Technology E&O vs Cyber: Protecting Your Business

Technology E&O vs Cyber: Navigating the complex world of technology risks requires understanding the differences between Errors and Omissions (E&O) insurance and Cyber Liability insurance. These two types of insurance […]

Technology E&O vs Cyber: Navigating the complex world of technology risks requires understanding the differences between Errors and Omissions (E&O) insurance and Cyber Liability insurance. These two types of insurance protect technology companies from different but often overlapping threats. While E&O covers professional negligence and errors, Cyber insurance safeguards against data breaches, cyberattacks, and other digital risks. Both are crucial for technology companies operating in today’s digital landscape.

This article delves into the specific risks technology companies face, explores the key differences between E&O and Cyber insurance, and provides practical advice for managing these risks effectively. We’ll examine real-world scenarios, highlight best practices, and emphasize the importance of comprehensive risk management strategies to protect your business.

Understanding E&O and Cyber Risks: Technology E&o Vs Cyber

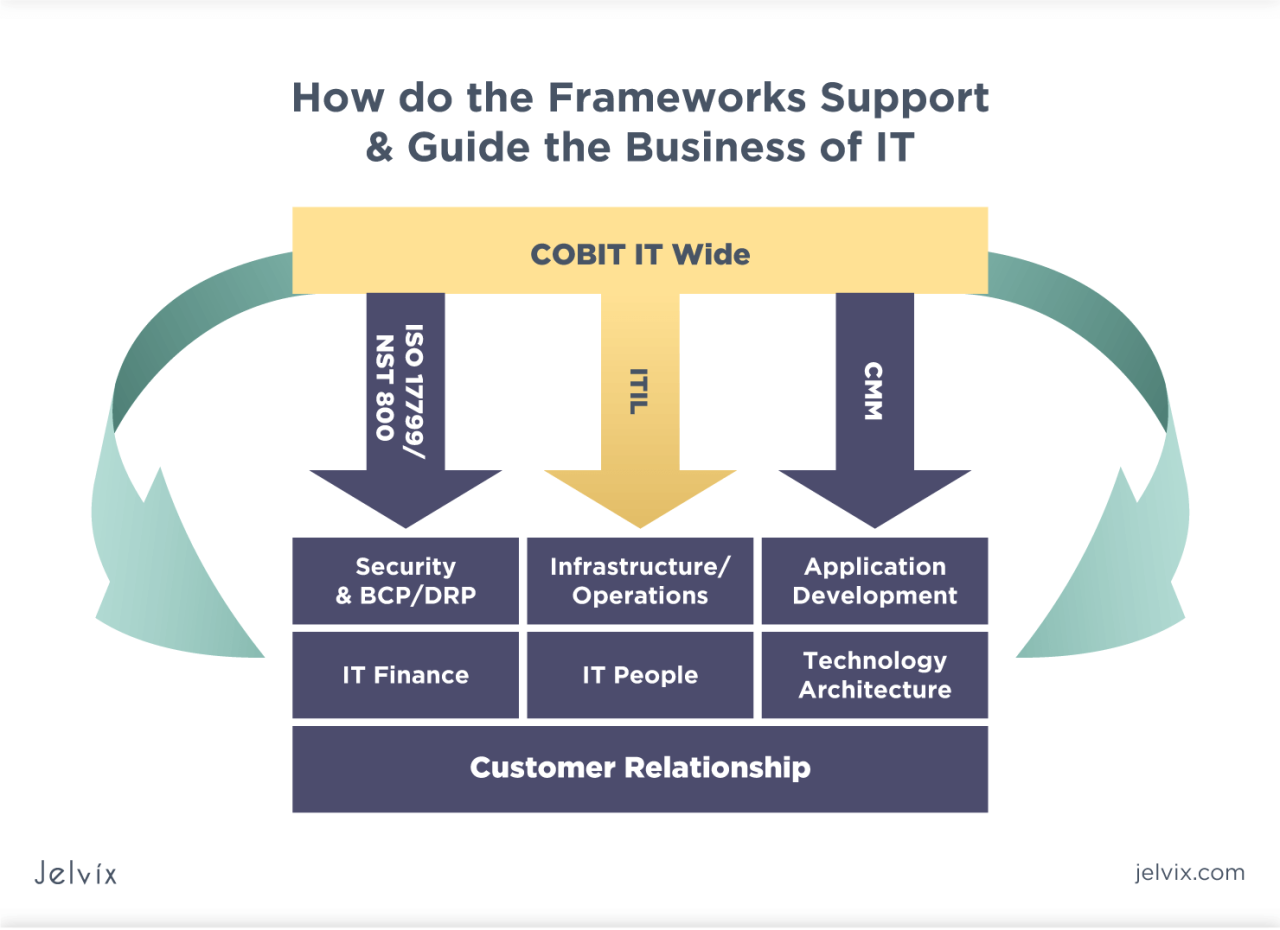

E&O and Cyber insurance policies are essential for technology companies, providing financial protection against various risks. While both cover potential losses, they differ significantly in their scope and coverage. This guide will delve into the core differences between these two types of insurance and provide examples of typical risks faced by technology companies in each category.

E&O and Cyber Risks: Core Differences

E&O and Cyber insurance policies address distinct risks faced by technology companies. E&O insurance, also known as Professional Liability Insurance, protects against financial losses arising from professional negligence, errors, or omissions in the services provided by a company. Cyber insurance, on the other hand, focuses on protecting against financial losses stemming from data breaches, cyberattacks, and other cyber-related incidents.

Typical E&O Risks for Technology Companies

Technology companies are susceptible to various E&O risks due to the complex nature of their services and the potential for errors in software development, data management, or consulting services. Here are some common examples:

- Software Bugs and Defects: Errors in software code can lead to malfunctions, data loss, or security vulnerabilities, resulting in financial losses for clients and potential legal claims against the technology company.

- Data Breaches and Privacy Violations: Failure to protect sensitive client data, such as personal information or financial records, can lead to data breaches, exposing the company to significant financial penalties and reputational damage.

- Misleading or Inaccurate Advice: Technology consultants or service providers may provide incorrect or incomplete advice to clients, leading to financial losses or project delays, potentially exposing the company to E&O claims.

- Contractual Disputes: Disputes over service agreements, intellectual property rights, or payment terms can result in legal actions and financial losses for technology companies.

Common Cyber Threats to Technology Companies, Technology e&o vs cyber

Technology companies are prime targets for cybercriminals due to their reliance on sensitive data and sophisticated IT infrastructure. These companies face various cyber threats, including:

- Malware Attacks: Viruses, ransomware, and other malicious software can infiltrate systems, steal data, disrupt operations, or demand ransom payments.

- Phishing Attacks: Cybercriminals use deceptive emails or websites to trick employees into revealing sensitive information, such as login credentials or financial details.

- Denial-of-Service (DoS) Attacks: These attacks aim to overwhelm a company’s website or network with traffic, making it inaccessible to legitimate users.

- Data Breaches: Hackers can exploit vulnerabilities in systems or networks to gain unauthorized access to sensitive data, leading to data theft, financial losses, and reputational damage.

Overlap Between E&O and Cyber Risks

The lines between E&O and Cyber risks can blur in the context of technology companies. Some incidents can trigger both types of coverage, requiring a comprehensive understanding of the specific circumstances.

- Data Breaches: A data breach resulting from a software flaw or negligence in data security practices can trigger both E&O and Cyber claims. The E&O claim would focus on the professional negligence aspect, while the Cyber claim would cover the costs associated with data recovery, notification, and legal expenses.

- Cyberattacks: Cyberattacks targeting a technology company’s systems or data can also lead to both E&O and Cyber claims. The E&O claim might cover losses resulting from business interruption or service disruptions caused by the attack, while the Cyber claim would address the costs of data recovery, security enhancements, and legal defense.

Cyber Risks for Technology Companies

Technology companies are increasingly vulnerable to cyberattacks due to their reliance on digital infrastructure, sensitive data, and complex operations. These attacks can disrupt business operations, damage reputation, and lead to significant financial losses. Understanding the specific cyber risks faced by technology companies is crucial for implementing effective security measures.

Ransomware Attacks

Ransomware attacks are a significant threat to technology companies, potentially causing severe disruption and financial damage. These attacks involve malicious software that encrypts a company’s data, making it inaccessible. Attackers then demand payment in cryptocurrency to decrypt the data. The impact of ransomware attacks on technology companies can be far-reaching:

- Business Interruption: Encrypted data can render critical systems and applications unusable, halting operations and impacting productivity.

- Data Loss: If the ransom is not paid or decryption fails, valuable data may be permanently lost, potentially impacting customer information, intellectual property, or financial records.

- Financial Losses: Paying the ransom can be costly, and companies may also incur expenses related to data recovery, system restoration, and legal fees.

- Reputational Damage: A ransomware attack can damage a company’s reputation, leading to loss of customer trust and potential business opportunities.

Data Breaches and Intellectual Property Theft

Technology companies often handle sensitive data, including customer information, financial records, and intellectual property. Data breaches can result in the unauthorized access and theft of this data, leading to significant consequences:

- Financial Losses: Stolen financial data can be used for fraudulent activities, leading to financial losses for both the company and its customers.

- Legal Liabilities: Companies may face legal penalties and lawsuits for failing to protect sensitive data, especially if it involves personal information.

- Reputational Damage: Data breaches can damage a company’s reputation, leading to loss of customer trust and potential business opportunities.

- Competitive Advantage Loss: Stolen intellectual property, such as source code, design plans, or research data, can give competitors an unfair advantage, potentially harming the company’s market position.

Cyberattacks Targeting Technology Infrastructure and Operations

Technology companies rely on complex infrastructure and systems for their operations. Cyberattacks targeting these systems can disrupt services, compromise security, and impact business continuity:

- Distributed Denial of Service (DDoS) Attacks: These attacks overwhelm a company’s servers with traffic, making it impossible for legitimate users to access services. This can disrupt operations and damage the company’s reputation.

- Malware Infections: Malware, such as viruses, worms, and Trojans, can infiltrate a company’s systems, steal data, or disrupt operations. This can lead to data loss, financial losses, and reputational damage.

- Supply Chain Attacks: Attackers can target software vendors or other third-party providers, compromising their systems and using them to gain access to technology companies’ networks. This can lead to widespread data breaches and operational disruptions.

- Phishing Attacks: These attacks involve sending fraudulent emails or messages designed to trick employees into revealing sensitive information or clicking on malicious links. This can compromise security and lead to data breaches.

Types of Cyberattacks and their Potential Consequences for Technology Companies

| Type of Cyberattack | Potential Consequences for Technology Companies |

|---|---|

| Ransomware Attacks | Business interruption, data loss, financial losses, reputational damage |

| Data Breaches | Financial losses, legal liabilities, reputational damage, competitive advantage loss |

| Distributed Denial of Service (DDoS) Attacks | Business interruption, reputational damage |

| Malware Infections | Data loss, financial losses, reputational damage |

| Supply Chain Attacks | Widespread data breaches, operational disruptions |

| Phishing Attacks | Compromised security, data breaches |

| Social Engineering Attacks | Data breaches, unauthorized access to systems |

| Insider Threats | Data breaches, sabotage, intellectual property theft |

Last Recap

In conclusion, understanding the nuances of technology E&O and Cyber insurance is critical for technology companies. By carefully evaluating their specific risks, implementing robust security measures, and securing comprehensive insurance coverage, businesses can mitigate potential losses and protect their future. Remember, proactive risk management is not just about compliance; it’s about safeguarding your company’s reputation, operations, and financial stability in the face of evolving technology threats.

Understanding the nuances of technology E&O versus cyber liability insurance is crucial for any tech company. While both cover potential risks, their focus differs significantly. For instance, if you’re developing innovative technology, you’ll want to consider consulting with a technology patent lawyer to protect your intellectual property.

This proactive approach not only safeguards your inventions but also strengthens your overall risk management strategy, which is essential when navigating the complexities of technology E&O and cyber insurance.