Portfolio Technology: Managing Investments Smarter

Portfolio technology, at its core, empowers investors to navigate the complexities of financial markets with greater efficiency and insight. It encompasses a range of tools and techniques that streamline investment […]

Portfolio technology, at its core, empowers investors to navigate the complexities of financial markets with greater efficiency and insight. It encompasses a range of tools and techniques that streamline investment management, risk assessment, and performance analysis, ultimately aiming to optimize portfolio returns and mitigate risk.

The evolution of portfolio technology has been driven by advancements in computing power, data analytics, and financial modeling. This has led to sophisticated software solutions that automate tasks, generate actionable insights, and provide real-time market data. These advancements have revolutionized how individuals and institutions approach investment strategies, fostering a more informed and data-driven approach to wealth management.

What is Portfolio Technology?

Portfolio technology encompasses a broad range of tools, strategies, and processes used to manage and optimize investment portfolios. It leverages technology to streamline and enhance various aspects of portfolio management, from investment selection and allocation to risk management and performance analysis.

Portfolio technology plays a crucial role in the modern financial landscape, enabling investors to make informed decisions, manage risk effectively, and maximize returns. Its core components, including investment management, risk management, and performance measurement, work in synergy to achieve these goals.

Investment Management

Investment management involves the selection and allocation of assets within a portfolio. Portfolio technology facilitates this process by providing tools for:

- Asset Selection: Portfolio technology enables investors to analyze a wide range of assets, including stocks, bonds, real estate, and commodities, based on various criteria, such as historical performance, risk profiles, and market trends. Sophisticated algorithms and data analytics can help identify potential investment opportunities and assess their suitability for different portfolio objectives.

- Portfolio Allocation: Portfolio technology assists in determining the optimal allocation of assets across different asset classes and investment strategies. It considers factors such as risk tolerance, investment horizon, and return expectations to create a balanced and diversified portfolio.

- Rebalancing: As market conditions change, portfolios may drift away from their initial allocation targets. Portfolio technology can automatically rebalance portfolios by adjusting asset weights to maintain the desired risk-return profile.

Risk Management

Risk management is a critical aspect of portfolio technology, focusing on identifying, assessing, and mitigating potential risks. It involves:

- Risk Assessment: Portfolio technology employs sophisticated models and analytics to measure and quantify the various risks associated with different investments and portfolios. This includes market risk, credit risk, liquidity risk, and operational risk.

- Risk Mitigation: Once risks are identified, portfolio technology provides tools for implementing strategies to mitigate them. This may involve diversifying investments, hedging against market fluctuations, or using derivative instruments to manage specific risks.

- Risk Monitoring: Portfolio technology enables continuous monitoring of portfolio risk levels and provides alerts when risks exceed predetermined thresholds. This allows investors to take timely action to adjust their strategies and mitigate potential losses.

Performance Measurement

Performance measurement is essential for evaluating the effectiveness of investment strategies and making informed decisions. Portfolio technology facilitates this process by providing:

- Performance Tracking: Portfolio technology automatically tracks and records portfolio performance, including returns, volatility, and risk-adjusted returns. This data can be visualized in various formats, such as charts, graphs, and tables, to provide a comprehensive overview of portfolio performance.

- Benchmarking: Portfolio technology allows investors to compare their portfolio performance against relevant benchmarks, such as market indices or other investment strategies. This helps assess the relative performance of the portfolio and identify areas for improvement.

- Attribution Analysis: Portfolio technology can identify the specific factors contributing to portfolio performance, such as asset allocation, security selection, and market timing. This analysis helps understand the sources of returns and identify potential areas for optimization.

Types of Portfolio Technology

Portfolio technology encompasses a range of tools and software designed to streamline and enhance portfolio management activities. These tools vary in their functionalities, catering to different aspects of portfolio management, from tracking and analysis to trading and reporting. Understanding the different types of portfolio technology is crucial for investors and financial professionals seeking to optimize their investment strategies.

Portfolio Accounting Systems

Portfolio accounting systems are software applications that help investors and financial professionals track and manage their investments. These systems provide a comprehensive view of an investor’s portfolio, including asset holdings, cash flows, and performance metrics.

Portfolio accounting systems offer several benefits, including:

- Accurate and timely reporting: Portfolio accounting systems automate the process of tracking and reporting on investment performance, ensuring that investors have access to accurate and up-to-date information.

- Improved efficiency: By automating tasks such as data entry and reconciliation, portfolio accounting systems free up time for investors and financial professionals to focus on other aspects of portfolio management.

- Enhanced compliance: Portfolio accounting systems can help investors comply with regulatory requirements by providing auditable records of investment transactions and holdings.

However, portfolio accounting systems also have some drawbacks:

- Cost: Implementing and maintaining a portfolio accounting system can be expensive, especially for small investors or those with simple portfolios.

- Complexity: Portfolio accounting systems can be complex to use, requiring specialized knowledge and training.

- Limited functionality: Some portfolio accounting systems may lack the advanced features required by sophisticated investors or institutional clients.

Examples of portfolio accounting systems include:

- Morningstar Portfolio: This system provides a comprehensive view of an investor’s portfolio, including asset holdings, performance, and risk metrics. It also offers features for portfolio planning and rebalancing.

- Personal Capital: This system offers portfolio management, financial planning, and investment advisory services. It aggregates data from multiple accounts and provides insights into investment performance and financial goals.

- Yodlee: This system is a data aggregation platform that connects to multiple financial accounts, allowing users to track their assets and liabilities in one place. It provides features for budgeting, investment tracking, and financial planning.

Portfolio Analytics Tools

Portfolio analytics tools are software applications that provide insights into investment performance and risk. These tools use data from portfolio accounting systems and other sources to generate reports and visualizations that help investors make informed investment decisions.

Portfolio analytics tools offer several benefits, including:

- Improved decision-making: By providing insights into investment performance and risk, portfolio analytics tools help investors make more informed decisions about asset allocation, trading strategies, and portfolio optimization.

- Enhanced risk management: Portfolio analytics tools can help investors identify and manage potential risks, such as market volatility, interest rate changes, and credit risk.

- Improved performance measurement: Portfolio analytics tools provide comprehensive performance metrics, such as returns, volatility, and Sharpe ratio, allowing investors to track their portfolio’s performance over time.

However, portfolio analytics tools also have some drawbacks:

- Data dependency: Portfolio analytics tools rely on accurate and timely data, which can be challenging to obtain and maintain.

- Complexity: Some portfolio analytics tools can be complex to use, requiring specialized knowledge and training.

- Limited customization: Some portfolio analytics tools may lack the customization options required by sophisticated investors or institutional clients.

Examples of portfolio analytics tools include:

- Portfolio Visualizer: This tool provides a variety of portfolio analysis features, including backtesting, performance measurement, and risk analysis. It allows users to compare different investment strategies and evaluate their performance over time.

- QuantConnect: This platform provides tools for backtesting and live trading of quantitative investment strategies. It offers a wide range of data sources and algorithms for building and evaluating trading models.

- Bloomberg Terminal: This platform provides a comprehensive suite of tools for financial analysis, including portfolio analytics, market data, and news. It is widely used by institutional investors and financial professionals.

Trading Platforms

Trading platforms are software applications that allow investors to buy and sell securities. These platforms provide access to real-time market data, order execution tools, and account management features.

Trading platforms offer several benefits, including:

- Convenience: Trading platforms allow investors to trade securities from anywhere with an internet connection.

- Speed and efficiency: Trading platforms provide fast order execution and real-time market data, enabling investors to capitalize on market opportunities quickly.

- Advanced features: Many trading platforms offer advanced features, such as charting tools, technical analysis indicators, and automated trading strategies.

However, trading platforms also have some drawbacks:

- Fees: Trading platforms typically charge fees for order execution, data access, and other services.

- Complexity: Some trading platforms can be complex to use, especially for novice investors.

- Security risks: Trading platforms are vulnerable to security breaches, which can result in unauthorized access to accounts and financial data.

Examples of trading platforms include:

- TD Ameritrade: This platform offers a wide range of investment products and trading tools, including real-time market data, charting tools, and order execution features.

- E*TRADE: This platform provides a user-friendly interface for trading stocks, options, futures, and other securities. It offers features for research, analysis, and portfolio management.

- Interactive Brokers: This platform caters to experienced traders and institutional investors, offering access to global markets, advanced trading tools, and low commissions.

Applications of Portfolio Technology

Portfolio technology plays a crucial role in modern finance, enabling investors to optimize their portfolios, manage risk effectively, and achieve their financial goals. This technology is widely used across various financial sectors, including asset management, wealth management, and institutional investing.

Applications in Asset Management

Portfolio technology has revolutionized the asset management industry by automating various processes and enhancing investment decision-making.

- Portfolio Optimization: Portfolio technology uses algorithms to analyze market data, historical performance, and risk tolerance to create optimal portfolios that maximize returns while minimizing risk. This allows asset managers to construct diversified portfolios tailored to specific investment objectives.

- Risk Management: Portfolio technology helps asset managers identify and quantify various risks associated with different asset classes. This allows them to develop strategies to mitigate these risks and protect their clients’ investments.

- Performance Analysis: Portfolio technology provides tools for analyzing portfolio performance, tracking key metrics like returns, risk, and volatility. This helps asset managers monitor the effectiveness of their investment strategies and make adjustments as needed.

- Reporting and Communication: Portfolio technology facilitates the generation of comprehensive reports that provide investors with detailed information about their portfolio performance and investment strategies. This enhances transparency and communication between asset managers and their clients.

Applications in Wealth Management, Portfolio technology

Portfolio technology empowers wealth managers to provide personalized financial advice and services to individual investors.

- Financial Planning: Portfolio technology helps wealth managers develop customized financial plans that consider individual investors’ financial goals, risk tolerance, and time horizon.

- Portfolio Construction: Portfolio technology enables wealth managers to create diversified portfolios tailored to specific investment goals, such as retirement planning, education funding, or wealth preservation.

- Investment Management: Portfolio technology automates investment management processes, allowing wealth managers to monitor portfolios, rebalance assets, and execute trades efficiently.

- Client Communication: Portfolio technology provides tools for wealth managers to communicate with clients regularly, providing updates on portfolio performance, market trends, and financial planning strategies.

Applications in Institutional Investing

Portfolio technology is essential for institutional investors, such as pension funds, endowments, and insurance companies, who manage large and complex portfolios.

- Strategic Asset Allocation: Portfolio technology helps institutional investors develop strategic asset allocation plans that align with their investment objectives and risk tolerance.

- Performance Attribution: Portfolio technology provides tools for analyzing portfolio performance and attributing returns to different factors, such as asset class selection, market timing, and manager skill.

- Risk Management and Compliance: Portfolio technology helps institutional investors manage various risks, including market risk, credit risk, and operational risk, and ensure compliance with regulatory requirements.

- Investment Reporting and Governance: Portfolio technology facilitates the generation of comprehensive reports for investors, boards of directors, and regulators, providing transparency and accountability.

Benefits of Portfolio Technology

Portfolio technology offers a range of advantages for investors, from enhancing portfolio performance to simplifying investment management. By leveraging advanced analytics, automation, and data-driven insights, these technologies empower investors to make more informed decisions and optimize their investment strategies.

Improved Portfolio Performance

Portfolio technology plays a crucial role in enhancing portfolio performance by enabling investors to make more informed decisions. This is achieved through various means, including:

- Advanced Analytics: Portfolio technology leverages sophisticated algorithms and data analysis to identify investment opportunities, assess risk, and optimize asset allocation. This allows investors to make more informed decisions based on data-driven insights rather than relying solely on intuition or anecdotal evidence.

- Real-Time Monitoring: Portfolio technology provides real-time monitoring of market trends and portfolio performance, enabling investors to react quickly to changes in market conditions. This proactive approach can help mitigate losses and capitalize on emerging opportunities.

- Automated Rebalancing: Portfolio technology can automate portfolio rebalancing, ensuring that the asset allocation remains aligned with the investor’s risk tolerance and investment goals. This eliminates the need for manual adjustments and ensures that the portfolio remains optimized over time.

Reduced Risk

Portfolio technology can significantly reduce investment risk by providing tools and insights that help investors make more informed decisions and manage their portfolios effectively.

- Risk Assessment and Management: Portfolio technology utilizes advanced analytics to assess and manage risk across various asset classes. This allows investors to identify and mitigate potential risks, reducing the overall volatility of their portfolios.

- Diversification Strategies: Portfolio technology can help investors implement diversified investment strategies, spreading risk across different asset classes and reducing the impact of any single investment’s performance.

- Stress Testing: Portfolio technology enables investors to conduct stress tests on their portfolios, simulating different market scenarios and identifying potential vulnerabilities. This allows investors to prepare for potential downturns and make necessary adjustments to mitigate risks.

Increased Efficiency

Portfolio technology streamlines investment management processes, saving investors time and effort while improving efficiency.

- Automated Trading: Portfolio technology can automate trading activities, eliminating the need for manual order placement and execution. This saves investors time and reduces the risk of human error.

- Simplified Reporting: Portfolio technology provides comprehensive and easy-to-understand reports on portfolio performance, risk exposure, and asset allocation. This allows investors to monitor their investments and make informed decisions without spending hours analyzing data manually.

- Centralized Platform: Portfolio technology provides a centralized platform for managing all investment activities, including account management, trading, reporting, and research. This simplifies investment management and reduces the need for multiple platforms and accounts.

Challenges and Future Trends in Portfolio Technology

Portfolio technology, while offering numerous advantages, also presents challenges and opportunities for future growth. Understanding these aspects is crucial for stakeholders to effectively leverage its potential.

Challenges in Implementing and Utilizing Portfolio Technology

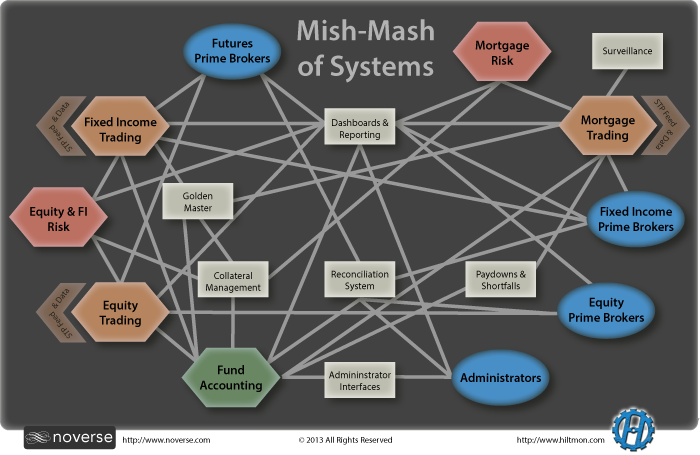

The implementation and utilization of portfolio technology present various challenges that require careful consideration and effective solutions. These challenges encompass data security, regulatory compliance, and integration with existing systems.

- Data Security: Protecting sensitive financial data is paramount. Portfolio technology often handles vast amounts of personal and financial information, making it a prime target for cyberattacks. Robust security measures, including encryption, access control, and regular security audits, are essential to mitigate these risks.

- Regulatory Compliance: The financial industry is subject to stringent regulations, and portfolio technology must comply with these rules. This involves adhering to data privacy laws like GDPR and maintaining proper record-keeping practices. Failing to comply can lead to hefty fines and reputational damage.

- Integration with Existing Systems: Integrating portfolio technology with legacy systems can be complex and time-consuming. Compatibility issues, data migration challenges, and potential disruptions to existing workflows can hinder seamless adoption.

Future Trends in Portfolio Technology

The landscape of portfolio technology is constantly evolving, driven by advancements in artificial intelligence (AI), machine learning (ML), and blockchain technology. These trends hold the potential to transform how portfolios are managed and optimize investment strategies.

- Adoption of Artificial Intelligence and Machine Learning: AI and ML algorithms can analyze vast datasets, identify patterns, and generate insights that human analysts might miss. This enables more sophisticated risk management, portfolio optimization, and personalized investment recommendations.

- Blockchain Technology: Blockchain offers secure and transparent transaction processing, enhancing trust and efficiency in financial markets. Its application in portfolio technology can streamline investment processes, improve data integrity, and facilitate fractional ownership of assets.

Impact of Portfolio Technology on the Financial Landscape

The evolution of portfolio technology is expected to have a profound impact on the financial landscape in the coming years.

- Enhanced Investment Strategies: AI-powered portfolio management can optimize investment strategies based on individual risk tolerance, financial goals, and market conditions, leading to more personalized and potentially higher returns.

- Increased Accessibility: Portfolio technology can democratize access to sophisticated investment tools and strategies, empowering individual investors to make informed decisions and participate in the market more effectively.

- Rise of Robo-Advisors: Automated investment platforms, powered by AI and algorithms, are gaining popularity, providing cost-effective and personalized investment advice to a wider audience.

Final Summary

Portfolio technology is no longer a luxury but a necessity in today’s dynamic financial landscape. By harnessing the power of technology, investors can gain a competitive edge, make well-informed decisions, and ultimately achieve their financial goals. As technology continues to evolve, we can expect even more innovative solutions to emerge, further transforming the way we manage our investments and navigate the financial markets.

Portfolio technology is all about managing your investments effectively, and one way to do that is by considering disruptive technology stocks. These stocks, often associated with innovative companies challenging established industries, can offer significant growth potential. For example, exploring disruptive technology stocks could help you identify companies pushing the boundaries in fields like artificial intelligence, renewable energy, or biotechnology, potentially adding a dynamic element to your portfolio.