Risk Technologies: Shaping a Safer Future

Risk technologies are revolutionizing how we manage and mitigate risks across various industries. From financial institutions to healthcare, these sophisticated tools are transforming decision-making, enhancing efficiency, and ultimately, safeguarding our […]

Risk technologies are revolutionizing how we manage and mitigate risks across various industries. From financial institutions to healthcare, these sophisticated tools are transforming decision-making, enhancing efficiency, and ultimately, safeguarding our world.

These technologies leverage advanced algorithms, data analytics, and machine learning to identify potential threats, predict future outcomes, and implement proactive measures to minimize risks. This proactive approach empowers businesses and organizations to make informed decisions, optimize resources, and ensure a safer and more secure future.

Risk Technologies

Risk technologies encompass a wide range of tools, techniques, and methodologies employed to identify, assess, manage, and mitigate risks across various domains. These technologies leverage data analysis, predictive modeling, and advanced algorithms to provide insights and support decision-making in the face of uncertainty.

Definition and Scope of Risk Technologies

Risk technologies are a broad category encompassing various tools and methodologies used to identify, assess, manage, and mitigate risks across various domains. These technologies utilize data analysis, predictive modeling, and advanced algorithms to provide insights and support decision-making in the face of uncertainty.

Examples of Risk Technologies

Risk technologies are used across various industries, including finance, healthcare, cybersecurity, and insurance. Examples include:

- Risk Management Software: These platforms streamline risk identification, assessment, and mitigation processes. They provide tools for risk mapping, risk registers, and reporting, enabling organizations to manage their risk profiles effectively.

- Fraud Detection Systems: These systems use machine learning algorithms to identify fraudulent transactions and patterns in real-time. They analyze vast amounts of data to detect anomalies and prevent financial losses.

- Cybersecurity Threat Intelligence Platforms: These platforms collect and analyze data on cyber threats, vulnerabilities, and attack patterns. They provide insights into emerging threats and help organizations strengthen their security posture.

- Predictive Analytics: This technique uses statistical models and machine learning algorithms to forecast future events and risks. It helps organizations anticipate potential issues and take proactive measures to mitigate them.

- Scenario Planning: This methodology involves developing and analyzing different future scenarios to understand the potential impact of risks on an organization. It helps organizations prepare for unforeseen events and make informed decisions.

Evolution of Risk Technologies

Risk technologies have evolved significantly over time, driven by advancements in computing power, data analytics, and artificial intelligence. Early risk management practices relied heavily on manual processes and expert judgment. However, the advent of technology has enabled the development of more sophisticated and automated solutions.

- Early Risk Management: Early risk management practices were primarily manual, relying on expert judgment and historical data. This approach was often time-consuming and prone to human error.

- Emergence of Computerized Systems: The introduction of computers in the 1970s and 1980s revolutionized risk management. Computerized systems enabled organizations to automate data analysis and reporting, improving efficiency and accuracy.

- Data-Driven Risk Management: With the rise of big data and advanced analytics, risk management has become increasingly data-driven. Organizations now leverage vast datasets to identify patterns, predict risks, and make more informed decisions.

- Artificial Intelligence and Machine Learning: The integration of AI and machine learning technologies has further enhanced risk management capabilities. AI algorithms can analyze complex data sets, identify subtle patterns, and make predictions with greater accuracy than traditional methods.

Types of Risk Technologies

Risk technologies are tools and methods used to identify, assess, manage, and mitigate risks in various fields. These technologies leverage data analysis, machine learning, and other advanced techniques to provide insights and solutions for risk-related challenges.

Risk Assessment Technologies

Risk assessment technologies are designed to identify and analyze potential risks. They help organizations understand the likelihood and impact of risks, enabling them to prioritize mitigation efforts.

- Risk Management Software: These platforms offer comprehensive risk management capabilities, including risk identification, assessment, prioritization, and reporting. Examples include Riskonnect, LogicManager, and Protiviti Risk & Compliance.

- Data Analytics Tools: Big data analytics and machine learning algorithms can be used to analyze historical data, identify patterns, and predict potential risks. For instance, insurance companies use data analytics to assess the risk of fraud or to determine premiums for policyholders.

- Simulation and Modeling Tools: These tools allow organizations to simulate various scenarios and model potential outcomes to assess the impact of different risks. Monte Carlo simulations, for example, are widely used in finance to estimate the potential returns and risks of investment portfolios.

Risk Mitigation Technologies

Risk mitigation technologies focus on reducing the likelihood or impact of identified risks. They provide tools and strategies to prevent or control risks, minimizing potential losses.

- Cybersecurity Solutions: These technologies protect organizations from cyber threats, such as malware, data breaches, and ransomware attacks. Examples include firewalls, intrusion detection systems, and endpoint security software.

- Business Continuity and Disaster Recovery Solutions: These technologies ensure business operations continue in the event of a disruption, such as a natural disaster or cyberattack. Examples include data backup and recovery systems, disaster recovery plans, and business continuity management software.

- Insurance Products: Insurance policies provide financial protection against various risks, such as property damage, liability claims, and health issues. Insurance companies use risk assessment technologies to determine premiums and coverage levels.

Risk Monitoring Technologies

Risk monitoring technologies track and monitor potential risks over time. They provide real-time insights into changing risk landscapes and enable organizations to adjust their risk management strategies accordingly.

- Real-time Data Monitoring Systems: These systems continuously collect and analyze data from various sources to identify emerging risks. For example, financial institutions use real-time data monitoring to detect fraudulent transactions or unusual trading patterns.

- Social Media Monitoring Tools: These tools track social media conversations and online sentiment to identify potential risks related to reputation, brand image, or product safety.

- Risk Management Dashboards: These dashboards provide a centralized view of risk data, allowing organizations to monitor key risk indicators, track progress on mitigation efforts, and make informed decisions.

Benefits and Challenges of Risk Technologies

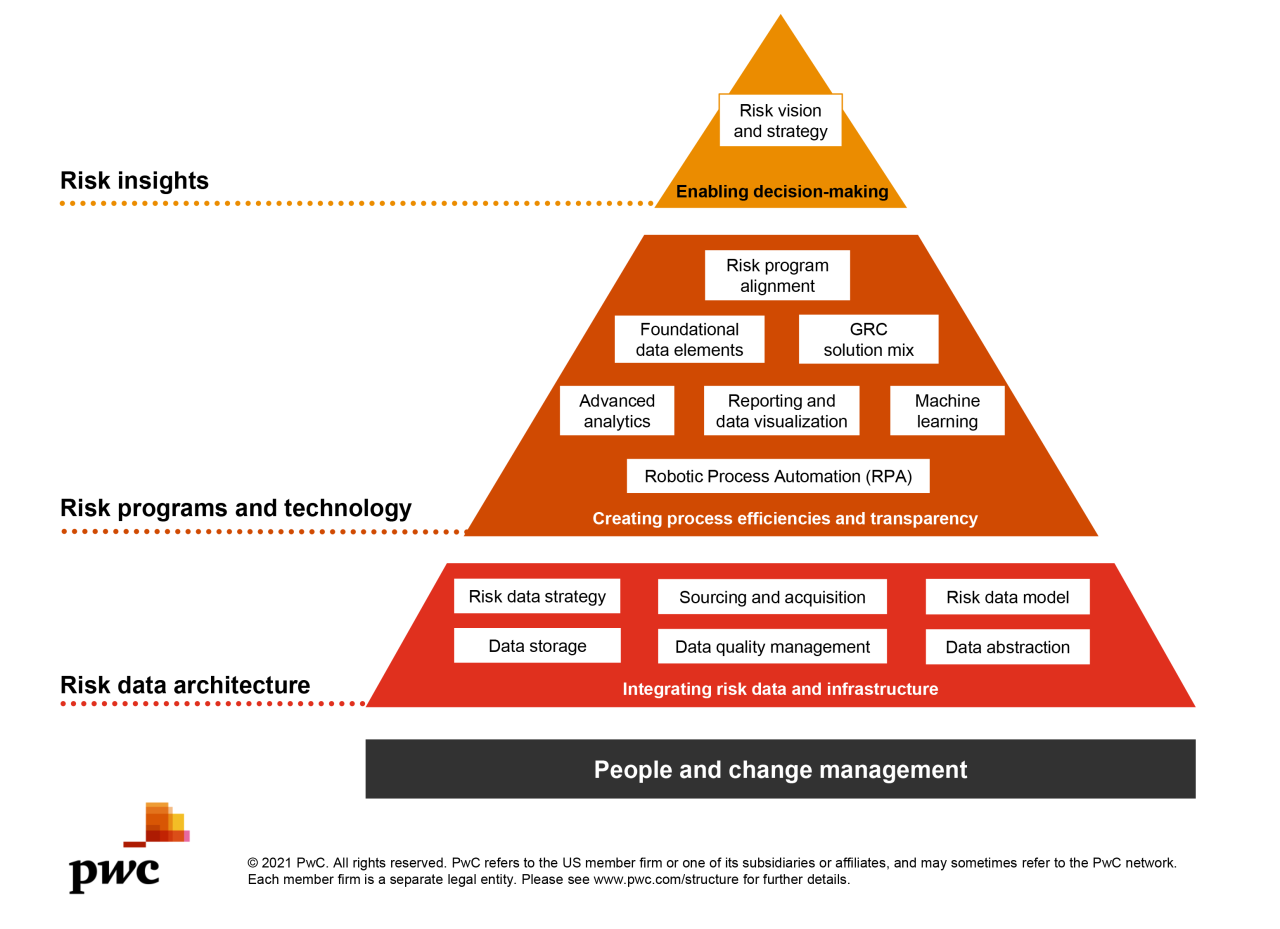

Risk technologies offer a powerful toolkit for organizations to navigate the complexities of uncertainty and potential threats. By leveraging data analysis, predictive modeling, and advanced algorithms, these technologies can help businesses make informed decisions, minimize losses, and enhance overall resilience. However, the implementation of risk technologies also comes with its own set of challenges and considerations.

Benefits of Risk Technologies

The benefits of implementing risk technologies are multifaceted and can significantly contribute to an organization’s success.

- Increased Efficiency: Risk technologies can automate many manual tasks associated with risk management, such as data collection, analysis, and reporting. This frees up valuable time for risk professionals to focus on more strategic initiatives. For example, automating the process of identifying and assessing potential risks in a supply chain can significantly reduce the time and effort required compared to manual methods.

- Reduced Risk: By providing insights into potential threats and vulnerabilities, risk technologies enable organizations to take proactive measures to mitigate risks. For instance, a fraud detection system powered by machine learning can identify suspicious transactions in real time, preventing financial losses and reputational damage.

- Improved Decision-Making: Risk technologies provide data-driven insights that support better decision-making. By analyzing historical data and identifying patterns, organizations can make more informed choices regarding risk management strategies. For example, a risk assessment tool that analyzes past cybersecurity incidents can help organizations prioritize security investments and allocate resources effectively.

Challenges of Implementing Risk Technologies

While risk technologies offer numerous benefits, their implementation also presents several challenges that organizations need to address.

- Cost: Implementing risk technologies can be expensive, requiring investments in software, hardware, and specialized expertise. The initial cost of acquiring and deploying these technologies can be a significant barrier for some organizations, especially smaller businesses with limited budgets.

- Complexity: Risk technologies are often complex and require specialized skills to implement and manage. Organizations may need to hire or train personnel with expertise in data science, machine learning, and cybersecurity to effectively utilize these technologies. This can add to the overall cost and complexity of implementation.

- Ethical Considerations: The use of risk technologies raises ethical concerns, particularly regarding data privacy, bias, and accountability. Organizations need to ensure that their use of risk technologies complies with relevant regulations and ethical principles. For example, organizations should be transparent about how they collect and use data, and they should take steps to mitigate potential biases in algorithms.

Risks and Limitations of Relying Solely on Risk Technologies

While risk technologies offer valuable tools for risk management, it is crucial to recognize their limitations and avoid overreliance on them.

- Data Quality: The accuracy and effectiveness of risk technologies depend heavily on the quality of the data they use. If the data is incomplete, inaccurate, or biased, the outputs of these technologies can be unreliable and lead to poor decisions. Organizations need to ensure that they have robust data governance processes in place to maintain data quality and integrity.

- Human Judgment: Risk technologies should not replace human judgment entirely. They can provide valuable insights, but ultimately, risk professionals need to use their experience and expertise to interpret the results and make informed decisions. Relying solely on technology can lead to blind spots and potentially missed risks.

- Evolving Threats: Risk technologies are often designed to address known threats and vulnerabilities. However, the landscape of risks is constantly evolving, and new threats emerge regularly. Organizations need to stay vigilant and adapt their risk management strategies to address emerging threats. This requires ongoing monitoring, analysis, and adjustments to risk technologies and processes.

Future Trends in Risk Technologies

The field of risk technologies is constantly evolving, driven by advancements in artificial intelligence (AI), big data analytics, and cloud computing. These trends are shaping the future of risk management, offering innovative solutions and creating new challenges for organizations across industries.

The Rise of Artificial Intelligence and Machine Learning

AI and machine learning (ML) are playing a pivotal role in revolutionizing risk technologies. AI-powered systems can analyze vast amounts of data, identify patterns, and predict potential risks with greater accuracy and speed than traditional methods. This enables organizations to proactively manage risks, optimize resource allocation, and make more informed decisions.

- Automated Risk Assessment: AI algorithms can automate the process of risk assessment, reducing manual effort and improving efficiency. For example, in financial institutions, AI can analyze customer data and transaction history to identify potential fraud or money laundering activities.

- Predictive Risk Modeling: AI models can analyze historical data and identify trends to predict future risks. This allows organizations to anticipate potential threats and develop mitigation strategies. For instance, insurance companies can use AI to predict the likelihood of claims based on factors like weather patterns, driving habits, and health records.

- Real-time Risk Monitoring: AI-powered systems can continuously monitor data streams and identify emerging risks in real-time. This enables organizations to respond quickly to evolving threats and prevent potential damage. For example, cybersecurity teams can use AI to detect and respond to cyberattacks in real-time.

Integration of Big Data and Analytics

Big data analytics is becoming increasingly important in risk management. Organizations are collecting vast amounts of data from various sources, including internal systems, social media, and external databases. This data can be analyzed to gain insights into potential risks, customer behavior, and market trends.

- Enhanced Risk Profiling: Big data analytics can provide a more comprehensive understanding of risk factors, enabling organizations to create detailed risk profiles for individuals, businesses, and assets. This information can be used to develop tailored risk mitigation strategies.

- Improved Risk Quantification: Big data analytics can help organizations quantify risks more accurately. By analyzing large datasets, organizations can identify the frequency, severity, and potential impact of various risks. This information is crucial for making informed decisions about risk management strategies.

- Early Warning Systems: Big data analytics can be used to develop early warning systems that detect potential risks before they materialize. This allows organizations to take proactive steps to mitigate the impact of these risks. For example, financial institutions can use big data analytics to identify potential economic downturns or market volatility.

Cloud-Based Risk Management Platforms

Cloud computing is transforming the way organizations manage risks. Cloud-based platforms provide scalable and flexible solutions for risk management, allowing organizations to access advanced tools and data analytics capabilities without significant upfront investments.

- Increased Accessibility: Cloud-based platforms make risk management tools and data accessible to employees across different locations and departments. This fosters collaboration and improves efficiency in risk management processes.

- Cost-Effectiveness: Cloud-based platforms offer a pay-as-you-go model, reducing the upfront costs associated with traditional risk management solutions. This makes risk management more affordable for organizations of all sizes.

- Enhanced Security: Cloud providers invest heavily in security infrastructure and offer advanced security features, providing organizations with a more secure environment for managing sensitive data and risk information.

Closing Summary: Risk Technologies

As risk technologies continue to evolve, we can expect even more innovative solutions that will reshape how we approach risk management. From AI-powered fraud detection to predictive analytics for natural disasters, these technologies hold immense potential to improve our lives and safeguard our future.

Risk technologies are constantly evolving, requiring a forward-thinking approach to stay ahead of potential threats. This is where technology thought leadership becomes crucial, providing insights into emerging trends and best practices. By embracing thought leadership, organizations can effectively leverage risk technologies to mitigate vulnerabilities and safeguard their operations.