Blue Owl Technology Finance Corp.: A Deep Dive

Blue Owl Technology Finance Corp. stands as a prominent player in the dynamic landscape of technology finance, a sector characterized by rapid innovation and constant evolution. The company’s journey, marked […]

Blue Owl Technology Finance Corp. stands as a prominent player in the dynamic landscape of technology finance, a sector characterized by rapid innovation and constant evolution. The company’s journey, marked by strategic acquisitions and a commitment to growth, reflects the dynamism of the industry it serves. This analysis explores Blue Owl’s financial performance, investment strategy, and future prospects, providing a comprehensive understanding of its position in the market.

From its early days, Blue Owl has been at the forefront of technological advancements, leveraging its expertise to provide financial solutions tailored to the unique needs of technology companies. Its mission, rooted in supporting innovation and fostering growth, has guided its operations and shaped its reputation as a trusted partner for tech-driven enterprises.

Investment Strategy

Blue Owl Capital, formerly known as Owl Rock Capital, is a leading alternative investment manager specializing in private credit and real estate. The company’s investment strategy is focused on providing investors with attractive risk-adjusted returns through a diversified portfolio of private credit and real estate investments.

Investment Focus

Blue Owl’s investment strategy centers around three key areas:

- Private Credit: This segment includes direct lending, structured credit, and special situations investments. Blue Owl provides capital to companies across various industries, including healthcare, technology, and consumer goods, offering financing solutions that traditional banks may not provide.

- Real Estate: Blue Owl invests in various real estate sectors, including commercial, industrial, and residential properties. The company focuses on both debt and equity investments, seeking opportunities to generate attractive returns through value creation and asset management.

- Strategic Investments: Blue Owl also makes strategic investments in other alternative investment managers, allowing the company to expand its reach and access new investment opportunities.

Investment Criteria

Blue Owl’s investment criteria are designed to ensure that the company invests in high-quality assets with a strong potential for growth and profitability. The company’s investment team carefully evaluates each investment opportunity, considering factors such as:

- Management Team: Blue Owl focuses on partnering with experienced and reputable management teams that have a proven track record of success.

- Business Model: The company invests in businesses with sustainable and scalable business models that generate consistent cash flows.

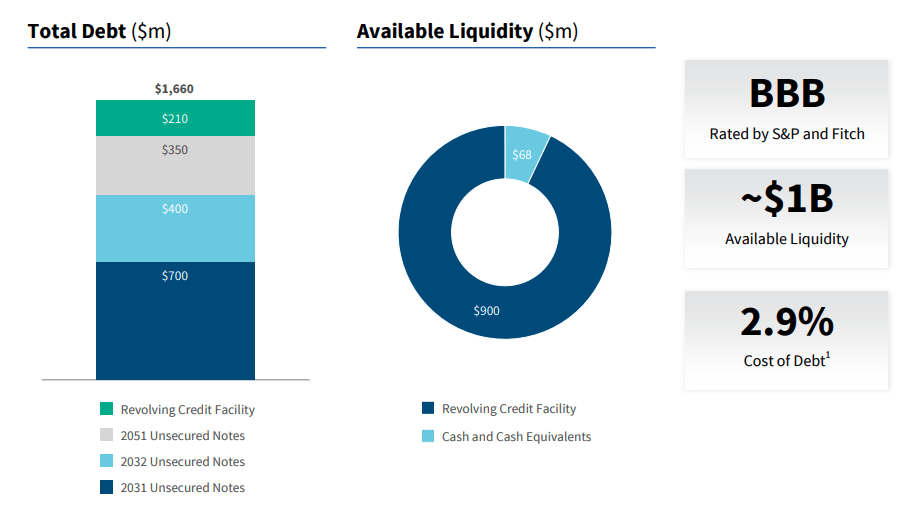

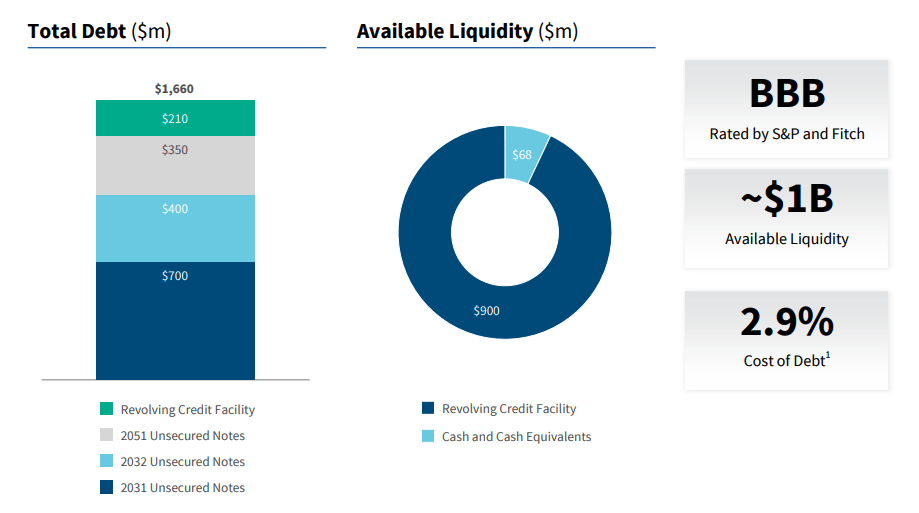

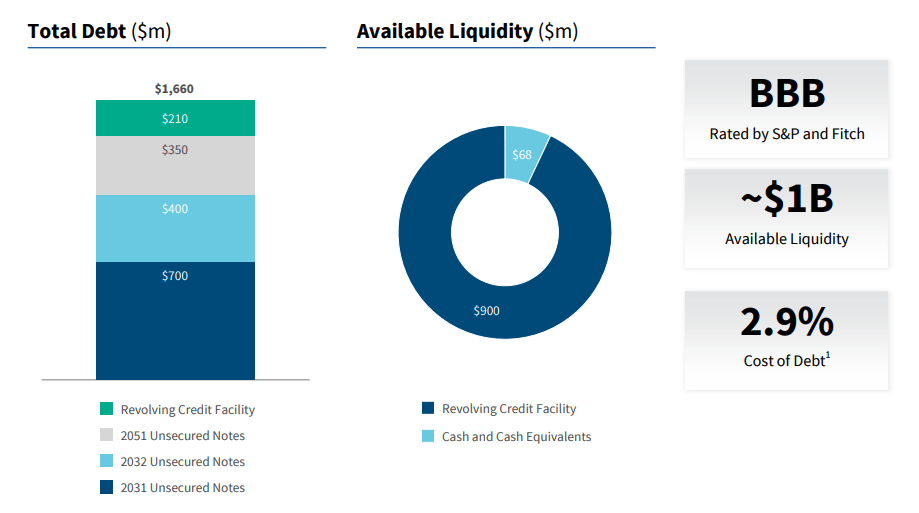

- Financial Performance: Blue Owl assesses the financial health of potential investments, evaluating metrics such as revenue growth, profitability, and debt levels.

- Market Opportunity: The company seeks investments in industries with attractive growth potential and favorable market dynamics.

Risk Management

Blue Owl’s risk management practices are designed to mitigate potential losses and protect investor capital. The company employs a comprehensive risk management framework that includes:

- Diversification: Blue Owl maintains a diversified portfolio across various industries, asset classes, and geographies to reduce exposure to any single investment or market risk.

- Due Diligence: The company conducts thorough due diligence on all potential investments, evaluating the underlying assets, management team, and market conditions.

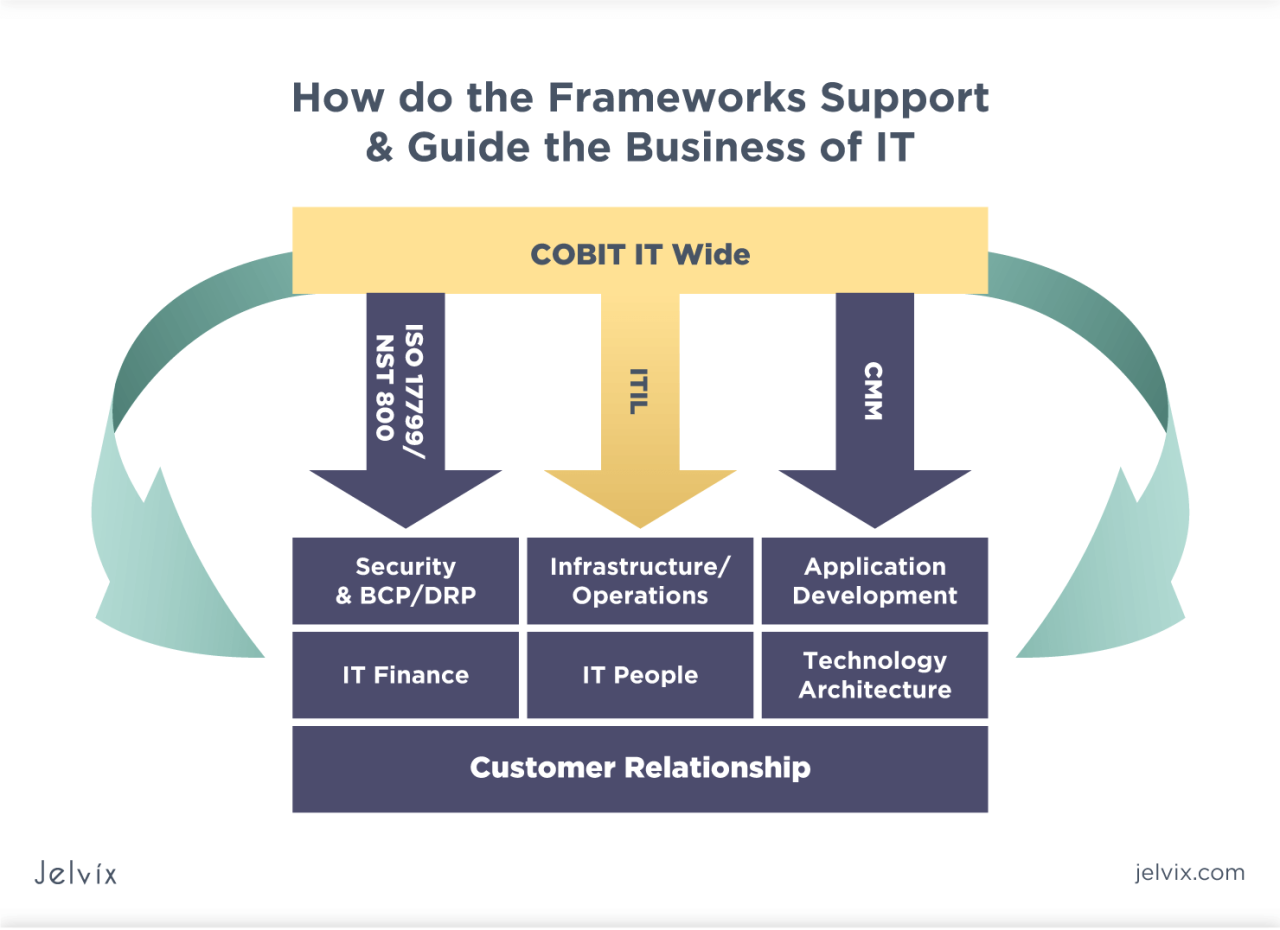

- Risk Monitoring: Blue Owl actively monitors its portfolio for potential risks, employing sophisticated risk management tools and systems to identify and address any emerging issues.

- Stress Testing: The company regularly conducts stress tests to assess the portfolio’s resilience under various adverse market scenarios.

Investment Portfolio, Blue owl technology finance corp.

Blue Owl’s investment portfolio is comprised of a diverse range of private credit and real estate investments. The company’s key holdings include:

| Asset Class | Investment Type | Key Holdings |

|---|---|---|

| Private Credit | Direct Lending | Healthcare, Technology, Consumer Goods |

| Structured Credit | Asset-Backed Securities, Collateralized Loan Obligations | |

| Special Situations | Distressed Debt, Restructuring Opportunities | |

| Real Estate | Commercial Real Estate | Office Buildings, Retail Centers, Industrial Properties |

| Residential Real Estate | Multifamily Housing, Single-Family Homes | |

| Strategic Investments | Alternative Investment Managers | Private Equity Funds, Hedge Funds |

Investment Performance

Blue Owl has consistently generated strong investment returns for its investors. The company’s investment performance is driven by its experienced investment team, disciplined investment process, and focus on generating attractive risk-adjusted returns.

Future Prospects: Blue Owl Technology Finance Corp.

Blue Owl’s future prospects are promising, driven by the continued growth of the alternative investment market and the company’s strategic initiatives. The company is well-positioned to capitalize on the increasing demand for alternative investments, particularly in private equity and credit.

Growth Prospects and Areas of Expansion

Blue Owl’s future growth prospects are driven by several factors, including the increasing demand for alternative investments, the company’s strong track record, and its strategic initiatives. The company is expanding its product offerings to meet the evolving needs of investors, including the development of new investment strategies and the expansion into new markets. Blue Owl is also focusing on growing its distribution channels to reach a wider range of investors.

Strategic Initiatives and Plans for the Future

Blue Owl has several strategic initiatives in place to drive future growth. These include:

- Expanding into new markets, such as Asia and Latin America, to tap into the growing demand for alternative investments in these regions.

- Developing new investment strategies, such as direct lending and venture capital, to offer investors a wider range of investment opportunities.

- Investing in technology to enhance its operations and improve the client experience.

- Building strategic partnerships with other leading financial institutions to expand its reach and capabilities.

Potential Risks and Challenges

While Blue Owl has a strong track record and is well-positioned for future growth, the company faces certain risks and challenges, including:

- Volatility in the financial markets, which could impact investor sentiment and reduce demand for alternative investments.

- Increased competition from other financial institutions, both traditional and alternative asset managers.

- Regulatory changes, which could impact the company’s operations and profitability.

- Cybersecurity threats, which could compromise the company’s data and systems.

Long-Term Sustainability and Competitive Advantage

Blue Owl’s long-term sustainability is supported by its strong brand reputation, experienced management team, and diversified investment portfolio. The company has a strong track record of delivering consistent returns to investors, which has helped to build its reputation as a trusted and reliable partner. Blue Owl’s competitive advantage is derived from its ability to source and manage high-quality investments, its strong relationships with leading investors, and its commitment to innovation.

Impact of Emerging Technologies on the Technology Finance Industry

Emerging technologies, such as artificial intelligence (AI), blockchain, and big data, are transforming the technology finance industry. These technologies are enabling financial institutions to automate processes, improve risk management, and enhance the client experience. Blue Owl is investing in these technologies to remain competitive and leverage their potential to enhance its operations and product offerings.

Closing Notes

As the technology finance industry continues to evolve, Blue Owl Technology Finance Corp. is poised to remain a significant player, capitalizing on its strong financial foundation and deep industry expertise. Its commitment to innovation, coupled with a strategic approach to investment, positions it for continued success in the years to come. The company’s future hinges on its ability to navigate the challenges and opportunities presented by emerging technologies, while staying true to its core values of transparency, integrity, and customer focus.

Blue Owl Technology Finance Corp. specializes in providing financial solutions for businesses operating in the tech sector. They understand the unique challenges faced by companies navigating the rapidly evolving tech landscape, and offer a range of services to help them thrive.

One key aspect of their approach is recognizing the importance of a reliable “technology handyman,” like those offered by smartorders.ca , to ensure smooth operations and minimize downtime. This focus on supporting the technological infrastructure of their clients is a testament to Blue Owl Technology Finance Corp.’s commitment to their success.