Fleetcor Technologies Operating: A Comprehensive Analysis

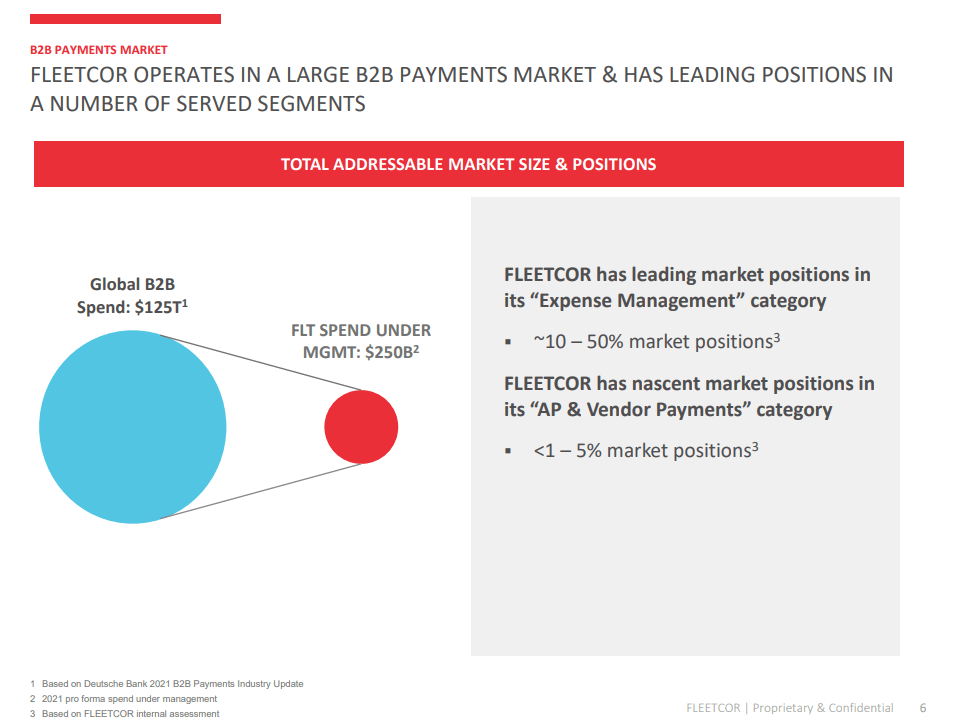

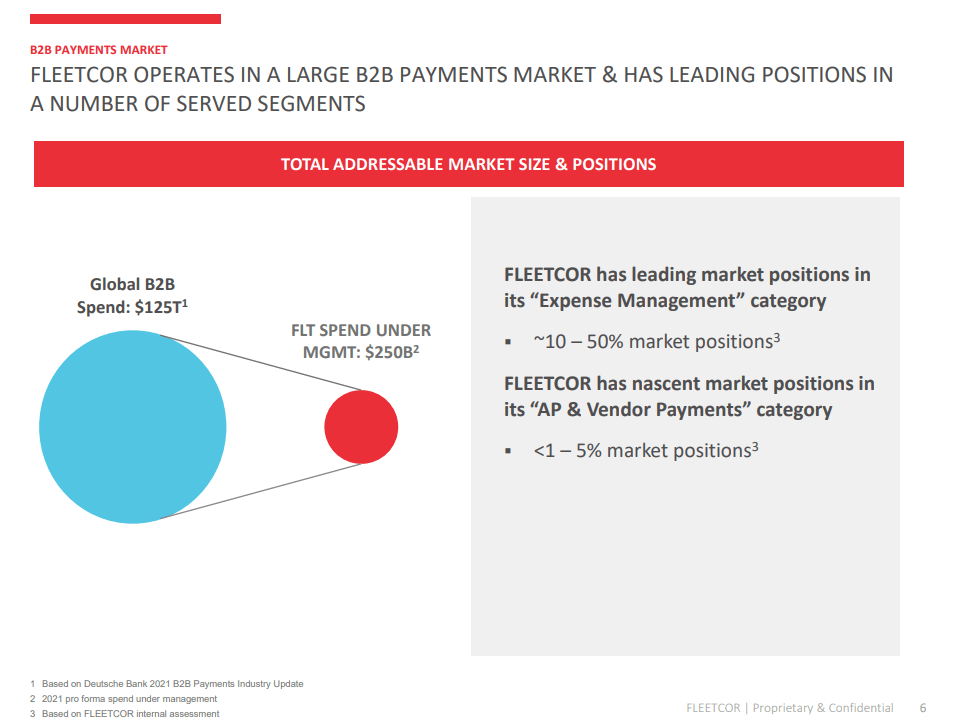

Fleetcor technologies operatin – Fleetcor Technologies operates within the complex world of payment processing, offering specialized solutions for businesses across various industries. This company has carved a niche for itself […]

Fleetcor technologies operatin – Fleetcor Technologies operates within the complex world of payment processing, offering specialized solutions for businesses across various industries. This company has carved a niche for itself by streamlining expense management and simplifying payment processes, particularly for fleet-related expenses. This exploration delves into the intricate workings of Fleetcor Technologies, examining its core business model, market presence, and strategic initiatives.

From its humble beginnings, Fleetcor has grown into a global leader, acquiring numerous companies and expanding its service offerings. Its success lies in its ability to understand the unique needs of businesses and provide customized solutions. The company’s mission is to empower businesses to manage their expenses efficiently, enabling them to focus on their core operations. This deep dive examines Fleetcor’s operational model, customer acquisition strategies, financial performance, and future prospects, providing a comprehensive overview of this industry giant.

Financial Performance and Key Metrics

Fleetcor Technologies has consistently demonstrated strong financial performance, driven by its robust business model and strategic acquisitions. The company’s revenue growth, profitability, and cash flow have been impressive, solidifying its position as a leading provider of fuel cards and payment solutions.

Revenue Growth and Profitability

Fleetcor Technologies’ revenue growth has been driven by both organic growth and acquisitions. The company has consistently expanded its product offerings and geographic reach, attracting new customers and increasing its market share. Fleetcor’s profitability has been consistently strong, with high operating margins and net income. This is attributed to its efficient operating model, strong brand recognition, and recurring revenue streams.

Key Financial Metrics

Several key financial metrics provide insights into Fleetcor Technologies’ operational efficiency and profitability.

- Revenue Growth: Fleetcor Technologies has consistently achieved double-digit revenue growth, reflecting its strong market position and expansion strategies.

- Operating Margin: The company’s operating margin has remained consistently high, indicating its ability to control costs and generate profits.

- Return on Equity (ROE): Fleetcor Technologies’ ROE has been consistently above average, demonstrating its efficient use of shareholder capital to generate profits.

- Free Cash Flow: Fleetcor Technologies generates substantial free cash flow, which it uses to fund acquisitions, invest in growth initiatives, and return capital to shareholders through dividends and share repurchases.

Financial Outlook and Growth Prospects

Fleetcor Technologies is well-positioned for continued growth, driven by several factors. The global demand for fuel cards and payment solutions is expected to continue to increase, fueled by the growth of the e-commerce and mobile payments sectors. Fleetcor Technologies is also benefiting from the increasing adoption of its products and services by businesses of all sizes.

Fleetcor Technologies’ financial outlook remains positive, with continued growth expected in the coming years. The company’s strong track record of financial performance, coupled with its robust business model and growth strategies, positions it for continued success.

Competitive Landscape and Market Trends

Fleetcor Technologies operates in a highly competitive industry, facing challenges from established players and emerging fintech companies. The company’s success hinges on its ability to adapt to evolving market trends, including technological advancements, regulatory changes, and shifting customer preferences.

Major Competitors and Strategies

Fleetcor’s main competitors include:

- WEX Inc.: WEX is a leading provider of fuel cards and payment processing services, directly competing with Fleetcor in several key markets. Their strategy focuses on expanding into new markets and acquiring smaller competitors.

- Elavon: Elavon, a subsidiary of U.S. Bank, offers a range of payment processing solutions, including fuel card services. They compete with Fleetcor by leveraging their extensive network and banking relationships.

- Comdata: Comdata specializes in fleet management and payment solutions, focusing on providing integrated technology platforms for fleet operations. They differentiate themselves through their comprehensive software and data analytics capabilities.

- Fuelman: Fuelman is a provider of fuel management and payment solutions, targeting smaller businesses and independent truck drivers. They compete by offering specialized solutions tailored to specific customer segments.

- Emerging Fintech Companies: The emergence of fintech companies, particularly those specializing in mobile payments and alternative payment methods, poses a potential threat to Fleetcor. These companies leverage technology to disrupt traditional payment models and offer innovative solutions to businesses.

Industry Trends and Growth Prospects

The fleet management and payment processing industry is characterized by several key trends:

- Digital Transformation: Businesses are increasingly adopting digital technologies to streamline operations, enhance efficiency, and improve customer experience. This trend drives demand for integrated payment solutions and data analytics capabilities.

- Mobile Payments: The rise of mobile payments and contactless transactions is transforming the way businesses manage expenses and pay for goods and services. Fleetcor is responding by investing in mobile payment solutions and expanding its reach in the mobile payments market.

- Data Analytics: Businesses are leveraging data analytics to gain insights into spending patterns, optimize operations, and improve decision-making. Fleetcor is integrating data analytics capabilities into its platforms to provide customers with valuable insights and support.

- Sustainability: Sustainability is becoming increasingly important for businesses, and fleet management plays a crucial role in reducing environmental impact. Fleetcor is responding to this trend by offering solutions that promote fuel efficiency and sustainable practices.

- Regulatory Changes: The industry is subject to ongoing regulatory changes, including data privacy regulations and anti-money laundering requirements. Fleetcor is adapting to these changes by investing in compliance technologies and ensuring its operations adhere to regulatory standards.

Impact of Regulatory Changes and Emerging Technologies

Regulatory changes and emerging technologies have a significant impact on Fleetcor’s business.

- Data Privacy Regulations: Regulations such as the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA) require companies to protect customer data and obtain consent for data processing. Fleetcor is investing in data security measures and implementing policies to comply with these regulations.

- Blockchain Technology: Blockchain technology has the potential to disrupt the payment processing industry by offering secure and transparent transactions. Fleetcor is exploring the potential applications of blockchain technology to enhance its payment processing systems and improve efficiency.

- Artificial Intelligence (AI): AI is being used to automate tasks, improve fraud detection, and enhance customer service. Fleetcor is incorporating AI into its platforms to optimize operations, personalize customer experiences, and enhance risk management.

Risks and Challenges

Fleetcor Technologies, like any company, faces a number of risks and challenges that could impact its long-term sustainability. These risks can be categorized into various areas, including competitive pressure, regulatory changes, and economic uncertainty.

Competitive Pressure

The fuel card and payment processing industry is highly competitive, with a number of large and established players. Fleetcor faces competition from both traditional financial institutions and specialized payment processors. These competitors may offer similar products and services at lower prices, or they may introduce new innovations that could disrupt Fleetcor’s market position.

Regulatory Changes

Fleetcor operates in a heavily regulated industry, and changes in regulations could significantly impact its business. These regulations can vary by region and may involve aspects like data privacy, consumer protection, and anti-money laundering. The company must continually adapt to evolving regulatory landscapes and ensure compliance with all applicable rules.

Economic Uncertainty

Economic downturns can negatively impact Fleetcor’s business. In a recession, businesses may reduce their spending on travel and transportation, leading to a decline in demand for Fleetcor’s products and services. Additionally, economic uncertainty can lead to increased credit risk, which could affect the company’s ability to collect payments from its customers.

Strategies for Mitigating Risks

Fleetcor has implemented a number of strategies to mitigate these risks and challenges:

- Continuous Innovation: Fleetcor invests heavily in research and development to create new products and services that meet the evolving needs of its customers. This includes developing new technologies, expanding into new markets, and enhancing its existing offerings.

- Strong Customer Relationships: The company focuses on building strong relationships with its customers by providing excellent customer service and tailored solutions. This helps to ensure customer loyalty and reduce the risk of churn.

- Regulatory Compliance: Fleetcor has a dedicated team that monitors regulatory changes and ensures the company’s compliance with all applicable laws and regulations. This includes proactively seeking guidance from regulators and maintaining transparent communication with stakeholders.

- Diversification: Fleetcor operates in a variety of markets and segments, which helps to reduce its exposure to any single economic downturn or regulatory change. The company’s diversified business model provides a buffer against unexpected events.

- Financial Strength: Fleetcor has a strong financial position, with ample cash flow and a conservative debt profile. This allows the company to weather economic storms and invest in growth opportunities.

Potential Impact of Risks, Fleetcor technologies operatin

Despite its mitigation strategies, Fleetcor’s long-term sustainability could be impacted by these risks. For example, if a major competitor were to introduce a disruptive innovation, Fleetcor could lose market share and experience a decline in profitability. Similarly, a significant regulatory change could increase the company’s compliance costs and reduce its earnings. Finally, a prolonged economic downturn could lead to a decrease in demand for Fleetcor’s products and services, resulting in lower revenue and profitability.

Sustainability and Corporate Social Responsibility

Fleetcor Technologies, a global leader in payment processing and fleet management solutions, recognizes the importance of sustainable business practices and actively integrates corporate social responsibility (CSR) into its operations. The company’s commitment to sustainability is reflected in its efforts to minimize environmental impact, promote ethical business practices, and contribute to the well-being of its stakeholders.

Sustainability Initiatives and Impact

Fleetcor Technologies has implemented a range of initiatives to enhance its sustainability performance. These initiatives focus on key areas such as:

- Environmental Stewardship:

- Reducing carbon emissions through energy efficiency measures and promoting sustainable transportation practices. Fleetcor encourages its employees to utilize public transportation, carpool, or bike to work. The company also invests in fuel-efficient vehicles and renewable energy sources for its offices and data centers.

- Minimizing waste through recycling and composting programs. Fleetcor actively promotes waste reduction and responsible disposal practices across its offices and operations. The company also partners with local organizations to recycle and reuse materials whenever possible.

- Conserving water through water-saving fixtures and landscaping practices. Fleetcor has implemented water-efficient technologies in its offices and facilities, including low-flow faucets and water-saving toilets. The company also promotes the use of drought-tolerant landscaping and irrigation systems to conserve water.

- Social Responsibility:

- Promoting diversity and inclusion in the workplace. Fleetcor actively seeks to create a diverse and inclusive work environment by promoting equal opportunities for all employees, regardless of gender, race, ethnicity, or sexual orientation. The company has implemented programs and policies to ensure that all employees feel valued and respected.

- Supporting local communities through charitable donations and volunteerism. Fleetcor believes in giving back to the communities where it operates. The company supports various charitable organizations and encourages its employees to volunteer their time and skills to make a difference.

- Promoting ethical business practices and compliance with relevant regulations. Fleetcor operates with a strong commitment to ethical business practices and compliance with all applicable laws and regulations. The company has implemented robust internal controls and ethical guidelines to ensure that its operations are conducted in a responsible and transparent manner.

- Governance and Transparency:

- Adhering to high standards of corporate governance. Fleetcor maintains a strong corporate governance framework, with a board of directors that oversees the company’s operations and ensures accountability. The company also publishes its sustainability reports and performance metrics to provide transparency to its stakeholders.

- Engaging with stakeholders on sustainability issues. Fleetcor actively engages with its stakeholders, including investors, employees, customers, and suppliers, to understand their expectations and concerns regarding sustainability. The company provides regular updates on its sustainability initiatives and progress to its stakeholders.

- Promoting responsible investment practices. Fleetcor’s investment decisions are guided by principles of responsible investing, considering environmental, social, and governance factors. The company invests in companies that share its commitment to sustainability and ethical business practices.

ESG Performance

Fleetcor Technologies’ performance in terms of environmental, social, and governance (ESG) factors is evaluated by various independent organizations. The company has received positive ratings from organizations such as:

- MSCI ESG Ratings: Fleetcor has consistently received a high ESG rating from MSCI, a leading provider of ESG research and ratings. This indicates that the company has strong ESG practices and a low risk profile.

- Sustainalytics ESG Ratings: Sustainalytics, another prominent ESG ratings agency, has also recognized Fleetcor’s commitment to sustainability. The company has received a positive ESG rating from Sustainalytics, reflecting its strong ESG performance.

Fleetcor Technologies’ sustainability initiatives and performance are recognized by its stakeholders, including investors, customers, and employees. The company’s commitment to sustainability has helped to enhance its reputation and attract investors who prioritize ESG factors in their investment decisions.

Future Outlook and Growth Strategies

Fleetcor Technologies is well-positioned for continued growth and expansion, driven by its robust business model, strong market position, and strategic initiatives. The company’s future outlook is optimistic, with significant opportunities for growth in both existing and new markets.

Growth Prospects and Expansion

Fleetcor’s growth prospects are underpinned by several key factors:

- Expanding Global Footprint: Fleetcor continues to expand its global reach, entering new markets and acquiring businesses to broaden its customer base. This strategy allows the company to tap into new revenue streams and diversify its portfolio.

- Product Diversification: Fleetcor is actively developing and launching new products and services to meet the evolving needs of its customers. This includes expanding into adjacent markets such as expense management and prepaid cards for businesses.

- Technological Advancements: The company is leveraging technology to enhance its offerings and improve operational efficiency. This includes investments in artificial intelligence, data analytics, and mobile solutions to provide a seamless customer experience.

Key Factors Shaping Future Success

Several key factors will shape Fleetcor’s future success:

- Economic Growth: Fleetcor’s business is closely tied to economic activity. Continued global economic growth will support demand for its products and services, driving revenue growth.

- Regulatory Environment: The regulatory landscape for payment processing and financial services is constantly evolving. Fleetcor’s ability to navigate these changes and maintain compliance will be crucial for its long-term success.

- Competition: The payment processing industry is highly competitive, with established players and emerging fintech companies vying for market share. Fleetcor’s ability to differentiate its offerings and maintain a competitive edge will be essential.

- Innovation and Technology: Continuous innovation and investment in technology will be critical for Fleetcor to stay ahead of the curve and meet the evolving needs of its customers. This includes developing new products, improving existing offerings, and enhancing the customer experience.

Potential for Expansion into New Markets and Product Offerings

Fleetcor has identified several areas for potential expansion, including:

- Emerging Markets: The company is exploring opportunities in emerging markets with high growth potential, such as Asia and Latin America. These markets offer significant growth opportunities for Fleetcor’s products and services.

- New Product Lines: Fleetcor is actively developing new product lines to expand its reach and cater to a wider customer base. This includes exploring opportunities in adjacent markets such as expense management and prepaid cards for businesses.

Conclusive Thoughts: Fleetcor Technologies Operatin

Fleetcor Technologies’ commitment to innovation and its focus on providing value to its customers have propelled it to the forefront of the payment processing industry. The company’s strategic acquisitions, expansion into new markets, and commitment to sustainability position it for continued growth and success. As the global economy evolves, Fleetcor’s ability to adapt and anticipate emerging trends will be crucial in maintaining its competitive edge. With its robust operational model, dedicated customer service, and commitment to innovation, Fleetcor Technologies is poised to continue its journey as a leader in the payment processing space.

Fleetcor Technologies operates in a dynamic industry that requires skilled professionals. The career and technology center cape girardeau mo is a great example of a resource that can equip individuals with the necessary knowledge and skills to succeed in fields like technology and business, potentially even within the realm of fleet management solutions like those offered by Fleetcor.