Financial Insight Technology: Revolutionizing Finance

Financial insight technology is transforming the way financial institutions operate, analyze data, and make decisions. From traditional methods to modern AI-driven solutions, the evolution of financial insight technology has been […]

Financial insight technology is transforming the way financial institutions operate, analyze data, and make decisions. From traditional methods to modern AI-driven solutions, the evolution of financial insight technology has been marked by significant advancements, driven by a desire to enhance efficiency, accuracy, and decision-making capabilities.

This technology encompasses a range of tools and techniques, including data analytics, machine learning, and artificial intelligence, all designed to extract meaningful insights from vast amounts of financial data. By harnessing the power of these technologies, financial institutions can gain a deeper understanding of their customers, markets, and risks, leading to better informed decisions and improved outcomes.

The Rise of Financial Insight Technology

Financial insight technology has undergone a dramatic transformation, moving from traditional, manual methods to sophisticated, AI-driven solutions. This evolution has been driven by several key factors, including the increasing volume and complexity of financial data, the need for faster and more accurate insights, and the desire to gain a competitive edge in the market.

Evolution of Financial Insight Technology

The evolution of financial insight technology can be broadly categorized into three phases:

- Traditional Methods: In the past, financial institutions relied heavily on manual processes for data analysis and reporting. This involved collecting data from various sources, manually entering it into spreadsheets, and then using basic statistical tools to generate insights. This approach was time-consuming, prone to errors, and limited in its ability to uncover complex relationships and patterns in data.

- Business Intelligence (BI) Tools: The advent of BI tools in the 1990s marked a significant shift towards automation. These tools enabled financial institutions to collect, store, and analyze data more efficiently, providing better insights into business performance. However, BI tools were still largely based on pre-defined reports and dashboards, limiting their ability to adapt to changing business needs.

- AI-Driven Solutions: The emergence of AI and machine learning (ML) technologies in recent years has revolutionized financial insight technology. AI-powered solutions can now analyze vast amounts of data in real-time, identify complex patterns, and generate actionable insights that were previously impossible to uncover. These solutions are also highly adaptable and can be customized to meet the specific needs of different financial institutions.

Key Drivers and Trends

Several key drivers and trends are shaping the landscape of financial insight technology:

- Big Data and Data Analytics: The exponential growth of financial data, driven by factors such as electronic trading, social media, and regulatory reporting, has created a need for sophisticated data analytics tools to extract meaningful insights. AI-powered solutions are particularly well-suited to handle this challenge, as they can process vast amounts of data in real-time and identify complex patterns that would be impossible to detect manually.

- Cloud Computing: Cloud computing has made it easier and more affordable for financial institutions to access and process large volumes of data. This has enabled them to adopt AI-powered solutions more readily, as these solutions typically require significant computing power and storage capacity. The cloud also offers scalability and flexibility, allowing institutions to adjust their computing resources as needed.

- Regulation and Compliance: Increasing regulatory scrutiny and compliance requirements are driving the adoption of financial insight technology. AI-powered solutions can help institutions automate compliance tasks, reduce risk, and improve transparency. For example, AI can be used to detect and prevent fraud, monitor market risk, and ensure compliance with Know Your Customer (KYC) regulations.

- Customer Experience: Financial institutions are increasingly using AI-powered solutions to enhance customer experience. For example, AI-powered chatbots can provide personalized customer service, while AI-driven fraud detection systems can help prevent unauthorized transactions and protect customer data.

Examples of Financial Institutions Leveraging Technology

Several financial institutions are leveraging financial insight technology to gain a competitive edge:

- JPMorgan Chase uses AI to detect and prevent fraud, analyze market trends, and personalize customer experiences. For example, the bank has developed an AI-powered system that can identify fraudulent transactions in real-time, reducing losses and improving customer satisfaction.

- Goldman Sachs uses AI to automate trading, analyze investment opportunities, and manage risk. The firm has developed a system that can execute trades at optimal times, maximizing returns and reducing risk. Goldman Sachs also uses AI to analyze large datasets of financial news and social media posts to identify potential investment opportunities.

- Citigroup uses AI to improve customer service, streamline operations, and manage risk. The bank has developed an AI-powered chatbot that can answer customer questions, provide personalized recommendations, and resolve issues quickly and efficiently. Citigroup also uses AI to monitor market risk and identify potential regulatory violations.

Key Components of Financial Insight Technology

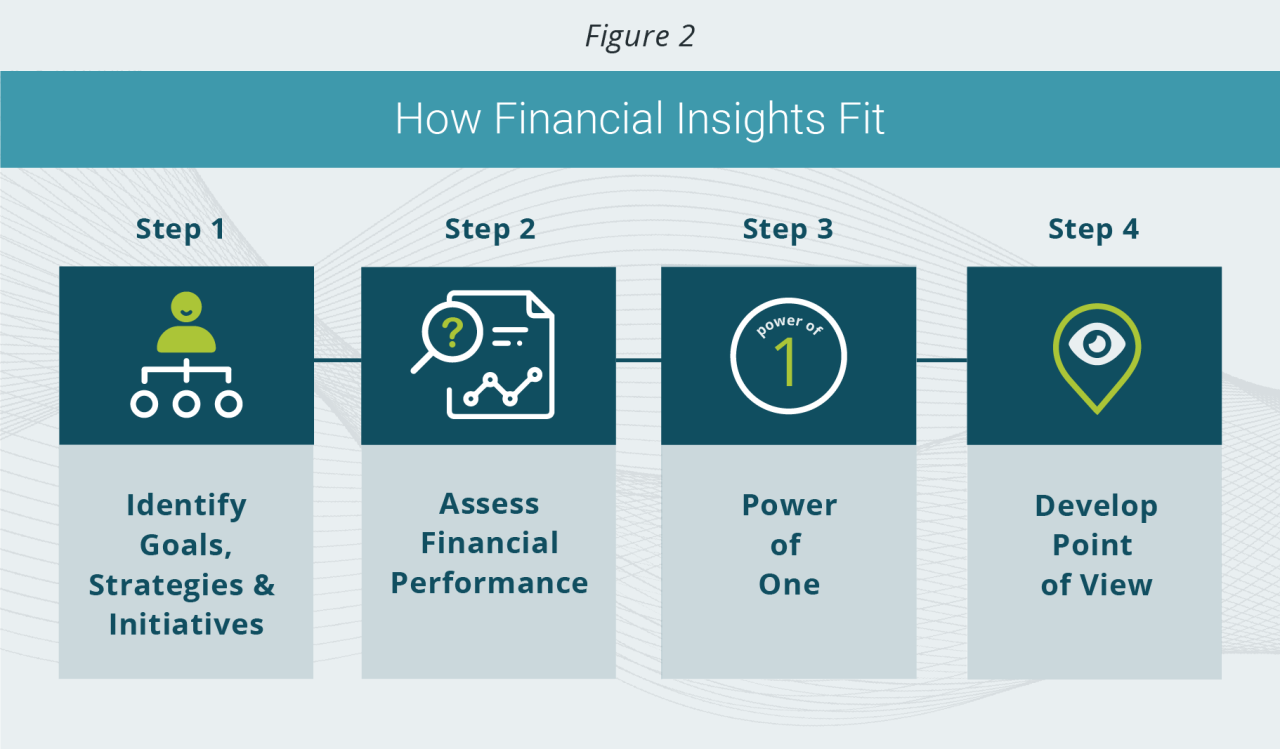

Financial insight technology relies on a sophisticated blend of cutting-edge technologies to extract meaningful information from vast datasets and deliver actionable insights. This section delves into the core components that underpin the power of financial insight technology, exploring how they work together to empower informed decision-making.

Data Analytics, Financial insight technology

Data analytics plays a crucial role in financial insight technology, enabling organizations to uncover hidden patterns, trends, and anomalies within their financial data. By applying statistical methods, data mining techniques, and visualization tools, financial analysts can gain a deeper understanding of historical performance, market dynamics, and risk factors.

Data analytics helps organizations make better financial decisions by providing insights into:

- Revenue trends and drivers

- Cost optimization opportunities

- Customer behavior and segmentation

- Investment performance and risk assessment

Machine Learning

Machine learning algorithms empower financial insight technology to automate complex tasks, predict future outcomes, and identify patterns that might be missed by human analysts. These algorithms learn from historical data, constantly refining their ability to make accurate predictions and recommendations.

Machine learning applications in financial insight technology include:

- Fraud detection

- Credit risk assessment

- Algorithmic trading

- Personalized financial advice

Artificial Intelligence

Artificial intelligence (AI) takes machine learning a step further by enabling systems to perform tasks that typically require human intelligence. AI-powered financial insight platforms can analyze vast amounts of data, identify complex relationships, and generate insights that would be difficult or impossible for humans to uncover.

AI applications in financial insight technology include:

- Natural language processing for analyzing financial news and reports

- Computer vision for image recognition in financial documents

- Chatbots for providing automated customer support

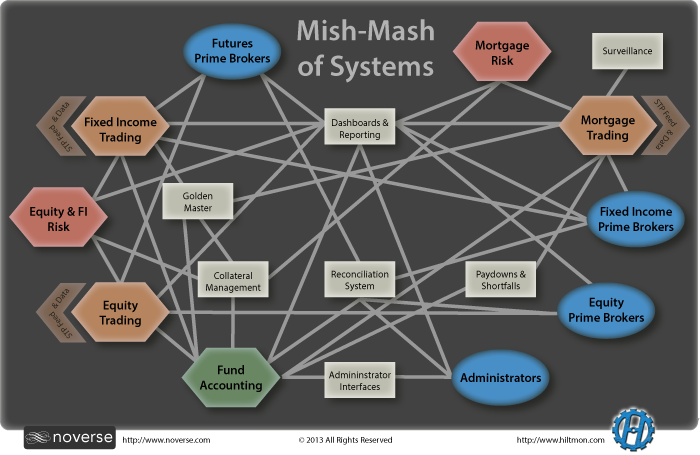

Data Management and Integration

The foundation of any robust financial insight technology is a well-structured data management and integration framework. This involves collecting, cleaning, transforming, and storing financial data from various sources, ensuring data quality and consistency.

Key aspects of data management and integration include:

- Data warehousing and data lakes

- Data quality assurance and cleansing

- Data integration and transformation

- Data security and compliance

User Interfaces and Visualizations

Effective communication of financial insights is paramount. User-friendly interfaces and intuitive visualizations play a critical role in presenting complex data in a clear, concise, and engaging way. This allows stakeholders to easily understand the insights and make informed decisions.

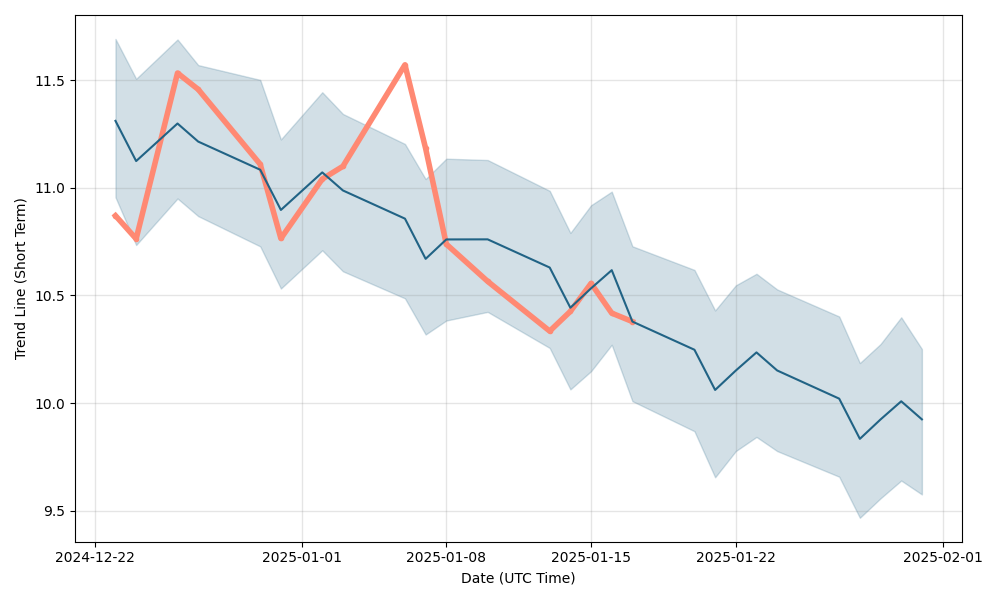

Examples of effective visualizations include:

- Interactive dashboards

- Charts and graphs

- Heatmaps and scatter plots

- Animated visualizations

Applications of Financial Insight Technology

Financial insight technology, with its powerful analytical capabilities, has a wide range of applications across various areas of finance. This technology helps financial institutions and individuals make informed decisions, optimize operations, and mitigate risks.

Applications Across Finance

Financial insight technology finds its applications in various areas of finance, enabling better decision-making and risk management.

| Application | Area of Finance | Example |

|---|---|---|

| Risk Management | Credit Risk Assessment | Using AI to identify potential loan defaults by analyzing borrower data, credit history, and market trends. |

| Investment Management | Portfolio Optimization | Leveraging machine learning to predict asset performance and allocate investments across different asset classes based on risk tolerance and investment goals. |

| Fraud Detection | Transaction Monitoring | Identifying suspicious activities in real-time by analyzing transaction patterns and comparing them against predefined rules and historical data. |

| Regulatory Compliance | Know Your Customer (KYC) | Utilizing AI to automate KYC processes by verifying customer identities and ensuring compliance with regulatory requirements. |

| Customer Segmentation | Marketing and Sales | Analyzing customer data to identify different segments with specific needs and preferences, enabling targeted marketing campaigns and personalized product offerings. |

| Market Analysis | Trading and Investment | Utilizing natural language processing (NLP) to analyze news articles, social media posts, and other market data to identify emerging trends and predict market movements. |

Enhancement of Decision-Making

Financial insight technology significantly enhances decision-making in various areas of finance by providing valuable insights and automating complex processes.

Regulatory Compliance

Financial institutions can use financial insight technology to automate regulatory compliance processes, such as Know Your Customer (KYC) and Anti-Money Laundering (AML) checks. For example, AI-powered systems can analyze customer data and transactions in real-time to identify potential risks and ensure compliance with regulatory requirements. This helps financial institutions reduce the risk of penalties and maintain a good reputation.

Customer Segmentation

By analyzing customer data, financial insight technology helps financial institutions segment their customer base based on demographics, financial behavior, and other factors. This enables them to tailor their products and services to meet the specific needs of each customer segment. For example, a bank can use AI to identify customers who are likely to be interested in a new investment product based on their past investment behavior and financial goals.

Market Analysis

Financial insight technology provides valuable insights into market trends and sentiment, enabling financial institutions to make informed trading and investment decisions. For example, AI-powered systems can analyze news articles, social media posts, and other market data to identify emerging trends and predict market movements. This helps traders and investors make more informed decisions and potentially improve their returns.

Benefits and Challenges of Financial Insight Technology

Financial insight technology offers numerous benefits, enabling organizations to make more informed decisions and optimize their financial performance. However, its implementation also presents various challenges that require careful consideration and strategic planning.

Benefits of Financial Insight Technology

Financial insight technology provides a powerful toolkit for enhancing financial operations and driving strategic decision-making. It offers several key benefits:

- Improved Accuracy: Financial insight technology leverages advanced analytics and automation to minimize manual errors and ensure data accuracy. This is crucial for reliable financial reporting and decision-making.

- Enhanced Efficiency: By automating repetitive tasks and streamlining processes, financial insight technology frees up valuable time for financial professionals to focus on strategic initiatives and higher-value activities.

- Data-Driven Insights: Financial insight technology empowers organizations to analyze vast amounts of data and uncover hidden patterns and trends. This provides deeper insights into financial performance, customer behavior, and market dynamics, enabling better informed decisions.

- Proactive Risk Management: By identifying potential risks early, financial insight technology enables organizations to take proactive steps to mitigate them. This helps to protect financial stability and reduce the likelihood of costly financial crises.

- Competitive Advantage: Organizations that embrace financial insight technology can gain a significant competitive advantage by making faster, more informed decisions and adapting quickly to changing market conditions.

Challenges of Implementing Financial Insight Technology

While the benefits of financial insight technology are significant, its implementation also poses several challenges:

- Data Quality and Security: Financial data is highly sensitive and requires robust security measures to prevent unauthorized access and data breaches. Ensuring data quality is also critical for accurate analysis and reliable insights.

- Ethical Considerations: The use of financial insight technology raises ethical concerns, such as potential bias in algorithms, data privacy, and the impact on employment. Organizations must carefully consider these issues and implement ethical guidelines for the responsible use of this technology.

- Skills Gap in Data Science and Analytics: Implementing and utilizing financial insight technology requires skilled professionals with expertise in data science, analytics, and financial modeling. The lack of such talent can be a significant barrier to successful adoption.

Concluding Remarks

As financial insight technology continues to evolve, we can expect even more transformative applications in the years to come. From explainable AI to blockchain and quantum computing, the future holds exciting possibilities for financial institutions to leverage these technologies to navigate an increasingly complex and dynamic financial landscape. By embracing the power of financial insight technology, financial institutions can position themselves for success in the ever-evolving world of finance.

Financial insight technology can be a powerful tool for optimizing energy consumption and reducing costs. One example of this is the solaredge technologies bat-10k1p , a home battery system that can store excess solar energy for use during peak demand periods.

By utilizing such technology, businesses and individuals can gain a better understanding of their energy usage patterns and make informed decisions to improve their financial standing.