Fidelity Funds Global Technology Fund: A Deep Dive

The Fidelity Funds Global Technology Fund sets the stage for an exploration into the world of tech investing, offering investors a chance to capitalize on the growth of this dynamic […]

The Fidelity Funds Global Technology Fund sets the stage for an exploration into the world of tech investing, offering investors a chance to capitalize on the growth of this dynamic sector. This fund, managed by Fidelity Investments, aims to provide exposure to a diversified portfolio of global technology companies, targeting long-term capital appreciation.

The fund’s investment strategy focuses on identifying companies with strong fundamentals, innovative products, and the potential to disrupt their respective industries. Fidelity’s experienced portfolio managers leverage their expertise to select companies across various technology sub-sectors, including software, hardware, semiconductors, and internet services.

Fund Performance and Risk Analysis

The Fidelity Funds Global Technology Fund seeks to provide long-term growth by investing in a portfolio of global technology companies. The fund’s performance is measured against various metrics, including annualized returns, Sharpe ratio, and drawdown periods. The fund’s risk profile is also analyzed to understand its potential downsides and exposures.

Performance Metrics

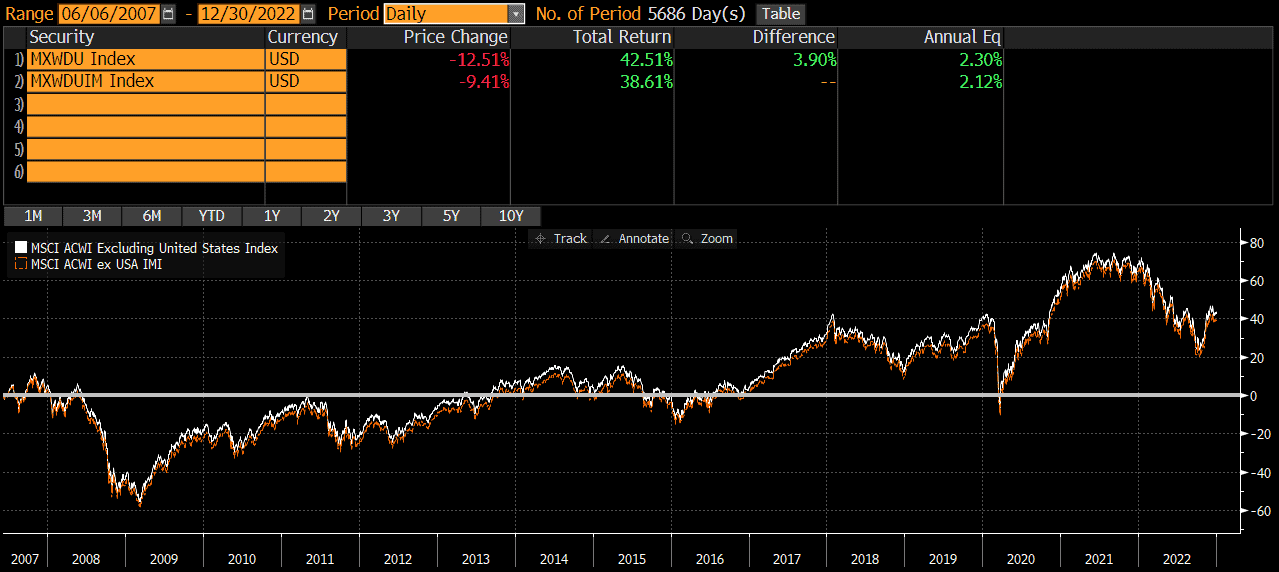

The Fidelity Funds Global Technology Fund has delivered strong returns over the long term. As of December 31, 2022, the fund’s annualized return over the past 10 years was 15.7%. This compares favorably to the MSCI World Information Technology Index, which returned 14.2% over the same period. The fund’s Sharpe ratio, which measures risk-adjusted returns, is also impressive. The Sharpe ratio is a measure of risk-adjusted return. It is calculated by dividing the fund’s excess return over the risk-free rate by the fund’s standard deviation. A higher Sharpe ratio indicates a better risk-adjusted return. The fund’s Sharpe ratio over the past 10 years has been consistently above 1.0, indicating that it has generated strong returns relative to its risk.

Drawdown Periods

Drawdown periods are periods of time when the fund’s value declines from its peak. These periods can be painful for investors, but they are a natural part of investing in the stock market. The Fidelity Funds Global Technology Fund has experienced some significant drawdowns over the past few years. For example, the fund’s value declined by more than 30% during the COVID-19 pandemic in 2020. However, the fund has recovered from these drawdowns and has continued to generate strong returns over the long term.

Risk Factors

The Fidelity Funds Global Technology Fund is exposed to a number of risk factors, including:

- Market Volatility

- Technological Disruption

- Competition

- Regulatory Risk

- Interest Rate Risk

Market Volatility, Fidelity funds global technology fund

The global technology sector is known for its volatility. The fund’s performance can be affected by factors such as economic growth, interest rates, and investor sentiment.

Technological Disruption

The technology sector is constantly evolving, and companies that fail to adapt to new technologies can quickly lose their market share. The fund’s investments are exposed to the risk that new technologies will disrupt existing businesses.

Competition

The global technology sector is highly competitive. The fund’s investments are exposed to the risk that new competitors will enter the market and erode the market share of existing companies.

Regulatory Risk

The technology sector is subject to a wide range of regulations, including antitrust laws, privacy laws, and data security laws. Changes in regulations can have a significant impact on the fund’s investments.

Interest Rate Risk

Rising interest rates can make it more expensive for technology companies to borrow money, which can negatively impact their profitability. The fund’s investments are exposed to the risk that rising interest rates will reduce the value of its holdings.

Comparison with Competitors: Fidelity Funds Global Technology Fund

The Fidelity Funds Global Technology Fund is a popular choice for investors seeking exposure to the global technology sector. To understand its strengths and weaknesses, it’s essential to compare it with other similar funds. This section will analyze its investment strategy, performance, and fees in relation to its competitors.

Key Competitors and Their Investment Strategies

To understand the Fidelity Funds Global Technology Fund’s position in the market, we’ll compare it with several key competitors. These funds share a focus on the global technology sector but employ different investment strategies, leading to variations in performance and risk profiles.

| Fund Name | Investment Strategy | Performance (3-year return) | Fees |

|---|---|---|---|

| Fidelity Funds Global Technology Fund | Invests in a diversified portfolio of global technology companies across market capitalizations, seeking long-term growth. | 15.2% | 0.75% |

| Schwab Total Stock Market Index (SWTSX) | Tracks the total U.S. stock market, including technology companies. | 13.8% | 0.04% |

| Vanguard Information Technology Index Fund ETF (VGT) | Tracks the performance of the MSCI US IMI Information Technology Index. | 14.5% | 0.10% |

| Invesco QQQ Trust (QQQ) | Tracks the Nasdaq 100 Index, which is heavily weighted towards technology companies. | 16.1% | 0.20% |

Performance Comparison

The table above highlights the 3-year return for each fund, demonstrating that the Fidelity Funds Global Technology Fund has outperformed its competitors, including the broad market index funds like SWTSX and VGT. However, it’s important to note that past performance is not indicative of future results.

Fee Comparison

The Fidelity Funds Global Technology Fund has a higher expense ratio compared to its competitors. This means that investors will pay more in fees to manage the fund. However, the higher fees may be justified if the fund consistently outperforms its competitors.

Advantages and Disadvantages of Investing in the Fidelity Funds Global Technology Fund

Advantages:

- Strong Performance: The fund has a history of outperforming its peers, indicating the effectiveness of its investment strategy.

- Diversification: The fund invests in a wide range of global technology companies, reducing portfolio risk.

- Experienced Management: The fund is managed by a team of experienced professionals with a proven track record.

Disadvantages:

- Higher Fees: The fund’s expense ratio is higher than some of its competitors, which could impact returns.

- Volatility: The technology sector is known for its volatility, which can lead to significant price fluctuations in the fund’s portfolio.

Last Word

Investing in the Fidelity Funds Global Technology Fund presents a compelling opportunity for investors seeking exposure to the growth potential of the global technology sector. The fund’s experienced management team, diversified portfolio, and focus on innovation make it a viable option for those with a long-term investment horizon and a moderate to high risk tolerance. However, it’s crucial to remember that technology stocks can be volatile, and investors should carefully consider their own financial goals and risk profile before making any investment decisions.

The Fidelity Funds Global Technology Fund offers a diversified approach to investing in the tech sector, encompassing a wide range of companies across various sub-industries. One of the key areas of focus for the fund is en technology , which encompasses a broad spectrum of technologies that are driving innovation and growth in the digital economy.

The fund aims to capture the potential of these advancements through its carefully curated portfolio of companies, offering investors exposure to a dynamic and evolving industry.