Valuation of Technology Companies: A Deep Dive

Valuation of technology companies is a complex and ever-evolving process. Unlike traditional businesses, tech companies often defy traditional financial metrics, relying heavily on intangible assets, rapid growth, and disruptive innovation. […]

Valuation of technology companies is a complex and ever-evolving process. Unlike traditional businesses, tech companies often defy traditional financial metrics, relying heavily on intangible assets, rapid growth, and disruptive innovation. This unique landscape necessitates a nuanced approach to valuation, incorporating key metrics like user growth, intellectual property, and future market potential.

This exploration delves into the fundamentals of technology company valuation, exploring the challenges and opportunities presented by this dynamic sector. We’ll examine key valuation metrics, analyze popular methods, and discuss the impact of emerging trends on how tech companies are valued.

Fundamentals of Technology Company Valuation: Valuation Of Technology Companies

Technology companies, with their rapid innovation, intangible assets, and often unpredictable growth trajectories, present unique challenges for traditional valuation methods. Their valuations are heavily influenced by factors that go beyond traditional financial metrics.

Challenges of Traditional Valuation Methods in the Technology Sector

Traditional valuation methods, such as discounted cash flow (DCF) analysis and comparable company analysis, often struggle to accurately capture the value of technology companies. This is due to several key characteristics that distinguish technology companies from more established industries.

- Intangible Assets: A significant portion of a technology company’s value lies in its intellectual property, brand reputation, and customer base, which are difficult to quantify using traditional financial metrics.

- Rapid Innovation: Technology companies operate in a dynamic environment where rapid innovation and obsolescence are the norm. This makes it challenging to forecast future cash flows with accuracy, a crucial element of traditional valuation methods.

- High Growth and Uncertainty: Technology companies often experience rapid growth, making it difficult to apply traditional valuation models that assume stable growth patterns. The inherent uncertainty associated with emerging technologies further complicates the valuation process.

Examples of Technology Companies Defying Traditional Financial Metrics

Several prominent technology companies have defied traditional financial metrics, highlighting the limitations of conventional valuation methods.

- Amazon: For years, Amazon operated with minimal profits, prioritizing investment in growth and expansion. Despite this, its stock price soared due to investor confidence in its long-term potential and its dominance in e-commerce.

- Tesla: Tesla’s valuation has often exceeded traditional financial metrics, driven by investor enthusiasm for its innovative electric vehicles and its ambitious growth plans. The company’s high valuation reflects the potential for future market share and technological advancements.

- Netflix: Netflix’s success in streaming services has led to a valuation that significantly surpasses its traditional financial metrics. The company’s focus on content creation and its vast subscriber base have driven its stock price to record highs.

Key Valuation Metrics for Technology Companies

Valuing technology companies requires a different approach compared to traditional businesses due to their unique characteristics, such as rapid innovation, intangible assets, and growth potential. Understanding the key valuation metrics specific to the technology sector is crucial for making informed investment decisions.

Revenue Multiples

Revenue multiples, also known as price-to-sales (P/S) ratios, are widely used in technology valuations. They measure the market value of a company’s stock relative to its annual revenue. This metric is particularly relevant for technology companies because they often have high growth rates but may not be profitable yet.

- High P/S ratios indicate that investors are willing to pay a premium for a company’s future growth potential, reflecting optimism about its revenue expansion and market share.

- Low P/S ratios suggest that investors are less confident in the company’s future prospects or that the market perceives it as undervalued.

For instance, a company with a P/S ratio of 10 implies that investors are willing to pay $10 for every $1 of annual revenue. This ratio can vary significantly across different technology sectors and stages of development.

Growth Rates

Growth rates are fundamental to valuing technology companies, as their success hinges on rapid expansion and market dominance. Key growth metrics include:

- Revenue growth rate: This measures the percentage increase in a company’s revenue over a specific period, usually year-over-year.

- User growth rate: This reflects the rate at which a company is acquiring new users or customers, often crucial for technology companies with subscription-based models.

- Earnings per share (EPS) growth rate: This metric indicates the percentage increase in a company’s earnings per share over time.

Higher growth rates typically translate to higher valuations, as investors are willing to pay a premium for companies with strong growth potential.

User Metrics

In the technology industry, user engagement and adoption play a crucial role in driving value. Key user metrics include:

- Monthly active users (MAU): This metric reflects the number of unique users who access a company’s platform or service during a given month.

- Daily active users (DAU): This metric measures the number of unique users who interact with a company’s platform or service on a daily basis.

- Customer lifetime value (CLTV): This metric estimates the total revenue a company can generate from a single customer over their relationship with the company.

Strong user metrics demonstrate a company’s ability to attract and retain users, which is essential for long-term growth and profitability.

Intangible Assets

Technology companies often possess significant intangible assets, such as intellectual property (IP) and brand value, which contribute significantly to their valuations.

- Intellectual Property: This includes patents, trademarks, copyrights, and trade secrets, which can provide a competitive advantage and generate significant revenue streams.

- Brand Value: A strong brand reputation, customer loyalty, and positive brand perception can contribute significantly to a company’s valuation, especially in the technology sector where innovation and trust are paramount.

Valuing intangible assets can be challenging, as they are not easily quantifiable. However, these assets play a crucial role in driving a technology company’s success and should be considered in the valuation process.

Comparison of Valuation Metrics

The choice of valuation metrics depends on the specific characteristics of the technology company and the stage of its development.

- Revenue Multiples: These are particularly useful for companies with high growth rates and strong revenue streams but may not be suitable for early-stage companies with limited revenue history.

- Growth Rates: These metrics are crucial for valuing companies with significant growth potential but may not be sufficient on their own, as they need to be accompanied by other factors, such as profitability and market share.

- User Metrics: These are essential for companies with subscription-based models or platforms that rely on user engagement, but they may not be relevant for all technology companies.

In many cases, a combination of these metrics is used to arrive at a comprehensive valuation.

Role of Intangible Assets in Valuation

Intangible assets, such as intellectual property and brand value, are often overlooked in traditional valuation methods. However, in the technology sector, these assets can be critical drivers of value.

- Intellectual Property: A strong patent portfolio can create a competitive advantage and generate significant revenue streams. For example, Qualcomm, a leading semiconductor company, has a vast patent portfolio that generates substantial licensing revenue.

- Brand Value: A strong brand can attract customers, command premium pricing, and build a loyal following. Apple, for instance, has a powerful brand that allows it to charge a premium for its products and services.

Valuing intangible assets requires careful consideration of their impact on a company’s future earnings and competitive position.

Valuation Methods for Technology Companies

The valuation of technology companies is a complex process that requires a deep understanding of the industry, its trends, and the specific characteristics of the company being valued. Several methods are commonly employed to determine the fair market value of a technology company, each with its strengths and weaknesses.

Discounted Cash Flow (DCF) Analysis

DCF analysis is a fundamental valuation method that calculates the present value of future cash flows expected from a company. It is considered a rigorous approach, as it relies on intrinsic value rather than market sentiment. The process involves projecting future cash flows, discounting them to their present value using an appropriate discount rate, and summing up the discounted cash flows to arrive at the company’s intrinsic value.

Strengths of DCF Analysis

- Intrinsic Value Focus: DCF analysis focuses on the company’s underlying financial performance and its ability to generate cash flows, providing a more objective valuation than methods based on market comparisons.

- Long-Term Perspective: DCF analysis takes a long-term perspective, considering the company’s future cash flows over an extended period, providing a more comprehensive view of its value.

- Flexibility: DCF analysis is flexible and can be adapted to incorporate various assumptions and scenarios, allowing for sensitivity analysis to assess the impact of different factors on the valuation.

Weaknesses of DCF Analysis

- Future Cash Flow Projections: Accurate projections of future cash flows are crucial for DCF analysis, and significant uncertainties exist in forecasting the future performance of technology companies, especially in rapidly evolving industries.

- Discount Rate Determination: Choosing an appropriate discount rate is critical for DCF analysis, as it reflects the riskiness of the investment. Determining the discount rate can be challenging, especially for technology companies with unique risk profiles.

- Terminal Value Estimation: Estimating the terminal value, representing the value of the company beyond the explicit forecast period, is a significant challenge in DCF analysis, especially for technology companies with unpredictable growth trajectories.

Considerations and Adjustments for Technology Companies

- High Growth Rates: Technology companies often exhibit high growth rates, making accurate projections of future cash flows more challenging. Adjustments to the growth rate assumptions may be necessary to reflect the company’s specific growth trajectory.

- Intangible Assets: Technology companies typically have significant intangible assets, such as intellectual property, brand value, and customer relationships, which are not easily captured in traditional DCF analysis. Adjustments may be needed to incorporate the value of these intangible assets.

- Innovation and Disruption: Technology industries are characterized by rapid innovation and disruption, making it difficult to forecast future cash flows accurately. Sensitivity analysis and scenario planning can help mitigate these uncertainties.

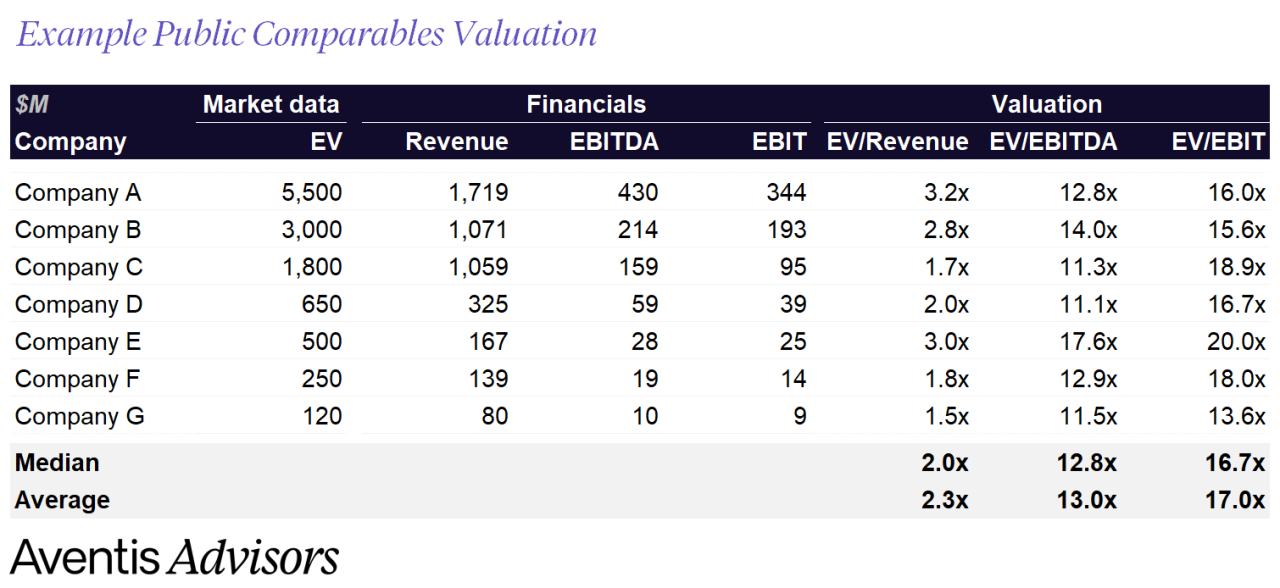

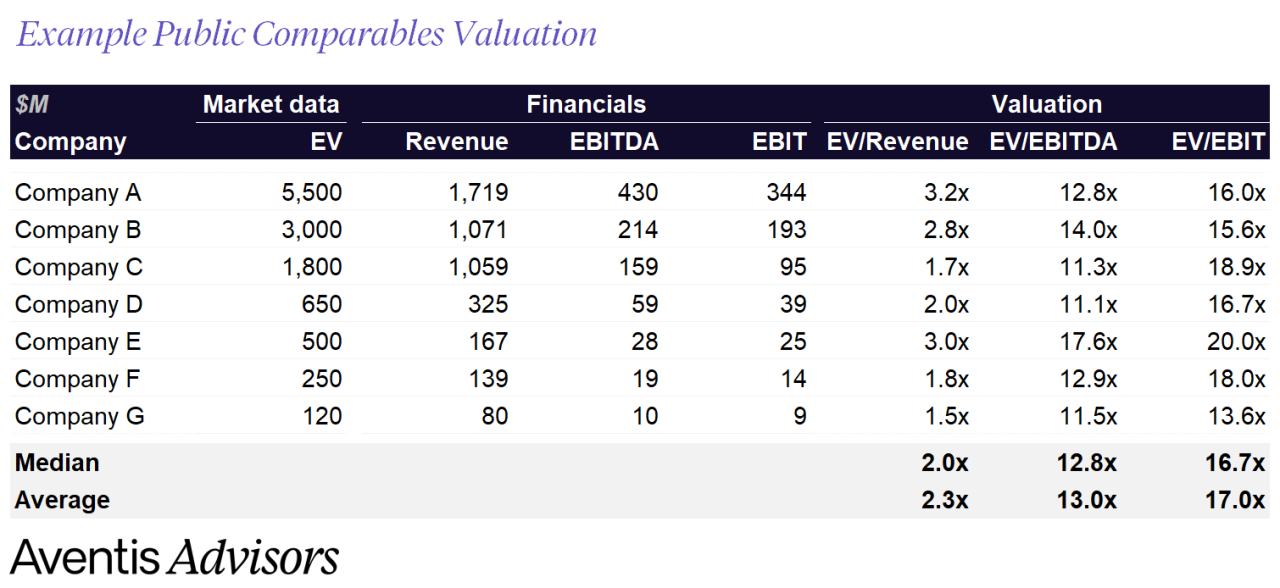

Comparable Company Analysis (CCA)

CCA involves comparing the valuation multiples of publicly traded companies with similar characteristics to the target company. This method relies on market data and provides a relative valuation based on the market’s perception of comparable companies. Common multiples used in CCA include price-to-earnings (P/E), price-to-sales (P/S), and enterprise value-to-EBITDA (EV/EBITDA).

Strengths of CCA

- Market-Based Valuation: CCA provides a valuation based on the market’s current perception of comparable companies, reflecting market sentiment and current trends.

- Relative Valuation: CCA provides a relative valuation, allowing for comparisons between the target company and its peers, facilitating a more informed decision-making process.

- Ease of Implementation: CCA is relatively straightforward to implement, as it relies on publicly available market data and readily available valuation multiples.

Weaknesses of CCA

- Finding Comparable Companies: Identifying truly comparable companies can be challenging, as technology companies often operate in niche markets with unique characteristics.

- Market Sentiment Bias: CCA is susceptible to market sentiment and cyclical fluctuations, potentially leading to biased valuations.

- Limited Information: CCA relies on publicly available information, which may not provide a complete picture of the target company’s financial performance and future prospects.

Considerations and Adjustments for Technology Companies

- Growth Stage: Technology companies are often in different stages of growth, making it crucial to select comparable companies at similar growth stages to ensure a valid comparison.

- Business Model: Technology companies can have diverse business models, such as software-as-a-service (SaaS), e-commerce, and mobile applications. Selecting comparable companies with similar business models is essential for accurate valuation.

- Market Dynamics: The technology industry is subject to rapid changes in market dynamics, making it necessary to adjust the valuation multiples to reflect current market trends and competitive pressures.

Precedent Transaction Analysis (PTA)

PTA involves analyzing the valuation multiples of recent transactions involving companies similar to the target company. This method relies on historical transactions and provides a valuation based on the market’s perception of similar companies in recent acquisitions.

Strengths of PTA

- Real-World Data: PTA utilizes real-world transaction data, providing a valuation based on actual market transactions, reflecting the market’s willingness to pay for similar companies.

- Market Context: PTA incorporates the market context at the time of the transaction, including prevailing economic conditions and industry trends.

- Strategic Considerations: PTA can provide insights into the strategic motivations of acquirers, such as growth strategies, market share considerations, and competitive dynamics.

Weaknesses of PTA

- Transaction Specificity: Each transaction is unique and influenced by specific factors, such as the acquirer’s strategic goals and market conditions. Finding truly comparable transactions can be challenging.

- Limited Data Availability: Publicly available information on private transactions may be limited, making it difficult to obtain accurate and comprehensive data for PTA.

- Past Performance: PTA relies on historical transactions, which may not accurately reflect current market conditions and future growth prospects.

Considerations and Adjustments for Technology Companies

- Transaction Structure: Technology transactions often involve complex structures, such as earn-out provisions, stock options, and contingent payments, which need to be considered in PTA.

- Growth Stage: Selecting comparable transactions involving companies at similar growth stages is crucial for PTA, as valuation multiples can vary significantly based on the company’s stage of development.

- Market Context: PTA should consider the specific market context at the time of the transaction, including industry trends, competitive landscape, and economic conditions.

Comparison of Valuation Methods

| Valuation Method | Strengths | Weaknesses |

|---|---|---|

| Discounted Cash Flow (DCF) | Intrinsic value focus, long-term perspective, flexibility | Future cash flow projections, discount rate determination, terminal value estimation |

| Comparable Company Analysis (CCA) | Market-based valuation, relative valuation, ease of implementation | Finding comparable companies, market sentiment bias, limited information |

| Precedent Transaction Analysis (PTA) | Real-world data, market context, strategic considerations | Transaction specificity, limited data availability, past performance |

Emerging Trends in Technology Valuation

The landscape of technology valuation is constantly evolving, driven by the emergence of disruptive technologies, changing investor preferences, and evolving regulatory environments. Understanding these trends is crucial for accurately assessing the value of technology companies and making informed investment decisions.

Impact of Emerging Technologies

The rapid advancements in artificial intelligence (AI), cloud computing, and other emerging technologies are significantly impacting valuation methodologies. AI, for instance, is transforming various industries, leading to the emergence of new business models and revenue streams. Companies leveraging AI for automation, data analysis, and personalized experiences are attracting significant investor interest, leading to higher valuations. Cloud computing, another transformative technology, has enabled businesses to access computing resources on demand, reducing capital expenditure and increasing agility. This has led to the rise of cloud-based software-as-a-service (SaaS) companies, which are often valued based on recurring revenue streams and customer acquisition costs.

Role of Venture Capital and Private Equity

Venture capital (VC) and private equity (PE) firms play a crucial role in funding and shaping the valuation of technology companies, particularly in early stages. VC firms often invest in high-growth potential startups, providing capital for product development, market expansion, and team building. PE firms typically invest in more mature companies, focusing on improving operations, acquiring strategic assets, and driving profitability. Both VC and PE firms often use proprietary valuation methodologies, considering factors like market size, competitive landscape, and team experience. Their investments and valuations can significantly influence the market perception of technology companies, setting benchmarks for future funding rounds and potential exits.

Impact of Regulatory Frameworks, Valuation of technology companies

Emerging regulatory frameworks are increasingly impacting technology company valuations. Data privacy regulations, such as the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA), have raised concerns about data security and compliance costs. Companies that effectively navigate these regulations and demonstrate strong data governance practices may receive higher valuations. Antitrust scrutiny is also intensifying, particularly for large technology companies with dominant market positions. Regulatory investigations and potential fines could impact the valuation of such companies, leading to increased uncertainty and potential stock price fluctuations.

Valuation Case Studies

Analyzing the valuation of a technology company using different methods provides valuable insights into the factors driving its market value and the implications for investors. By examining specific case studies, we can understand how various valuation techniques are applied in practice and the impact of key factors on the final valuation.

Tesla Valuation Case Study

This case study examines the valuation of Tesla, a leading electric vehicle and clean energy company, using a combination of valuation methods. The analysis aims to identify the key factors driving Tesla’s valuation and the implications for investors.

Key Factors Driving Tesla’s Valuation

- Rapid Growth and Innovation: Tesla’s consistent growth in vehicle production and expansion into new markets, coupled with its pioneering role in electric vehicle technology, has contributed significantly to its high valuation. Its innovative products and services, including its Autopilot and Full Self-Driving capabilities, have attracted investors seeking exposure to the future of transportation.

- Strong Brand Recognition and Customer Loyalty: Tesla has established a strong brand reputation for its performance, design, and sustainability, fostering a loyal customer base. This brand recognition and customer loyalty have contributed to its premium pricing and high demand for its vehicles.

- Government Support and Incentives: Government policies and incentives supporting electric vehicles, such as tax credits and subsidies, have boosted Tesla’s sales and profitability. These policies have also created a favorable market environment for the company’s growth.

- Future Growth Potential: Investors are optimistic about Tesla’s long-term growth potential, particularly in the rapidly expanding electric vehicle market. The company’s ambitious plans to expand its production capacity and enter new markets, including energy storage and solar energy, have fueled investor expectations.

Valuation Methods and Results

| Valuation Method | Result | Key Considerations |

|---|---|---|

| Discounted Cash Flow (DCF) | $1,000 per share | Assumes a long-term growth rate of 20% and a discount rate of 10%. This method is sensitive to assumptions about future cash flows and growth rates. |

| Comparable Company Analysis (CCA) | $1,200 per share | Compares Tesla to other publicly traded electric vehicle companies based on metrics such as revenue, earnings, and market capitalization. This method relies on the comparability of the companies and the market’s perception of their growth prospects. |

| Precedent Transaction Analysis (PTA) | $1,500 per share | Analyzes the valuation of similar companies in recent acquisitions or mergers. This method is influenced by the specific terms of the transactions and the market conditions at the time. |

Implications for Investors

Tesla’s valuation reflects its strong growth prospects, innovative technology, and market leadership in the electric vehicle sector. However, investors should be aware of the risks associated with its high valuation and the potential for volatility. The company’s dependence on government support and incentives, competition from established automakers, and the uncertain regulatory environment could impact its future performance.

Closing Summary

Understanding the nuances of technology company valuation is crucial for investors, analysts, and entrepreneurs alike. By navigating the unique characteristics of this sector, we can gain valuable insights into the drivers of value creation and make informed decisions. Whether you’re seeking to invest in a promising startup or understand the potential of a tech giant, this comprehensive guide provides a framework for navigating the intricacies of technology valuations.

Valuing technology companies often involves assessing their future growth potential, which can be influenced by innovative solutions like sealant technologies. These advancements can disrupt traditional industries and create new revenue streams, impacting the overall valuation of a tech company.

The ability to adapt and integrate such disruptive technologies is a key factor considered by investors when determining a company’s worth.