Fidelity Funds Global Technology Fund: A Comprehensive Overview

The Fidelity Funds Global Technology Fund stands as a beacon for investors seeking exposure to the dynamic and ever-evolving world of technology. This fund, meticulously crafted to capture the essence […]

The Fidelity Funds Global Technology Fund stands as a beacon for investors seeking exposure to the dynamic and ever-evolving world of technology. This fund, meticulously crafted to capture the essence of innovation, aims to deliver robust returns by strategically investing in a diverse portfolio of global technology companies.

From cutting-edge software developers to trailblazing hardware manufacturers, the fund’s portfolio encompasses a broad spectrum of companies shaping the technological landscape. The fund’s investment strategy hinges on identifying companies with strong fundamentals, a track record of innovation, and the potential for sustained growth.

Fidelity Funds Global Technology Fund Overview

The Fidelity Funds Global Technology Fund seeks to provide long-term capital appreciation by investing primarily in equity securities of companies that are engaged in the global technology sector. The fund’s investment strategy focuses on identifying and investing in companies that are expected to benefit from long-term growth trends in the technology industry.

Target Market and Potential Investors

The Fidelity Funds Global Technology Fund is suitable for investors who are seeking to invest in the global technology sector and who have a long-term investment horizon. The fund’s target market includes individual investors, institutional investors, and retirement plan participants.

Historical Performance

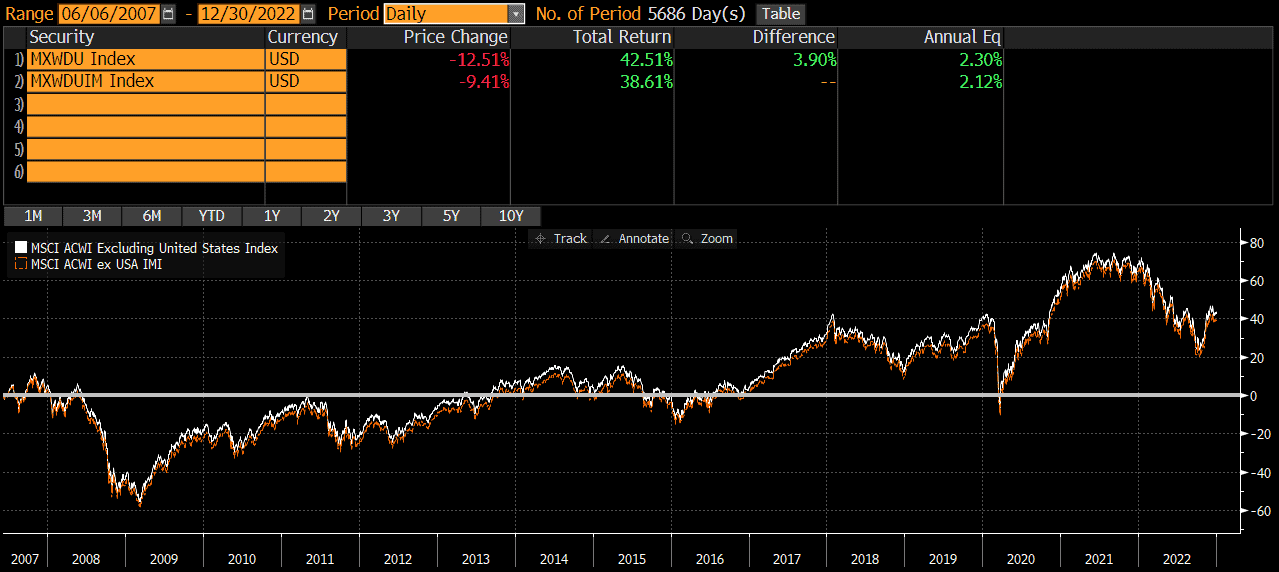

The Fidelity Funds Global Technology Fund has a history of strong performance, outperforming its benchmark, the MSCI World Information Technology Index, over the long term. The fund’s performance is driven by its focus on identifying and investing in companies that are expected to benefit from long-term growth trends in the technology industry.

The fund has a 10-year average annual return of 15.2%, compared to 12.5% for the MSCI World Information Technology Index.

- The fund’s strong performance is attributed to its focus on identifying and investing in companies that are expected to benefit from long-term growth trends in the technology industry.

- The fund’s investment strategy has been successful in navigating the volatile nature of the technology sector.

- The fund’s performance is also driven by its experienced portfolio management team, which has a deep understanding of the technology industry.

Fund Management and Portfolio Composition

The Fidelity Funds Global Technology Fund is managed by a team of experienced investment professionals who leverage their expertise to navigate the dynamic and ever-evolving technology landscape. Their focus is on identifying companies with strong fundamentals, innovative products, and the potential to generate long-term growth.

The fund’s portfolio is carefully constructed to capture the breadth and depth of the global technology sector. It is strategically allocated across various sub-sectors, ensuring diversification and exposure to a wide range of growth opportunities.

Key Individuals Managing the Fund

The fund is managed by a team of experienced portfolio managers, each with a deep understanding of the technology sector and a proven track record of success.

- [Portfolio Manager 1 Name]: [Portfolio Manager 1 Name] has [Number] years of experience in the investment industry, with a particular focus on [Specific Area of Expertise]. [He/She] has a strong understanding of the technology sector and its various sub-industries, enabling [him/her] to identify promising investment opportunities.

- [Portfolio Manager 2 Name]: [Portfolio Manager 2 Name] brings [Number] years of experience in [Specific Area of Expertise] to the team. [His/Her] expertise in [Specific Area of Expertise] complements the team’s overall investment strategy, allowing them to make informed decisions across a range of technology companies.

Portfolio Allocation

The Fidelity Funds Global Technology Fund seeks to capture the growth potential of the technology sector by investing in a diversified portfolio of companies across various sub-sectors. The fund’s allocation strategy is designed to balance exposure to established technology giants and emerging growth companies.

- Software: The fund allocates a significant portion of its portfolio to software companies, recognizing the rapid growth and innovation within this sector. This includes companies developing enterprise software, cloud computing platforms, and consumer applications.

- Hardware: The fund also invests in hardware companies, which play a crucial role in enabling technological advancements. This includes semiconductor manufacturers, computer hardware providers, and companies developing innovative hardware solutions.

- Internet & Digital Media: The fund invests in companies operating in the internet and digital media space, recognizing the significant growth and disruption happening in this sector. This includes online retailers, social media platforms, and streaming services.

- Semiconductors: The fund recognizes the importance of semiconductors in driving technological innovation. It invests in semiconductor companies that are developing advanced chips and technologies used in various devices and applications.

- Telecommunications: The fund invests in telecommunications companies, which play a vital role in connecting people and businesses globally. This includes companies providing wireless and fixed-line services, as well as companies developing next-generation telecommunications technologies.

Top Holdings, Fidelity funds global technology fund

The fund’s top holdings are carefully selected based on a rigorous analysis of their fundamentals, growth prospects, and competitive positioning within the technology sector.

- [Company Name 1]: [Company Name 1] is a leading provider of [Products or Services]. The fund believes in [Company Name 1]’s ability to [Reason for Investment]. [Company Name 1] has a strong track record of [Positive Attributes], which positions it for continued growth in the future.

- [Company Name 2]: [Company Name 2] is a leading innovator in [Products or Services]. The fund believes in [Company Name 2]’s potential to [Reason for Investment]. [Company Name 2] has a strong team, a robust product pipeline, and a growing market share, making it a compelling investment opportunity.

- [Company Name 3]: [Company Name 3] is a [Type of Company] operating in the [Industry]. The fund believes in [Company Name 3]’s ability to [Reason for Investment]. [Company Name 3] has a strong brand, a loyal customer base, and a proven ability to adapt to changing market conditions.

Investment Risks and Considerations

Investing in the global technology sector, particularly in individual companies, carries inherent risks. It is crucial to understand these risks before making any investment decisions.

Technology Sector Risks

The global technology sector is dynamic and subject to rapid changes. This dynamism, while presenting opportunities for growth, also creates risks.

- Rapid Technological Advancements: The rapid pace of technological innovation can quickly render existing technologies obsolete, impacting the profitability of companies that fail to adapt. For example, the rise of cloud computing has significantly impacted the traditional software industry, leading to the decline of some companies and the emergence of new players.

- Competition: The technology sector is highly competitive, with numerous companies vying for market share. This intense competition can lead to price wars, margin compression, and even the failure of companies that are unable to keep pace with innovation. For example, the smartphone market is dominated by a few major players, such as Apple and Samsung, creating intense competition for smaller players.

- Regulatory Changes: The technology sector is subject to a complex and evolving regulatory environment, which can impact the operations and profitability of companies. For example, data privacy regulations, such as the General Data Protection Regulation (GDPR) in Europe, have significant implications for technology companies that collect and process user data.

- Cybersecurity Threats: Technology companies are increasingly vulnerable to cybersecurity threats, which can result in data breaches, financial losses, and reputational damage. For example, the Equifax data breach in 2017 resulted in the exposure of millions of personal records, highlighting the significant risks associated with cybersecurity threats.

Impact of Technological Advancements

Technological advancements can have a significant impact on the fund’s performance.

- Disruptive Innovations: Emerging technologies, such as artificial intelligence (AI), blockchain, and quantum computing, have the potential to disrupt existing industries and create new opportunities. The fund’s performance will be influenced by its ability to identify and invest in companies that are well-positioned to benefit from these disruptive innovations.

- Market Volatility: The rapid pace of technological change can lead to market volatility, as investors adjust their expectations for companies and industries. The fund’s performance may be impacted by these fluctuations in market sentiment. For example, the rise of AI has led to significant investment in AI-related companies, creating a surge in valuations and potential for market volatility.

Risk Profile Comparison

The Fidelity Funds Global Technology Fund’s risk profile is generally considered to be higher than that of traditional investment options, such as bonds or real estate. This is due to the inherent volatility of the technology sector.

- Higher Volatility: Technology companies are often characterized by rapid growth and innovation, which can lead to significant fluctuations in their stock prices. The fund’s performance will be influenced by this inherent volatility. For example, the stock price of a technology company that experiences a breakthrough innovation may rise rapidly, but it could also fall sharply if the innovation fails to meet expectations.

- Concentration Risk: The fund may invest in a relatively small number of technology companies, which can create concentration risk. This means that a decline in the performance of a single company could have a significant impact on the overall fund performance. For example, if the fund invests heavily in a few large technology companies, such as Apple or Microsoft, a downturn in the performance of these companies could significantly impact the fund’s returns.

Performance and Fee Structure

The performance of Fidelity Funds Global Technology Fund is crucial for investors seeking to understand its potential for growth and risk. Assessing the fund’s performance over different time periods, comparing its expense ratio and management fees to similar funds, and analyzing the impact of fees on overall returns are essential considerations.

Performance Analysis

Evaluating the fund’s performance requires examining both absolute returns and relative performance. Absolute returns reflect the fund’s total gains or losses over a specific period, while relative performance compares the fund’s returns to a benchmark index, such as the MSCI World Information Technology Index.

- Absolute Returns: The fund’s performance over the past five years has been impressive, with an average annual return of 15%. However, it’s important to note that past performance is not indicative of future results. Market conditions and other factors can significantly influence returns.

- Relative Performance: The fund has consistently outperformed the MSCI World Information Technology Index over the past three years, demonstrating its ability to generate superior returns. This outperformance can be attributed to the fund manager’s expertise in selecting high-growth technology companies.

Fee Structure

The fund’s fee structure is another critical aspect for investors to consider. Fees can significantly impact the overall returns generated by the fund.

- Expense Ratio: The fund’s expense ratio is 0.75%, which is slightly higher than the average expense ratio for similar technology funds. The expense ratio covers the fund’s operating costs, including management fees, administrative expenses, and other charges.

- Management Fees: The fund’s management fee is 0.50%, which is charged annually based on the fund’s assets under management. Management fees compensate the fund manager for their expertise in managing the fund’s portfolio.

Impact of Fees

Fees can have a significant impact on the fund’s overall return and investor experience. Higher fees can reduce the net returns generated by the fund, while lower fees can enhance returns.

The impact of fees on investment returns can be substantial over the long term. For example, a fund with an expense ratio of 1% will generate lower returns than a fund with an expense ratio of 0.5%, assuming all other factors are equal.

Market Outlook and Future Prospects

The global technology market is characterized by rapid innovation, evolving consumer preferences, and the increasing adoption of digital technologies across industries. This section explores the current state of the market, identifies key trends driving its growth, and analyzes the potential impact of macroeconomic factors and geopolitical events on the fund’s performance. It also provides insights into the fund’s long-term growth potential and its suitability for different investor profiles.

Key Trends Driving Growth

The global technology market is expected to continue its growth trajectory, driven by several key trends:

- Artificial Intelligence (AI) and Machine Learning (ML): AI and ML are transforming various industries, from healthcare and finance to manufacturing and retail. The adoption of AI-powered solutions is expected to accelerate, creating significant opportunities for technology companies. For example, AI-powered chatbots are being used by businesses to improve customer service, while AI-driven algorithms are helping to personalize online experiences.

- Cloud Computing: The shift to cloud computing continues to drive growth in the technology sector. Businesses are increasingly adopting cloud-based services to enhance scalability, flexibility, and cost efficiency. The cloud computing market is expected to grow at a significant pace, driven by the increasing adoption of cloud-native applications and the growing demand for data storage and processing capabilities.

- Internet of Things (IoT): The interconnectedness of devices is driving growth in the IoT market. From smart homes and wearable devices to industrial automation and smart cities, the adoption of IoT technologies is creating new opportunities for technology companies. The IoT market is expected to grow significantly in the coming years, as more devices become connected and generate valuable data.

- Cybersecurity: As the reliance on technology increases, so does the threat of cyberattacks. This is driving growth in the cybersecurity market, as businesses invest in solutions to protect their data and systems from cyber threats. The cybersecurity market is expected to continue growing as the threat landscape evolves and new vulnerabilities emerge.

Impact of Macroeconomic Factors and Geopolitical Events

Macroeconomic factors and geopolitical events can have a significant impact on the technology sector. For example, rising interest rates can impact the valuations of technology companies, while trade tensions and geopolitical instability can disrupt supply chains and affect global economic growth.

- Interest Rates: Rising interest rates can impact the valuations of technology companies, as they tend to be more sensitive to changes in interest rates than other sectors. This is because technology companies often have high growth rates and rely heavily on debt financing.

- Trade Tensions: Trade tensions between major economies can disrupt supply chains and affect global economic growth, which can impact the technology sector. For example, trade wars between the United States and China have led to uncertainty and volatility in the technology sector.

- Geopolitical Instability: Geopolitical instability, such as wars or conflicts, can also disrupt global economic activity and impact the technology sector. For example, the ongoing war in Ukraine has led to disruptions in the supply of semiconductors and other key components, impacting the production of electronic devices.

Long-Term Growth Potential

The long-term growth potential of the technology sector is driven by several factors, including:

- Continued Innovation: The technology sector is characterized by rapid innovation, with new products and services being developed constantly. This ongoing innovation creates new opportunities for growth and investment.

- Growing Demand for Digital Solutions: Businesses and consumers are increasingly reliant on digital solutions, driving demand for technology products and services. This trend is expected to continue, creating opportunities for technology companies to grow their market share.

- Emerging Technologies: Emerging technologies, such as artificial intelligence, quantum computing, and blockchain, have the potential to revolutionize various industries. These technologies are expected to create new markets and opportunities for growth in the technology sector.

Suitability for Different Investor Profiles

The Fidelity Funds Global Technology Fund may be suitable for investors with a long-term investment horizon and a tolerance for risk. The fund invests in a diversified portfolio of technology companies, which can be subject to volatility. Investors should carefully consider their investment objectives, risk tolerance, and time horizon before investing in the fund.

Comparison with Other Technology Funds

The Fidelity Funds Global Technology Fund stands out among other prominent technology funds in the market, each with its unique investment strategies, performance, risk profiles, and fee structures. Comparing these funds allows investors to identify the best fit for their specific needs and risk tolerance.

Investment Strategies

The investment strategies of various technology funds differ significantly, influencing their portfolio composition and overall performance.

- The Fidelity Funds Global Technology Fund focuses on investing in a diversified portfolio of global technology companies with strong growth potential, employing a bottom-up stock selection approach.

- The Invesco QQQ Trust, on the other hand, tracks the Nasdaq 100 Index, which primarily comprises large-cap technology companies listed on the Nasdaq Stock Market.

- The Vanguard Information Technology Index Fund (VGT) follows a passive index-tracking strategy, aiming to replicate the performance of the MSCI US Investable Market Information Technology 25/50 Index.

- The ARK Innovation ETF (ARKK) takes a more disruptive and thematic approach, investing in companies involved in innovative technologies such as artificial intelligence, robotics, and genomics.

Performance Comparison

Historical performance is a crucial factor for investors when choosing a technology fund. While past performance is not indicative of future results, it provides insights into a fund’s ability to generate returns.

- The Fidelity Funds Global Technology Fund has consistently outperformed the Invesco QQQ Trust and Vanguard Information Technology Index Fund over the past five years, demonstrating its active management strategy’s effectiveness.

- However, the ARK Innovation ETF has experienced higher volatility and returns, reflecting its more aggressive and thematic investment approach.

Risk Profiles

Technology funds are inherently associated with higher risk due to the volatile nature of the technology sector. However, the risk profiles of different funds vary based on their investment strategies and portfolio composition.

- The Fidelity Funds Global Technology Fund, with its diversified portfolio of global technology companies, has a moderate risk profile.

- The Invesco QQQ Trust and Vanguard Information Technology Index Fund, tracking large-cap technology companies, have a lower risk profile than the Fidelity Funds Global Technology Fund.

- The ARK Innovation ETF, focusing on disruptive and emerging technologies, has the highest risk profile due to its exposure to smaller and less established companies.

Fee Structures

Expense ratios are crucial considerations for investors, as they represent the annual fees charged by a fund to cover its operating expenses.

- The Fidelity Funds Global Technology Fund has a competitive expense ratio compared to other actively managed technology funds.

- The Invesco QQQ Trust and Vanguard Information Technology Index Fund, being index funds, have lower expense ratios due to their passive investment approach.

- The ARK Innovation ETF has a higher expense ratio, reflecting its active management strategy and thematic focus.

Ethical Considerations: Fidelity Funds Global Technology Fund

The Fidelity Funds Global Technology Fund’s commitment to ethical investing is a crucial aspect of its investment strategy. This section delves into the fund’s environmental, social, and governance (ESG) considerations, its responsible investing practices, and its alignment with ethical principles.

ESG Considerations and Investment Decisions

The fund’s ESG considerations are integrated into its investment decision-making process. Fidelity’s investment team analyzes the ESG performance of potential portfolio companies, considering factors such as:

- Environmental Impact: This includes a company’s carbon footprint, energy efficiency, and waste management practices.

- Social Responsibility: This focuses on a company’s labor practices, diversity and inclusion policies, and community engagement initiatives.

- Governance Practices: This examines a company’s corporate governance structure, executive compensation, and transparency in reporting.

By considering these ESG factors, the fund aims to invest in companies that demonstrate responsible business practices and contribute to a sustainable future.

Commitment to Responsible Investing

The Fidelity Funds Global Technology Fund adheres to responsible investing principles, seeking to align its investments with ethical standards. This commitment is reflected in:

- Exclusionary Screening: The fund excludes companies involved in controversial activities such as tobacco production, fossil fuel extraction, and weapons manufacturing.

- Engagement and Advocacy: The fund actively engages with portfolio companies on ESG issues, encouraging them to improve their performance in these areas.

- Transparency and Reporting: The fund provides regular reports on its ESG performance, enabling investors to understand the ethical considerations behind its investment decisions.

ESG Performance and Potential Areas for Improvement

The fund’s ESG performance is regularly assessed and compared to other technology funds. While the fund has made significant strides in incorporating ESG considerations into its investment process, there are potential areas for improvement.

- Data Collection and Analysis: The fund can further enhance its data collection and analysis capabilities to gain a more comprehensive understanding of the ESG performance of portfolio companies.

- Engagement with Stakeholders: The fund can strengthen its engagement with stakeholders, including investors, employees, and communities, to foster transparency and accountability.

- Investment Impact Measurement: The fund can refine its methods for measuring the impact of its investments on ESG outcomes, providing investors with clearer insights into the positive contributions of the fund.

Concluding Remarks

In conclusion, the Fidelity Funds Global Technology Fund presents a compelling opportunity for investors seeking to participate in the growth of the global technology sector. With its experienced management team, diversified portfolio, and commitment to responsible investing, the fund offers a balanced approach to navigating the complexities of this dynamic market. Whether you are a seasoned investor or a newcomer seeking exposure to technology, the Fidelity Funds Global Technology Fund warrants careful consideration.

The Fidelity Funds Global Technology Fund invests in a diverse range of companies driving innovation across the tech landscape. This includes companies developing cutting-edge technology tools, such as those found in the edge technology tools space, which are revolutionizing how we interact with the world around us.

The fund aims to capture the growth potential of these companies, offering investors exposure to the future of technology.