactions, reducing the risk of fraud and improving settlement times.

Evolution of Bond Technologies

The evolution of bond technologies has been driven by a combination of factors, including technological advancements, regulatory changes, and evolving market demands.

- Early Days (Pre-1990s): The bond market was primarily paper-based, with transactions executed over the phone or through brokers. Information was limited and often outdated, making it difficult for investors to make informed decisions.

- Rise of Electronic Trading (1990s-2000s): The advent of electronic trading platforms revolutionized the bond market, enabling faster and more efficient transactions. These platforms also provided access to real-time pricing information and enhanced market transparency.

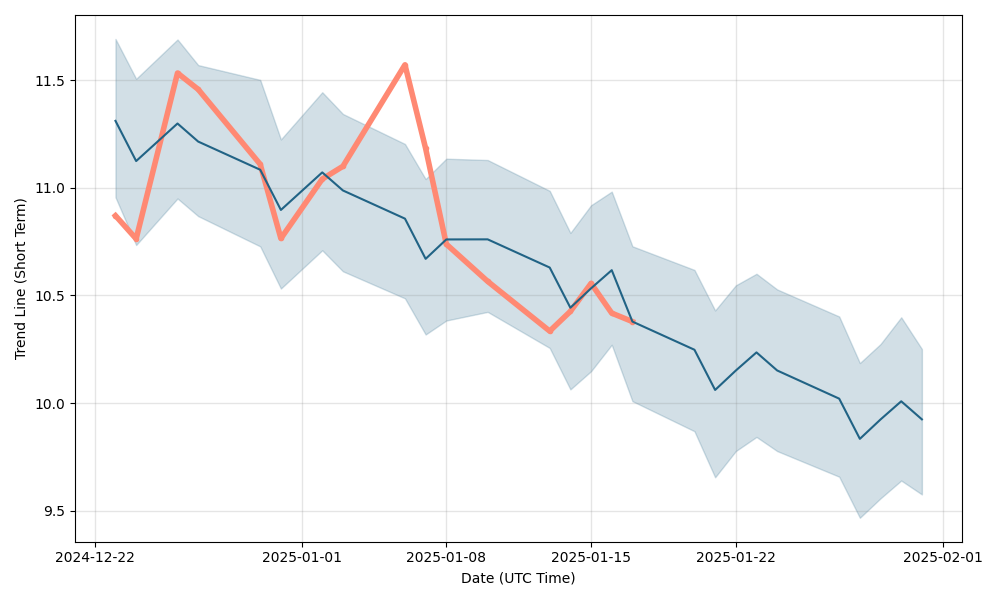

- Data Analytics and Automation (2000s-Present): The growth of data analytics and automation technologies has further transformed the bond market, allowing investors to analyze vast amounts of data and automate complex processes. This has led to improved risk management, enhanced portfolio performance, and greater efficiency.

- Blockchain and Other Emerging Technologies (Present and Future): Blockchain technology and other emerging technologies are poised to further disrupt the bond market, offering new possibilities for efficiency, transparency, and security. These technologies have the potential to streamline bond issuance, trading, and settlement processes, reducing costs and improving access for investors.

Impact of Bond Technologies on the Financial Markets

Bond technologies have had a profound impact on the financial markets, transforming the way bonds are issued, traded, and managed.

- Increased Efficiency: Bond technologies have streamlined bond market operations, enabling faster and more efficient transactions. This has reduced transaction costs and improved market liquidity.

- Enhanced Transparency: Electronic trading platforms and bond information systems provide real-time pricing information and access to comprehensive data, enhancing market transparency and enabling investors to make more informed decisions.

- Greater Accessibility: Bond technologies have made it easier for investors of all sizes to access the bond market, expanding investment opportunities and promoting market participation.

- Improved Risk Management: Bond analytics and valuation tools provide sophisticated risk management capabilities, enabling investors to better assess and manage their risk exposure.

- Innovation and New Products: Bond technologies are driving innovation in the bond market, enabling the development of new products and services that meet evolving investor needs.

Benefits of Bond Technologies

Bond technologies, encompassing a range of innovations from blockchain and distributed ledger technology (DLT) to artificial intelligence (AI) and machine learning (ML), are transforming the bond market. These technologies offer a wide range of benefits for investors, issuers, and market participants, leading to increased efficiency, reduced costs, and improved transparency.

Enhanced Efficiency and Cost Reduction

Bond technologies streamline processes, automate tasks, and optimize workflows, resulting in significant efficiency gains and cost reductions. For instance, blockchain-based platforms facilitate faster and more efficient issuance and settlement of bonds, eliminating intermediaries and reducing transaction costs. These platforms also enable automated KYC/AML checks, reducing manual verification and processing time.

- Automated Trade Execution: AI-powered trading platforms can execute trades faster and more accurately than traditional methods, reducing execution costs and minimizing slippage.

- Improved Data Management: DLT-based platforms provide a single, shared ledger for all bond transactions, eliminating data silos and ensuring data integrity. This improves data management efficiency and reduces the risk of errors.

- Reduced Settlement Times: Blockchain technology allows for near-instantaneous settlement of bond transactions, reducing the time and cost associated with traditional settlement processes.

Increased Transparency and Accessibility

Bond technologies promote greater transparency and accessibility in the bond market, providing investors with better information and access to a wider range of investment opportunities. For example, blockchain platforms allow for the public and immutable recording of bond issuance details, making it easier for investors to verify the authenticity and legitimacy of bonds.

- Real-Time Data: Blockchain platforms provide real-time access to bond data, including pricing, issuance details, and trading activity, allowing investors to make more informed decisions.

- Improved Market Liquidity: Increased transparency and accessibility lead to improved market liquidity, as more investors can participate in the bond market.

- Reduced Information Asymmetry: Bond technologies reduce information asymmetry between issuers and investors, creating a more level playing field and fostering greater trust.

Enhanced Risk Management and Portfolio Optimization

Bond technologies enable sophisticated risk management and portfolio optimization strategies. AI-powered tools can analyze large datasets of market data, identify trends, and predict potential risks, allowing investors to make more informed decisions. These technologies also enable the development of customized investment portfolios based on individual investor needs and risk tolerance.

- Advanced Analytics: AI and ML algorithms can analyze vast amounts of data to identify patterns, trends, and potential risks, providing investors with deeper insights into market behavior.

- Automated Portfolio Rebalancing: AI-powered platforms can automate portfolio rebalancing based on predefined risk parameters and market conditions, ensuring optimal portfolio performance.

- Improved Credit Risk Assessment: AI and ML algorithms can analyze credit data and financial statements to assess the creditworthiness of borrowers, providing investors with more accurate and timely credit risk assessments.

Impact on Investment Decision-Making

Bond technologies empower investors with greater access to information, advanced analytics, and sophisticated risk management tools, leading to improved investment decision-making. Investors can now analyze market trends, identify investment opportunities, and manage risk more effectively than ever before.

- Enhanced Due Diligence: Blockchain platforms allow investors to access and verify bond issuance details and track the history of transactions, facilitating thorough due diligence.

- Improved Investment Selection: AI-powered tools can analyze market data and identify investment opportunities that align with investor goals and risk tolerance.

- Reduced Investment Costs: Increased efficiency and transparency in the bond market lead to lower investment costs, making it more affordable for investors to access a wider range of opportunities.

Challenges and Trends in Bond Technologies: S Bond Technologies

The adoption and implementation of bond technologies present both challenges and opportunities for market participants. As technology continues to evolve, new trends are emerging, transforming the bond market landscape and shaping its future.

Challenges in Implementing Bond Technologies

Implementing bond technologies presents several challenges, including:

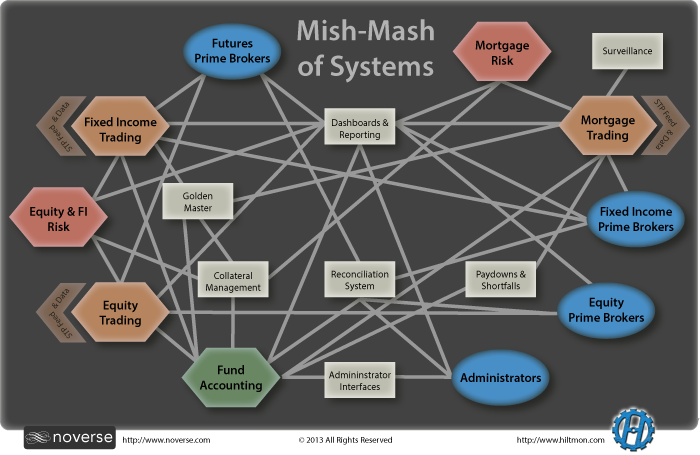

- Data Integration and Standardization: Integrating data from diverse sources, often in different formats, is a significant challenge. Lack of standardized data formats hinders interoperability and creates barriers to data sharing and analysis.

- Regulatory Compliance: The bond market is heavily regulated, and new technologies must comply with existing rules and regulations. Navigating complex regulatory frameworks can be time-consuming and costly.

- Security and Privacy: Ensuring the security and privacy of sensitive data is paramount in bond markets. Protecting against cyber threats and data breaches is crucial to maintain investor confidence.

- Cost and Complexity: Implementing and maintaining bond technologies can be expensive, particularly for smaller market participants. The complexity of these technologies also requires specialized expertise and technical skills.

- Market Adoption: Wide-scale adoption of new technologies requires collaboration and consensus among market participants. Overcoming inertia and encouraging widespread adoption can be challenging.

Opportunities Presented by Bond Technologies, S bond technologies

Bond technologies offer numerous opportunities to enhance market efficiency, reduce costs, and improve transparency:

- Automated Trading and Execution: Automated trading platforms can execute trades faster and more efficiently, reducing transaction costs and improving market liquidity.

- Improved Risk Management: Advanced analytics and machine learning can help investors better assess and manage risk, leading to more informed investment decisions.

- Enhanced Transparency and Data Availability: Bond technologies can improve data transparency and accessibility, providing investors with more comprehensive and real-time information.

- New Product Development: New technologies enable the creation of innovative bond products, such as tokenized bonds and synthetic securities, offering investors greater diversification and access to new markets.

- Reduced Costs and Increased Efficiency: Automation and streamlining of processes can significantly reduce costs and improve operational efficiency for market participants.

Emerging Trends in Bond Technologies

The bond market is witnessing the emergence of several key trends driven by technological advancements:

- Artificial Intelligence (AI): AI is transforming bond markets by automating tasks, enhancing risk management, and improving investment decision-making. AI-powered algorithms can analyze vast datasets, identify patterns, and predict market trends, enabling investors to make more informed investment choices.

- Blockchain: Blockchain technology offers a secure and transparent platform for recording and tracking bond transactions, reducing the risk of fraud and improving efficiency. It can also facilitate the issuance and trading of tokenized bonds, expanding access to new markets.

- Big Data: Big data analytics allows investors to analyze large datasets and gain valuable insights into market trends, investor behavior, and risk factors. This data-driven approach can improve investment strategies and risk management.

Impact of Emerging Trends on the Future of the Bond Market

Emerging trends in bond technologies are expected to have a profound impact on the future of the bond market:

- Increased Efficiency and Liquidity: Automation and improved data transparency will lead to more efficient and liquid bond markets, enabling faster and more cost-effective trading.

- Greater Access and Inclusion: New technologies can lower barriers to entry, making bond markets more accessible to a wider range of investors, including retail investors.

- Innovation and New Product Development: Emerging technologies will drive the development of innovative bond products and services, offering investors greater diversification and investment opportunities.

- Enhanced Risk Management and Compliance: AI and big data analytics will improve risk management capabilities, enabling investors to make more informed and responsible investment decisions while ensuring compliance with regulations.

Impact of Bond Technologies on the Financial Landscape

Bond technologies have revolutionized the way bonds are traded, managed, and analyzed, profoundly impacting the financial landscape. These technologies have streamlined processes, increased efficiency, and opened up new opportunities for investors and institutions alike. This section delves into the influence of bond technologies on market liquidity, investor behavior, and regulatory frameworks, and explores their role in shaping the future of finance.

Influence on Market Liquidity

Bond technologies have significantly enhanced market liquidity by facilitating faster and more efficient trading. This has led to increased trading volumes and reduced transaction costs. Here are some key ways bond technologies impact liquidity:

- Automated trading platforms: These platforms allow investors to execute trades quickly and efficiently, reducing the need for manual intervention and increasing trading volume.

- Real-time data and analytics: Bond technologies provide access to real-time data and analytics, enabling investors to make informed trading decisions and identify liquidity opportunities.

- Fragmentation of markets: Bond technologies have led to the fragmentation of bond markets, with different platforms and trading venues competing for liquidity. This can increase overall liquidity but also pose challenges for investors seeking to access the best prices.

Impact on Investor Behavior

Bond technologies have empowered investors with tools and resources that have fundamentally altered their behavior. This includes:

- Increased access to information: Bond technologies have democratized access to information, allowing investors of all sizes to gain insights into the bond market.

- Greater transparency: Bond technologies have increased transparency in the bond market, enabling investors to monitor and analyze market trends and issuer behavior.

- Improved risk management: Bond technologies provide sophisticated risk management tools that help investors manage their portfolios more effectively and mitigate potential losses.

Influence on Regulatory Frameworks

The emergence of bond technologies has also posed challenges for regulators, who are tasked with ensuring market stability and investor protection. Here are some key areas where bond technologies have influenced regulatory frameworks:

- Cybersecurity: Bond technologies have raised concerns about cybersecurity, as data breaches and cyberattacks can threaten the integrity of financial markets.

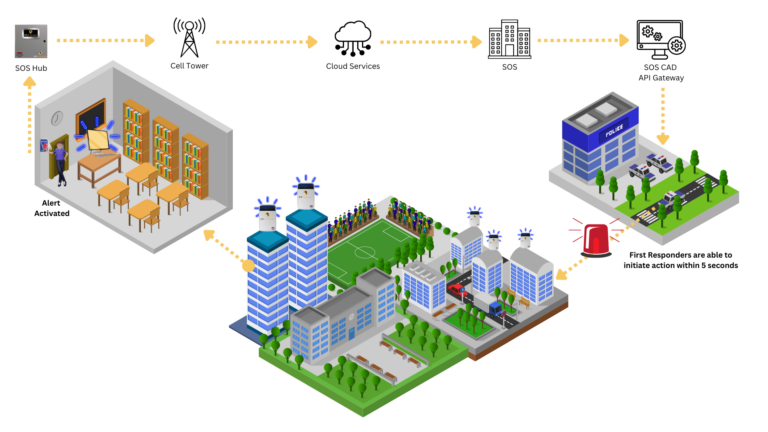

- Market surveillance: Regulators are using bond technologies to enhance market surveillance and detect potential misconduct or manipulation.

- Data privacy: The collection and use of data by bond technologies have raised concerns about data privacy and the need for appropriate safeguards.

Role in Shaping the Future of Finance

Bond technologies are playing a crucial role in shaping the future of finance, driving innovation and creating new opportunities. This includes:

- The rise of robo-advisors: Bond technologies are powering the rise of robo-advisors, which use algorithms to provide automated investment advice and portfolio management services.

- Increased use of artificial intelligence (AI): AI is being used to analyze bond data, identify investment opportunities, and automate trading processes.

- Growth of decentralized finance (DeFi): DeFi platforms are using blockchain technology to create new and innovative ways to trade and manage bonds.

Outcome Summary

As the bond market continues to evolve, S Bond Technologies will play an increasingly vital role in shaping its future. Their ability to enhance efficiency, reduce costs, and improve transparency will continue to attract investors and issuers alike. By embracing these technologies, the bond market can navigate the complexities of the modern financial landscape and unlock new possibilities for growth and innovation.

S bond technologies are often associated with fixed income securities, offering a predictable stream of income. However, the world of finance is constantly evolving, and flex technologies are emerging as a powerful alternative, providing greater flexibility and responsiveness to market changes.

This shift towards dynamic solutions, like those offered by flex technologies, is likely to influence the future of s bond technologies, potentially leading to innovative hybrid models that combine the stability of traditional bonds with the adaptability of newer approaches.