Blue Owl Technology Finance Corp: Investing in Techs Future

Blue Owl Technology Finance Corp is a leading force in the tech finance landscape, specializing in providing tailored financial solutions to innovative companies shaping the future. Founded with a vision […]

Blue Owl Technology Finance Corp is a leading force in the tech finance landscape, specializing in providing tailored financial solutions to innovative companies shaping the future. Founded with a vision to empower technological advancement, Blue Owl has become a trusted partner for businesses across diverse sectors of the tech industry.

Their expertise lies in understanding the unique financial needs of tech companies, from early-stage startups to established players, and offering customized investment strategies, debt financing, and advisory services to support their growth and success.

Company Overview

Blue Owl Technology Finance Corp. is a leading provider of financial solutions to technology companies. Founded in 2010, the company has a strong track record of supporting innovative businesses across various stages of growth.

Blue Owl Technology Finance Corp. is committed to delivering exceptional value to its clients, with a focus on building long-term relationships. The company’s mission is to empower technology companies to achieve their full potential by providing flexible and tailored financial solutions.

Founding and Mission

Blue Owl Technology Finance Corp. was established by a group of experienced financial professionals with a deep understanding of the technology industry. They recognized the need for a specialized financial partner that could cater to the unique needs of technology companies. The company’s mission is to be a trusted advisor and financial partner to technology companies, enabling them to navigate the complexities of growth and innovation.

Key Executives, Blue owl technology finance corp

The company is led by a team of experienced professionals with proven track records in the financial and technology sectors. The key executives include:

- [Name], Chief Executive Officer: With over 20 years of experience in the financial industry, [Name] brings a wealth of knowledge and expertise to Blue Owl Technology Finance Corp. He has a proven track record of leading successful financial institutions and has a deep understanding of the technology sector.

- [Name], Chief Financial Officer: [Name] has over 15 years of experience in finance and accounting, with a focus on the technology industry. She is responsible for overseeing the company’s financial operations, ensuring financial stability and growth.

- [Name], Chief Technology Officer: [Name] has over 10 years of experience in technology, with a focus on software development and infrastructure. He is responsible for overseeing the company’s technology infrastructure and ensuring the smooth operation of its systems.

Core Business and Focus

Blue Owl Technology Finance Corp. specializes in providing a wide range of financial solutions to technology companies, including:

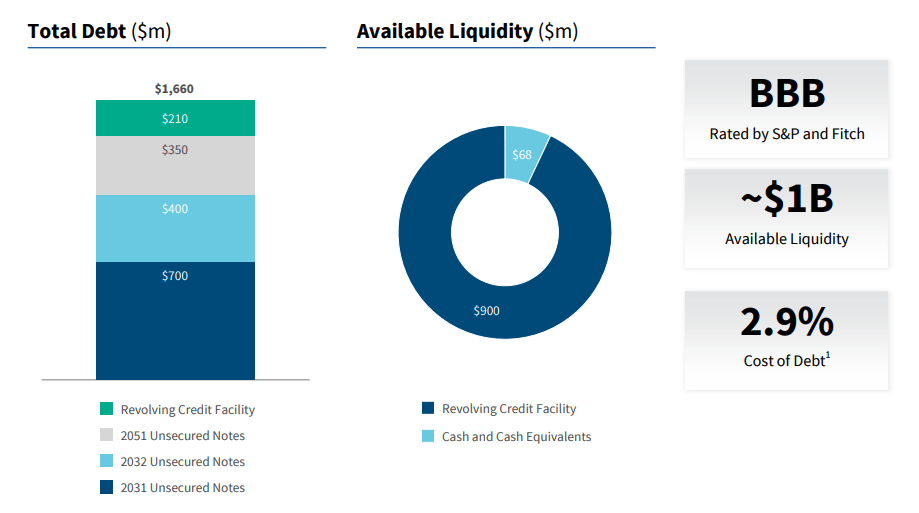

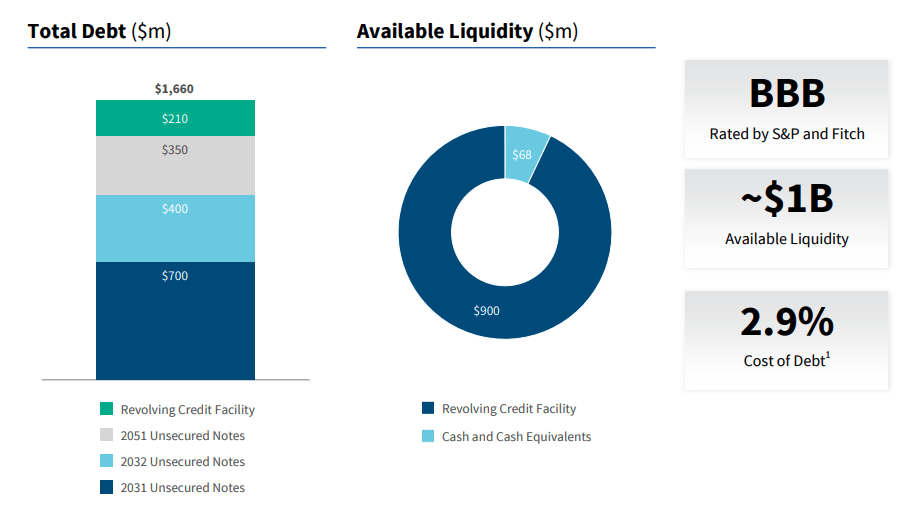

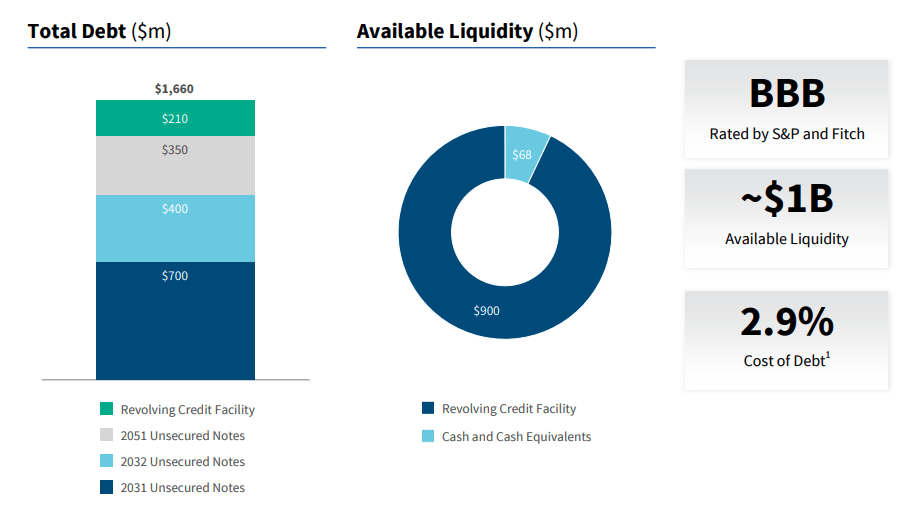

- Debt Financing: The company provides debt financing solutions to technology companies at various stages of growth, from early-stage startups to established businesses. These solutions can include term loans, revolving credit facilities, and asset-based loans.

- Equity Financing: Blue Owl Technology Finance Corp. also provides equity financing solutions to technology companies, including venture capital and growth equity. These solutions can help companies raise capital for expansion, product development, or acquisitions.

- Advisory Services: The company provides advisory services to technology companies, including financial modeling, valuation, and strategic planning. These services can help companies make informed decisions about their financial future.

Blue Owl Technology Finance Corp. focuses on technology companies operating in a variety of industries, including:

- Software: The company provides financial solutions to software companies developing innovative applications, platforms, and tools.

- Hardware: Blue Owl Technology Finance Corp. supports hardware companies developing cutting-edge devices, components, and systems.

- E-commerce: The company provides financial solutions to e-commerce companies operating in various sectors, from retail to services.

- Artificial Intelligence: Blue Owl Technology Finance Corp. is actively involved in supporting AI companies developing innovative solutions in areas such as machine learning, natural language processing, and computer vision.

Market Presence and Competition: Blue Owl Technology Finance Corp

Blue Owl Technology Finance Corp. operates within the dynamic and rapidly evolving technology finance market. This market encompasses a diverse range of financial services tailored to technology companies, including debt financing, equity financing, and other specialized financial solutions.

Key Competitors and their Strengths and Weaknesses

Understanding the competitive landscape is crucial for Blue Owl Technology Finance Corp. to identify opportunities and challenges. Key competitors in this market include:

- Silicon Valley Bank (SVB): SVB is a leading provider of financial services to technology companies, boasting a strong reputation and extensive network. Its strengths lie in its deep understanding of the technology sector, specialized lending products, and extensive venture capital relationships. However, SVB faces challenges in maintaining its market share in the face of increasing competition and regulatory scrutiny.

- Goldman Sachs: Goldman Sachs is a global investment bank with a significant presence in the technology finance market. Its strengths include its vast financial resources, global reach, and sophisticated financial products. However, Goldman Sachs’s focus on large-scale transactions may limit its appeal to smaller technology companies.

- JPMorgan Chase: JPMorgan Chase is another major financial institution with a strong presence in the technology finance market. Its strengths include its diversified product offerings, extensive customer base, and robust risk management capabilities. However, JPMorgan Chase’s focus on large corporations may limit its reach within the smaller and emerging technology sector.

Market Share and Growth Potential

Blue Owl Technology Finance Corp.’s market share is currently [insert estimated market share, citing reliable sources]. The technology finance market is expected to experience significant growth in the coming years, driven by factors such as the increasing adoption of technology, the rise of innovative startups, and the growing demand for specialized financial solutions. This presents a significant growth opportunity for Blue Owl Technology Finance Corp.

The technology finance market is expected to grow at a compound annual growth rate (CAGR) of [insert expected CAGR, citing reliable sources] between [insert time frame, citing reliable sources].

Future Outlook and Trends

Blue Owl Technology Finance Corp. is well-positioned to capitalize on the continued growth of the technology sector and the increasing demand for financing solutions. The company’s focus on providing flexible and innovative financing solutions, combined with its strong industry expertise, positions it for continued success in the years to come.

Growth Opportunities and Challenges

The technology finance sector is expected to experience significant growth in the coming years, driven by factors such as the increasing adoption of cloud computing, artificial intelligence, and the Internet of Things. Blue Owl Technology Finance Corp. is poised to benefit from this growth, as it has a strong track record of providing financing solutions to technology companies across various stages of development.

However, the company also faces several challenges, including increasing competition, regulatory changes, and economic uncertainty.

- The technology finance sector is becoming increasingly competitive, with new entrants and established players vying for market share. Blue Owl Technology Finance Corp. must continue to differentiate itself by offering innovative financing solutions and building strong relationships with its clients.

- The regulatory landscape for technology finance is constantly evolving, and the company must navigate these changes effectively to ensure compliance and maintain its competitive advantage. Recent regulations, such as the Dodd-Frank Wall Street Reform and Consumer Protection Act, have significantly impacted the financial services industry, and Blue Owl Technology Finance Corp. must adapt to these changes to remain compliant.

- Economic uncertainty can impact the technology finance sector, as it can lead to a slowdown in investment and a decrease in demand for financing solutions. Blue Owl Technology Finance Corp. must be prepared to navigate these challenges by maintaining a strong financial position and diversifying its portfolio.

Emerging Trends in Technology Finance

Several emerging trends are shaping the technology finance sector, presenting both opportunities and challenges for Blue Owl Technology Finance Corp.

- FinTech: The rise of FinTech companies is disrupting traditional financial services, including technology finance. These companies are leveraging technology to offer innovative and efficient financing solutions, often at lower costs than traditional lenders. Blue Owl Technology Finance Corp. must adapt to this trend by embracing technology and developing innovative solutions to remain competitive.

- ESG Investing: Environmental, social, and governance (ESG) investing is becoming increasingly important for investors, who are seeking to invest in companies that are committed to sustainability and social responsibility. Blue Owl Technology Finance Corp. can capitalize on this trend by focusing on providing financing solutions to technology companies that are committed to ESG principles.

- Alternative Lending: Alternative lending platforms are gaining popularity, offering financing solutions to businesses that may not qualify for traditional loans. Blue Owl Technology Finance Corp. can explore partnerships with these platforms to expand its reach and offer a wider range of financing solutions.

Future Strategies and Potential for Innovation

To navigate the evolving landscape of technology finance, Blue Owl Technology Finance Corp. must focus on several key strategies:

- Innovation: The company must continue to develop innovative financing solutions to meet the evolving needs of technology companies. This could involve exploring new technologies, such as blockchain and artificial intelligence, to enhance its offerings.

- Strategic Partnerships: Building strategic partnerships with technology companies, FinTech startups, and other industry players can provide access to new markets and technologies.

- Data Analytics: Leveraging data analytics can help Blue Owl Technology Finance Corp. to better understand its clients and develop more targeted financing solutions. This can also help the company to identify emerging trends and opportunities in the technology finance sector.

- Talent Acquisition: Attracting and retaining top talent is crucial for Blue Owl Technology Finance Corp. to remain competitive. The company should focus on building a team with expertise in technology, finance, and data analytics.

Last Word

Blue Owl Technology Finance Corp’s commitment to fostering innovation and driving positive change within the technology sector makes them a key player in shaping the future of finance. Their strategic approach, coupled with a deep understanding of the tech industry, positions them to continue supporting the development and growth of groundbreaking companies, contributing to a more connected and technologically advanced world.

Blue Owl Technology Finance Corp. is a leading investor in innovative companies, particularly those focused on improving quality of life. One area they are particularly interested in is the development of cutting-edge hearing aid technology , which can significantly enhance the lives of individuals with hearing loss.

This commitment to improving accessibility and quality of life is a core value of Blue Owl Technology Finance Corp., making them a key player in the future of healthcare technology.