Accounts Receivable Technologies: Streamlining Business Finances

Accounts receivable technologies are revolutionizing how businesses manage their finances. In today’s fast-paced business environment, traditional manual methods for managing accounts receivable are simply not sustainable. Businesses face challenges such […]

Accounts receivable technologies are revolutionizing how businesses manage their finances. In today’s fast-paced business environment, traditional manual methods for managing accounts receivable are simply not sustainable. Businesses face challenges such as delayed payments, inaccurate record-keeping, and difficulty in forecasting cash flow. Accounts receivable technologies offer a solution by automating processes, improving efficiency, and providing valuable insights.

These technologies encompass a wide range of tools and solutions, from automated invoice generation and tracking to cloud-based platforms and artificial intelligence (AI)-powered analytics. By leveraging these technologies, businesses can streamline their accounts receivable processes, reduce costs, and improve customer satisfaction.

Benefits of Implementing Accounts Receivable Technologies

Implementing accounts receivable (AR) technologies can significantly enhance a business’s financial health and operational efficiency. By automating and streamlining AR processes, businesses can experience numerous benefits that directly impact their bottom line and customer satisfaction.

Improved Cash Flow and Reduced Days Sales Outstanding (DSO)

Streamlining AR processes with technology can directly impact cash flow and reduce the days sales outstanding (DSO). By automating invoice generation, sending timely reminders, and providing online payment options, businesses can expedite the payment collection process.

A study by the Association for Finance Professionals (AFP) found that companies using AR automation tools reduced their DSO by an average of 10-15%.

Enhanced Customer Satisfaction Through Faster and More Efficient Service

Customers appreciate prompt and efficient service, especially when it comes to payment processing. Accounts receivable technologies can enhance customer satisfaction by offering convenient and user-friendly payment options, such as online portals and mobile apps.

- Customers can access their invoices, track payment history, and make payments at their convenience.

- Automated reminders and notifications ensure customers are aware of upcoming payment deadlines, minimizing late payments and potential disputes.

Reduced Risk of Errors and Fraud

Manual processes in AR are prone to human errors and fraud. Implementing technology can significantly reduce these risks by automating tasks and incorporating robust security measures.

- Automated invoice generation and data entry minimize the potential for manual errors.

- Advanced security features, such as multi-factor authentication and fraud detection algorithms, protect sensitive data and prevent unauthorized access.

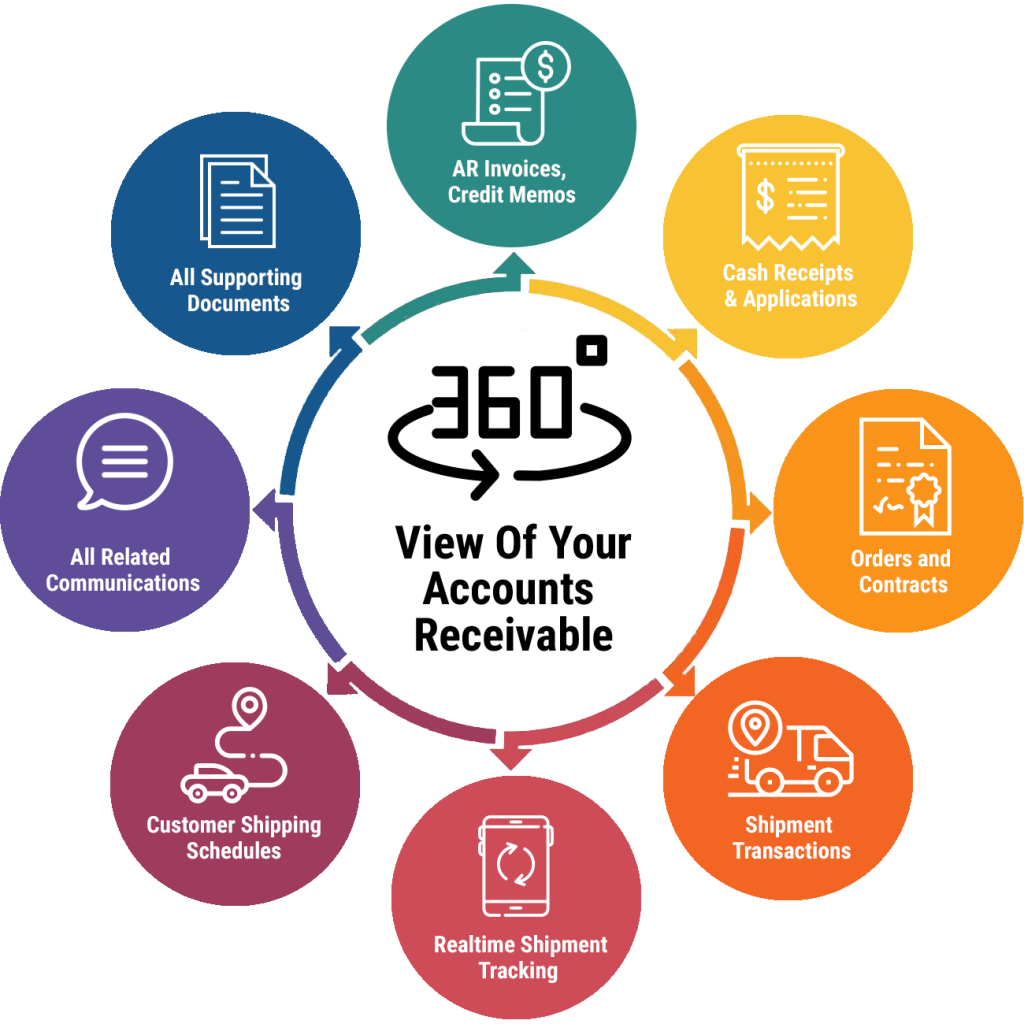

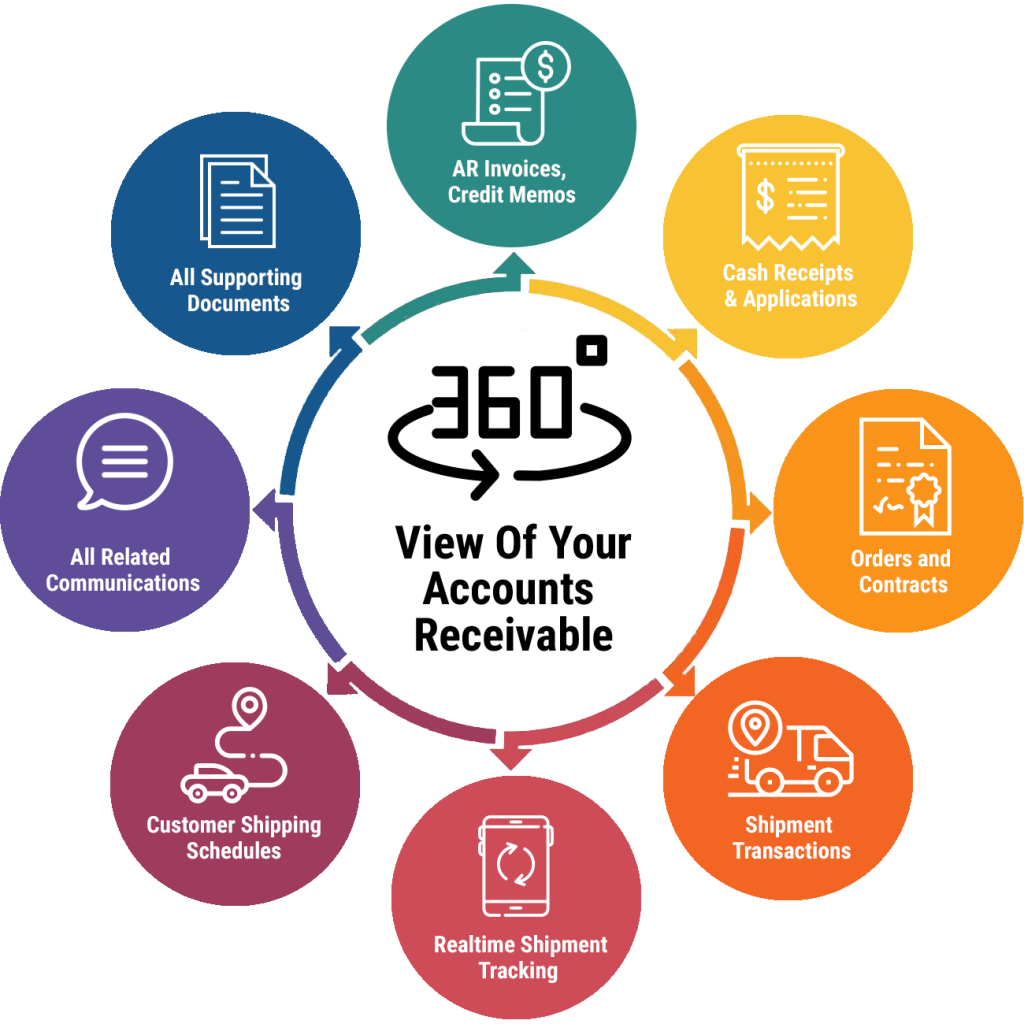

Increased Visibility and Control Over Accounts Receivable Processes

AR technologies provide real-time visibility into AR processes, allowing businesses to monitor key metrics, identify potential issues, and take corrective actions proactively.

- Dashboards and reports offer insights into invoice status, payment trends, and customer payment behavior.

- This data-driven approach enables businesses to optimize their AR strategies and improve collection efficiency.

Implementation and Integration of Accounts Receivable Technologies

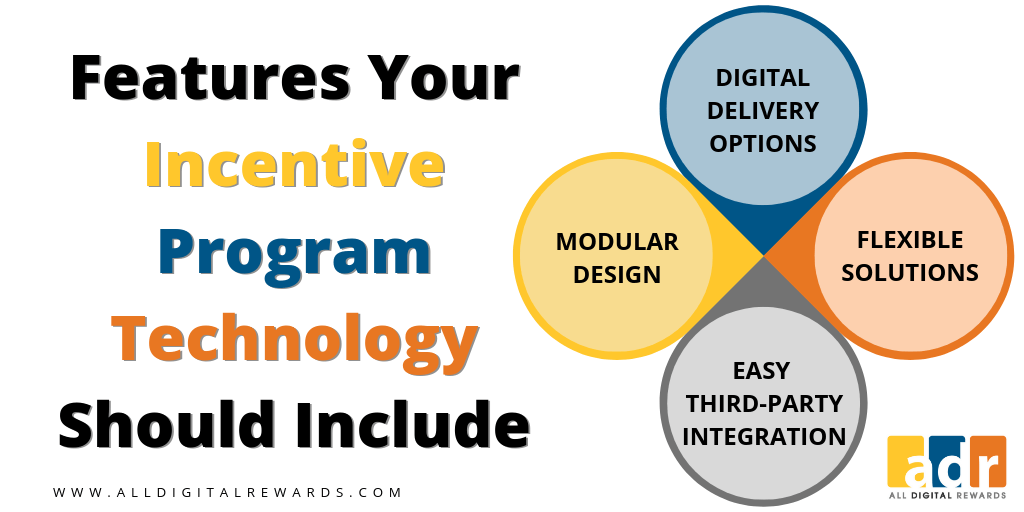

Successfully implementing accounts receivable (AR) technologies requires a strategic approach to ensure a smooth transition and maximize the benefits. This involves careful planning, selection of the right technology, and integration with existing systems.

Choosing the Right Technology, Accounts receivable technologies

Choosing the right AR technology is crucial for achieving desired results. It’s important to consider factors like business size, industry, and specific needs.

- Evaluate existing processes: Analyze your current AR processes to identify areas for improvement. This includes understanding bottlenecks, inefficiencies, and potential risks.

- Define your objectives: Clearly define what you hope to achieve with AR technology. This could include faster invoice processing, improved cash flow, reduced manual tasks, or enhanced customer satisfaction.

- Research and compare solutions: Explore various AR solutions available in the market, considering features, pricing, and compatibility with your existing systems.

- Consider scalability and future needs: Choose a solution that can adapt to your business growth and evolving needs.

- Seek expert advice: Consult with AR technology experts or consultants to get insights and guidance on selecting the best solution for your specific requirements.

Integration with Existing Systems

Integrating AR technology with your existing systems is crucial for a seamless workflow.

- Assess current systems: Evaluate the compatibility of your existing systems, such as ERP, CRM, and accounting software, with the chosen AR technology.

- Develop an integration plan: Create a detailed plan outlining the steps involved in integrating the AR technology with your existing systems.

- Consider data migration: Determine how to migrate existing AR data to the new system, ensuring data accuracy and integrity.

- Utilize APIs: Utilize Application Programming Interfaces (APIs) to enable communication and data exchange between the AR technology and other systems.

- Test thoroughly: Conduct rigorous testing before going live to ensure seamless integration and prevent any issues.

Best Practices for Utilizing Accounts Receivable Technologies

Implementing accounts receivable (AR) technologies can significantly streamline your business processes and improve cash flow. However, maximizing their effectiveness requires adopting best practices to ensure seamless integration and optimize their full potential.

Optimizing Invoice Processing and Collections

Streamlining invoice processing and collections is crucial for efficient AR management. By implementing best practices, you can ensure timely payments and minimize outstanding receivables.

- Automate Invoice Generation and Delivery: Automating invoice generation and delivery eliminates manual errors and ensures timely delivery to customers. This reduces the risk of late payments and improves customer satisfaction.

- Implement Electronic Invoice Processing: Transitioning to electronic invoice processing speeds up the invoice lifecycle, reduces paper usage, and facilitates faster payments. By adopting e-invoicing, you can streamline the entire process from invoice creation to payment receipt.

- Offer Multiple Payment Options: Providing diverse payment options, including online portals, mobile apps, and digital wallets, enhances customer convenience and encourages prompt payments.

- Utilize Automated Payment Reminders: Implementing automated payment reminders, through email or SMS, minimizes late payments by gently prompting customers to settle their outstanding invoices.

- Implement Self-Service Portals: Providing customers with self-service portals allows them to access their invoices, payment history, and other relevant information independently. This reduces administrative burden and empowers customers to manage their accounts efficiently.

Leveraging Data Analytics for Enhanced AR Performance

Data analytics plays a pivotal role in optimizing AR performance by providing valuable insights into customer payment patterns, identifying potential risks, and predicting future trends.

- Analyze Customer Payment History: Analyzing customer payment history reveals patterns and trends that can be used to predict future payment behavior. This information can be used to proactively address potential payment delays and improve collection strategies.

- Identify High-Risk Customers: Data analytics can help identify customers with a higher risk of late payments based on their historical payment patterns and other factors. This allows you to take proactive measures to mitigate risks and improve cash flow.

- Optimize Collection Efforts: By analyzing data on payment patterns and customer demographics, you can tailor collection efforts to specific customer segments. This personalized approach can significantly improve collection rates and reduce the time it takes to collect outstanding receivables.

- Predict Future Trends: Data analytics can help you predict future trends in customer behavior and market conditions, allowing you to proactively adjust your AR strategies and optimize your cash flow.

Future Trends in Accounts Receivable Technologies

The accounts receivable (AR) landscape is constantly evolving, driven by technological advancements and changing business needs. Emerging technologies are poised to revolutionize AR processes, offering enhanced efficiency, improved security, and greater insights into customer behavior.

Blockchain Technology in Accounts Receivable

Blockchain technology offers a decentralized and secure ledger system that can significantly improve the transparency and security of AR processes. Blockchain enables the creation of a shared, immutable record of transactions, eliminating the need for intermediaries and reducing the risk of fraud.

- Improved Transparency: All transactions are recorded on the blockchain, creating a transparent and auditable trail. This can help businesses track payments, identify discrepancies, and resolve disputes more efficiently.

- Enhanced Security: The decentralized nature of blockchain makes it highly resistant to hacking and data breaches. Transactions are encrypted and verified by multiple nodes, making it difficult for malicious actors to alter or corrupt data.

- Reduced Costs: By eliminating intermediaries and streamlining processes, blockchain can reduce administrative costs associated with AR management.

- Faster Payments: Blockchain-based platforms can facilitate faster payment processing, reducing the time it takes for businesses to receive payments.

Predictive Analytics in Accounts Receivable

Predictive analytics leverages historical data and machine learning algorithms to forecast future outcomes and identify potential risks. In AR, predictive analytics can help businesses anticipate customer payment patterns, identify high-risk accounts, and optimize collection strategies.

- Improved Forecasting: By analyzing historical payment data, predictive analytics models can forecast future cash flows, enabling businesses to make more informed financial decisions.

- Early Risk Detection: Predictive analytics can identify accounts that are at risk of delinquency, allowing businesses to take proactive steps to mitigate potential losses.

- Personalized Collection Strategies: Predictive analytics can help businesses tailor collection strategies to individual customers based on their payment history and other relevant factors.

Integration of Accounts Receivable Technologies with Other Business Functions

The integration of AR technologies with other business functions, such as customer relationship management (CRM) and enterprise resource planning (ERP), can streamline operations and provide a more holistic view of customer interactions.

- Improved Customer Experience: Integration with CRM systems can provide AR teams with access to customer data, enabling them to personalize communications and resolve issues more effectively.

- Automated Processes: Integration with ERP systems can automate tasks such as invoice generation, payment processing, and reconciliation, freeing up AR teams to focus on higher-value activities.

- Real-Time Visibility: Integration across different business functions provides real-time visibility into AR performance, allowing businesses to identify and address issues proactively.

Concluding Remarks

The implementation of accounts receivable technologies is a strategic investment that can yield significant benefits for businesses of all sizes. By embracing automation, cloud-based solutions, and AI, businesses can unlock a new level of efficiency, visibility, and control over their accounts receivable processes. The future of accounts receivable is bright, with emerging trends such as blockchain and predictive analytics promising to further enhance the capabilities of these technologies. As businesses continue to adopt these solutions, they will be well-positioned to optimize their cash flow, improve customer relationships, and drive sustainable growth.

Accounts receivable technologies are vital for streamlining financial operations in any industry, including dentistry. Keeping track of patient payments and insurance claims can be complex, but the right technology can make a huge difference. With the advent of new dental technology 2024 , like AI-powered billing systems, practices can automate tasks, reduce errors, and improve cash flow.

These technologies can help dentists focus on what matters most: patient care.