Kernel Trading Technologies: A Guide to Financial Markets

Kernel trading technologies are revolutionizing financial markets by harnessing the power of machine learning algorithms to analyze data and make trading decisions. This approach leverages complex mathematical functions, known as […]

Kernel trading technologies are revolutionizing financial markets by harnessing the power of machine learning algorithms to analyze data and make trading decisions. This approach leverages complex mathematical functions, known as kernel functions, to identify patterns and predict future market movements, providing traders with an edge in today’s dynamic and data-driven world.

Kernel trading has its roots in the field of statistical learning, where it was initially used to solve problems in pattern recognition and classification. Its application in finance has grown rapidly, driven by the increasing availability of high-frequency data and the need for sophisticated trading strategies to navigate complex market dynamics.

Kernel Trading Methods

Kernel trading methods are a class of quantitative trading strategies that leverage the power of machine learning to identify profitable trading opportunities. These methods analyze historical market data and identify patterns that can be used to predict future price movements. By training algorithms on large datasets, kernel trading techniques aim to capture complex relationships and non-linear patterns that traditional technical analysis might miss.

Kernel Trading Methods Overview

The table below presents a summary of popular kernel trading methods, highlighting their underlying principles, strengths, and weaknesses.

| Method | Underlying Principle | Strengths | Weaknesses |

|---|---|---|---|

| Support Vector Machines (SVM) | Finding the optimal hyperplane that separates data points into different classes, maximizing the margin between them. | High accuracy, robust to overfitting, can handle high-dimensional data. | Can be computationally expensive for large datasets, sensitive to outliers. |

| Kernel Ridge Regression | Regularized linear regression with a kernel function to capture non-linear relationships. | Good for predicting continuous variables, computationally efficient. | May not perform well with highly non-linear data. |

| Kernel Principal Component Analysis (KPCA) | Dimensionality reduction technique that projects data onto a lower-dimensional space using kernel functions. | Can extract relevant features from high-dimensional data, improve model performance. | May lose some information during dimensionality reduction. |

| Gaussian Processes (GP) | Bayesian approach that models the underlying function as a Gaussian process, capturing uncertainty and providing probabilistic predictions. | Provides uncertainty estimates, flexible and adaptable to different data structures. | Can be computationally expensive for large datasets. |

Kernel Trading Method Implementation

Example: Kernel Ridge Regression for Stock Price Prediction

Step 1: Data Preparation

Collect historical stock price data, including features like price, volume, and indicators. Preprocess the data by normalizing and scaling features.Step 2: Kernel Selection

Choose a suitable kernel function, such as the Gaussian kernel, to capture non-linear relationships in the data.Step 3: Model Training

Train the Kernel Ridge Regression model on the prepared data, adjusting hyperparameters like the regularization parameter and kernel bandwidth.Step 4: Prediction

Use the trained model to predict future stock prices based on new data.Step 5: Trading Signal Generation

Generate trading signals based on the predicted price movements, such as buy, sell, or hold.Step 6: Backtesting and Optimization

Backtest the trading strategy on historical data to evaluate its performance and optimize hyperparameters for better results.

Comparison of Kernel Trading Methods

Kernel trading methods differ in their suitability for various market conditions and risk profiles. SVM and GP are generally more robust and capable of handling complex relationships, making them suitable for volatile markets. However, they can be computationally expensive and may require extensive data preprocessing. Kernel Ridge Regression, on the other hand, is computationally efficient and performs well with less complex relationships, making it suitable for stable markets with less noise. KPCA can be used to reduce dimensionality and improve the performance of other kernel methods, especially when dealing with high-dimensional data.

Model Training and Optimization

Kernel trading models, like any machine learning model, require extensive training using historical data to learn patterns and predict future market movements. This process involves feeding the model with historical data, allowing it to identify relationships and correlations, and then optimizing its parameters to achieve the best possible performance.

Training Kernel Trading Models

Training kernel trading models involves feeding the model with historical data, allowing it to identify relationships and correlations. This process typically involves the following steps:

- Data Preparation: The first step is to collect and prepare historical data, such as price data, volume data, and other relevant market indicators. This data must be cleaned, formatted, and split into training and testing sets. The training set is used to train the model, while the testing set is used to evaluate its performance.

- Model Selection: Choosing the right kernel function is crucial for the performance of a kernel trading model. Common kernel functions include the linear kernel, polynomial kernel, and radial basis function (RBF) kernel. The choice of kernel function depends on the nature of the data and the desired trading strategy.

- Parameter Optimization: Once the kernel function is selected, the model’s parameters need to be optimized. This involves finding the optimal values for parameters such as the regularization constant, the kernel width, and the degree of the polynomial kernel. This optimization process aims to minimize the model’s error on the training data.

- Model Evaluation: After training, the model’s performance is evaluated on the testing data. This helps assess the model’s ability to generalize to unseen data and predict future market movements accurately.

Optimization Techniques

Optimizing kernel trading models involves using various techniques to enhance their performance and achieve the best possible results. These techniques include:

- Grid Search: This technique involves systematically trying out different combinations of model parameters within a predefined range. The best combination is then selected based on the model’s performance on the validation set.

- Random Search: This technique randomly samples parameter combinations within a predefined range. It can be more efficient than grid search, especially when dealing with a large number of parameters.

- Gradient Descent: This technique involves iteratively adjusting model parameters to minimize the model’s error on the training data. Gradient descent algorithms like stochastic gradient descent (SGD) are commonly used in kernel trading model optimization.

- Cross-Validation: This technique involves splitting the training data into multiple folds and using each fold as a validation set while training the model on the remaining folds. This helps to prevent overfitting and improve the model’s generalization ability.

- Regularization: This technique adds a penalty term to the model’s objective function to prevent overfitting. Common regularization techniques include L1 and L2 regularization.

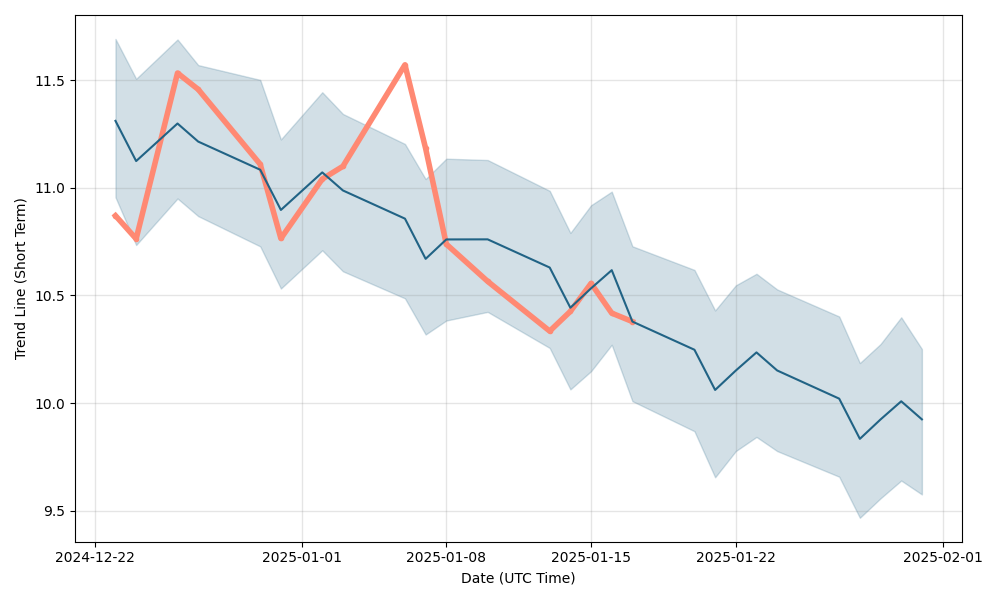

Backtesting

Backtesting is a crucial step in evaluating kernel trading strategies. It involves simulating the strategy on historical data to assess its performance and identify potential flaws. Backtesting allows traders to:

- Evaluate Performance: Backtesting provides insights into the strategy’s profitability, risk-reward ratio, and drawdown. This helps traders understand the strategy’s potential and its ability to generate returns.

- Identify Drawbacks: Backtesting can reveal potential weaknesses in the strategy, such as its sensitivity to market conditions, its ability to handle extreme events, and its overall robustness.

- Optimize Parameters: Backtesting allows traders to experiment with different parameters and identify the optimal settings for the strategy. This helps to fine-tune the strategy and improve its performance.

- Validate Assumptions: Backtesting helps validate the assumptions underlying the trading strategy. If the strategy performs poorly in backtesting, it may indicate that the assumptions are flawed or that the strategy is not well-suited to the market.

Backtesting is an essential tool for evaluating kernel trading strategies. It provides valuable insights into the strategy’s performance and helps traders make informed decisions about its implementation.

Risk Management and Evaluation

Kernel trading strategies, while offering potential for high returns, are not without inherent risks. Understanding and mitigating these risks is crucial for successful kernel trading. This section explores key risk factors associated with kernel trading and examines various risk management techniques applicable to this domain. Additionally, we will delve into the evaluation of kernel trading strategies using performance metrics to assess their effectiveness.

Risk Factors in Kernel Trading

Kernel trading strategies involve complex models trained on historical data. These models are susceptible to several risks, including:

- Overfitting: Kernel models can overfit the training data, leading to poor generalization to unseen data. This occurs when the model learns the training data too well, including its noise, resulting in poor performance on new data.

- Data Leakage: Using data that is not available at the time of trading can lead to unrealistic performance estimates. This is known as data leakage, where information from the future is used to train the model, leading to biased results.

- Market Volatility: Financial markets are inherently volatile, and kernel models trained on historical data may not be able to predict future market movements accurately. Sudden market shifts or unexpected events can significantly impact model performance.

- Model Drift: Market conditions and patterns can change over time, leading to model drift. This occurs when the model’s performance degrades due to changes in the underlying data distribution.

- Computational Complexity: Kernel methods can be computationally intensive, requiring significant processing power and time, particularly for large datasets. This can be a challenge for real-time trading, where quick decisions are essential.

Risk Management Techniques

Several risk management techniques can be employed to mitigate the risks associated with kernel trading strategies:

- Cross-Validation: Cross-validation techniques like k-fold cross-validation help assess model performance on unseen data, reducing overfitting. This technique involves splitting the data into multiple folds, training the model on a subset of folds and testing it on the remaining fold. This process is repeated for different folds, providing a more robust estimate of model performance.

- Regularization: Regularization techniques, such as L1 and L2 regularization, help prevent overfitting by penalizing complex models. These techniques add a penalty term to the model’s loss function, encouraging simpler models with fewer parameters. This can improve model generalization and reduce the risk of overfitting.

- Feature Engineering: Carefully selecting and engineering features can significantly improve model performance and reduce the risk of overfitting. Feature engineering involves transforming raw data into meaningful features that capture relevant information and improve model interpretability. This process can involve creating new features, combining existing features, or removing irrelevant features.

- Backtesting: Backtesting involves testing the trading strategy on historical data to evaluate its performance under different market conditions. This helps identify potential weaknesses and vulnerabilities in the strategy, allowing for adjustments and improvements before live trading. Backtesting should be performed using realistic market data and considering factors such as transaction costs and slippage.

- Position Sizing: Managing position size is crucial for risk control. It involves determining the amount of capital to allocate to each trade based on risk tolerance and the expected return. This helps limit potential losses and protect capital in case of adverse market movements.

- Stop-Loss Orders: Stop-loss orders are automated orders placed to limit potential losses on a trade. These orders are triggered when the price of the asset reaches a predetermined level, automatically exiting the position and minimizing potential losses.

- Monitoring and Evaluation: Continuous monitoring and evaluation of the trading strategy’s performance are essential. This involves tracking key metrics, identifying potential issues, and making necessary adjustments to the strategy. This process ensures that the strategy remains effective and adapts to changing market conditions.

Performance Metrics

Evaluating the effectiveness of kernel trading strategies requires using appropriate performance metrics. Here’s a table comparing various metrics:

| Metric | Description | Advantages | Disadvantages |

|---|---|---|---|

| Sharpe Ratio | Measures risk-adjusted return, considering the volatility of returns. | Provides a single number to compare different strategies. | Sensitive to the choice of risk-free rate and assumes normal distribution of returns. |

| Sortino Ratio | Similar to Sharpe Ratio but focuses on downside risk (negative returns). | Better reflects risk for investors concerned with downside volatility. | Requires identifying a minimum acceptable return. |

| Maximum Drawdown | Measures the maximum percentage loss experienced by the strategy. | Provides insight into the potential for large losses. | Doesn’t consider the duration of the drawdown. |

| Calmar Ratio | Measures the annualized return relative to the maximum drawdown. | Combines return and risk into a single metric. | Sensitive to the time period used for calculation. |

| Win Rate | Percentage of profitable trades. | Simple measure of strategy’s profitability. | Doesn’t consider the magnitude of wins and losses. |

| Profit Factor | Ratio of total profits to total losses. | Indicates the overall profitability of the strategy. | Doesn’t consider the number of trades or the risk taken. |

| R-Squared | Measures the proportion of variance in the returns explained by the model. | Indicates how well the model fits the data. | Can be misleading if the model is overfitted. |

Emerging Trends and Future Directions

The landscape of financial markets is continuously evolving, driven by advancements in technology, particularly in the realm of machine learning and artificial intelligence. These advancements are profoundly impacting kernel trading technologies, opening up new avenues for sophisticated strategies and enhanced efficiency.

The Impact of Machine Learning and Artificial Intelligence, Kernel trading technologies

The integration of machine learning and artificial intelligence into kernel trading technologies is transforming the way financial markets operate. Machine learning algorithms excel at identifying complex patterns and relationships within vast datasets, enabling traders to make more informed and precise trading decisions. These algorithms can analyze market data, including historical price movements, news sentiment, and economic indicators, to predict future price trends with greater accuracy. This ability to uncover hidden correlations and predict market behavior allows traders to develop more effective trading strategies and optimize their portfolio management.

Future Trends and Applications of Kernel Trading

Kernel trading is poised to play an increasingly significant role in shaping the future of financial markets. Here are some key trends and applications to anticipate:

- Personalized Trading Strategies: Machine learning algorithms can be customized to cater to individual investor preferences and risk profiles. This allows traders to tailor their strategies to their specific investment goals and risk tolerance.

- Automated Trading Systems: Kernel trading technologies are driving the development of automated trading systems that can execute trades based on pre-defined algorithms and real-time market data. These systems eliminate human emotions and biases, leading to more objective and efficient trading decisions.

- High-Frequency Trading: Kernel trading algorithms are well-suited for high-frequency trading, where trades are executed at extremely rapid speeds. These algorithms can analyze market data and execute trades in milliseconds, enabling traders to capitalize on fleeting market opportunities.

- Algorithmic Market Making: Kernel trading algorithms can be used to create liquidity in financial markets by providing continuous buy and sell orders. This helps to ensure market stability and facilitate efficient price discovery.

- Sentiment Analysis and News Monitoring: Kernel trading algorithms can analyze news articles, social media posts, and other forms of textual data to gauge market sentiment and identify potential trading opportunities.

Ethical Considerations and Regulatory Challenges

The widespread adoption of kernel trading technologies raises important ethical considerations and regulatory challenges:

- Algorithmic Bias: Machine learning algorithms are trained on historical data, which may contain biases that could lead to unfair or discriminatory trading practices. It is crucial to ensure that algorithms are trained on diverse and representative datasets to mitigate these risks.

- Market Manipulation: The potential for market manipulation through the use of advanced algorithms is a growing concern. Regulators need to establish clear guidelines and oversight mechanisms to prevent malicious actors from exploiting these technologies.

- Transparency and Accountability: The complex nature of kernel trading algorithms can make it difficult to understand how they make decisions. It is essential to promote transparency and accountability in the use of these technologies, ensuring that traders and regulators have access to clear explanations of algorithm behavior.

- Job Displacement: The automation of trading tasks through kernel trading technologies could lead to job displacement in the financial sector. It is important to address these concerns by investing in education and training programs to prepare workers for the changing job market.

Final Summary: Kernel Trading Technologies

Kernel trading technologies offer a powerful tool for financial market participants, providing opportunities to enhance trading strategies and potentially achieve superior returns. As the field continues to evolve, we can expect to see further advancements in algorithm design, data analysis techniques, and risk management practices. Understanding the principles and applications of kernel trading is crucial for anyone seeking to navigate the increasingly complex world of financial markets.

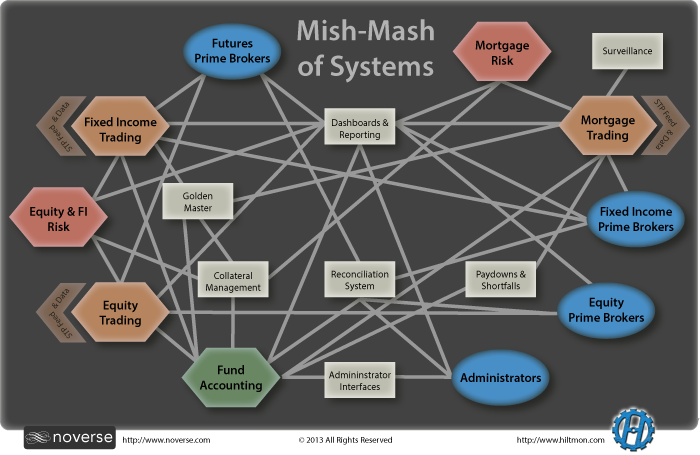

Kernel trading technologies are constantly evolving, requiring a skilled and experienced team to ensure smooth operations. The role of an information technology operations manager is crucial in this context, as they oversee the entire IT infrastructure, including the systems that power kernel trading platforms.

By managing and optimizing these systems, IT operations managers play a vital role in maintaining the efficiency and reliability of kernel trading operations.