Debt Collection Technology: Transforming the Industry

Debt collection technology sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. Debt […]

Debt collection technology sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset.

Debt collection technology has revolutionized the way businesses and debt collectors manage overdue payments. From traditional methods like phone calls and letters, the industry has embraced automation and advanced analytics, transforming the landscape of debt recovery. This evolution has brought about significant benefits, including improved efficiency, enhanced customer experience, and greater compliance. However, it has also introduced new challenges related to data privacy, system integration, and ethical considerations.

The Evolution of Debt Collection Technology

The debt collection industry has undergone a significant transformation, moving from traditional, manual methods to sophisticated, automated solutions. This evolution has been driven by technological advancements and the need for efficiency, accuracy, and compliance in a rapidly changing landscape.

Traditional Debt Collection Methods

Traditional debt collection methods relied heavily on human interaction and manual processes. These methods included:

- Phone Calls: Collectors would contact debtors via phone, attempting to negotiate payment arrangements or gather information. This method was often time-consuming and could be intrusive.

- Letters: Debt collectors would send letters to debtors, outlining the debt and demanding payment. This method was often slow and could be easily ignored.

- Personal Visits: In some cases, collectors would visit debtors in person to collect payments or gather information. This method was often confrontational and could be disruptive.

While these methods were effective in some cases, they also had significant drawbacks:

- High Costs: Traditional methods were labor-intensive and required significant staffing, leading to high operational costs.

- Limited Reach: Collectors often struggled to reach debtors who had moved or changed their phone numbers.

- High Error Rates: Manual processes were prone to errors, leading to inaccurate records and legal issues.

- Negative Customer Experiences: Traditional methods could be intrusive and confrontational, leading to negative customer experiences.

Modern Automated Debt Collection Solutions

Modern debt collection technologies leverage automation and data analytics to streamline processes, improve efficiency, and enhance customer experiences. These technologies include:

- Automated Dialers: These systems automatically dial debtors and deliver pre-recorded messages, freeing up collectors to handle more complex cases.

- Email and SMS Messaging: Automated systems can send personalized emails and text messages to debtors, providing reminders, payment options, and updates.

- Online Portals: Debtors can access secure online portals to view their account balances, make payments, and communicate with collectors.

- Artificial Intelligence (AI): AI-powered systems can analyze data, predict debtor behavior, and automate tasks such as account scoring and risk assessment.

- Data Analytics: Debt collectors can use data analytics to identify patterns and trends in debtor behavior, optimize collection strategies, and improve overall performance.

Impact of Technological Advancements

Technological advancements have significantly impacted the debt collection industry:

- Increased Efficiency: Automated systems have reduced the need for manual processes, improving efficiency and reducing costs.

- Improved Accuracy: Data analytics and AI have helped to minimize errors and improve the accuracy of debt collection records.

- Enhanced Customer Experiences: Automated systems can provide debtors with convenient and personalized communication channels, improving customer satisfaction.

- Compliance and Regulatory Adherence: Technological solutions can help debt collectors comply with evolving regulations and best practices.

“The debt collection industry is evolving rapidly, with technology playing a key role in driving efficiency, accuracy, and compliance. Automated solutions are helping collectors to streamline processes, improve customer experiences, and stay ahead of the curve.” – Industry Expert

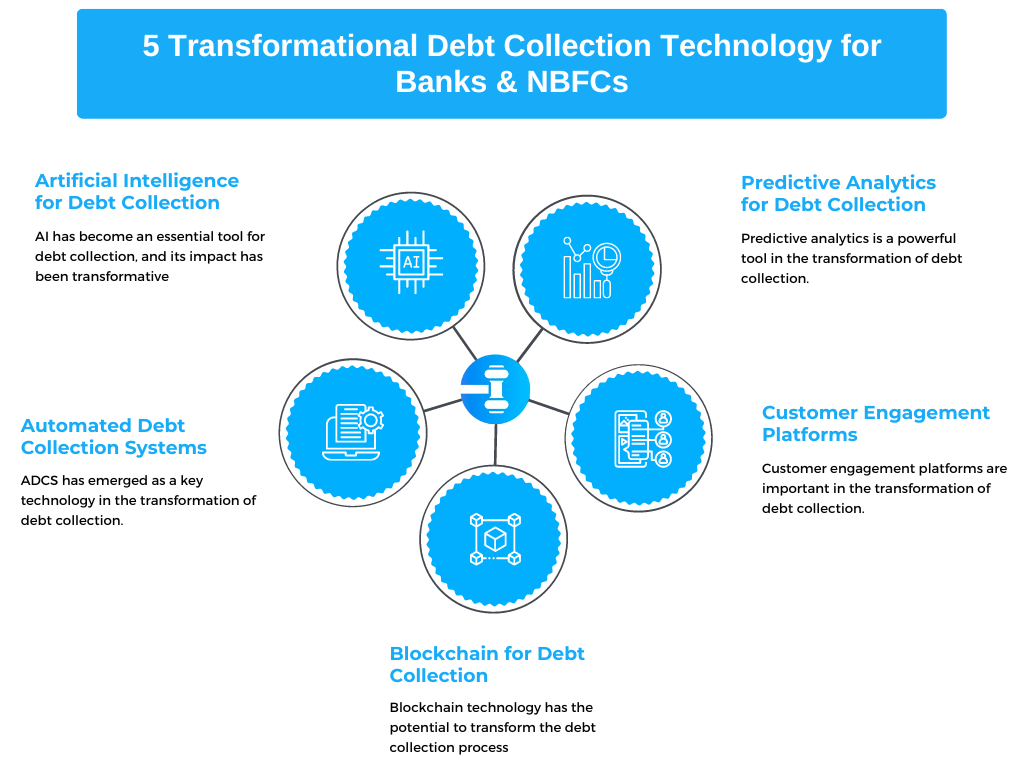

Key Technologies in Debt Collection: Debt Collection Technology

The debt collection industry is rapidly evolving, fueled by technological advancements that are streamlining processes, improving efficiency, and enhancing customer experiences. Several key technologies are transforming how debt collection agencies operate and interact with debtors.

Artificial Intelligence (AI) and Machine Learning

AI and machine learning are revolutionizing debt collection by automating tasks, optimizing workflows, and providing data-driven insights. These technologies analyze vast amounts of data to identify patterns and predict debtor behavior, enabling more personalized and effective collection strategies.

Applications and Benefits

- Automated Debt Collection: AI-powered chatbots and virtual assistants can handle initial contact with debtors, providing information, answering questions, and scheduling payments. This frees up human agents to focus on more complex cases.

- Predictive Analytics: AI algorithms analyze data on debtor demographics, payment history, and economic indicators to predict the likelihood of repayment. This allows debt collectors to prioritize cases and allocate resources effectively.

- Fraud Detection: AI can identify suspicious activities and patterns, helping to prevent fraudulent debt claims and protect businesses from financial losses.

- Personalized Communication: AI can tailor communication channels and messaging to individual debtors based on their preferences and behavior. This improves customer satisfaction and increases the likelihood of successful debt recovery.

Examples

- Debt collection chatbots: Companies like Zest AI and Experian offer AI-powered chatbots that automate initial debt collection interactions.

- Predictive modeling: Equifax and TransUnion use machine learning algorithms to predict credit risk and assess the likelihood of repayment.

- Fraud detection systems: FICO and LexisNexis provide AI-based solutions for identifying and preventing fraudulent debt claims.

Automated Dialers and Text Messaging

Automated dialers and text messaging are essential tools for efficient and cost-effective debt collection. They allow debt collectors to reach a large number of debtors quickly and easily, while also providing flexibility in communication channels.

Applications and Benefits

- Automated Outbound Calls: Automated dialers can make a high volume of calls to debtors, freeing up human agents for other tasks. They can also schedule calls at optimal times to maximize contact rates.

- Text Message Reminders: Text messages are a convenient and cost-effective way to send payment reminders, updates, and other important information to debtors. They can also be used to schedule appointments or confirm payment arrangements.

- Multi-Channel Communication: Automated dialers and text messaging can be integrated with other communication channels, such as email and voice mail, to provide a seamless and personalized experience for debtors.

Examples

- Automated dialers: RingCentral and Talkdesk offer automated dialing solutions that can be integrated with debt collection software.

- Text messaging platforms: Twilio and Nexmo provide APIs that allow debt collectors to send and receive text messages from their systems.

Data Analytics and Predictive Modeling

Data analytics and predictive modeling play a crucial role in debt collection by providing insights into debtor behavior and identifying potential risks. By analyzing data on payment history, demographics, and economic indicators, debt collectors can develop more effective strategies for recovering debt.

Applications and Benefits

- Debt Portfolio Segmentation: Data analytics can help debt collectors segment their portfolio based on factors such as debt amount, delinquency status, and risk profile. This allows them to tailor their collection strategies to specific groups of debtors.

- Predictive Modeling: Predictive models can forecast the likelihood of repayment, identify potential fraud, and predict the optimal timing for collection interventions. This helps debt collectors allocate resources effectively and maximize their chances of recovery.

- Performance Monitoring: Data analytics can track key performance indicators (KPIs), such as collection rates, contact rates, and resolution times. This provides valuable insights for optimizing collection strategies and improving efficiency.

Examples

- Debt portfolio segmentation: Experian and Equifax provide data analytics tools that help debt collectors segment their portfolio based on various criteria.

- Predictive modeling: FICO and SAS offer predictive modeling solutions that can forecast the likelihood of repayment and identify potential fraud.

- Performance monitoring: Salesforce and Microsoft Dynamics provide data analytics platforms that can track key performance indicators in debt collection operations.

Cloud-Based Platforms and Software

Cloud-based platforms and software are transforming debt collection by providing secure, scalable, and cost-effective solutions. They offer a centralized platform for managing debt portfolios, automating tasks, and improving communication with debtors.

Applications and Benefits

- Centralized Data Management: Cloud-based platforms provide a single source of truth for all debt collection data, ensuring consistency and accuracy across the organization.

- Automated Workflows: Cloud-based software can automate repetitive tasks, such as sending payment reminders, scheduling calls, and generating reports. This frees up human agents to focus on more strategic activities.

- Improved Collaboration: Cloud-based platforms facilitate collaboration among debt collectors, enabling them to share information, track progress, and make informed decisions.

- Scalability and Flexibility: Cloud-based solutions can be easily scaled to meet the needs of growing businesses, and they offer flexible subscription models that can be tailored to specific requirements.

Examples

- Debt collection software: Convercent, TrueAccord, and CloudPay offer cloud-based platforms for managing debt collection operations.

- Customer relationship management (CRM) systems: Salesforce and Microsoft Dynamics provide cloud-based CRM solutions that can be integrated with debt collection software.

| Technology | Application | Benefits | Examples |

|---|---|---|---|

| Artificial Intelligence (AI) and Machine Learning | Automated debt collection, predictive analytics, fraud detection, personalized communication | Increased efficiency, improved accuracy, enhanced customer experience, reduced costs | Zest AI, Experian, Equifax, TransUnion, FICO, LexisNexis |

| Automated Dialers and Text Messaging | Automated outbound calls, text message reminders, multi-channel communication | Increased contact rates, improved efficiency, cost savings, personalized communication | RingCentral, Talkdesk, Twilio, Nexmo |

| Data Analytics and Predictive Modeling | Debt portfolio segmentation, predictive modeling, performance monitoring | Data-driven insights, improved decision-making, optimized resource allocation, enhanced risk management | Experian, Equifax, FICO, SAS, Salesforce, Microsoft Dynamics |

| Cloud-Based Platforms and Software | Centralized data management, automated workflows, improved collaboration, scalability and flexibility | Improved efficiency, reduced costs, enhanced security, increased accessibility | Convercent, TrueAccord, CloudPay, Salesforce, Microsoft Dynamics |

Benefits of Implementing Debt Collection Technology

In today’s fast-paced business environment, debt collection technology plays a crucial role in streamlining processes, enhancing customer experiences, and optimizing profitability. Implementing these technologies offers a myriad of benefits for businesses and debt collectors alike.

Efficiency and Automation

Automating repetitive tasks frees up valuable time for debt collectors to focus on more complex cases. Debt collection technology can automate tasks like sending out reminders, generating reports, and updating customer records. This automation significantly improves efficiency, reduces human error, and allows debt collectors to handle a larger volume of cases with the same resources.

- Automated communication: Automated email and SMS reminders can be sent to customers at pre-defined intervals, reducing the need for manual follow-up and ensuring timely communication.

- Automated data entry: Integrating debt collection software with other business systems like CRM and accounting software can automate data entry, reducing the risk of errors and saving time.

- Automated reporting: Debt collection software can generate comprehensive reports on key metrics like collection rates, outstanding balances, and customer demographics, providing valuable insights for decision-making.

Customer Experience and Communication

Debt collection technology enables businesses to improve customer communication and provide a more personalized experience. This can lead to higher customer satisfaction and reduced risk of negative reviews or complaints.

- Personalized communication: Debt collection technology allows for personalized communication based on customer preferences, such as their preferred communication channel or the specific details of their debt.

- Self-service portals: Online portals allow customers to access their account information, make payments, and communicate with debt collectors at their convenience, enhancing their overall experience.

- Multilingual support: Some debt collection software offers multilingual support, ensuring effective communication with customers who speak different languages.

Compliance and Regulatory Adherence

Staying compliant with ever-evolving debt collection regulations is crucial for businesses. Debt collection technology helps businesses adhere to these regulations by providing features like automated compliance checks, audit trails, and secure data storage.

- Automated compliance checks: Debt collection software can automate compliance checks, ensuring that all communication and actions adhere to relevant regulations like the Fair Debt Collection Practices Act (FDCPA) and the Telephone Consumer Protection Act (TCPA).

- Audit trails: Automated audit trails provide a detailed record of all communication and actions taken, allowing businesses to demonstrate compliance and quickly resolve any disputes.

- Secure data storage: Debt collection software typically uses secure data storage methods like encryption and access controls, protecting sensitive customer information from unauthorized access.

Data Management and Reporting

Debt collection technology provides powerful tools for managing and analyzing debt collection data. This data can be used to identify trends, improve strategies, and optimize performance.

- Centralized data storage: Debt collection software provides a centralized repository for all debt collection data, allowing for easy access and analysis.

- Real-time data insights: Real-time data dashboards provide immediate insights into key metrics like collection rates, outstanding balances, and customer demographics, allowing businesses to make informed decisions.

- Predictive analytics: Advanced debt collection software can leverage predictive analytics to identify customers at risk of default and proactively intervene, improving collection rates and reducing losses.

Cost Reduction and Profitability

By automating tasks, improving efficiency, and optimizing strategies, debt collection technology can significantly reduce operational costs and increase profitability.

- Reduced labor costs: Automating tasks like sending out reminders and generating reports frees up debt collectors to focus on more complex cases, reducing the need for additional staff and lowering labor costs.

- Improved collection rates: By optimizing communication, improving customer experience, and using data-driven strategies, debt collection technology can lead to higher collection rates, increasing revenue and profitability.

- Reduced bad debt write-offs: Predictive analytics and early intervention strategies can help identify customers at risk of default, allowing businesses to take proactive measures and reduce bad debt write-offs.

Challenges and Considerations in Debt Collection Technology Adoption

While debt collection technology offers numerous advantages, its implementation comes with inherent challenges and considerations that organizations must address to ensure successful adoption and maximize its benefits. This section delves into key areas that require careful planning and execution.

Data Privacy and Security

Data privacy and security are paramount concerns in debt collection, as sensitive personal information is involved. Implementing debt collection technology necessitates robust security measures to protect this data from unauthorized access, breaches, and misuse.

- Compliance with Regulations: Debt collection technology must comply with stringent data privacy regulations like the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) in the United States. Organizations must ensure their technology solutions adhere to these regulations to avoid legal penalties and maintain consumer trust.

- Data Encryption and Access Control: Implementing robust data encryption protocols and access control mechanisms is crucial to protect sensitive information. This involves encrypting data at rest and in transit, limiting access to authorized personnel, and regularly auditing access logs to detect any suspicious activity.

- Data Retention Policies: Organizations must establish clear data retention policies that align with legal requirements and industry best practices. This ensures that personal data is not stored for longer than necessary and is securely deleted when no longer required.

Integration with Existing Systems

Integrating debt collection technology with existing systems, such as customer relationship management (CRM) platforms, accounting software, and communication channels, is crucial for seamless operation and data flow.

- Data Mapping and Standardization: Integrating different systems requires careful data mapping and standardization to ensure consistent data flow and avoid discrepancies. This involves identifying data fields, ensuring data formats are compatible, and establishing clear data exchange protocols.

- API Integration: Utilizing application programming interfaces (APIs) enables seamless data exchange between different systems. This allows for real-time data updates, automated processes, and streamlined workflows, reducing manual data entry and potential errors.

- System Compatibility: Before implementing debt collection technology, organizations must ensure compatibility with their existing systems. This involves evaluating technical specifications, software versions, and data structures to prevent integration issues and ensure smooth operation.

Training and Staff Adaptability

Successfully implementing debt collection technology requires adequate training and support for staff to ensure they understand and effectively utilize the new tools.

- Comprehensive Training Programs: Organizations must invest in comprehensive training programs that cover the functionalities of the debt collection technology, its integration with existing systems, and best practices for using the new tools. This ensures staff are equipped with the necessary knowledge and skills to operate effectively.

- Ongoing Support and Resources: Providing ongoing support and resources, such as user manuals, online tutorials, and dedicated support teams, is essential for staff to address any challenges they encounter and maximize the technology’s benefits. This fosters a positive user experience and encourages adoption.

- Change Management Strategies: Implementing new technology often involves significant changes in workflows and processes. Organizations should employ effective change management strategies to facilitate smooth transitions, address employee concerns, and ensure buy-in from all stakeholders.

Cost of Implementation and Maintenance

The cost of implementing and maintaining debt collection technology is a significant consideration for organizations.

- Initial Investment Costs: Implementing debt collection technology involves upfront costs for software licenses, hardware upgrades, integration services, and training. Organizations must carefully budget for these expenses and consider the long-term return on investment.

- Ongoing Maintenance Costs: Once implemented, debt collection technology requires ongoing maintenance, including software updates, technical support, and data security measures. Organizations should factor in these recurring costs when evaluating the overall financial impact of adopting the technology.

- Cost-Benefit Analysis: Conducting a thorough cost-benefit analysis is crucial to determine the financial viability of implementing debt collection technology. This involves quantifying the potential cost savings, efficiency gains, and improved customer satisfaction associated with the technology and comparing them to the associated expenses.

Ethical Considerations and Best Practices

Implementing debt collection technology raises ethical considerations that organizations must address to ensure responsible and humane practices.

- Transparency and Communication: Debtors should be informed about the use of technology in the debt collection process, and communication should be clear and transparent. This includes providing information about the technology’s capabilities, how data is collected and used, and the debtor’s rights.

- Respect for Privacy: Debt collection technology should be used in a way that respects debtors’ privacy. This involves avoiding excessive contact, using appropriate communication channels, and refraining from disclosing sensitive information to unauthorized parties.

- Fair and Equitable Treatment: Debt collection technology should be used to treat all debtors fairly and equitably. This includes avoiding discriminatory practices, ensuring access to information and resources, and providing opportunities for resolution.

Future Trends in Debt Collection Technology

The debt collection landscape is constantly evolving, driven by technological advancements and changing consumer expectations. As we move forward, we can expect to see even more innovative solutions emerge, further transforming the industry. These trends will likely lead to more efficient, personalized, and compliant debt collection practices.

Blockchain and Distributed Ledger Technology, Debt collection technology

Blockchain technology, known for its decentralized and secure nature, holds immense potential for revolutionizing debt collection. It can enhance transparency, immutability, and accountability within the debt collection process.

- Smart Contracts: Smart contracts can automate debt collection processes, streamlining tasks like payment reminders, late fee calculations, and debt settlements. These contracts are self-executing, eliminating the need for intermediaries and ensuring faster and more efficient transactions. For example, a smart contract can automatically trigger a late fee payment upon a missed deadline, ensuring compliance with agreed-upon terms.

- Secure Data Storage: Blockchain provides a secure and tamper-proof ledger for storing debt-related information. This ensures data integrity and prevents fraudulent activities, fostering trust between creditors and debtors. For instance, a blockchain-based system can securely store debt agreements, payment histories, and dispute records, ensuring their authenticity and preventing any manipulation.

- Improved Transparency: The decentralized nature of blockchain allows for greater transparency in debt collection. All parties involved can access the same information, promoting accountability and reducing disputes. For example, debtors can easily track their payment history and understand the status of their debt, while creditors can have a clear view of their outstanding receivables.

Advanced AI and Natural Language Processing

Artificial intelligence (AI) and natural language processing (NLP) are transforming how debt collection agencies operate. These technologies can automate tasks, personalize communication, and improve efficiency.

- Automated Communication: AI-powered chatbots and virtual assistants can handle routine communication tasks, such as sending payment reminders, answering frequently asked questions, and providing basic information. This frees up human agents to focus on more complex cases. For example, a chatbot can engage with a debtor, providing personalized payment options and answering their questions, before escalating the case to a human agent if needed.

- Personalized Communication: AI can analyze data to understand individual debtor preferences and tailor communication accordingly. This personalized approach can improve engagement and increase the likelihood of successful debt recovery. For instance, AI can analyze a debtor’s communication history and payment patterns to determine the best time and method to contact them.

- Predictive Analytics: AI can analyze data to predict future debt collection outcomes. This allows agencies to prioritize cases, identify high-risk debtors, and tailor their strategies for maximum effectiveness. For example, AI can predict the likelihood of a debtor defaulting based on their past behavior, allowing agencies to intervene early and implement appropriate measures.

Biometric Authentication and Identity Verification

Biometric authentication and identity verification technologies are enhancing security and fraud prevention in debt collection.

- Secure Access Control: Biometric authentication can secure access to sensitive debt collection systems, ensuring only authorized individuals can access information. This protects against unauthorized access and data breaches. For example, a debt collection agency can implement fingerprint or facial recognition for employees to access their accounts and confidential data.

- Enhanced Identity Verification: Biometric verification can confirm the identity of debtors, reducing the risk of fraud and identity theft. This ensures that the correct individuals are contacted and that payments are made to the right accounts. For instance, a debt collection agency can use facial recognition to verify the identity of a debtor during a phone call or video conference.

The Rise of Fintech and Alternative Debt Collection Solutions

Fintech companies are disrupting the traditional debt collection landscape, offering innovative solutions that leverage technology to improve efficiency and customer experience.

- Digital Payment Platforms: Fintech companies provide digital payment platforms that make it easier for debtors to make payments. These platforms offer convenient and secure payment options, such as mobile wallets and online banking integration. For example, a debtor can use a mobile app to make a payment directly from their bank account, without having to call or visit a physical office.

- Debt Consolidation and Management Tools: Fintech companies offer tools that help debtors consolidate their debt and manage their finances. These tools provide financial advice, budgeting assistance, and debt negotiation services. For example, a debtor can use a fintech platform to track their debt, create a budget, and explore debt consolidation options.

Outcome Summary

As debt collection technology continues to evolve, businesses and debt collectors will need to stay ahead of the curve by embracing innovation and adapting to changing trends. By leveraging the power of artificial intelligence, blockchain, and other emerging technologies, the industry can further optimize processes, improve customer satisfaction, and ensure responsible debt recovery practices.

Debt collection technology has evolved significantly, leveraging automation and data analysis to streamline processes. However, the principles of effective debt collection remain rooted in clear communication and understanding. This applies to diverse industries, like the manufacturing sector, where companies like tube mac piping technologies rely on efficient debt collection practices to ensure financial stability.

By implementing robust debt collection technology, businesses can foster positive relationships with clients while minimizing financial risks.