Technology Insurance Company Phone Numbers: Your Guide to Protection

Technology Insurance Company Phone Numbers: Navigating the world of technology today means facing a myriad of risks. From cyberattacks to data breaches, the potential for financial and reputational damage is […]

Technology Insurance Company Phone Numbers: Navigating the world of technology today means facing a myriad of risks. From cyberattacks to data breaches, the potential for financial and reputational damage is significant. This is where technology insurance comes in, offering a safety net for businesses of all sizes.

Finding the right technology insurance company can be a daunting task, but it’s crucial to ensure your business is adequately protected. This guide will delve into the key aspects of technology insurance, from understanding the types of coverage available to navigating the claims process.

The Importance of Technology Insurance

In today’s digital age, technology has become an indispensable asset for businesses of all sizes. From data storage and processing to online operations and customer interactions, technology underpins nearly every aspect of modern commerce. However, this reliance on technology also exposes businesses to a range of risks that can significantly impact their operations and financial stability. Technology insurance is a crucial safeguard against these risks, providing financial protection and peace of mind for businesses operating in the digital world.

Risks Faced by Technology Companies, Technology insurance company phone number

Technology companies face a unique set of risks that can disrupt their operations, damage their reputation, and lead to significant financial losses. These risks can be broadly categorized as follows:

- Cyberattacks: Cyberattacks are becoming increasingly sophisticated and prevalent, targeting businesses of all sizes. These attacks can involve data breaches, ransomware, denial-of-service attacks, and other malicious activities that can cripple operations, steal sensitive information, and damage the company’s reputation.

- Hardware and Software Failures: Technology equipment, including servers, computers, and network infrastructure, can fail due to various factors, such as hardware malfunctions, software bugs, or power outages. These failures can lead to downtime, data loss, and significant financial losses.

- Data Loss and Corruption: Businesses rely heavily on data for their operations and decision-making. Data loss or corruption due to hardware failures, cyberattacks, or human error can have devastating consequences, leading to financial losses, operational disruptions, and reputational damage.

- Business Interruption: Any disruption to a technology company’s operations, whether due to a cyberattack, hardware failure, or natural disaster, can result in significant financial losses. This includes lost revenue, increased costs, and potential legal liabilities.

- Employee Errors and Negligence: Human error can also lead to significant technology-related risks. For example, an employee might accidentally delete critical data, install malicious software, or misconfigure a system, resulting in data loss, downtime, and financial losses.

Financial Implications of Technology Failures and Cyberattacks

The financial implications of technology failures and cyberattacks can be substantial, impacting businesses in various ways:

- Lost Revenue: Downtime caused by technology failures or cyberattacks can lead to significant revenue losses, as businesses are unable to operate normally. This can include lost sales, missed opportunities, and reduced productivity.

- Increased Costs: Businesses may incur significant costs to recover from technology failures or cyberattacks, including expenses for data recovery, system restoration, cybersecurity experts, legal fees, and regulatory fines.

- Reputational Damage: Data breaches, cyberattacks, and other technology-related incidents can damage a company’s reputation, leading to lost customer trust, decreased brand value, and reduced market share.

- Legal Liabilities: Businesses may face legal liabilities for data breaches, privacy violations, and other technology-related incidents, leading to lawsuits, regulatory fines, and other financial penalties.

How Technology Insurance Can Protect Businesses

Technology insurance provides businesses with financial protection against the risks associated with technology failures and cyberattacks. It can cover a wide range of potential losses, including:

- Cyber Liability Coverage: This coverage provides protection against financial losses arising from cyberattacks, including data breaches, ransomware attacks, and denial-of-service attacks. It can cover costs associated with data recovery, system restoration, legal expenses, and regulatory fines.

- Hardware and Software Failure Coverage: This coverage provides protection against financial losses arising from hardware and software failures, including costs for repairs, replacements, and data recovery.

- Business Interruption Coverage: This coverage provides financial protection during periods of business interruption caused by technology failures or cyberattacks, covering lost revenue and increased costs.

- Data Loss and Corruption Coverage: This coverage provides protection against financial losses arising from data loss or corruption, including costs for data recovery, system restoration, and legal expenses.

- Employee Errors and Negligence Coverage: This coverage provides protection against financial losses arising from employee errors and negligence, including costs for data recovery, system restoration, and legal expenses.

Examples of Technology Insurance Coverage

Here are some real-life examples of how technology insurance can protect businesses:

- A small business suffers a ransomware attack, leading to data encryption and operational downtime. Technology insurance covers the costs of data recovery, system restoration, and lost revenue during the downtime.

- A large corporation experiences a hardware failure, resulting in data loss and system downtime. Technology insurance covers the costs of data recovery, system restoration, and business interruption.

- An online retailer suffers a data breach, exposing customer information. Technology insurance covers the costs of notifying affected customers, providing credit monitoring services, and legal expenses.

Finding the Right Technology Insurance Company

Navigating the world of technology insurance can feel overwhelming, especially with so many companies vying for your business. It’s crucial to find a reputable provider that offers comprehensive coverage and excellent customer service. This will ensure your valuable technology investments are protected in the event of an unforeseen incident.

Factors to Consider When Choosing a Technology Insurance Company

Selecting the right technology insurance company involves considering several crucial factors. Understanding these factors will help you make an informed decision and choose a provider that aligns with your specific needs and budget.

- Coverage: The type of coverage offered is paramount. Ensure the policy covers your specific devices, software, and data. Some policies may offer additional protection for cyberattacks, data breaches, or accidental damage.

- Pricing: Compare quotes from multiple providers to find the most competitive rates. Consider the coverage offered, deductibles, and premium costs when comparing prices. Look for companies that offer flexible payment options and discounts.

- Customer Service: A responsive and reliable customer service team is crucial. Look for providers with a proven track record of excellent customer service. Read online reviews and testimonials to gauge the company’s reputation.

Types of Technology Insurance Policies

Technology insurance policies come in various forms, each designed to address specific needs. Understanding the different types will help you choose the most appropriate coverage for your situation.

- Device Insurance: This type of policy covers individual devices, such as laptops, smartphones, tablets, and cameras. It typically provides protection against accidental damage, theft, and loss.

- Cyber Liability Insurance: This policy protects businesses from financial losses caused by cyberattacks, data breaches, and other online threats. It can cover costs associated with legal defense, data recovery, and reputation management.

- Data Breach Insurance: This policy helps businesses mitigate the financial and reputational risks associated with data breaches. It covers costs related to notifying affected individuals, credit monitoring services, and legal expenses.

Understanding Technology Insurance Coverage: Technology Insurance Company Phone Number

Technology insurance provides financial protection against various risks associated with your technology assets. It covers a wide range of scenarios, from accidental damage to data breaches, ensuring peace of mind and financial stability in the event of unforeseen circumstances.

Types of Coverage

Technology insurance policies offer different types of coverage to address specific needs and risks. Understanding the types of coverage available helps you choose a policy that aligns with your requirements and provides adequate protection.

- Hardware Coverage: This covers damage or loss of your physical technology equipment, such as laptops, smartphones, servers, and networking devices. This includes accidental damage, theft, and natural disasters.

- Software Coverage: This protects against financial losses incurred due to software failures, including bugs, data corruption, and system crashes. It can also cover the cost of data recovery and software replacement.

- Cyber Liability Coverage: This safeguards your business from financial losses caused by cyberattacks, including data breaches, ransomware attacks, and identity theft. It covers legal expenses, regulatory fines, and the cost of restoring your systems and data.

- Data Breach Coverage: This specifically covers the costs associated with data breaches, including notification costs, credit monitoring services, and legal expenses. It can also cover the cost of restoring data and systems after a breach.

- Business Interruption Coverage: This provides financial protection if your business is forced to shut down due to a technology-related incident, such as a fire, flood, or cyberattack. It covers lost revenue and ongoing expenses during the downtime.

Specific Risks Covered

Each type of technology insurance coverage addresses specific risks associated with your technology assets. Understanding these risks is crucial for selecting the right policy.

- Hardware Coverage: This covers risks such as accidental damage (e.g., dropping your laptop), theft (e.g., laptop stolen from your car), and natural disasters (e.g., damage from a flood or earthquake).

- Software Coverage: This covers risks such as software bugs causing data corruption, system crashes due to software malfunctions, and data loss due to software failure.

- Cyber Liability Coverage: This covers risks such as data breaches, ransomware attacks, and identity theft. It also covers legal expenses related to data breaches, regulatory fines, and the cost of restoring systems and data.

- Data Breach Coverage: This specifically covers the costs associated with data breaches, including notification costs, credit monitoring services, and legal expenses. It can also cover the cost of restoring data and systems after a breach.

- Business Interruption Coverage: This covers risks such as lost revenue due to a technology-related incident that forces your business to shut down temporarily, and ongoing expenses during the downtime.

Real-World Scenarios

Technology insurance can be a valuable asset in various real-world scenarios. Here are some examples:

- Accidental Damage: Imagine dropping your expensive laptop and damaging the screen. Hardware coverage can help you replace or repair the device, minimizing financial loss.

- Data Breach: If your business experiences a data breach, cyber liability coverage can help cover the costs of notifying affected individuals, providing credit monitoring services, and restoring your systems and data.

- Business Interruption: A fire or flood can damage your business’s technology infrastructure, leading to a temporary shutdown. Business interruption coverage can help cover lost revenue and ongoing expenses during the downtime, ensuring your business can recover quickly.

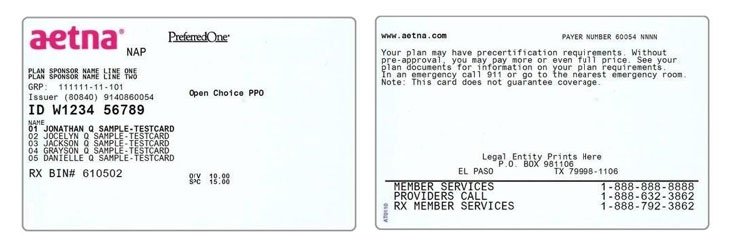

Obtaining a Quote and Filing a Claim

Getting a technology insurance quote is straightforward and can be done online or over the phone. Once you have a policy, filing a claim is also relatively easy.

Obtaining a Technology Insurance Quote

To get a quote, you’ll typically need to provide some basic information about your technology, such as the type of device, its make and model, and its purchase price. You may also be asked about the intended use of the device and its location. Once you’ve provided this information, the insurance company will calculate a quote based on the risk involved.

Here are the steps involved in obtaining a technology insurance quote:

- Gather your information. You’ll need information about your device, such as its make, model, purchase date, and purchase price. You’ll also need to provide information about yourself, such as your name, address, and contact information.

- Contact an insurance company. You can contact an insurance company online, over the phone, or in person. Most companies have websites where you can get a quote online.

- Provide your information. The insurance company will ask you to provide information about your device and yourself. This information will be used to calculate your quote.

- Review the quote. Once you’ve received a quote, review it carefully to make sure you understand the coverage and the cost. If you have any questions, don’t hesitate to ask the insurance company.

Filing a Technology Insurance Claim

If you need to file a claim, you’ll need to contact your insurance company and provide them with information about the incident. This information will help the insurance company determine if your claim is covered and how much you will be reimbursed.

Here are the steps involved in filing a technology insurance claim:

- Contact your insurance company. You can contact your insurance company by phone, email, or online.

- Provide information about the incident. You’ll need to provide information about the incident, such as the date, time, and location of the incident. You’ll also need to provide information about the damage to your device, such as the nature of the damage and the estimated cost of repair.

- Provide documentation. You may need to provide documentation to support your claim, such as a police report, a repair estimate, or a receipt for the purchase of your device.

- Wait for a decision. The insurance company will review your claim and make a decision about whether to approve it. If your claim is approved, you will receive a payment for the cost of repair or replacement of your device.

Tips for Maximizing the Chances of a Successful Claim

- Keep your receipts and documentation. This documentation will be crucial when filing a claim, so keep it organized and readily available.

- Report the incident promptly. The sooner you report the incident, the better. This will give the insurance company time to investigate and process your claim.

- Be honest and accurate. When you file a claim, it’s important to be honest and accurate about the incident. If you’re caught lying, your claim may be denied.

- Follow the instructions of your insurance company. Make sure to follow the instructions of your insurance company when filing a claim. This will help to ensure that your claim is processed smoothly.

Technology Insurance for Different Business Types

Technology insurance is crucial for businesses of all sizes, as it protects them from financial losses due to technology-related incidents. The specific technology insurance needs of a business will vary depending on the industry, size, and type of technology used.

Technology Insurance Needs for Different Business Types

Different business types face unique risks and require tailored technology insurance coverage. Here’s a comparison of the technology insurance needs of various business types:

| Business Type | Specific Risks | Coverage Requirements |

|---|---|---|

| Retail Businesses | Data breaches, POS system malfunctions, cyberattacks, network outages | Cyber liability insurance, data breach response coverage, business interruption insurance |

| Healthcare Providers | HIPAA violations, medical device malfunctions, ransomware attacks, data breaches | Cyber liability insurance, HIPAA violation coverage, medical device liability insurance, data breach response coverage |

| Financial Institutions | Cyberattacks, data breaches, fraud, identity theft, system failures | Cyber liability insurance, data breach response coverage, fraud insurance, identity theft insurance |

| Manufacturing Companies | Equipment breakdowns, cyberattacks, data breaches, production disruptions | Equipment breakdown insurance, cyber liability insurance, data breach response coverage, business interruption insurance |

| Software Development Companies | Cyberattacks, data breaches, software defects, intellectual property theft | Cyber liability insurance, data breach response coverage, intellectual property insurance, errors and omissions insurance |

Examples of Technology Insurance Policies Tailored to Specific Industries

Here are some examples of technology insurance policies tailored to specific industries:

- Retail Businesses: A retail business might need a technology insurance policy that includes coverage for data breaches, POS system malfunctions, cyberattacks, and network outages. This policy could also include business interruption insurance to cover lost revenue if the business is forced to close due to a technology-related incident.

- Healthcare Providers: A healthcare provider might need a technology insurance policy that includes coverage for HIPAA violations, medical device malfunctions, ransomware attacks, and data breaches. This policy could also include medical device liability insurance to cover claims related to defective medical devices.

- Financial Institutions: A financial institution might need a technology insurance policy that includes coverage for cyberattacks, data breaches, fraud, identity theft, and system failures. This policy could also include fraud insurance to cover losses due to fraudulent transactions.

- Manufacturing Companies: A manufacturing company might need a technology insurance policy that includes coverage for equipment breakdowns, cyberattacks, data breaches, and production disruptions. This policy could also include business interruption insurance to cover lost revenue if the business is forced to close due to a technology-related incident.

- Software Development Companies: A software development company might need a technology insurance policy that includes coverage for cyberattacks, data breaches, software defects, and intellectual property theft. This policy could also include errors and omissions insurance to cover claims related to faulty software.

The Future of Technology Insurance

The technology insurance landscape is constantly evolving, driven by advancements in technology and the changing nature of risk. As technology becomes increasingly integrated into our lives and businesses, the need for comprehensive and adaptable insurance solutions is more critical than ever.

Emerging Trends in Technology Insurance

The technology insurance industry is witnessing several emerging trends that are shaping the future of risk management for technology companies.

- Cybersecurity Insurance: As cyber threats become more sophisticated and prevalent, cybersecurity insurance is gaining immense importance. This type of insurance covers losses arising from data breaches, cyber extortion, and other cyber-related incidents.

- Data Breach Insurance: Data breach insurance is specifically designed to protect businesses from the financial consequences of data breaches. This type of insurance covers costs associated with notification, credit monitoring, forensic investigation, and legal defense.

- Artificial Intelligence (AI) and Machine Learning (ML) Integration: Insurance companies are increasingly leveraging AI and ML to enhance risk assessment, fraud detection, and claims processing. These technologies can analyze vast amounts of data to identify patterns and predict future risks.

- Internet of Things (IoT) Insurance: With the proliferation of connected devices, IoT insurance is emerging to cover risks associated with IoT devices, such as data breaches, cyberattacks, and physical damage.

Impact of New Technologies on Insurance Coverage

New technologies are profoundly impacting the way insurance coverage is designed and delivered.

- Cloud Computing: The rise of cloud computing has created new risks and challenges for technology companies. Insurance companies are adapting their policies to cover data security, data loss, and service disruptions in cloud environments.

- Blockchain Technology: Blockchain technology is transforming the insurance industry by providing a secure and transparent platform for managing and verifying data. This technology has the potential to streamline claims processing and reduce fraud.

- Autonomous Vehicles: The development of autonomous vehicles is raising new questions about liability and insurance coverage. Insurance companies are developing specialized policies to address the unique risks associated with self-driving cars.

Future of Risk Management for Technology Companies

Technology companies need to proactively manage their risks to protect their businesses from unforeseen events.

- Proactive Risk Assessment: Technology companies should conduct regular risk assessments to identify potential threats and vulnerabilities. This includes evaluating cybersecurity risks, data privacy concerns, and regulatory compliance issues.

- Cybersecurity Measures: Implementing robust cybersecurity measures is crucial to protect sensitive data and systems from cyberattacks. This includes using strong passwords, multi-factor authentication, and firewalls.

- Data Backup and Recovery: Technology companies should have comprehensive data backup and recovery plans in place to minimize data loss in the event of a disaster or cyberattack.

- Business Continuity Planning: Having a business continuity plan is essential to ensure that operations can continue uninterrupted in the event of a disruption. This plan should Artikel procedures for recovering data, restoring systems, and communicating with stakeholders.

Last Word

As technology continues to evolve, the need for robust insurance solutions will only grow. By understanding the intricacies of technology insurance and choosing the right provider, businesses can mitigate their risks and focus on achieving their goals. Whether you’re a small startup or a large corporation, investing in technology insurance is a wise decision that can safeguard your future.

Finding the right technology insurance company phone number can be a bit of a challenge, but once you’ve got it, you can ensure your valuable tech is protected. And speaking of protection, you might want to consider upgrading your workspace with some sturdy flat technology table bases to keep your devices safe from bumps and spills.

After all, a well-equipped workspace can make a big difference in your productivity, and having the right insurance can give you peace of mind.