Technological Acquisition: Shaping Business Strategy

Technological acquisition, a strategic move that can reshape businesses, involves acquiring new technologies to gain a competitive edge. This acquisition process can encompass a wide range of technologies, from software […]

Technological acquisition, a strategic move that can reshape businesses, involves acquiring new technologies to gain a competitive edge. This acquisition process can encompass a wide range of technologies, from software and hardware to intellectual property, all with the goal of achieving specific business objectives.

Whether it’s to expand into new markets, accelerate innovation, or simply gain a competitive advantage, companies often turn to technological acquisition as a powerful tool. Understanding the motivations behind these acquisitions is crucial, as it reveals the strategic thinking behind the decisions and the potential impact on the business landscape.

Defining Technological Acquisition

Technological acquisition, a strategic maneuver employed by businesses, involves obtaining control over technologies or intellectual property from external sources. This approach aims to enhance existing capabilities, expand into new markets, or gain a competitive edge in the marketplace.

Types of Technological Acquisitions

Technological acquisitions encompass a diverse range of assets, each contributing to a specific strategic goal.

- Software: This category includes acquiring software applications, platforms, or programming code to enhance operational efficiency, streamline processes, or develop new products and services.

- Hardware: Businesses may acquire hardware components, systems, or equipment to improve infrastructure, expand production capacity, or develop innovative devices.

- Intellectual Property: Acquiring patents, trademarks, copyrights, or trade secrets grants businesses exclusive rights to use, exploit, or commercialize specific technologies, inventions, or designs.

Motivations for Technological Acquisitions

Technological acquisitions are driven by a range of motivations, each tailored to a specific business objective.

- Market Expansion: Companies may acquire technologies to enter new markets, access new customer segments, or expand their geographical reach.

- Innovation: Technological acquisitions enable businesses to accelerate innovation, gain access to cutting-edge technologies, or acquire expertise in specific areas.

- Competitive Advantage: Acquiring technologies can help businesses differentiate themselves from competitors, enhance their product offerings, or develop unique capabilities.

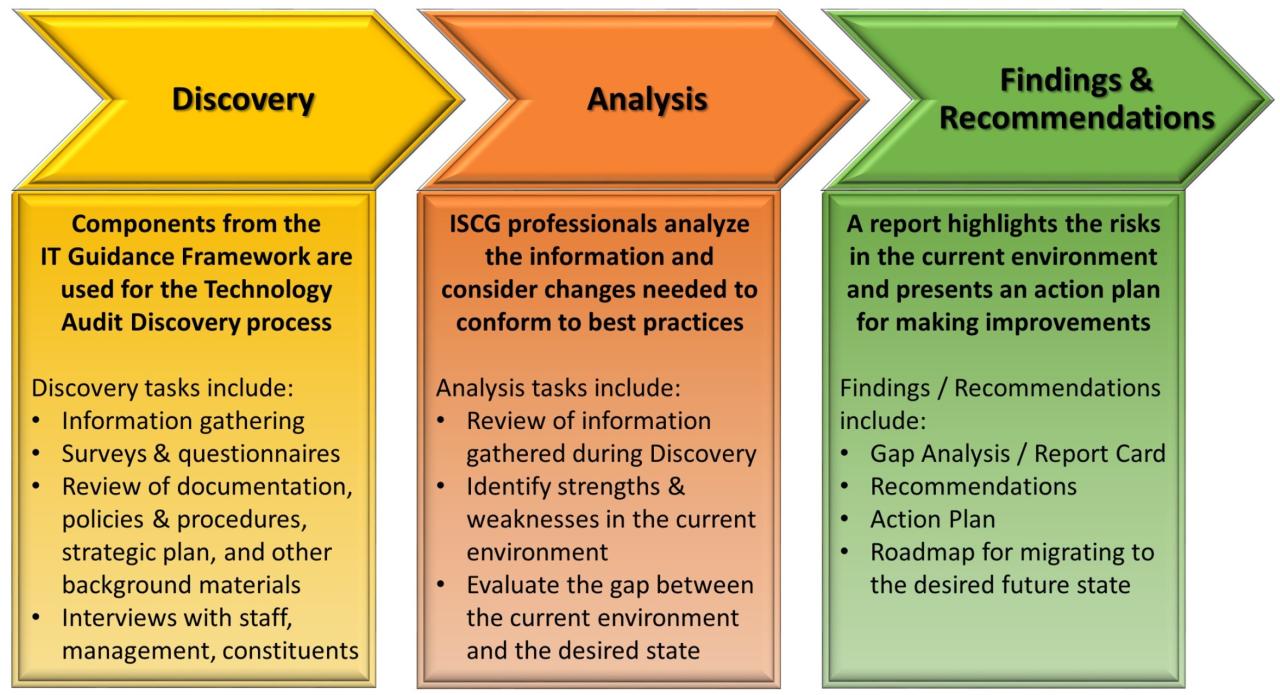

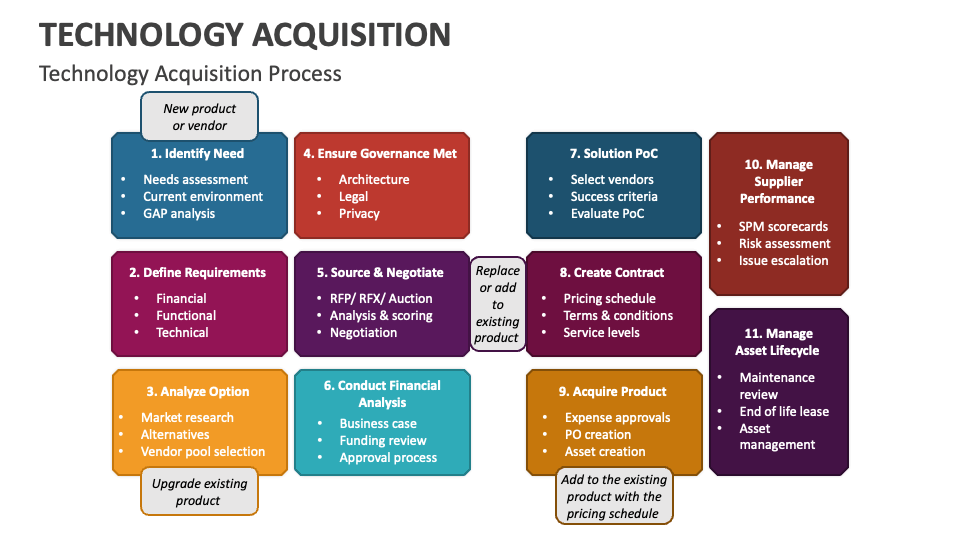

The Process of Technological Acquisition

Technological acquisition is a complex process that involves multiple stages, from identifying potential targets to integrating the acquired technology into existing systems. A well-structured process ensures a successful acquisition that delivers the desired benefits.

Key Stages of Technological Acquisition

The process of acquiring technology typically involves several key stages. Each stage is crucial for achieving a successful outcome.

- Identification: The process begins with identifying potential technology targets that align with the organization’s strategic goals and needs. This involves market research, competitive analysis, and assessing the potential benefits of acquiring the technology.

- Evaluation: Once potential targets are identified, they are thoroughly evaluated to determine their suitability and value. This stage involves assessing the technology’s functionality, performance, scalability, and compatibility with existing systems.

- Negotiation: After evaluating potential targets, negotiations with the target company begin to determine the terms of the acquisition. This involves discussing the purchase price, intellectual property rights, and other relevant factors.

- Integration: Once the acquisition is finalized, the acquired technology must be integrated into the acquiring organization’s existing systems and workflows. This stage involves adapting the technology, training staff, and ensuring seamless operation.

Due Diligence Process

Due diligence is a critical stage in the technological acquisition process. It involves a thorough examination of the target technology to assess its viability and potential risks.

Due diligence aims to provide a comprehensive understanding of the target technology’s strengths, weaknesses, opportunities, and threats (SWOT).

- Technical Due Diligence: This involves evaluating the technology’s functionality, performance, security, and compatibility with existing systems.

- Financial Due Diligence: This assesses the target company’s financial health, including revenue, profitability, and debt levels.

- Legal Due Diligence: This examines the target company’s legal compliance, intellectual property rights, and potential liabilities.

- Operational Due Diligence: This focuses on the target company’s operational efficiency, management team, and customer base.

Challenges of Integrating Acquired Technology

Integrating acquired technology into existing systems and workflows can present several challenges. These challenges need to be addressed effectively to ensure a smooth transition.

- Compatibility Issues: The acquired technology may not be compatible with existing systems, requiring modifications or adjustments.

- Data Migration: Moving data from the acquired technology to existing systems can be complex and time-consuming.

- Training and Adoption: Employees need to be trained on how to use the acquired technology, and resistance to change can be a factor.

- Security Risks: Integrating new technology can introduce security risks, requiring thorough security assessments and mitigation strategies.

Benefits and Risks of Technological Acquisition

Technological acquisition, a strategic move for companies seeking to enhance their capabilities, can be a double-edged sword. While it offers a path to rapid innovation and market expansion, it also comes with inherent risks that need careful consideration. This section delves into the potential benefits and risks associated with technological acquisition, providing a comprehensive understanding of this complex business strategy.

Benefits of Technological Acquisition

Acquiring technology can offer significant advantages to companies looking to accelerate their growth and gain a competitive edge. Here are some of the key benefits:

- Faster Innovation: Technological acquisitions can provide access to cutting-edge technologies, research, and development capabilities, allowing companies to accelerate their innovation cycles and introduce new products or services to the market faster. For example, in 2014, Facebook acquired Oculus VR, a virtual reality technology company, to enhance its offerings in immersive experiences. This acquisition allowed Facebook to quickly enter the burgeoning VR market and establish itself as a leader in the field.

- Market Access: Acquiring a company with established market presence or a unique technology can grant immediate access to new customer segments or geographical markets, reducing the time and resources needed to build a presence from scratch. For instance, in 2016, Salesforce acquired Quip, a collaboration software company, to expand its reach into the collaborative workspace market. This acquisition gave Salesforce instant access to Quip’s existing customer base and its innovative collaboration features.

- Cost Savings: Developing technology in-house can be a costly and time-consuming process. Acquiring an existing technology can significantly reduce development costs, as well as the time and resources required to bring it to market. This is particularly relevant for companies facing resource constraints or seeking to reduce their time-to-market. For example, in 2018, Microsoft acquired GitHub, a platform for software development and collaboration, to gain access to its vast developer community and tools. This acquisition allowed Microsoft to streamline its development processes and reduce the costs associated with building its own platform.

- Talent Acquisition: Technological acquisitions can bring in valuable expertise and talent, particularly in specialized fields or emerging technologies. This can significantly enhance a company’s capabilities and contribute to its long-term success. For instance, in 2019, Google acquired Fitbit, a wearable technology company, to gain access to its expertise in health and fitness tracking technologies, as well as its talented engineers and researchers. This acquisition strengthened Google’s position in the growing wearables market and allowed it to leverage Fitbit’s expertise in developing health-focused technologies.

Risks of Technological Acquisition

While technological acquisition offers numerous benefits, it also comes with inherent risks that can significantly impact the success of the acquisition. These risks include:

- Integration Challenges: Integrating the acquired technology, systems, and processes into the acquiring company’s existing infrastructure can be complex and time-consuming. This can lead to compatibility issues, data migration problems, and disruptions to business operations. For example, in 2016, HP acquired Autonomy, a software company, but faced significant integration challenges due to cultural differences and conflicting business practices. This resulted in a write-down of billions of dollars and ultimately led to a lawsuit against HP.

- Cultural Clashes: Merging two different corporate cultures can lead to conflicts, misunderstandings, and decreased employee morale. This can negatively impact the integration process and the overall success of the acquisition. For instance, in 2011, Yahoo acquired Tumblr, a microblogging platform, but failed to effectively integrate the two cultures. This led to a loss of talent and a decline in Tumblr’s popularity.

- Financial Strain: Technological acquisitions can be expensive, requiring significant capital investment. If the acquisition fails to deliver on its promised benefits, it can strain the acquiring company’s financial resources and impact its overall performance. For example, in 2014, Nokia acquired Alcatel-Lucent, a telecommunications equipment company, but the acquisition resulted in significant financial losses and eventually led to Nokia’s exit from the mobile phone business.

- Regulatory Hurdles: Acquiring a technology company may involve navigating complex regulatory hurdles, such as antitrust laws and data privacy regulations. This can delay the acquisition process and increase its overall cost. For example, in 2018, Qualcomm’s acquisition of NXP Semiconductors was delayed for months due to regulatory scrutiny, ultimately impacting the company’s overall strategy.

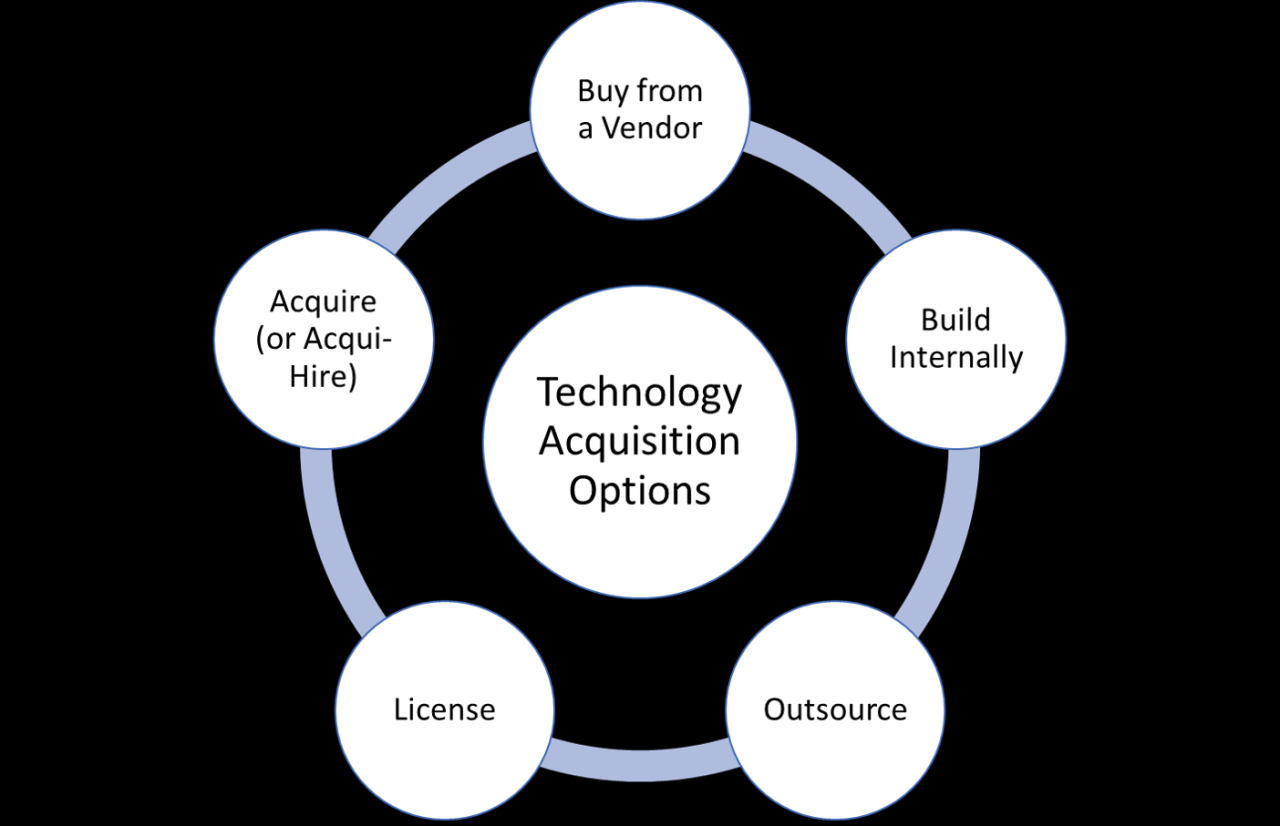

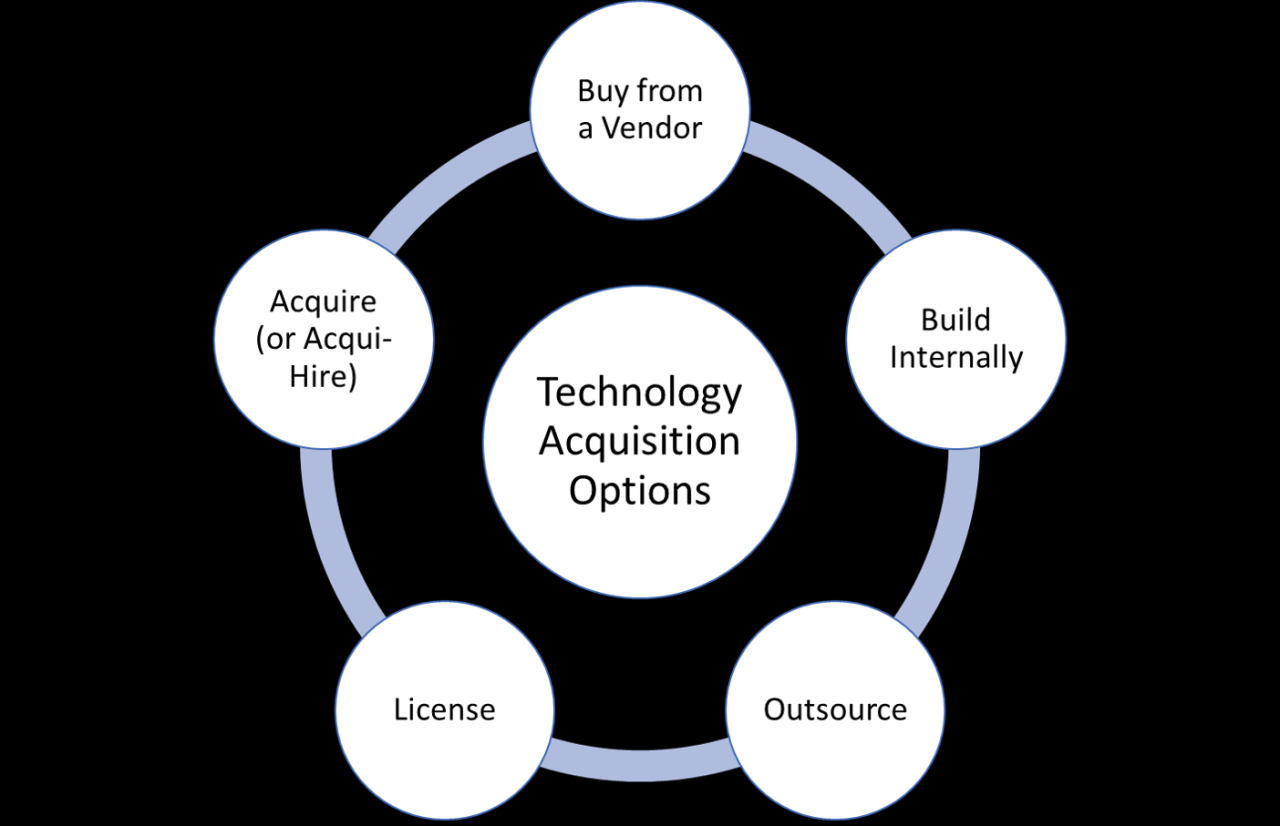

Acquiring Technology vs. Developing It Internally

Companies face a crucial decision when it comes to acquiring technology: whether to acquire it from an external source or develop it internally. This decision involves weighing the pros and cons of each approach:

- Acquiring Technology:

- Pros:

- Faster time to market

- Access to established technologies and expertise

- Reduced development costs

- Cons:

- Higher upfront costs

- Integration challenges

- Potential for cultural clashes

- Risk of acquiring outdated or inferior technology

- Pros:

- Developing Technology Internally:

- Pros:

- Greater control over development process

- Development of proprietary technologies

- Potential for long-term cost savings

- Cons:

- Slower time to market

- Higher development costs

- Risk of technological obsolescence

- Pros:

Case Studies of Technological Acquisitions

Technological acquisitions have become increasingly common in recent years, as companies seek to gain access to new technologies, markets, and talent. These acquisitions can have a significant impact on the acquiring company, the target company, and the industry as a whole. This section examines successful and failed technological acquisitions, analyzing the factors that contribute to their outcomes and their impact on various industries.

Successful Technological Acquisitions

Successful technological acquisitions often involve a combination of factors, including a clear strategic fit between the acquiring and target companies, effective integration of the acquired technology, and a strong management team that can execute the acquisition strategy.

- Google’s acquisition of YouTube (2006): Google acquired YouTube for $1.65 billion, a move that significantly expanded its reach in the online video market. The acquisition was successful due to Google’s ability to integrate YouTube’s technology into its existing platform, leverage its advertising network to monetize YouTube’s content, and create a strong brand for YouTube. This acquisition allowed Google to dominate the online video market and diversify its revenue streams.

- Microsoft’s acquisition of LinkedIn (2016): Microsoft acquired LinkedIn for $26.2 billion, a deal that gave Microsoft a strong foothold in the professional networking market. The acquisition was successful due to Microsoft’s ability to integrate LinkedIn’s platform into its existing Office 365 suite, leverage its cloud computing infrastructure to scale LinkedIn’s operations, and create a new revenue stream through LinkedIn’s premium subscription services. This acquisition allowed Microsoft to expand its reach in the enterprise market and offer a comprehensive suite of productivity tools.

- Salesforce’s acquisition of MuleSoft (2018): Salesforce acquired MuleSoft for $6.5 billion, a deal that strengthened its position in the cloud-based integration platform as a service (iPaaS) market. The acquisition was successful due to Salesforce’s ability to integrate MuleSoft’s technology into its existing platform, leverage its customer base to expand MuleSoft’s reach, and create a new revenue stream through MuleSoft’s enterprise integration solutions. This acquisition allowed Salesforce to offer a more comprehensive suite of cloud-based solutions and expand its reach in the enterprise market.

Failed Technological Acquisitions

Failed technological acquisitions often involve a lack of strategic fit between the acquiring and target companies, poor integration of the acquired technology, and a lack of leadership to execute the acquisition strategy.

- AOL’s acquisition of Time Warner (2000): AOL acquired Time Warner for $164 billion, a deal that was widely considered to be a failure. The acquisition was plagued by cultural clashes, integration problems, and a lack of strategic fit between the two companies. AOL’s internet-based business model was incompatible with Time Warner’s traditional media businesses, and the two companies struggled to integrate their operations. This acquisition resulted in significant financial losses for both companies and ultimately led to the breakup of AOL Time Warner in 2009.

- Yahoo’s acquisition of GeoCities (1999): Yahoo acquired GeoCities for $3.57 billion, a deal that was also considered to be a failure. The acquisition was plagued by poor integration of GeoCities’ technology into Yahoo’s platform, a lack of strategic fit between the two companies, and a decline in the popularity of GeoCities’ web hosting services. This acquisition resulted in significant financial losses for Yahoo and ultimately led to the closure of GeoCities in 2009.

- HP’s acquisition of Autonomy (2011): HP acquired Autonomy for $10.3 billion, a deal that was later written down as a $8.8 billion loss. The acquisition was plagued by accounting irregularities, cultural clashes, and a lack of strategic fit between the two companies. HP’s hardware-focused business model was incompatible with Autonomy’s software-focused business model, and the two companies struggled to integrate their operations. This acquisition resulted in significant financial losses for HP and ultimately led to the departure of HP’s CEO in 2012.

Impact of Technological Acquisitions on Industries

Technological acquisitions can have a significant impact on various industries, including:

- Technology industry: Acquisitions in the technology industry can lead to consolidation, innovation, and the emergence of new market leaders. For example, Google’s acquisition of YouTube and Microsoft’s acquisition of LinkedIn helped these companies dominate their respective markets and drive innovation in the online video and professional networking spaces.

- Healthcare industry: Acquisitions in the healthcare industry can lead to the development of new technologies and treatments, improved patient care, and increased efficiency. For example, the acquisition of pharmaceutical companies by larger healthcare companies can lead to the development of new drugs and treatments, while the acquisition of healthcare technology companies by hospitals and healthcare providers can lead to improved patient care and increased efficiency.

- Financial services industry: Acquisitions in the financial services industry can lead to the development of new financial products and services, improved customer experience, and increased competition. For example, the acquisition of fintech companies by traditional financial institutions can lead to the development of new financial products and services, while the acquisition of financial technology companies by other fintech companies can lead to increased competition in the market.

Final Wrap-Up

Navigating the complex world of technological acquisition requires a blend of strategic foresight, meticulous planning, and a keen understanding of both benefits and risks. From the initial identification of potential targets to the seamless integration of acquired technologies, each stage presents its own unique challenges and opportunities. Ultimately, successful technological acquisitions are those that not only enhance existing capabilities but also drive innovation and unlock new avenues for growth.

Technological acquisition can be a strategic move for companies looking to expand their capabilities or enter new markets. For example, a company might acquire a firm like polymer technologies inc clifton nj to gain expertise in polymer technology. This can give them a competitive edge and allow them to develop innovative products or processes.