Technology Businesses for Sale: A Guide to Acquisition

Technology businesses for sale present a unique opportunity for investors and entrepreneurs seeking to enter or expand within the rapidly evolving tech landscape. This guide provides a comprehensive overview of […]

Technology businesses for sale present a unique opportunity for investors and entrepreneurs seeking to enter or expand within the rapidly evolving tech landscape. This guide provides a comprehensive overview of the market, encompassing key trends, business models, valuation methods, and strategies for finding, acquiring, and integrating technology businesses.

From software development to SaaS and e-commerce, the technology sector offers a diverse range of business models, each with its own unique characteristics and growth potential. Understanding the intricacies of each model, the associated challenges, and the potential rewards is crucial for making informed investment decisions.

Understanding the Market

The technology sector is experiencing a period of unprecedented growth and innovation, driven by a confluence of factors that are shaping the future of businesses and societies alike. This dynamic environment presents both opportunities and challenges for technology businesses, requiring a deep understanding of the market landscape to navigate effectively.

Current Trends and Growth Potential

The technology sector is characterized by rapid innovation, constant disruption, and a relentless pace of change. Several key trends are driving this growth, including:

- Artificial Intelligence (AI): AI is revolutionizing industries across the board, from healthcare and finance to manufacturing and retail. The development of AI-powered solutions is creating new opportunities for businesses to automate processes, improve efficiency, and enhance customer experiences.

- Cloud Computing: The shift to cloud-based services has enabled businesses to access computing resources on demand, reducing costs and increasing flexibility. The cloud computing market is expected to continue its rapid growth in the coming years, driven by the adoption of cloud-native applications and the increasing demand for data storage and processing capabilities.

- Internet of Things (IoT): The interconnectedness of devices and systems is creating new opportunities for businesses to collect data, analyze trends, and optimize operations. The IoT is expected to have a significant impact on industries such as healthcare, manufacturing, and transportation.

- Cybersecurity: As businesses become increasingly reliant on technology, the threat of cyberattacks is growing. The cybersecurity market is expanding rapidly as businesses invest in solutions to protect their data and systems from malicious actors.

Factors Driving Demand for Technology Businesses

Several factors are driving the demand for technology businesses, including:

- Digital Transformation: Businesses across all industries are undergoing digital transformation, adopting new technologies to improve efficiency, enhance customer experiences, and gain a competitive edge.

- Globalization: The increasing interconnectedness of the global economy is creating opportunities for technology businesses to expand their reach and access new markets.

- Consumer Demand: Consumers are increasingly demanding digital experiences, driving the growth of e-commerce, mobile apps, and other technology-driven services.

- Government Initiatives: Governments around the world are investing in technology to promote innovation, create jobs, and address societal challenges.

Key Industry Segments Experiencing Growth and Innovation

The technology sector encompasses a wide range of industries, each with its own unique growth potential and challenges. Some of the key segments experiencing significant growth and innovation include:

- Software as a Service (SaaS): SaaS businesses provide software applications over the internet, enabling businesses to access and use software without the need for local installation or maintenance. The SaaS market is expected to continue its rapid growth in the coming years, driven by the increasing adoption of cloud-based solutions.

- E-commerce: The growth of online shopping has led to a surge in demand for e-commerce platforms, payment processing systems, and logistics solutions.

- FinTech: The financial technology industry is disrupting traditional financial services with innovative solutions such as mobile payments, peer-to-peer lending, and robo-advisory.

- Healthcare Technology: The healthcare industry is adopting new technologies to improve patient care, streamline operations, and reduce costs.

- Education Technology (EdTech): EdTech businesses are developing innovative solutions to enhance learning experiences, personalize education, and improve access to education.

Economic Climate and Its Impact on Technology Businesses

The global economic climate can have a significant impact on technology businesses. Factors such as interest rates, inflation, and geopolitical uncertainty can influence investment, consumer spending, and overall business growth.

“The economic climate is a key factor that influences the growth and profitability of technology businesses. During periods of economic expansion, technology businesses often see increased demand for their products and services, leading to higher revenue and profitability. However, during periods of economic contraction, businesses may reduce their technology spending, leading to slower growth or even decline for technology companies.”

Types of Technology Businesses for Sale

The technology sector is a dynamic and constantly evolving landscape, offering numerous opportunities for entrepreneurs and investors. With the increasing adoption of technology across various industries, the demand for innovative solutions and services is consistently growing. This has led to a surge in the number of technology businesses available for sale, ranging from startups to established companies. Understanding the different types of technology businesses available for sale is crucial for identifying the right opportunity and maximizing investment potential.

Software Development

Software development businesses create custom software applications tailored to specific client needs. They often specialize in particular programming languages, frameworks, or industries.

- Revenue Stream: Software development businesses typically generate revenue through fixed-price contracts, time-and-materials billing, or subscription models for ongoing maintenance and support.

- Key Characteristics: These businesses require skilled software developers with expertise in various technologies, strong project management capabilities, and a focus on delivering high-quality software solutions.

Software development businesses face challenges such as fierce competition, rapidly changing technology, and the need to attract and retain top talent. However, they also offer significant opportunities for growth, particularly in niche markets or areas with high demand. For instance, the demand for cybersecurity software is increasing as businesses become more reliant on technology and face growing threats.

Software as a Service (SaaS)

SaaS businesses deliver software applications over the internet, allowing users to access and utilize the software on a subscription basis. This model eliminates the need for software installation and maintenance, making it accessible and cost-effective for businesses of all sizes.

- Revenue Stream: SaaS businesses generate revenue through recurring subscription fees based on the number of users, features, or usage levels.

- Key Characteristics: SaaS businesses typically require a strong online presence, robust customer support systems, and a focus on user experience and continuous product development.

SaaS businesses face challenges such as acquiring new customers, retaining existing subscribers, and managing customer churn. However, the recurring revenue model and potential for scalability make SaaS a highly attractive business model. Examples of successful SaaS businesses include Salesforce, Zoom, and Dropbox.

E-commerce

E-commerce businesses operate online stores, selling products and services directly to consumers through websites or mobile applications. They leverage technology to streamline the entire buying process, from product discovery to payment and delivery.

- Revenue Stream: E-commerce businesses generate revenue from sales of products or services, often with additional income streams such as advertising or affiliate marketing.

- Key Characteristics: E-commerce businesses require a user-friendly website or mobile app, secure payment gateways, efficient logistics and fulfillment processes, and effective marketing strategies to attract and convert customers.

E-commerce businesses face challenges such as intense competition, managing inventory, and ensuring secure online transactions. However, the growing popularity of online shopping and the potential for global reach make e-commerce a highly competitive and potentially lucrative business model.

Mobile App Development

Mobile app development businesses create applications for smartphones and tablets, targeting specific user needs or industries. These apps can be developed for both iOS and Android platforms, providing access to a vast user base.

- Revenue Stream: Mobile app developers generate revenue through various models, including in-app purchases, subscriptions, advertising, or selling the app outright.

- Key Characteristics: Mobile app development businesses require skilled developers with expertise in mobile app development frameworks, user interface design, and app store optimization strategies.

Mobile app development businesses face challenges such as app store competition, user acquisition costs, and the need to adapt to rapidly evolving mobile technology. However, the increasing use of mobile devices and the potential for viral growth make mobile app development a potentially rewarding business model. Examples of successful mobile app businesses include Uber, Instagram, and TikTok.

Evaluating Technology Businesses

Evaluating a technology business involves a thorough analysis of its financial health, operational efficiency, and market position. This process helps potential buyers understand the true value of the business and make informed decisions.

Key Financial Metrics

Financial metrics provide a quantitative snapshot of a technology business’s performance. These metrics help assess profitability, growth potential, and financial stability.

- Revenue Growth: This metric indicates the rate at which the business is generating revenue. A consistent upward trend in revenue growth signifies a healthy business. For example, a technology company that consistently grows its revenue by 20% annually demonstrates strong market traction and potential for future growth.

- Profitability: Profitability measures the business’s ability to generate profits from its operations. Key metrics include gross profit margin, operating profit margin, and net profit margin. A high profit margin indicates that the business is efficiently managing its costs and generating substantial profits. For instance, a software company with a gross profit margin of 70% indicates that it is generating significant profits from its software sales after deducting the cost of goods sold.

- Customer Acquisition Cost (CAC): This metric reflects the cost of acquiring a new customer. A low CAC indicates that the business is efficiently acquiring customers at a reasonable cost. A technology company with a low CAC might have a strong marketing strategy and efficient sales processes.

- Customer Lifetime Value (CLTV): This metric measures the total revenue a customer generates over their relationship with the business. A high CLTV indicates that customers are loyal and continue to purchase products or services from the business. For example, a subscription-based software company with a high CLTV indicates that its customers are satisfied with the product and are likely to continue subscribing for an extended period.

- Burn Rate: This metric measures the rate at which a business is spending cash. A high burn rate can be a concern for investors as it indicates that the business is losing money quickly. A technology startup in its early stages may have a high burn rate as it invests heavily in research and development, but a sustainable burn rate is crucial for long-term success.

Essential Factors to Assess

Beyond financial metrics, it’s crucial to evaluate several qualitative factors that influence the long-term viability of a technology business.

- Customer Base: A strong customer base is essential for any technology business. Assess the size, concentration, and loyalty of the customer base. A diverse and loyal customer base indicates strong brand recognition and customer satisfaction. For example, a technology company with a large and diverse customer base across various industries demonstrates its ability to cater to a wide range of needs and potentially indicates its resilience to market fluctuations.

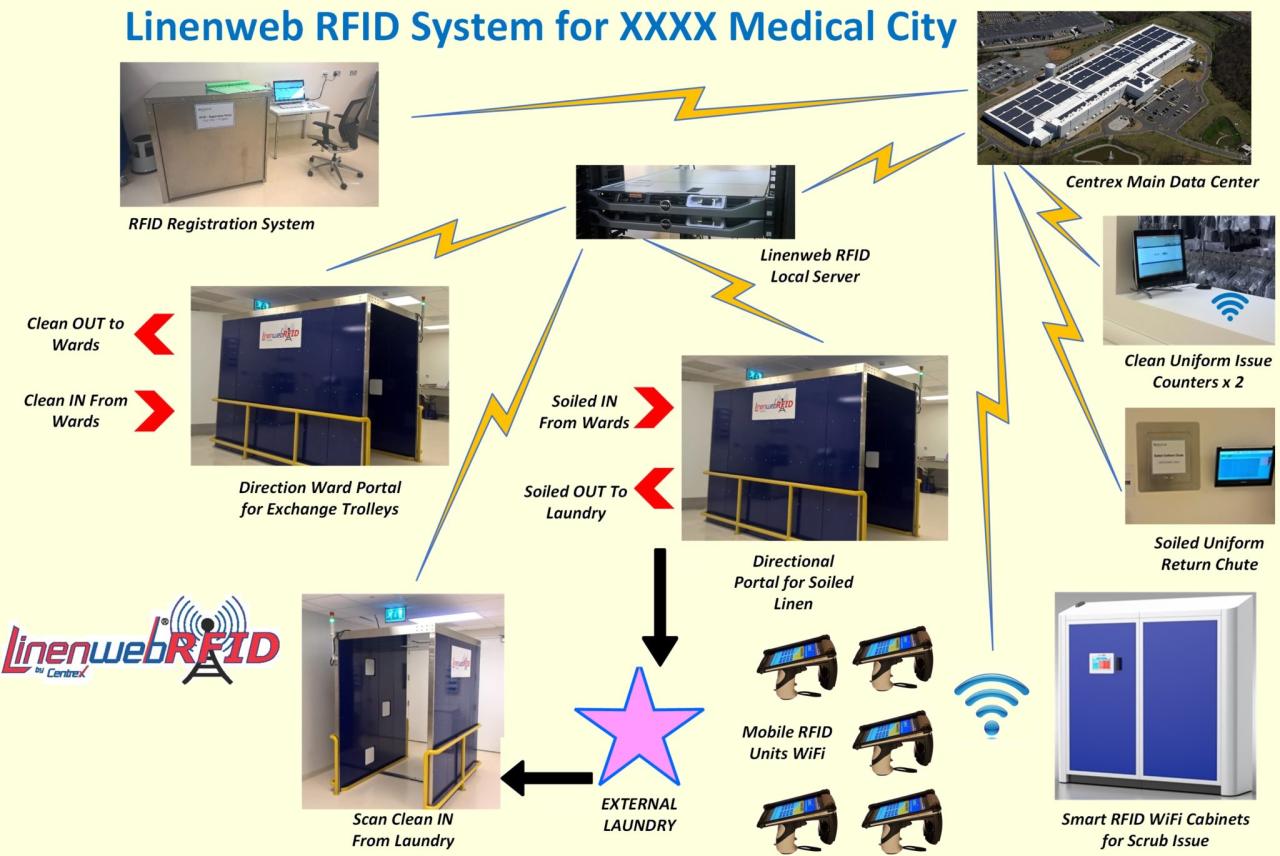

- Technology Stack: The technology stack refers to the software and hardware components that support the business’s operations. A modern and scalable technology stack is crucial for a technology business to stay competitive. Evaluate the technology stack for its efficiency, security, and ability to support future growth. For example, a technology company utilizing a cloud-based infrastructure with advanced security features demonstrates its commitment to scalability and data protection, enhancing its attractiveness to potential buyers.

- Intellectual Property: Intellectual property (IP) includes patents, trademarks, copyrights, and trade secrets. Strong IP protection can provide a competitive advantage and generate revenue streams. Assess the strength and scope of the business’s IP portfolio and its potential for future monetization. For example, a technology company holding patents for its core technology demonstrates its innovative capabilities and its potential to generate licensing revenue or attract strategic partnerships.

- Team and Management: The team and management play a crucial role in the success of a technology business. Evaluate the experience, expertise, and leadership qualities of the team. A strong and experienced team with a clear vision can significantly contribute to the business’s growth and success. For example, a technology company with a team of experienced engineers, developers, and marketing professionals with a proven track record of success is likely to attract higher valuations from potential buyers.

- Market Position: Assess the business’s market position, including its competitive landscape, market share, and growth potential. A strong market position indicates that the business has a clear understanding of its target market and has a competitive advantage in the industry. For example, a technology company with a dominant market share in a rapidly growing market demonstrates its ability to capitalize on market opportunities and achieve significant growth.

Valuation Methods

Various valuation methods are used to determine the fair market value of a technology business.

- Discounted Cash Flow (DCF) Analysis: This method estimates the present value of future cash flows generated by the business. It involves forecasting future cash flows, discounting them back to their present value, and adding the present value of any terminal value. The DCF analysis provides a more intrinsic valuation based on the business’s projected future earnings. For example, a technology company with a strong track record of profitability and a robust growth plan can be valued using a DCF analysis to determine its intrinsic value based on its expected future cash flows.

- Market Multiples: This method compares the business’s valuation metrics to those of comparable companies in the same industry. Common multiples include price-to-earnings (P/E) ratio, price-to-sales (P/S) ratio, and enterprise value-to-EBITDA (EV/EBITDA) ratio. This method provides a relative valuation based on market trends and industry benchmarks. For example, a technology company with a P/E ratio of 20x compared to an average P/E ratio of 15x for its peers in the industry suggests that it may be overvalued.

Due Diligence

Due diligence is a critical step in evaluating a technology business. It involves a thorough examination of the business’s financial records, operations, and legal documentation.

- Review Financial Statements: Carefully examine the business’s financial statements, including income statements, balance sheets, and cash flow statements. Verify the accuracy and consistency of the data and look for any red flags or inconsistencies. For example, a significant increase in accounts receivable without a corresponding increase in revenue could indicate potential issues with customer collections.

- Conduct Customer Due Diligence: Contact a sample of the business’s customers to assess their satisfaction levels and the strength of their relationships with the business. This can provide valuable insights into the business’s customer retention rates and its ability to maintain strong customer relationships. For example, conducting customer interviews can reveal potential issues with customer service or product quality.

- Assess Technology Stack: Evaluate the business’s technology stack to ensure it is modern, secure, and scalable. Conduct a security audit to identify any vulnerabilities and assess the business’s compliance with relevant data privacy regulations. For example, a thorough security audit can identify any potential weaknesses in the technology stack that could expose the business to cyberattacks.

- Review Legal Documentation: Examine the business’s legal documentation, including contracts, licenses, and intellectual property agreements. Ensure that all legal requirements are met and that there are no potential legal risks. For example, reviewing employment contracts can identify any potential liabilities related to employee compensation or non-compete clauses.

- Interview Key Personnel: Meet with key personnel, including management, engineers, and sales representatives. Conduct interviews to assess their experience, expertise, and commitment to the business. For example, interviewing the CEO can provide insights into their vision for the business and their plans for future growth.

Finding Technology Businesses for Sale

Finding technology businesses for sale requires a strategic approach that involves exploring various online marketplaces, uncovering hidden gems, and leveraging the power of networking. By utilizing these methods, you can significantly enhance your chances of discovering profitable and scalable businesses that align with your investment goals.

Leading Online Marketplaces and Platforms

Online marketplaces and platforms serve as central hubs for connecting buyers and sellers of technology businesses. They offer a comprehensive range of listings, providing a convenient and efficient way to browse potential acquisitions.

- BizBuySell: A leading platform specializing in the sale of small businesses, including technology companies. BizBuySell boasts a vast database of listings, detailed business profiles, and financial information.

- Flippa: Focusing on the sale of online businesses, including websites, apps, and e-commerce stores, Flippa provides a platform for buying and selling digital assets.

- Quiet Light Brokerage: Specializing in the sale of technology businesses, Quiet Light Brokerage offers a curated selection of high-quality listings, along with expert guidance and support throughout the acquisition process.

- FE International: A global marketplace for buying and selling established businesses, FE International features a wide range of technology businesses, including SaaS companies, e-commerce platforms, and software development firms.

Finding Hidden Gems and Overlooked Opportunities

Beyond the well-known platforms, uncovering hidden gems and overlooked opportunities requires a proactive approach.

- Search for Businesses in Niche Markets: Explore specific industry segments or niche markets where competition may be less intense, offering potential for higher returns.

- Attend Industry Events and Conferences: Networking at industry events and conferences can provide access to valuable insights and connections, potentially leading to off-market deals.

- Contact Business Brokers and M&A Advisors: Engage with experienced professionals who specialize in technology business acquisitions. They can provide access to exclusive listings and assist in identifying hidden gems.

- Leverage Online Business Directories: Explore directories that list businesses for sale, focusing on technology-related categories.

The Importance of Networking and Building Relationships

Building relationships within the tech community is crucial for finding promising technology businesses for sale.

“Networking is not about just collecting business cards; it’s about building relationships.” – Unknown

- Attend Tech Meetups and Events: Regularly attending tech meetups and events allows you to connect with entrepreneurs, investors, and other industry professionals.

- Join Online Tech Communities: Engage in online forums and communities dedicated to technology, entrepreneurship, and business acquisitions. This provides opportunities to learn about emerging trends and connect with potential sellers.

- Seek Introductions from Trusted Contacts: Leverage your existing network to request introductions to individuals who may be interested in selling their technology businesses.

Resources and Directories

Several resources and directories specialize in facilitating technology business acquisitions.

- The M&A Advisor: A leading resource for M&A professionals, providing industry news, deal announcements, and a directory of M&A advisors specializing in technology.

- TechCrunch: A popular online publication covering technology news, startups, and investments, TechCrunch often features articles about technology businesses for sale.

- Crunchbase: A comprehensive database of companies, investors, and funding rounds, Crunchbase can be used to identify technology businesses with potential acquisition opportunities.

- LinkedIn: A professional networking platform, LinkedIn allows you to connect with individuals in the tech industry and search for businesses for sale.

Negotiating and Closing the Deal

Once you’ve identified a technology business that aligns with your goals and have a strong understanding of its financial health, the next step is to negotiate and close the deal. This phase involves a series of complex steps, each demanding careful consideration and strategic planning.

Negotiation Strategies and Tactics

Negotiation in technology business acquisitions is a delicate dance, requiring a blend of assertiveness and flexibility. The goal is to arrive at a mutually beneficial agreement that satisfies both the buyer and seller.

- Identify Key Negotiation Points: Before entering negotiations, clearly define your priorities and non-negotiables. These could include purchase price, financing terms, transition period, and intellectual property rights.

- Research and Preparation: Thoroughly research industry benchmarks and comparable transactions to inform your negotiating position. Understand the seller’s motivations and potential leverage points.

- Active Listening and Communication: Engage in open and honest communication, actively listening to the seller’s perspective. This fosters trust and understanding, leading to more productive negotiations.

- Creative Solutions and Trade-offs: Be prepared to explore creative solutions and consider trade-offs. This may involve adjusting the purchase price, structuring the payment schedule, or offering a combination of cash and equity.

- Negotiation Tactics: Common tactics include anchoring, bracketing, and concession strategies. Anchoring involves setting a starting point for negotiations, while bracketing involves setting a range for acceptable outcomes. Concession strategies involve making gradual concessions while ensuring that you retain leverage.

Structuring the Purchase Agreement, Technology businesses for sale

The purchase agreement is the legal document that Artikels the terms and conditions of the acquisition. It should be comprehensive and address all key aspects of the transaction.

- Purchase Price and Payment Terms: This section defines the total purchase price and payment schedule. It may involve a combination of cash, debt financing, and earn-out provisions.

- Assets and Liabilities: The agreement should clearly specify which assets and liabilities are included in the transaction. This can include tangible assets (equipment, inventory), intangible assets (intellectual property, customer lists), and liabilities (loans, accounts payable).

- Representations and Warranties: These statements ensure that the seller is making truthful representations about the business, its financial condition, and legal compliance.

- Covenants and Indemnification: Covenants are agreements that the parties make to each other, such as the seller’s commitment to provide transition support or the buyer’s obligation to maintain confidentiality. Indemnification clauses protect one party from financial losses arising from the other party’s actions or omissions.

- Closing Conditions: These are specific requirements that must be met before the transaction can be completed. Examples include obtaining regulatory approvals, completing due diligence, and securing financing.

Securing Financing

Financing plays a crucial role in technology business acquisitions. It may be necessary to secure a loan or other forms of financing to fund the purchase.

- Explore Financing Options: Options include bank loans, private equity financing, venture capital, and seller financing. Each option comes with its own terms and conditions, such as interest rates, repayment schedules, and equity stakes.

- Build a Strong Business Plan: A well-structured business plan outlining the acquisition’s financial projections, growth strategy, and exit plan will be essential for securing financing.

- Secure Loan Commitments: Obtain loan commitments from lenders before the closing date. This provides certainty and avoids delays in the transaction.

Legal and Regulatory Considerations

Technology business acquisitions often involve complex legal and regulatory considerations.

- Antitrust Laws: The transaction may be subject to antitrust review if it raises concerns about market concentration or potential anti-competitive behavior.

- Intellectual Property: Carefully review the intellectual property rights associated with the target business, including patents, trademarks, and copyrights.

- Data Privacy and Security: Ensure compliance with relevant data privacy laws and regulations, such as the General Data Protection Regulation (GDPR) or the California Consumer Privacy Act (CCPA).

- Employment Law: Consider the implications for employees of the target business, including their employment contracts, benefits, and potential changes to their roles or employment status.

- Tax Considerations: Consult with tax advisors to understand the tax implications of the acquisition, including capital gains taxes, transfer taxes, and the potential for tax deductions.

Post-Acquisition Integration and Growth: Technology Businesses For Sale

Successfully integrating a newly acquired technology business is crucial for maximizing returns on investment and achieving long-term growth. This involves navigating various aspects, from retaining talent to optimizing operations, all while ensuring a smooth transition for both the acquired company and the acquirer.

Integrating the Acquired Business

Integrating a technology business involves merging operations, systems, and cultures. This requires a strategic approach to ensure a smooth transition and minimize disruption.

- Due diligence: Before closing the deal, thorough due diligence is essential to understand the acquired company’s operations, financials, and potential risks. This includes reviewing contracts, technology infrastructure, and employee agreements.

- Communication: Open and transparent communication with employees, customers, and partners is crucial throughout the integration process. This helps build trust and manage expectations.

- Systems and processes: Aligning the acquired company’s systems and processes with the acquirer’s is essential for operational efficiency. This may involve integrating CRM systems, ERP systems, and financial reporting processes.

- Technology infrastructure: Integrating technology infrastructure, such as data centers, networks, and software applications, can be complex. A well-defined plan and skilled IT professionals are necessary to ensure a seamless transition.

- Legal and regulatory compliance: Ensuring compliance with all applicable laws and regulations is crucial, especially when dealing with data privacy, intellectual property, and employee rights.

Retaining Key Employees and Customers

Retaining key employees and customers is essential for the success of any acquisition. Losing valuable talent or customers can significantly impact the acquired company’s performance.

- Employee retention: Offering competitive compensation and benefits packages, providing opportunities for career growth, and fostering a positive work environment are crucial for retaining key employees. Understanding their motivations and concerns is vital.

- Customer retention: Maintaining existing customer relationships is crucial. This involves communicating the acquisition effectively, assuring them of continued service quality, and addressing any concerns they may have.

Maximizing Growth and Profitability

Post-acquisition growth strategies aim to unlock the acquired company’s full potential and maximize profitability.

- Leveraging synergies: Identifying and exploiting synergies between the acquired company and the acquirer can create significant value. This may involve cross-selling products or services, sharing resources, or leveraging complementary expertise.

- Expanding into new markets: The acquisition can provide access to new markets or customer segments. By leveraging the acquired company’s brand, technology, or customer base, the acquirer can expand its reach and market share.

- Developing new products and services: Combining the acquired company’s technology, expertise, and customer base with the acquirer’s resources can lead to the development of innovative products and services that cater to new market needs.

- Optimizing operations: Streamlining processes, reducing costs, and improving efficiency can significantly enhance profitability. This may involve consolidating operations, automating tasks, or implementing lean management principles.

Post-Acquisition Management Checklist

A comprehensive checklist helps ensure a smooth post-acquisition transition and maximizes the value of the acquisition.

- Integration planning: Develop a detailed integration plan that Artikels the steps, timelines, and responsibilities for each phase of the integration process.

- Communication plan: Establish a communication plan for internal and external stakeholders, ensuring clear and consistent messaging throughout the integration process.

- Risk assessment: Identify and assess potential risks associated with the integration, such as technology compatibility issues, cultural clashes, or regulatory compliance challenges.

- Performance monitoring: Implement performance metrics to track the integration progress, identify areas for improvement, and ensure the achievement of key objectives.

- Post-acquisition review: Conduct regular reviews to evaluate the integration process, assess the acquired company’s performance, and make necessary adjustments to the integration plan.

Concluding Remarks

Acquiring a technology business requires a meticulous approach, encompassing market research, financial analysis, due diligence, and effective negotiation. By navigating the intricacies of this process with a strategic mindset, investors can unlock significant opportunities for growth and success in the dynamic world of technology.

Looking to buy a technology business? There are many opportunities out there, ranging from established companies to promising startups. If you’re interested in a specific area, consider exploring z technology , a rapidly growing field with potential for significant returns.

Whatever your tech business aspirations, thorough research and due diligence are essential before making any investment decisions.