Battery Storage Technology Tax Credit: A Guide to Incentives

The Battery Storage Technology Tax Credit offers financial incentives to businesses and individuals investing in energy storage solutions. This program aims to encourage the adoption of battery storage technology, which […]

The Battery Storage Technology Tax Credit offers financial incentives to businesses and individuals investing in energy storage solutions. This program aims to encourage the adoption of battery storage technology, which plays a crucial role in transitioning to a cleaner, more sustainable energy future.

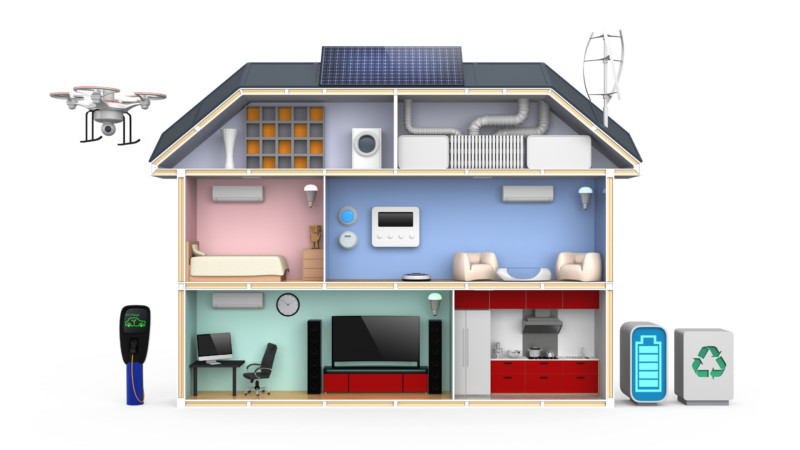

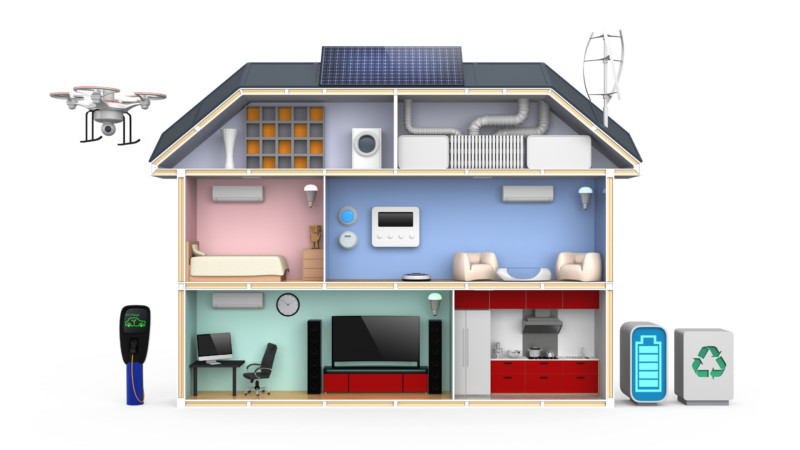

The tax credit covers a wide range of battery storage technologies, including lithium-ion batteries, flow batteries, and compressed air energy storage. It incentivizes the use of these technologies for residential, commercial, and industrial applications, promoting energy independence, grid stability, and environmental sustainability.

Introduction to Battery Storage Technology Tax Credit

The Battery Storage Technology Tax Credit is a federal tax incentive designed to encourage the adoption of battery storage technologies in the United States. This credit aims to promote clean energy, reduce reliance on fossil fuels, and enhance grid reliability.

The history of the tax credit dates back to 2009 when it was first introduced as part of the American Recovery and Reinvestment Act. The credit has undergone several revisions and extensions over the years, reflecting the growing importance of battery storage in the energy landscape.

Types of Battery Storage Technologies Eligible for the Credit

The tax credit applies to a range of battery storage technologies, including:

- Lithium-ion batteries

- Flow batteries

- Lead-acid batteries

- Sodium-sulfur batteries

- Redox flow batteries

These technologies are used in various applications, such as residential energy storage, commercial and industrial energy storage, and utility-scale energy storage.

Current Tax Credit Amount and Eligibility Criteria

The current tax credit amount is 30% of the cost of the battery storage system, up to a maximum of $2,000 per kilowatt-hour (kWh) of storage capacity. To be eligible for the credit, the battery storage system must meet certain criteria, including:

- It must be installed in the United States.

- It must be used for energy storage purposes.

- It must meet certain performance standards.

The tax credit is available to both businesses and individuals. Businesses can claim the credit on their federal income tax return, while individuals can claim it as a tax credit on their Form 1040.

Benefits of Battery Storage Technology Tax Credit

The Battery Storage Technology Tax Credit provides financial incentives for businesses and individuals to invest in battery storage systems. This tax credit offers numerous economic, environmental, and energy security benefits, contributing to a more sustainable and resilient energy future.

Economic Benefits

The tax credit directly reduces the upfront cost of battery storage systems, making them more financially attractive for businesses and individuals. This can lead to increased investment in battery storage technology, stimulating economic growth and creating new jobs in the manufacturing, installation, and maintenance sectors.

- Reduced Investment Costs: The tax credit lowers the initial investment cost, making battery storage more affordable for businesses and individuals. This can incentivize a wider adoption of battery storage, particularly for those who may have previously hesitated due to high upfront costs.

- Increased Investment and Job Creation: The tax credit can encourage greater investment in battery storage technology, leading to increased demand for related products and services. This, in turn, can stimulate economic growth and create new jobs in various sectors, including manufacturing, installation, maintenance, and research and development.

- Improved Business Competitiveness: By reducing energy costs and enhancing energy reliability, battery storage can help businesses become more competitive. This can lead to increased productivity, improved profitability, and enhanced resilience against energy price fluctuations.

Environmental Benefits, Battery storage technology tax credit

The tax credit promotes the adoption of battery storage technology, which can play a crucial role in reducing reliance on fossil fuels and mitigating climate change. Battery storage systems can help integrate renewable energy sources, such as solar and wind power, into the grid, leading to a cleaner and more sustainable energy system.

- Reduced Greenhouse Gas Emissions: By enabling greater integration of renewable energy sources, battery storage helps reduce reliance on fossil fuels, leading to lower greenhouse gas emissions. This contributes to efforts to mitigate climate change and improve air quality.

- Enhanced Energy Efficiency: Battery storage can improve energy efficiency by storing excess energy generated from renewable sources, reducing energy waste and lowering overall energy consumption.

- Increased Renewable Energy Penetration: Battery storage systems provide a reliable way to store excess renewable energy, making it possible to integrate more renewable sources into the grid. This can lead to a cleaner and more sustainable energy mix.

Impact on Energy Independence and Grid Stability

Battery storage technology can enhance energy independence by reducing reliance on centralized power generation and enabling distributed energy resources. It can also improve grid stability by providing fast-responding energy storage that can help balance supply and demand, preventing power outages and enhancing grid resilience.

- Enhanced Energy Independence: By storing energy locally, battery storage can reduce dependence on centralized power generation, increasing energy independence for businesses and communities. This can be particularly beneficial in areas with limited grid infrastructure or remote locations.

- Improved Grid Stability: Battery storage can provide fast-responding energy storage that can help balance supply and demand on the grid. This can prevent power outages, improve grid reliability, and enhance the overall stability of the electricity system.

- Increased Grid Resilience: Battery storage can help improve grid resilience against disruptions, such as natural disasters or cyberattacks. By providing backup power and smoothing out energy fluctuations, battery storage can help maintain power supply even during emergencies.

Conclusion

The Battery Storage Technology Tax Credit is a powerful tool for driving innovation and investment in clean energy solutions. By providing financial incentives, the program encourages the adoption of battery storage technology, contributing to a more resilient and sustainable energy future. As battery storage technology continues to evolve, the tax credit will likely play an increasingly important role in shaping the landscape of the energy sector.

The battery storage technology tax credit is a great way to incentivize the adoption of clean energy solutions. While the credit itself is a fantastic way to support this transition, it’s also worth noting that many companies offer technology giveaways as part of their sustainability initiatives.

This can be a great way to get your hands on some cutting-edge battery storage technology without breaking the bank, so keep an eye out for these opportunities.