Hedge Fund Technology: Revolutionizing Finance

Hedge fund technology has become a cornerstone of modern finance, driving innovation and shaping investment strategies. This powerful combination of cutting-edge tools and data-driven approaches has revolutionized the way hedge […]

Hedge fund technology has become a cornerstone of modern finance, driving innovation and shaping investment strategies. This powerful combination of cutting-edge tools and data-driven approaches has revolutionized the way hedge funds operate, enabling them to analyze vast amounts of information, automate trading decisions, and manage risk with unprecedented precision.

From the early days of basic data analysis to the current era of artificial intelligence (AI) and machine learning, the evolution of technology has significantly impacted the hedge fund landscape. This article delves into the key technologies shaping the industry, exploring their applications, benefits, and challenges.

The Evolution of Hedge Fund Technology

The world of hedge funds has undergone a dramatic transformation, driven by the relentless advancement of technology. From the early days of rudimentary data analysis tools to the sophisticated AI-powered platforms of today, technology has fundamentally reshaped the way hedge funds operate, invest, and manage risk.

The Early Days: Data Analysis and Spreadsheets

The initial use of technology in hedge funds focused on basic data analysis and spreadsheet-based calculations. In the 1980s and 1990s, hedge fund managers relied heavily on spreadsheets to track portfolio performance, manage risk, and conduct basic research. This era was marked by the emergence of personal computers and the development of specialized financial software.

The Rise of Quantitative Strategies and Algorithmic Trading

The late 1990s and early 2000s witnessed a significant shift towards quantitative strategies and algorithmic trading. This era saw the development of sophisticated statistical models and algorithms for identifying trading opportunities, executing trades, and managing risk. The increased use of quantitative methods led to the rise of quantitative hedge funds (quant funds) that relied heavily on computer-driven trading strategies.

The Era of Big Data and Machine Learning

The explosion of big data in recent years has revolutionized hedge fund technology. Hedge funds now have access to massive datasets, including financial data, social media feeds, news articles, and even satellite imagery. Machine learning algorithms can analyze these vast datasets to identify patterns and anomalies, predict market movements, and generate investment insights.

The Emergence of AI-Powered Platforms

The latest frontier in hedge fund technology is the development of AI-powered platforms that automate various aspects of the investment process. These platforms leverage advanced machine learning algorithms to perform tasks such as portfolio optimization, risk management, and even investment decision-making.

The Impact of Technology on Hedge Fund Strategies

Technological advancements have significantly impacted hedge fund strategies, enabling the development of new investment approaches and enhancing existing ones.

- Quantitative Strategies: Technology has enabled the development of increasingly complex quantitative strategies, allowing hedge funds to identify and exploit subtle market inefficiencies.

- Algorithmic Trading: High-frequency trading and other algorithmic trading strategies rely heavily on technology to execute trades at lightning speed, taking advantage of fleeting market opportunities.

- Alternative Data: The use of alternative data sources, such as satellite imagery and social media data, has enabled hedge funds to gain insights into market trends and company performance that were previously unavailable.

- Artificial Intelligence: AI-powered platforms are transforming the way hedge funds make investment decisions, automating tasks and providing data-driven insights that were previously only possible through human analysis.

Technology’s Impact on Risk Management, Hedge fund technology

Technology has played a crucial role in enhancing risk management practices in hedge funds.

- Real-Time Risk Monitoring: Sophisticated risk management software allows hedge funds to monitor their portfolios in real time, identifying potential risks and taking corrective actions quickly.

- Stress Testing: Technology enables hedge funds to perform stress tests on their portfolios, simulating different market scenarios to assess their resilience and identify potential vulnerabilities.

- Risk Analytics: Advanced analytics tools provide hedge funds with a deeper understanding of their risk exposures, allowing them to make informed decisions about risk mitigation strategies.

The Technological Landscape of Hedge Funds: Past vs. Present

The technological landscape of hedge funds has undergone a dramatic transformation over the past few decades.

| Past | Present |

|---|---|

| Spreadsheets and basic data analysis tools | AI-powered platforms, machine learning algorithms, and big data analytics |

| Limited access to data and market information | Access to massive datasets, including alternative data sources |

| Manual trading and investment decision-making | Automated trading, algorithmic strategies, and data-driven decision-making |

| Limited risk management capabilities | Sophisticated risk management software and real-time monitoring |

Cloud Computing and Infrastructure

The advent of cloud computing has revolutionized the hedge fund industry, transforming how they manage their infrastructure, access data, and execute strategies. Cloud-based platforms offer a flexible and scalable environment that enables hedge funds to adapt to the ever-changing demands of the financial markets.

Impact of Cloud Computing on Hedge Fund Infrastructure

Cloud computing has significantly impacted hedge fund infrastructure, particularly in areas such as data storage, processing power, and security.

- Data Storage: Cloud storage solutions provide hedge funds with a secure and scalable way to store vast amounts of data, including market data, trade records, and client information. Cloud providers offer various storage options, from object storage for unstructured data to block storage for high-performance applications, allowing hedge funds to choose the most suitable solution for their specific needs.

- Processing Power: Cloud computing offers on-demand access to massive processing power, enabling hedge funds to run complex algorithms and simulations without investing in expensive hardware infrastructure. This flexibility allows hedge funds to scale their computing resources up or down as needed, ensuring they have the processing power required for real-time analysis and execution.

- Security: Cloud providers invest heavily in security measures, offering advanced security features such as encryption, access control, and intrusion detection systems. This helps hedge funds protect their sensitive data and comply with regulatory requirements.

Cloud-Based Platforms and Hedge Fund Operations

Cloud-based platforms enable hedge funds to scale their operations, access advanced technologies, and improve efficiency.

- Scalability: Cloud computing provides the flexibility to scale operations up or down as needed, allowing hedge funds to respond quickly to changing market conditions and handle increased trading volumes without significant upfront investments.

- Advanced Technologies: Cloud providers offer access to a wide range of advanced technologies, including artificial intelligence (AI), machine learning (ML), and high-performance computing (HPC), enabling hedge funds to leverage these technologies for data analysis, risk management, and portfolio optimization.

- Efficiency: Cloud-based platforms automate many tasks, reducing manual effort and improving efficiency. For example, cloud-based data management solutions streamline data collection, processing, and analysis, freeing up time for analysts to focus on strategic decision-making.

Advantages and Challenges of Cloud Computing in Hedge Funds

Adopting cloud computing in the hedge fund industry offers several advantages but also presents some challenges.

Advantages

- Cost Savings: Cloud computing eliminates the need for significant upfront investments in hardware and infrastructure, reducing capital expenditure and allowing hedge funds to allocate resources to other areas.

- Flexibility and Scalability: Cloud-based platforms offer the flexibility to scale resources up or down as needed, enabling hedge funds to adapt to changing market conditions and handle fluctuating workloads.

- Innovation: Cloud providers offer access to a wide range of advanced technologies, enabling hedge funds to leverage cutting-edge solutions for data analysis, risk management, and portfolio optimization.

- Security: Cloud providers invest heavily in security measures, offering advanced security features such as encryption, access control, and intrusion detection systems, enhancing the security of sensitive data.

Challenges

- Security Concerns: While cloud providers offer robust security measures, some hedge funds may have concerns about data security and privacy, especially when dealing with sensitive financial information.

- Vendor Lock-In: Hedge funds may face vendor lock-in, making it difficult to switch providers without incurring significant costs or disrupting operations.

- Compliance: Compliance with regulatory requirements can be complex in a cloud environment, as hedge funds need to ensure that their cloud providers meet regulatory standards and that their data is properly managed and protected.

- Integration: Integrating cloud-based platforms with existing legacy systems can be challenging, requiring careful planning and execution.

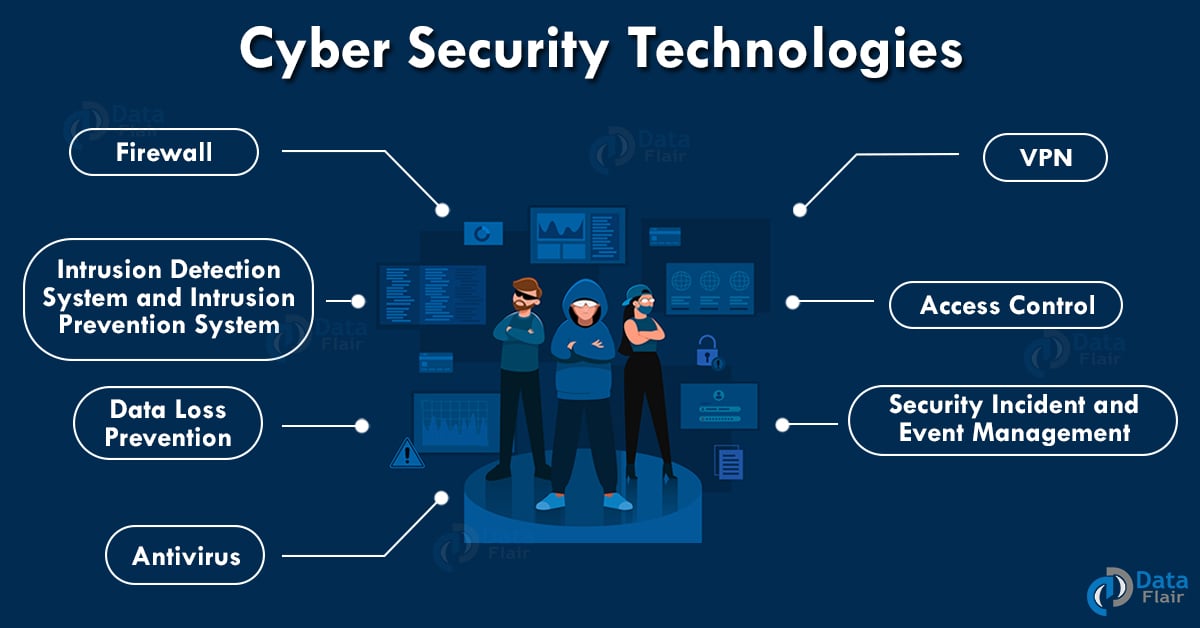

Cybersecurity and Data Protection: Hedge Fund Technology

In the high-stakes world of hedge funds, where vast sums of money are managed and sensitive information is constantly in motion, cybersecurity and data protection are paramount. Hedge funds face a unique set of challenges, as they are attractive targets for cybercriminals due to their valuable data and financial resources. Robust security measures are crucial to safeguarding sensitive data, preventing cyberattacks, and ensuring compliance with increasingly stringent regulations.

Cybersecurity Threats Facing Hedge Funds

Cybersecurity threats to hedge funds are multifaceted and constantly evolving. Here are some of the most prominent threats:

- Data Breaches: Hackers may target hedge funds to steal sensitive data, such as client information, trading strategies, and financial records. This can lead to financial losses, reputational damage, and regulatory fines.

- Ransomware Attacks: Ransomware attacks encrypt a hedge fund’s data, making it inaccessible until a ransom is paid. This can cripple operations and disrupt trading activities, causing significant financial damage.

- Insider Threats: Employees with access to sensitive data can pose a significant threat. Malicious insiders may steal data, sabotage systems, or leak information to competitors.

- Phishing and Social Engineering: Phishing attacks use deceptive emails or websites to trick employees into revealing sensitive information or clicking on malicious links. Social engineering techniques involve manipulating individuals into granting unauthorized access to systems or data.

- Distributed Denial-of-Service (DDoS) Attacks: DDoS attacks overwhelm a hedge fund’s website or network with traffic, making it unavailable to legitimate users. This can disrupt trading activities and damage the fund’s reputation.

Data Protection Measures

Hedge funds employ various security protocols to safeguard sensitive data, prevent cyberattacks, and comply with regulatory requirements. These measures include:

- Multi-factor Authentication (MFA): MFA adds an extra layer of security by requiring users to provide multiple forms of authentication, such as a password and a one-time code, before granting access to systems or data.

- Encryption: Encryption scrambles data, making it unreadable to unauthorized individuals. Hedge funds encrypt data at rest (stored on servers) and in transit (transmitted over networks).

- Intrusion Detection and Prevention Systems (IDS/IPS): IDS/IPS monitor network traffic for suspicious activity and block potential threats. They can detect and prevent attacks in real-time.

- Firewalls: Firewalls act as barriers between a hedge fund’s network and the outside world, filtering incoming and outgoing traffic to prevent unauthorized access.

- Regular Security Audits: Regular security audits identify vulnerabilities and weaknesses in a hedge fund’s systems and data protection measures. These audits help ensure that security protocols are effective and up-to-date.

- Employee Training: Hedge funds train employees on cybersecurity best practices, such as recognizing phishing emails, avoiding suspicious websites, and handling sensitive data responsibly.

- Data Loss Prevention (DLP): DLP solutions monitor and control the movement of sensitive data within a hedge fund’s network, preventing unauthorized copying, sharing, or transfer of critical information.

Best Practices for Cybersecurity and Data Protection

Best practices for cybersecurity and data protection in the hedge fund industry include:

- Implement a Comprehensive Cybersecurity Strategy: A comprehensive strategy should encompass all aspects of cybersecurity, from risk assessment and threat intelligence to incident response and recovery.

- Adopt a Zero-Trust Security Model: The zero-trust model assumes that no user or device can be trusted by default. This approach requires strict authentication and authorization for all access requests.

- Use Cloud-Based Security Solutions: Cloud-based security solutions offer scalability, flexibility, and advanced threat detection capabilities. Hedge funds can leverage cloud services to enhance their cybersecurity posture.

- Stay Updated on Emerging Threats and Technologies: The cybersecurity landscape is constantly evolving. Hedge funds must stay informed about emerging threats and technologies to adapt their security measures accordingly.

- Foster a Culture of Cybersecurity Awareness: A culture of cybersecurity awareness is essential. Employees should be encouraged to report suspicious activity and follow security best practices.

- Regularly Review and Update Security Policies: Security policies should be reviewed and updated regularly to reflect evolving threats and regulatory requirements.

- Conduct Regular Security Drills and Simulations: Security drills and simulations help test the effectiveness of a hedge fund’s incident response plan and ensure that employees are prepared to handle cybersecurity incidents.

The Future of Hedge Fund Technology

The hedge fund industry is constantly evolving, driven by advancements in technology. As we look ahead, several emerging technologies are poised to revolutionize hedge fund operations, strategies, and the broader financial markets. This section will explore the potential impact of artificial intelligence (AI), blockchain, and quantum computing on the future of hedge fund technology.

Artificial Intelligence

AI is rapidly transforming various industries, and the financial sector is no exception. Hedge funds are increasingly adopting AI-powered tools for tasks such as:

- Algorithmic Trading: AI algorithms can analyze vast amounts of data in real-time, identifying patterns and making trading decisions with greater speed and accuracy than human traders. For example, Renaissance Technologies, a highly successful quantitative hedge fund, has long relied on AI algorithms for its trading strategies.

- Risk Management: AI can help hedge funds assess and manage risk more effectively by analyzing market data, identifying potential threats, and developing sophisticated risk mitigation strategies.

- Portfolio Optimization: AI algorithms can optimize portfolio allocation by considering factors such as risk tolerance, investment goals, and market conditions. This can lead to improved returns and reduced volatility.

- Fraud Detection: AI can be used to detect fraudulent activities by analyzing transaction data, identifying anomalies, and flagging suspicious patterns.

Blockchain

Blockchain technology, known for its decentralized and secure nature, is gaining traction in the financial industry. Hedge funds are exploring its potential applications in areas such as:

- Securities Settlement: Blockchain can streamline the settlement process for securities transactions, reducing costs and improving efficiency. This is particularly relevant for hedge funds that engage in complex and high-frequency trading.

- Digital Asset Management: Blockchain can facilitate the management and trading of digital assets, such as cryptocurrencies, offering transparency and security. This is becoming increasingly important as hedge funds explore investment opportunities in the growing digital asset space.

- Fund Administration: Blockchain can be used to automate fund administration tasks, such as record-keeping, reporting, and investor communication, improving transparency and reducing administrative overhead.

Quantum Computing

Quantum computing is a nascent technology with the potential to solve complex problems that are intractable for classical computers. Its impact on hedge fund technology is still in its early stages, but it holds promise for:

- Financial Modeling: Quantum computers can perform complex financial simulations and risk assessments with greater speed and accuracy, enabling hedge funds to develop more sophisticated trading strategies.

- Portfolio Optimization: Quantum algorithms can optimize portfolio allocation by considering a wider range of factors and constraints than traditional methods, potentially leading to superior returns.

- Market Prediction: Quantum computing can be used to analyze vast datasets and identify complex patterns in market data, potentially leading to more accurate market predictions.

Challenges and Opportunities

The adoption of these emerging technologies presents both challenges and opportunities for hedge funds.

Challenges:

- Data Security and Privacy: AI, blockchain, and quantum computing all involve handling sensitive data. Hedge funds need to ensure robust cybersecurity measures to protect their data from breaches and comply with data privacy regulations.

- Regulatory Uncertainty: The regulatory landscape surrounding these technologies is still evolving, creating uncertainty for hedge funds. They need to navigate these regulations effectively to avoid legal and compliance risks.

- Talent Acquisition: The successful implementation of these technologies requires specialized skills in areas such as data science, AI, and quantum computing. Hedge funds may face challenges in attracting and retaining qualified talent.

Opportunities:

- Enhanced Investment Returns: AI, blockchain, and quantum computing have the potential to improve investment returns by enabling more efficient trading, risk management, and portfolio optimization.

- Competitive Advantage: Hedge funds that embrace these technologies can gain a competitive advantage by developing innovative strategies and solutions.

- New Business Models: These technologies can create opportunities for new business models, such as AI-driven investment platforms and blockchain-based trading networks.

Conclusion

As technology continues to advance at a rapid pace, hedge funds are poised to embrace even more innovative solutions in the years to come. The integration of artificial intelligence, blockchain, and quantum computing holds the potential to transform the industry, opening up new opportunities while presenting unique challenges. The future of hedge fund technology is bright, promising a dynamic and evolving landscape that will continue to redefine the boundaries of financial innovation.

Hedge fund technology is constantly evolving, with new tools and strategies emerging all the time. One area that has seen significant growth is in the use of AI-powered algorithms for portfolio management. This trend is also being seen in the restoration industry, with companies like Restoration Technologies Inc using cutting-edge technology to streamline their processes and improve customer service.

The insights gained from these applications can then be applied back to the hedge fund world, leading to further advancements in financial technology.