Accounting Technology Careers: Shaping the Future of Finance

Accounting technology careers are rapidly evolving, merging the traditional world of finance with cutting-edge technologies. From automating tedious tasks to analyzing complex data, these professionals are at the forefront of […]

Accounting technology careers are rapidly evolving, merging the traditional world of finance with cutting-edge technologies. From automating tedious tasks to analyzing complex data, these professionals are at the forefront of innovation, transforming how businesses manage their finances. The rise of artificial intelligence (AI), blockchain, and cloud computing is driving significant changes in the accounting landscape, creating a surge in demand for skilled individuals who can navigate this dynamic environment.

This field offers a wide range of opportunities for individuals with diverse skill sets. Whether you’re a data enthusiast, a tech-savvy accountant, or a problem-solver with a passion for finance, there’s a place for you in the world of accounting technology.

Evolution of Accounting Technology

Accounting technology has undergone a remarkable transformation, evolving from manual processes to sophisticated digital systems that streamline financial operations. This evolution has been driven by advancements in computing power, software development, and the changing demands of businesses.

Impact of Automation on Traditional Accounting Practices, Accounting technology careers

Automation has revolutionized accounting practices, automating repetitive tasks and freeing up accountants to focus on higher-value activities.

- Data Entry and Processing: Automation tools like optical character recognition (OCR) and data capture software have significantly reduced the time and effort required for data entry and processing. OCR technology can automatically extract data from documents, such as invoices and receipts, and populate accounting systems, eliminating manual data entry errors.

- Reconciliation: Automated reconciliation tools compare data from different sources, such as bank statements and accounting records, to identify discrepancies and ensure accuracy. This process, previously a time-consuming and error-prone manual task, is now significantly faster and more efficient.

- Reporting: Automation enables the generation of standardized financial reports, including balance sheets, income statements, and cash flow statements, with greater accuracy and speed. This allows businesses to gain insights into their financial performance in real-time.

Emerging Technologies Transforming the Accounting Landscape

Emerging technologies are further transforming the accounting landscape, bringing new levels of efficiency, accuracy, and insights.

- Artificial Intelligence (AI): AI algorithms can analyze vast amounts of financial data to identify patterns, anomalies, and potential risks. This enables accountants to make more informed decisions and proactively address financial issues. For example, AI-powered fraud detection systems can identify suspicious transactions and alert auditors to potential irregularities.

- Blockchain: Blockchain technology offers a secure and transparent way to track financial transactions. Its decentralized and immutable nature makes it ideal for recording financial data and ensuring its integrity. Blockchain is being explored for applications in accounting, such as supply chain management, asset tracking, and financial reporting.

- Cloud Computing: Cloud-based accounting software provides access to financial data and applications from anywhere with an internet connection. This enables businesses to collaborate on accounting tasks, improve data security, and reduce IT infrastructure costs.

In-Demand Accounting Technology Careers

The accounting profession is rapidly evolving, with technology playing a crucial role in shaping the future of the industry. As a result, a growing demand for professionals with a blend of accounting knowledge and technical skills is emerging. These professionals are sought after by businesses across various industries to streamline financial processes, improve efficiency, and enhance data-driven decision-making.

Accounting Technology Roles

The intersection of accounting and technology has created a new breed of professionals with specialized skills. Here are some of the most in-demand accounting technology roles:

- Accounting Automation Specialist: This role focuses on automating repetitive tasks, such as data entry, invoice processing, and reconciliation, using tools like robotic process automation (RPA) and other automation software. Responsibilities include identifying areas for automation, developing automation workflows, and testing and implementing solutions. Skills required include strong analytical abilities, technical proficiency in automation tools, and knowledge of accounting principles.

- Data Analyst: Data analysts are crucial in extracting meaningful insights from financial data. They use data visualization tools and statistical analysis techniques to identify trends, patterns, and anomalies in financial information. Responsibilities include gathering and cleaning data, performing statistical analysis, creating dashboards and reports, and communicating findings to stakeholders. Skills required include strong analytical skills, proficiency in data visualization tools, and a solid understanding of accounting principles.

- Financial Technology (FinTech) Consultant: FinTech consultants advise businesses on implementing new technologies to improve their financial operations. They assess a company’s financial processes, identify areas for improvement, and recommend and implement technology solutions. Responsibilities include conducting needs assessments, designing and implementing FinTech solutions, providing training, and supporting ongoing operations. Skills required include a deep understanding of financial systems and processes, knowledge of FinTech solutions, and strong communication and consulting skills.

- Cloud Accounting Specialist: With the increasing adoption of cloud-based accounting software, cloud accounting specialists are in high demand. They manage and maintain cloud accounting platforms, ensuring smooth operations, data security, and compliance. Responsibilities include configuring and customizing cloud accounting software, providing user training, troubleshooting issues, and managing data backups. Skills required include proficiency in cloud accounting software, knowledge of data security best practices, and understanding of accounting principles.

Industry-Specific Accounting Technology Careers

Accounting technology careers are not limited to traditional accounting roles. Many industries have specialized roles that require both accounting and technology expertise. Here are a few examples:

- Healthcare Finance Analyst: Healthcare finance analysts are responsible for managing the financial aspects of hospitals, clinics, and other healthcare organizations. They use accounting and technology skills to analyze financial data, track expenses, and make recommendations for cost optimization. Responsibilities include developing financial forecasts, managing budgets, and analyzing the impact of regulatory changes on healthcare finance. Skills required include a strong understanding of healthcare finance principles, knowledge of healthcare technology, and data analysis skills.

- E-commerce Accountant: E-commerce businesses rely heavily on technology for their operations, and e-commerce accountants are responsible for managing the financial aspects of these businesses. They use accounting and technology skills to track online sales, manage inventory, and analyze customer data. Responsibilities include reconciling online payment gateways, managing customer refunds, and analyzing sales trends. Skills required include experience with e-commerce platforms, knowledge of online payment processing systems, and understanding of accounting principles.

- Cybersecurity Analyst: Cybersecurity analysts are responsible for protecting sensitive financial data from cyberattacks. They use their knowledge of accounting and technology to identify vulnerabilities in financial systems and implement security measures. Responsibilities include monitoring network traffic, detecting and responding to security threats, and conducting security audits. Skills required include a strong understanding of cybersecurity principles, knowledge of accounting systems, and experience with security tools.

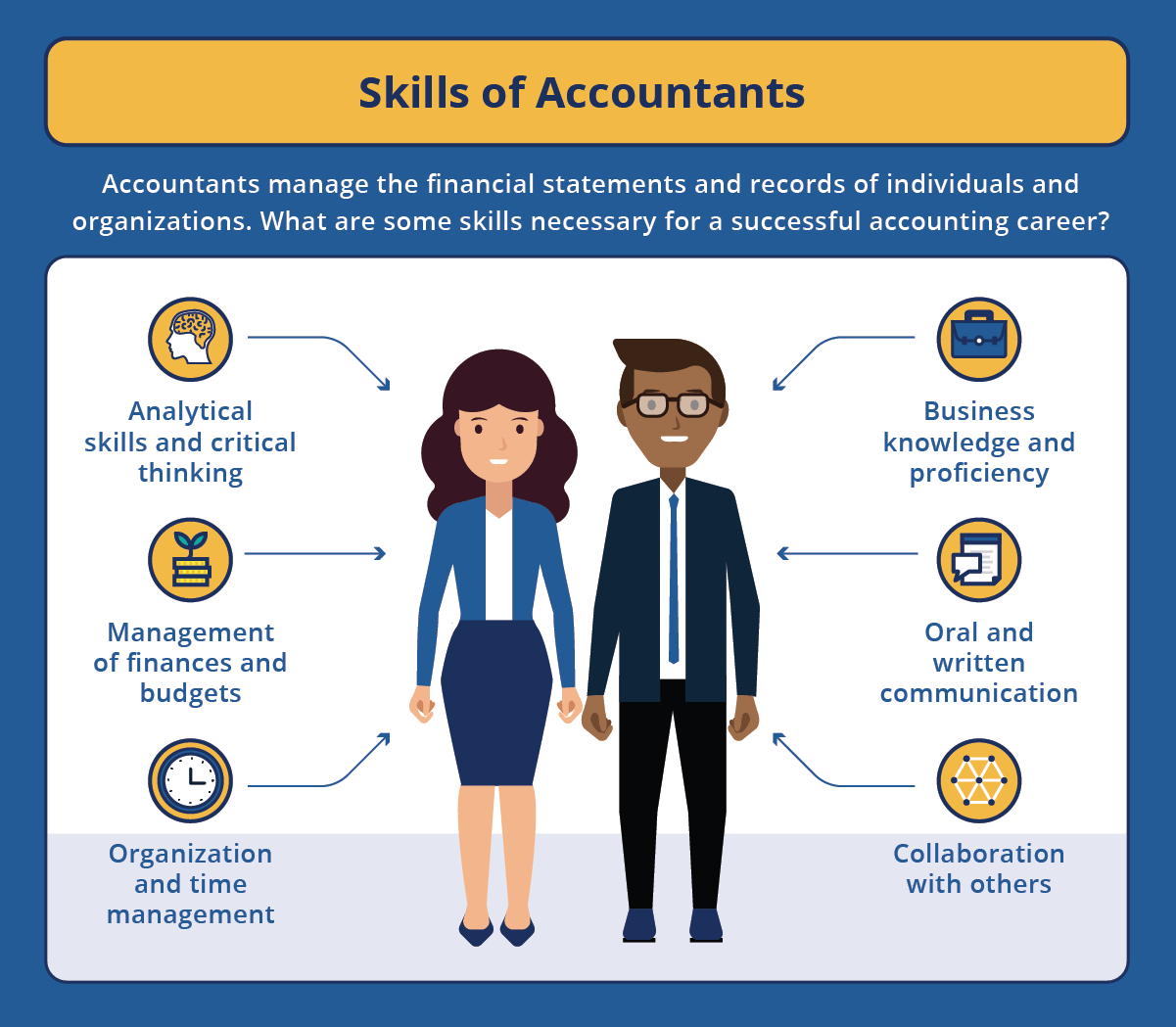

Essential Skills for Accounting Technology Professionals

The dynamic field of accounting technology demands a unique blend of technical and soft skills. Individuals seeking success in this area need to possess a robust skill set that allows them to navigate the complexities of accounting software, data analysis, and technological advancements while effectively collaborating with colleagues and clients.

Technical Skills

Technical skills are the foundation of accounting technology careers. These skills equip professionals to work with accounting software, analyze data, and leverage technology to enhance accounting processes.

- Accounting Software Proficiency: Expertise in popular accounting software like QuickBooks, Xero, and Sage Intacct is essential. Professionals should be able to navigate these platforms, perform tasks such as data entry, reconciliation, and reporting, and understand the nuances of each software’s features.

- Data Analysis: Accounting technology professionals must be adept at extracting meaningful insights from financial data. This includes skills in data visualization, using tools like Excel, Tableau, or Power BI to create charts and dashboards, and understanding statistical analysis techniques.

- Programming and Scripting: While not always mandatory, familiarity with programming languages like Python or R can significantly enhance an accounting technology professional’s skillset. These skills allow for automation, data manipulation, and building custom solutions.

- Cloud Computing: Knowledge of cloud-based accounting platforms like NetSuite and Intuit’s QuickBooks Online is becoming increasingly important. Understanding cloud infrastructure, security, and data storage is vital.

- Cybersecurity: With the increasing reliance on technology, cybersecurity awareness is critical. Professionals should be familiar with basic security principles, data encryption, and best practices to protect sensitive financial information.

Soft Skills

Soft skills are equally important in accounting technology careers. These skills enable professionals to communicate effectively, solve problems, and collaborate with diverse stakeholders.

- Communication: Clear and concise communication is essential for conveying complex financial information to colleagues, clients, and stakeholders. Strong written and verbal communication skills are crucial for preparing reports, presentations, and explaining technical concepts.

- Problem-Solving: Accounting technology professionals often encounter challenges related to data discrepancies, software glitches, or process inefficiencies. Analytical thinking and problem-solving skills are essential to identify issues, develop solutions, and implement improvements.

- Critical Thinking: The ability to analyze situations, evaluate data, and make informed decisions is crucial in accounting technology. Critical thinking allows professionals to identify trends, assess risks, and propose effective strategies.

- Teamwork and Collaboration: Many accounting technology projects involve collaboration with colleagues, clients, and IT professionals. Strong teamwork and interpersonal skills are essential for working effectively in diverse teams, fostering communication, and achieving shared goals.

Training Program for Aspiring Accounting Technology Professionals

A comprehensive training program can equip aspiring professionals with the necessary skills to thrive in accounting technology careers. This hypothetical program would incorporate both technical and soft skills development:

Phase 1: Foundational Knowledge

- Accounting Fundamentals: A solid understanding of accounting principles, financial statements, and accounting software is essential.

- Data Analysis Basics: Introduction to data visualization, statistical analysis, and using tools like Excel or Google Sheets.

- Introduction to Cloud Computing: Overview of cloud infrastructure, security, and popular cloud accounting platforms.

Phase 2: Technical Skills Development

- Accounting Software Proficiency: Hands-on training in popular accounting software like QuickBooks, Xero, and Sage Intacct.

- Advanced Data Analysis: Learning data manipulation, data mining, and using advanced data visualization tools like Tableau or Power BI.

- Programming and Scripting: Introduction to Python or R for automation, data manipulation, and building custom solutions.

- Cybersecurity Awareness: Training on data encryption, best practices for online security, and recognizing potential threats.

Phase 3: Soft Skills Enhancement

- Communication and Presentation Skills: Workshops on effective written and verbal communication, preparing reports, and delivering presentations.

- Problem-Solving and Critical Thinking: Exercises and case studies to develop analytical thinking, problem-solving skills, and decision-making abilities.

- Teamwork and Collaboration: Group projects and simulations to foster teamwork, communication, and collaborative problem-solving.

Phase 4: Practical Experience

- Internships or Job Shadowing: Gaining real-world experience in accounting technology roles to apply learned skills and develop practical knowledge.

- Mentorship and Networking: Connecting with experienced professionals in the field for guidance, insights, and career advice.

Emerging Trends in Accounting Technology

The field of accounting technology is constantly evolving, driven by advancements in artificial intelligence (AI), cloud computing, and data analytics. These trends are reshaping the way accounting professionals work and the skills they need to succeed.

Impact of Automation on Job Roles

Automation is playing a significant role in transforming accounting tasks. Routine and repetitive tasks, such as data entry and reconciliation, are being automated, freeing up accountants to focus on higher-value activities like analysis, strategy, and advisory services. While automation may lead to job displacement in some areas, it also creates new opportunities in fields like data science, AI development, and process optimization.

“The rise of automation is not about replacing jobs, it’s about augmenting human capabilities.” – Deloitte

- Increased Demand for Specialized Skills: Automation is driving a shift in demand for accounting professionals with specialized skills in data analysis, AI, and cloud technologies.

- Focus on Advisory and Strategic Roles: Automation enables accountants to move away from transactional tasks and focus on providing strategic insights and advisory services to clients.

- Upskilling and Reskilling: To adapt to the changing landscape, accountants need to upskill and reskill to acquire new technologies and analytical abilities.

The Future of Accounting Technology

The future of accounting technology is characterized by continued advancements in AI, cloud computing, and blockchain technology. These technologies are poised to further automate tasks, enhance data analysis capabilities, and improve the efficiency and transparency of accounting processes.

- AI-powered Audit and Compliance: AI algorithms can analyze vast amounts of data to identify potential risks and anomalies, automating audit and compliance processes.

- Real-time Financial Reporting: Cloud-based accounting systems enable real-time data updates and reporting, providing businesses with instant insights into their financial performance.

- Blockchain for Secure Transactions: Blockchain technology can enhance the security and transparency of financial transactions, reducing the risk of fraud and errors.

Education and Training for Accounting Technology Careers

A career in accounting technology requires a solid foundation in both accounting principles and technology skills. There are several educational pathways available to individuals interested in this field, ranging from traditional college degrees to specialized certifications. This section explores these options and provides insights into relevant professional development opportunities.

Educational Pathways

Individuals seeking a career in accounting technology can choose from various educational pathways. These options cater to different levels of experience and career aspirations.

- Associate’s Degree in Accounting or Business Administration: This is a two-year program that provides a foundational understanding of accounting principles, business operations, and basic technology skills. It can be a stepping stone for entry-level positions in accounting departments or for pursuing a bachelor’s degree.

- Bachelor’s Degree in Accounting or Accounting Information Systems: A four-year program that offers a comprehensive understanding of accounting principles, financial reporting, auditing, and technology applications in accounting. This degree is often preferred for more advanced roles such as financial analysts, accountants, or systems analysts.

- Master’s Degree in Accounting or Accounting Information Systems: This advanced degree provides specialized knowledge in areas like tax, auditing, or financial management. It can be beneficial for aspiring accounting professionals seeking leadership positions or specialized roles.

- Online Courses and Bootcamps: Several online platforms offer short-term courses and bootcamps focusing on specific accounting technology skills, such as data analysis, financial modeling, or accounting software applications. These programs can be a good option for individuals looking to upskill or specialize in a particular area.

Certifications

Obtaining relevant certifications can enhance your credentials and demonstrate your expertise in accounting technology.

- Certified Public Accountant (CPA): This is a highly respected certification for accounting professionals. Earning a CPA license requires passing a rigorous exam and meeting specific experience requirements. While it is not specifically focused on technology, it provides a strong foundation in accounting principles, which is essential for accounting technology roles.

- Certified Management Accountant (CMA): This certification focuses on the management and strategic aspects of accounting. It is valuable for individuals seeking careers in financial planning, cost accounting, or management consulting.

- Certified Internal Auditor (CIA): This certification is for professionals who perform internal audits to ensure compliance with regulations and best practices. It is relevant for individuals interested in roles within internal audit departments or risk management.

- Certified Information Systems Auditor (CISA): This certification focuses on IT auditing and control. It is beneficial for individuals who want to specialize in IT security, risk management, or data governance within accounting departments.

- Software-Specific Certifications: Several accounting software vendors offer certifications for their products, such as QuickBooks, Xero, or Sage. These certifications demonstrate proficiency in using specific software and can be valuable for entry-level positions.

Professional Development Opportunities

Continuous learning and professional development are crucial for staying ahead in the evolving field of accounting technology.

- Conferences and Workshops: Attending industry conferences and workshops provides opportunities to network with professionals, learn about new technologies, and stay up-to-date on industry trends.

- Online Learning Platforms: Platforms like Coursera, edX, and Udemy offer a wide range of courses and certifications in accounting technology, data analytics, and related fields. These platforms provide flexibility and access to expert instructors.

- Professional Organizations: Joining professional organizations such as the American Institute of Certified Public Accountants (AICPA), the Institute of Management Accountants (IMA), or the Information Systems Audit and Control Association (ISACA) provides access to resources, networking opportunities, and continuing education programs.

Educational Options and Career Paths

| Educational Option | Career Paths |

|---|---|

| Associate’s Degree in Accounting or Business Administration | Bookkeeper, Accounts Payable/Receivable Clerk, Data Entry Clerk, Junior Accountant |

| Bachelor’s Degree in Accounting or Accounting Information Systems | Financial Analyst, Cost Accountant, Management Accountant, Internal Auditor, Systems Analyst, Accountant |

| Master’s Degree in Accounting or Accounting Information Systems | Senior Accountant, Financial Manager, CFO, Controller, Auditor, Tax Manager |

| Online Courses and Bootcamps | Data Analyst, Financial Modeler, Accounting Software Specialist, Business Intelligence Analyst |

Job Market Outlook for Accounting Technology Careers

The accounting technology field is experiencing a surge in demand, fueled by the increasing adoption of automation and digital transformation across industries. As businesses continue to embrace technological advancements, the need for skilled professionals who can navigate the complexities of accounting software, data analytics, and cybersecurity is growing rapidly.

Current Job Market Demand

The current job market for accounting technology professionals is highly competitive, with employers actively seeking candidates with the right skills and experience. The demand for these professionals is driven by several factors, including:

- Growing Adoption of Accounting Software: Businesses are increasingly adopting cloud-based accounting software solutions, such as QuickBooks Online and Xero, which require professionals with expertise in these platforms.

- Rise of Data Analytics: Data analytics is playing a crucial role in accounting, enabling businesses to gain insights from financial data and make informed decisions. This has led to an increased demand for professionals with data analysis skills.

- Importance of Cybersecurity: As businesses become more reliant on technology, cybersecurity has become a top priority. Accounting technology professionals are needed to ensure the security of financial data and systems.

Projected Growth and Salary Trends

The Bureau of Labor Statistics (BLS) projects a strong growth outlook for accounting and auditing occupations, with a projected job growth rate of 7% from 2020 to 2030. This growth is expected to be driven by the continued adoption of technology in the accounting profession.

- Salary Trends: According to Glassdoor, the average salary for an accounting technology professional in the United States is around $75,000 per year. However, salaries can vary depending on experience, location, and industry. Professionals with advanced skills and certifications can command higher salaries.

- Job Growth Outlook: The demand for accounting technology professionals is expected to grow significantly in the coming years. This growth will be driven by the increasing adoption of cloud-based accounting software, data analytics, and automation technologies.

Future of Work and its Implications for Accounting Technology Careers

The future of work is likely to be characterized by automation, artificial intelligence (AI), and the rise of new technologies. This will have significant implications for accounting technology careers.

- Automation: Automation will continue to play a significant role in accounting, automating routine tasks and freeing up professionals to focus on more strategic activities. This will require accounting technology professionals to develop skills in automation and process improvement.

- AI: AI is being used to automate tasks such as data entry, financial analysis, and fraud detection. This will require accounting technology professionals to understand how AI works and how to leverage it to improve efficiency and accuracy.

- New Technologies: Emerging technologies, such as blockchain and cryptocurrency, are transforming the financial landscape. Accounting technology professionals will need to stay abreast of these developments and adapt their skills accordingly.

Resources and Networks for Accounting Technology Professionals

Staying connected with the latest developments and connecting with peers is crucial for success in the dynamic field of accounting technology. Fortunately, a wealth of resources and networks are available to support accounting technology professionals.

These resources offer valuable insights, professional development opportunities, and a platform to exchange knowledge and experiences with like-minded individuals.

Reputable Organizations and Associations

Several organizations and associations are dedicated to advancing the field of accounting technology and supporting its professionals. These groups provide a platform for networking, education, and advocacy, ensuring professionals stay ahead of the curve.

- Association of International Certified Professional Accountants (AICPA): The AICPA offers resources and certifications specifically tailored for accounting technology professionals. Their website provides access to research, webinars, and publications on emerging trends and best practices in accounting technology.

- Institute of Management Accountants (IMA): The IMA focuses on management accounting and finance professionals. They offer resources and certifications relevant to accounting technology, including topics like data analytics, financial modeling, and automation.

- American Institute of Certified Public Accountants (AICPA): The AICPA offers resources and certifications specifically tailored for accounting technology professionals. Their website provides access to research, webinars, and publications on emerging trends and best practices in accounting technology.

- Association for Financial Professionals (AFP): The AFP focuses on financial professionals, including those working in accounting technology. They offer resources, certifications, and networking opportunities related to treasury management, risk management, and financial technology.

- Institute of Internal Auditors (IIA): The IIA focuses on internal audit professionals, many of whom work with accounting technology. They offer resources, certifications, and networking opportunities related to internal controls, risk management, and data analytics.

Online Forums, Communities, and Professional Networking Platforms

Online platforms provide a space for accounting technology professionals to connect, share insights, and engage in discussions. These communities offer a valuable resource for staying informed, seeking advice, and building relationships with peers.

- AccountingTools: AccountingTools is a comprehensive online resource for accounting professionals, providing a platform for discussions and knowledge sharing related to accounting technology.

- AccountingWEB: AccountingWEB is a popular online community for accounting professionals, offering forums, articles, and resources related to accounting technology and automation.

- LinkedIn: LinkedIn is a professional networking platform where accounting technology professionals can connect with peers, industry experts, and potential employers. It offers groups and discussions specific to accounting technology.

- Reddit: Reddit hosts several subreddits dedicated to accounting and finance, providing a space for discussions on topics related to accounting technology.

Key Resources and Their Benefits

The following table Artikels some of the key resources available to accounting technology professionals and their associated benefits:

| Resource | Benefits |

|---|---|

| Professional Associations (AICPA, IMA, AFP, IIA) | Access to industry research, certifications, networking events, and advocacy efforts. |

| Online Forums and Communities (AccountingTools, AccountingWEB, LinkedIn, Reddit) | Opportunities for knowledge sharing, peer-to-peer support, and staying informed about emerging trends. |

| Industry Publications (Journal of Accountancy, CFO Magazine, Harvard Business Review) | Access to in-depth articles, research, and case studies on accounting technology and its impact on the industry. |

| Educational Institutions (Universities, Colleges, Online Courses) | Opportunities for formal education and training in accounting technology, data analytics, and related fields. |

Summary: Accounting Technology Careers

The future of accounting is bright, and those who embrace technology will be well-positioned to thrive in this evolving landscape. By developing a strong foundation in accounting principles and technical skills, and by staying abreast of emerging trends, you can unlock a rewarding and impactful career in the exciting world of accounting technology.

Accounting technology careers are becoming increasingly in-demand as businesses adopt new software and tools. One company at the forefront of this trend is Filter Technologies Inc , which develops innovative solutions for managing financial data. Their expertise in automation and data analytics is helping accounting professionals streamline their processes and make better decisions.