Evolution of Technology: Credit Card Payments

Evolution technology charge on credit card – The evolution of technology has fundamentally transformed the way we pay, and credit cards have been at the forefront of this revolution. From […]

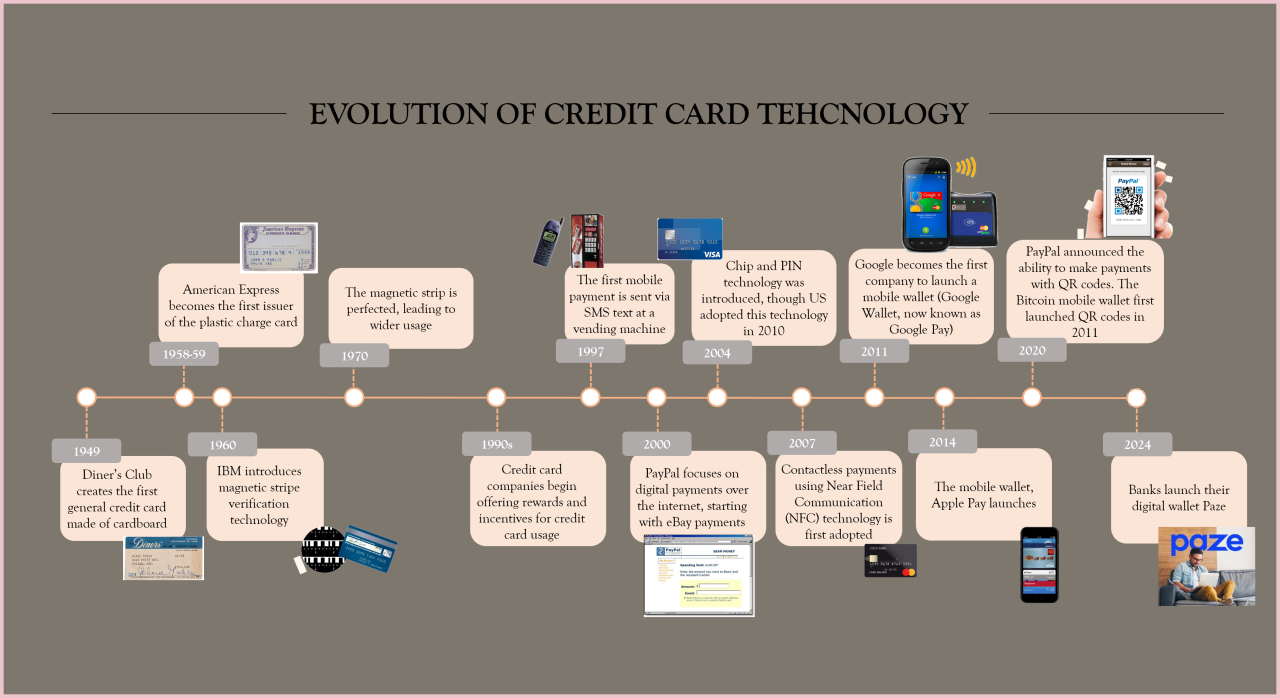

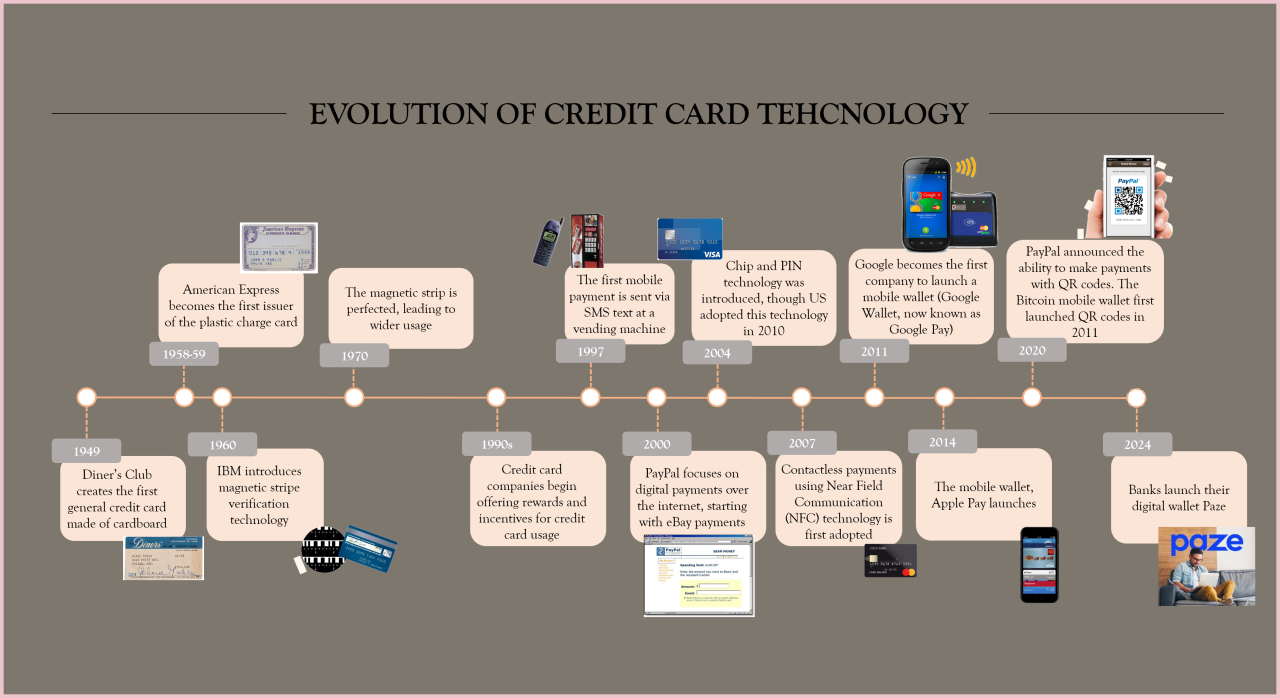

Evolution technology charge on credit card – The evolution of technology has fundamentally transformed the way we pay, and credit cards have been at the forefront of this revolution. From the humble beginnings of plastic cards to the advent of contactless payments and mobile wallets, credit card technology has constantly evolved, shaping the financial landscape and impacting our daily lives.

This exploration delves into the history of credit card technology, examining key innovations, analyzing their impact on security, and forecasting future trends. We’ll explore how advancements like chip-and-PIN, contactless payments, and mobile wallets have enhanced convenience and security while also considering the challenges and opportunities that lie ahead for this ever-evolving industry.

Evolution of Technology in Credit Card Payments

Credit card payments have undergone a remarkable evolution, transforming from a simple paper-based system to a sophisticated and convenient digital experience. This evolution has been driven by technological advancements that have significantly enhanced security, efficiency, and user experience.

Early Credit Cards

The concept of credit cards emerged in the early 20th century, with companies offering charge accounts for specific goods and services. However, the first modern credit card, known as the Diner’s Club Card, was introduced in 1950. This card allowed users to charge purchases at participating restaurants and hotels. The Diner’s Club Card was a significant step forward as it offered a universal payment method, paving the way for the widespread adoption of credit cards.

Magnetic Stripe Cards

The introduction of magnetic stripe cards in the 1960s marked a major milestone in credit card technology. These cards stored account information on a magnetic strip, enabling automated processing of transactions. The magnetic stripe card revolutionized credit card payments by making them faster and more efficient.

Chip-and-PIN Technology

In the 1990s, chip-and-PIN technology emerged as a more secure alternative to magnetic stripe cards. This technology embeds a microchip into the card, which stores encrypted account information. During a transaction, the chip communicates with the payment terminal, providing a more secure and tamper-resistant method of authentication. Chip-and-PIN technology significantly reduced credit card fraud, making it a widely adopted standard in many countries.

Contactless Payments

The advent of contactless payments in the early 2000s further enhanced the convenience and speed of credit card transactions. Contactless payments use near-field communication (NFC) technology, allowing users to make payments by simply tapping their cards on a payment terminal. This technology eliminates the need for inserting or swiping cards, making transactions faster and more convenient.

Mobile Wallets

The rise of smartphones has led to the development of mobile wallets, which enable users to store and manage their credit card information on their mobile devices. Mobile wallets use NFC technology to make contactless payments through their smartphones, eliminating the need for physical credit cards. Mobile wallets also offer additional features, such as loyalty programs, digital receipts, and peer-to-peer payments.

Impact of Technology on Credit Card Security

The evolution of technology has been instrumental in enhancing credit card security, transforming it from a vulnerable system to a more robust and secure method of payment. Credit card companies and financial institutions have implemented a range of technological measures to combat fraud and protect consumer data.

Encryption and Tokenization

Encryption and tokenization are two fundamental security measures employed to safeguard sensitive credit card information. Encryption involves converting data into an unreadable format, making it incomprehensible to unauthorized individuals. Tokenization, on the other hand, replaces actual credit card numbers with unique, randomly generated tokens. This ensures that the original card number is never transmitted or stored in vulnerable systems.

Encryption and tokenization are critical in protecting credit card information during online transactions and data storage.

Fraud Detection Systems

Advanced fraud detection systems utilize sophisticated algorithms and machine learning techniques to identify suspicious transactions and patterns that could indicate fraudulent activity. These systems analyze vast amounts of data, including transaction history, purchase patterns, and location information, to detect anomalies and flag potential fraudulent transactions.

Fraud detection systems are constantly evolving to stay ahead of fraudsters, leveraging data analytics and artificial intelligence to identify and prevent fraudulent activities.

Biometrics and Blockchain

Emerging technologies like biometrics and blockchain are poised to further enhance credit card security. Biometric authentication methods, such as fingerprint scanning and facial recognition, provide an additional layer of security by verifying the identity of the cardholder. Blockchain technology offers a decentralized and transparent ledger system that can track transactions and prevent tampering, enhancing the integrity of credit card transactions.

Biometrics and blockchain hold the potential to revolutionize credit card security, providing more robust and secure authentication and transaction verification mechanisms.

Real-World Examples

Numerous real-world examples illustrate the impact of technology in preventing credit card fraud. For instance, the implementation of EMV chip technology has significantly reduced counterfeit card fraud. Furthermore, the use of fraud detection systems has helped identify and prevent millions of fraudulent transactions, saving consumers and financial institutions from substantial losses.

The adoption of EMV chip technology has led to a significant reduction in counterfeit card fraud, demonstrating the effectiveness of technological advancements in enhancing credit card security.

Technological Trends Shaping the Future of Credit Card Payments

The credit card industry is constantly evolving, driven by advancements in technology that are reshaping the way we make payments. Emerging technologies are revolutionizing the user experience, enhancing security measures, and streamlining payment processes.

Artificial Intelligence (AI)

AI is transforming the credit card industry by automating tasks, improving fraud detection, and personalizing customer experiences.

- AI-powered chatbots are becoming increasingly popular for customer service, providing instant responses to inquiries and resolving issues efficiently.

- AI algorithms analyze vast amounts of data to identify fraudulent transactions, reducing financial losses and improving security.

- AI-driven personalized recommendations and targeted offers enhance the customer experience, making payments more convenient and rewarding.

Virtual Reality (VR)

VR technology is emerging as a new frontier for credit card payments, offering immersive and interactive experiences.

- VR can be used to create virtual shopping environments, allowing customers to browse and purchase products in a realistic and engaging way.

- VR can be used to provide interactive financial education, helping users understand credit card usage and financial management in a more engaging and memorable way.

- VR can be used to create immersive payment experiences, such as virtual storefronts or interactive payment portals.

Internet of Things (IoT)

The rise of IoT devices is creating new opportunities for seamless and convenient credit card payments.

- Smartwatches and other wearable devices can be used for contactless payments, eliminating the need for physical cards.

- Smart home devices can be integrated with credit card systems, allowing users to make payments for utilities, subscriptions, and other services directly from their homes.

- IoT devices can be used to track spending habits and provide personalized financial insights, helping users manage their finances more effectively.

Comparison of Emerging Technologies, Evolution technology charge on credit card

| Technology | Advantages | Disadvantages |

|---|---|---|

| AI | Improved fraud detection, personalized customer experiences, efficient customer service. | Potential for bias in algorithms, privacy concerns, reliance on large data sets. |

| VR | Immersive and interactive shopping experiences, engaging financial education, unique payment experiences. | High initial investment costs, potential for technical limitations, limited accessibility. |

| IoT | Seamless and convenient payments, enhanced financial management, increased security. | Security vulnerabilities, potential for data breaches, reliance on internet connectivity. |

The Rise of Alternative Payment Methods

The traditional credit card payment system, though dominant for decades, is facing increasing competition from a wave of alternative payment methods. These alternatives, ranging from mobile wallets to peer-to-peer (P2P) platforms and buy now, pay later (BNPL) services, are gaining traction due to their convenience, accessibility, and often, lower transaction fees.

Factors Contributing to the Popularity of Alternative Payment Methods

The rise of alternative payment methods is driven by a confluence of factors, including:

- Increased Smartphone Penetration: The widespread adoption of smartphones has provided a ubiquitous platform for mobile wallets and other digital payment methods.

- Evolving Consumer Preferences: Consumers are increasingly seeking faster, more convenient, and secure payment options, leading to the popularity of contactless payments and mobile wallets.

- Technological Advancements: Innovations in mobile technology, data security, and digital identity verification have paved the way for secure and seamless alternative payment methods.

- Growing Awareness of Security Concerns: Concerns about data breaches and fraud associated with traditional credit card payments have driven consumers towards alternative payment methods that often offer enhanced security features.

Comparison of Alternative Payment Methods

Alternative payment methods offer a diverse range of features, benefits, and drawbacks.

Mobile Wallets

- Features: Mobile wallets like Apple Pay, Google Pay, and Samsung Pay allow users to store credit card information and make contactless payments through their smartphones.

- Benefits: Convenience, security, and faster checkout times.

- Drawbacks: Limited acceptance at certain merchants, potential for device loss or theft, and reliance on a smartphone.

Peer-to-Peer (P2P) Payments

- Features: P2P payment platforms like Venmo, Zelle, and PayPal enable users to send and receive money directly from their bank accounts or linked credit cards.

- Benefits: Ease of use, speed, and low or no transaction fees.

- Drawbacks: Security concerns associated with sharing personal financial information, limited merchant acceptance, and potential for fraud.

Buy Now, Pay Later (BNPL) Services

- Features: BNPL services like Affirm, Klarna, and Afterpay allow consumers to purchase goods and pay for them in installments over a period of time.

- Benefits: Flexibility in payment options, affordability, and potential for interest-free financing.

- Drawbacks: Potential for overspending and accumulating debt, high interest rates on late payments, and limited merchant acceptance.

Flowchart Comparing Credit Card and Alternative Payment Methods

Credit Card Payment Process

[Flowchart depicting the stages involved in a typical credit card payment process]

* Customer selects items and proceeds to checkout.

* Customer enters credit card details.

* Merchant processes the transaction through the payment gateway.

* Payment gateway verifies the credit card details and authorizes the transaction.

* Bank processes the payment and debits the customer’s account.

* Merchant receives the payment and fulfills the order.

Alternative Payment Method Process (e.g., Mobile Wallet)

[Flowchart depicting the stages involved in a typical mobile wallet payment process]

* Customer selects items and proceeds to checkout.

* Customer chooses mobile wallet as the payment method.

* Customer authenticates the transaction using biometrics or a PIN.

* Merchant processes the transaction through the payment gateway.

* Payment gateway verifies the mobile wallet details and authorizes the transaction.

* Bank processes the payment and debits the customer’s account.

* Merchant receives the payment and fulfills the order.

The Future of Credit Card Payments: Evolution Technology Charge On Credit Card

The credit card industry is constantly evolving, driven by technological advancements and changing consumer preferences. The future of credit card payments is likely to be characterized by even greater innovation, convenience, and security.

The Rise of Digital Wallets and Mobile Payments

Digital wallets and mobile payments are rapidly gaining popularity, offering consumers a seamless and secure way to make payments. These platforms leverage technologies like near-field communication (NFC) and QR codes to facilitate transactions.

- Apple Pay and Google Pay are examples of popular digital wallets that allow users to store their credit card information securely on their mobile devices.

- Samsung Pay, another major player in the mobile payments space, offers features like magnetic secure transmission (MST) technology, enabling payments at traditional card readers.

Increased Adoption of Biometric Authentication

Biometric authentication, such as fingerprint scanning and facial recognition, is becoming increasingly prevalent in the credit card industry. This technology enhances security by verifying the identity of the cardholder, reducing the risk of fraud.

- Visa and Mastercard have incorporated biometric authentication into their payment systems, allowing cardholders to authenticate transactions using their fingerprints or faces.

- Financial institutions are also implementing biometric authentication at ATMs and point-of-sale terminals to improve security.

The Integration of Artificial Intelligence (AI)

AI is revolutionizing the credit card industry by enabling personalized experiences, fraud detection, and risk assessment. AI-powered systems can analyze transaction data to identify potential fraudulent activity and provide tailored recommendations to consumers.

- AI algorithms can be used to detect unusual spending patterns and flag suspicious transactions, reducing the risk of fraud.

- AI-powered chatbots are being deployed by financial institutions to provide customer support and answer queries related to credit card payments.

The Emergence of Blockchain Technology

Blockchain technology is gaining traction in the credit card industry, offering potential benefits such as increased transparency, reduced transaction fees, and improved security. Blockchain-based credit card platforms can facilitate faster and more secure transactions while providing a decentralized ledger for tracking payments.

- Cryptocurrency platforms like Bitcoin and Ethereum are exploring the use of blockchain technology for credit card payments.

- Financial institutions are experimenting with blockchain-based solutions to streamline credit card processing and reduce costs.

The Growing Importance of Data Security

As credit card payments become increasingly digital, data security is paramount. Financial institutions are investing heavily in advanced security measures to protect sensitive customer information from cyberattacks.

- Encryption technologies are used to protect credit card data during transmission and storage.

- Multi-factor authentication is being implemented to enhance security by requiring users to provide multiple forms of identification.

Challenges and Opportunities for the Credit Card Industry

The future of credit card payments presents both challenges and opportunities for the industry.

- Staying ahead of technological advancements is crucial for credit card companies to remain competitive. They must continuously innovate and adapt to emerging technologies to provide consumers with the latest payment options.

- Maintaining data security is essential to build trust with consumers. Financial institutions need to invest in robust security measures to protect customer information from cyberattacks.

- Adapting to changing consumer preferences is crucial for the credit card industry. Consumers are increasingly demanding personalized experiences and seamless payment processes. Credit card companies need to understand these evolving needs and provide solutions that meet them.

Final Wrap-Up

As technology continues to advance at a rapid pace, the future of credit card payments promises to be even more dynamic and transformative. We can expect to see new payment methods emerge, enhanced security measures, and a greater focus on personalization and user experience. The journey of credit card technology is a testament to human ingenuity and the relentless pursuit of innovation, shaping the way we manage our finances and interact with the world around us.

The evolution of technology has revolutionized the way we charge on credit cards. From swiping to tapping, we’ve seen a rapid shift in payment methods. Companies like mccown technology corporation are at the forefront of this evolution, developing innovative solutions that enhance security and convenience for consumers.

This ongoing progress ensures that credit card transactions remain safe and efficient in the ever-evolving digital landscape.