Prime Financial Technologies: Shaping the Future of Finance

Prime financial technologies are revolutionizing the way we manage our money, invest, and interact with financial institutions. These cutting-edge technologies are transforming traditional financial practices, empowering individuals and businesses alike […]

Prime financial technologies are revolutionizing the way we manage our money, invest, and interact with financial institutions. These cutting-edge technologies are transforming traditional financial practices, empowering individuals and businesses alike with greater control and access to financial services. From mobile banking and digital payments to robo-advisors and blockchain solutions, prime financial technologies are shaping a new era of financial innovation.

The rise of prime financial technologies is driven by several key factors, including the increasing adoption of smartphones and mobile devices, the growing demand for personalized financial services, and the desire for greater transparency and efficiency in the financial system. These technologies are enabling faster, more secure, and more convenient ways to manage finances, opening up new opportunities for financial inclusion and economic growth.

The Rise of Prime Financial Technologies

The modern financial landscape is experiencing a transformative shift, driven by the emergence and rapid growth of prime financial technologies. These technologies, collectively known as FinTech, are revolutionizing traditional financial services, offering innovative solutions that are more accessible, efficient, and customer-centric.

Drivers and Factors Contributing to the Rise of Prime Financial Technologies

The increasing prominence of prime financial technologies is driven by a confluence of factors, including technological advancements, changing consumer preferences, and regulatory changes.

- Technological Advancements: The rapid advancements in technology, particularly in areas such as cloud computing, artificial intelligence (AI), and blockchain, have created the foundation for the development of innovative financial solutions. These technologies enable FinTech companies to process transactions faster, reduce costs, and offer personalized services.

- Changing Consumer Preferences: Consumers today are increasingly demanding convenient, transparent, and personalized financial services. FinTech companies are catering to these needs by offering digital-first experiences, real-time data access, and tailored solutions.

- Regulatory Changes: Regulatory changes, such as the introduction of open banking initiatives, have created opportunities for FinTech companies to innovate and offer new services. These changes are fostering a more competitive and dynamic financial ecosystem.

Prominent Prime Financial Technology Companies and Their Innovations

Numerous prime financial technology companies have emerged, disrupting various segments of the financial services industry. Here are some prominent examples:

- PayPal: A leading online payment platform, PayPal has revolutionized the way people send and receive money online. Its innovative features, such as buyer and seller protection, have made it a trusted and widely used platform.

- Stripe: Stripe provides a comprehensive payments platform for businesses, enabling them to accept payments online and manage their financial operations efficiently. Its API-driven approach has made it a popular choice for businesses of all sizes.

- Robinhood: A mobile-first investment platform, Robinhood has democratized investing by making it accessible to a wider audience. Its commission-free trading and user-friendly interface have attracted millions of users.

- Ant Financial: A Chinese FinTech giant, Ant Financial offers a range of financial services, including online payments, micro-loans, and wealth management. Its Alipay platform is one of the most popular mobile payment systems in the world.

Key Applications of Prime Financial Technologies

Prime financial technologies, or “fintech,” have emerged as a transformative force across various sectors, revolutionizing traditional financial practices and services. These technologies leverage innovative approaches, including artificial intelligence, blockchain, and big data analytics, to enhance efficiency, accessibility, and customer experience in the financial realm.

Transforming Financial Services

The application of prime financial technologies is reshaping the landscape of financial services. These technologies are empowering consumers and businesses with a wide range of innovative solutions.

- Digital Payments and Transfers: Fintech platforms are facilitating seamless and secure digital payments and transfers, enabling individuals and businesses to transact quickly and conveniently across borders. Examples include mobile payment applications like PayPal and Venmo, which have revolutionized person-to-person payments, and digital wallets that allow users to store and manage their financial information digitally.

- Peer-to-Peer Lending: Fintech companies are disrupting traditional lending models by connecting borrowers and lenders directly through online platforms. These platforms allow individuals to access loans at potentially lower interest rates, while investors can earn returns by lending their funds. Notable examples include LendingClub and Prosper, which have facilitated billions of dollars in peer-to-peer loans.

- Robo-Advisors: These automated investment platforms utilize algorithms to create and manage investment portfolios based on individual risk tolerance and financial goals. Robo-advisors offer a cost-effective and personalized approach to wealth management, particularly for individuals who may not have access to traditional financial advisors. Companies like Betterment and Wealthfront are prominent players in this space.

- Insurtech: Fintech companies are leveraging technology to innovate the insurance industry, offering personalized policies, faster claims processing, and data-driven risk assessments. Insurtech startups are developing solutions for various insurance segments, including health, life, and property insurance.

Revolutionizing Banking

Fintech is driving significant changes in the banking sector, enhancing efficiency, accessibility, and customer experience.

- Digital Banking: Fintech platforms are enabling customers to manage their finances entirely online, offering a range of services, including account opening, bill payments, and money transfers. Digital banks, like Monzo and Revolut, have gained traction by providing a seamless and personalized banking experience.

- Open Banking: This concept allows customers to share their financial data with third-party applications and services with their consent. Open banking enables innovative financial solutions, such as personalized financial management tools and tailored financial products.

- AI-Powered Fraud Detection: Fintech companies are utilizing artificial intelligence to detect fraudulent transactions in real time, enhancing security and reducing financial losses for banks and customers.

Empowering Businesses

Prime financial technologies are empowering businesses with tools and solutions to streamline their financial operations and access capital more efficiently.

- Business Lending: Fintech companies are offering alternative lending solutions to small and medium-sized enterprises (SMEs), providing faster access to capital with less stringent requirements compared to traditional banks. Online platforms like Kabbage and OnDeck have emerged as key players in this space.

- Financial Management Software: Fintech companies are developing sophisticated financial management software that helps businesses automate accounting tasks, track expenses, and generate financial reports. Xero and QuickBooks Online are popular examples of such software.

- Blockchain for Supply Chain Finance: Blockchain technology is enabling greater transparency and efficiency in supply chain finance by providing a secure and immutable record of transactions. This can streamline payments and improve visibility throughout the supply chain.

Benefits and Challenges of Prime Financial Technologies

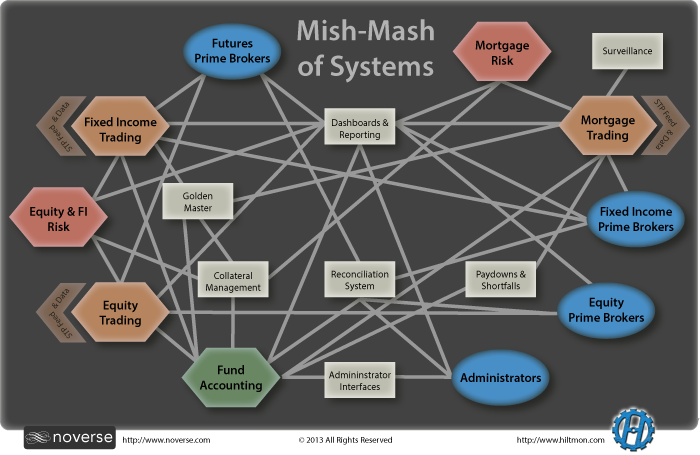

The implementation of prime financial technologies presents both benefits and challenges for different industries. The following table summarizes some of the key aspects:

| Industry | Benefits | Challenges |

|---|---|---|

| Financial Services | – Enhanced efficiency and cost savings – Improved customer experience – Greater accessibility to financial services – Personalized financial products and services |

– Cybersecurity risks – Regulatory uncertainty – Data privacy concerns – Potential for financial exclusion |

| Banking | – Increased customer engagement – Reduced operational costs – Improved fraud detection – Enhanced data analytics capabilities |

– Legacy systems integration – Maintaining customer trust in digital banking – Ensuring data security and compliance |

| Businesses | – Streamlined financial operations – Faster access to capital – Improved cash flow management – Enhanced data-driven decision-making |

– Adoption of new technologies – Integration with existing systems – Ensuring data security and compliance |

Prime Financial Technologies and Customer Experience

Prime financial technologies are revolutionizing the way financial institutions interact with their customers, leading to a more personalized, efficient, and seamless experience. These technologies are empowering customers to take control of their finances and access financial services with greater ease and convenience.

Customer-Centric Solutions Powered by Prime Financial Technologies

Prime financial technologies are enabling the development of innovative customer-centric solutions that address the evolving needs of consumers.

- Personalized Financial Advice and Recommendations: AI-powered chatbots and robo-advisors provide personalized financial advice and recommendations based on individual customer profiles, risk tolerance, and financial goals. These technologies analyze vast amounts of data to offer tailored investment strategies, budgeting tips, and financial planning guidance, empowering customers to make informed decisions.

- Seamless Digital Onboarding: Prime financial technologies streamline the onboarding process, making it faster and more efficient for customers to open accounts and access financial services. Digital KYC (Know Your Customer) verification, e-signature tools, and automated document processing simplify the process, reducing paperwork and waiting times.

- 24/7 Accessibility and Support: Mobile banking apps and online platforms provide customers with round-the-clock access to their accounts and financial information. AI-powered chatbots offer instant support and answers to common queries, enhancing customer service responsiveness and reducing wait times.

- Enhanced Security and Fraud Prevention: Prime financial technologies employ advanced security measures, including biometrics, multi-factor authentication, and fraud detection algorithms, to protect customer accounts and sensitive data. These technologies proactively identify and mitigate potential threats, ensuring a secure and trustworthy financial experience.

Impact on Customer Satisfaction and Loyalty

The adoption of prime financial technologies has a significant impact on customer satisfaction and loyalty.

- Improved Customer Experience: Prime financial technologies deliver a more personalized, convenient, and efficient customer experience, leading to higher satisfaction levels. Customers appreciate the ease of access, personalized recommendations, and seamless digital interactions.

- Increased Customer Engagement: Interactive features, gamification, and personalized notifications encourage customer engagement and promote financial literacy. By making financial management more engaging and accessible, prime financial technologies foster a stronger connection between customers and their financial institutions.

- Enhanced Customer Retention: Satisfied customers are more likely to remain loyal to financial institutions that provide a superior digital experience. Prime financial technologies contribute to customer retention by offering a value-added service and building strong customer relationships.

Regulatory Landscape and Ethical Considerations

The rapid growth of prime financial technologies necessitates a robust regulatory framework to ensure stability, security, and consumer protection. At the same time, the innovative nature of these technologies presents unique ethical challenges that require careful consideration.

Regulatory Frameworks

The regulatory landscape for prime financial technologies is constantly evolving, but several key frameworks are emerging globally.

- Financial Conduct Authority (FCA) in the UK: The FCA has established guidelines for the use of fintech in financial services, emphasizing consumer protection, market integrity, and innovation.

- Securities and Exchange Commission (SEC) in the US: The SEC is actively regulating the use of cryptocurrencies and other digital assets, aiming to protect investors and ensure market fairness.

- European Union’s General Data Protection Regulation (GDPR): GDPR sets strict rules for the collection, processing, and storage of personal data, particularly relevant for fintech companies that rely on data analytics.

These frameworks aim to promote responsible innovation while mitigating risks associated with prime financial technologies.

Ethical Considerations, Prime financial technologies

Prime financial technologies raise ethical concerns that demand careful consideration.

- Data Privacy and Security: Fintech companies often collect and process vast amounts of sensitive personal data. Ensuring data privacy and security is paramount to prevent breaches and protect consumer rights.

- Algorithmic Bias: Algorithms used in prime financial technologies can perpetuate existing societal biases, leading to unfair outcomes for certain groups. Addressing bias in algorithms is crucial for promoting fairness and inclusivity.

- Financial Inclusion: While prime financial technologies have the potential to improve financial inclusion, there is a risk of exacerbating existing inequalities if access is not equitable.

Measures for Responsible Implementation

To address the ethical and regulatory challenges, stakeholders are implementing measures to ensure responsible and secure implementation of prime financial technologies.

- Data Protection Standards: Companies are adopting robust data encryption, access control, and data governance practices to protect sensitive information.

- Algorithmic Auditing: Regular audits of algorithms are essential to identify and mitigate bias, ensuring fairness and transparency.

- Consumer Education: Educating consumers about the risks and benefits of prime financial technologies is crucial for empowering them to make informed decisions.

Future Trends and Innovations in Prime Financial Technologies

Prime financial technologies are constantly evolving, driven by advancements in artificial intelligence (AI), blockchain, and other disruptive technologies. This evolution promises to reshape the financial landscape, creating new opportunities and challenges for both consumers and institutions.

Emerging Trends and Innovations in Prime Financial Technologies

The prime financial technology landscape is marked by rapid innovation. Here are some of the key trends and innovations shaping the future:

- Artificial Intelligence (AI): AI is transforming financial services by automating tasks, enhancing risk management, and providing personalized financial advice. Machine learning algorithms are used for fraud detection, credit scoring, and investment recommendations.

- Blockchain Technology: Blockchain is revolutionizing financial transactions by providing a secure, transparent, and efficient platform for recording and verifying data. It is being used for cross-border payments, digital asset management, and supply chain finance.

- Open Banking: Open banking enables consumers to share their financial data with third-party applications, fostering innovation and competition in financial services. This allows for personalized financial management tools, customized lending options, and improved financial literacy.

- RegTech: RegTech uses technology to improve compliance and regulatory processes in the financial industry. This includes tools for KYC/AML (Know Your Customer/Anti-Money Laundering) verification, regulatory reporting, and risk management.

- InsurTech: InsurTech leverages technology to improve insurance products and services. This includes using AI for claims processing, providing personalized insurance policies, and using telematics data for risk assessment.

Potential Impact of Prime Financial Technologies on the Future of Finance

The advancements in prime financial technologies have a profound impact on the future of finance:

- Enhanced Financial Inclusion: Prime financial technologies can extend financial services to underserved populations, such as those without access to traditional banking. Mobile banking and microfinance platforms powered by AI and blockchain can bridge the financial gap.

- Improved Efficiency and Cost Reduction: Automation and digitization driven by prime financial technologies can streamline financial processes, reducing costs and increasing efficiency. This can benefit both consumers and financial institutions.

- Personalized Financial Services: AI-powered tools can provide tailored financial advice and recommendations, enhancing the customer experience and improving financial outcomes. This can include personalized investment portfolios, tailored insurance policies, and customized loan offerings.

- Increased Transparency and Security: Blockchain technology can provide a secure and transparent ledger for financial transactions, reducing fraud and enhancing trust in the financial system.

Future Applications and Implications of Prime Financial Technologies

| Application | Implications |

|---|---|

| AI-powered investment advisors | Personalized investment strategies, reduced fees, increased accessibility to financial advice |

| Blockchain-based cross-border payments | Faster, cheaper, and more secure international transactions, increased financial inclusion |

| Open banking-enabled financial management tools | Enhanced financial literacy, improved budgeting, customized financial solutions |

| RegTech for KYC/AML compliance | Reduced risk of fraud and money laundering, improved regulatory compliance, increased trust in the financial system |

| InsurTech for personalized insurance policies | Tailored insurance coverage, lower premiums, improved customer experience |

Final Summary

As prime financial technologies continue to evolve, we can expect to see even more innovative solutions that enhance financial well-being and empower individuals to take control of their financial futures. These technologies are not only transforming the financial landscape but also creating new opportunities for businesses and individuals to thrive in a rapidly changing world. The future of finance is bright, and prime financial technologies are leading the way.

Prime financial technologies are rapidly changing the way we manage our money. From robo-advisors to digital payment platforms, these advancements are making financial services more accessible and efficient. One key aspect of this transformation is the use of survey technology to gather valuable customer insights.

This data helps financial institutions tailor their offerings to individual needs and preferences, further enhancing the user experience.