Technology Insurance Company Inc. NAIC: Navigating the Digital Risk Landscape

Technology insurance company inc naic – Technology Insurance Company Inc. NAIC represents a crucial sector within the insurance industry, dedicated to mitigating the ever-growing risks associated with technology advancements. These […]

Technology insurance company inc naic – Technology Insurance Company Inc. NAIC represents a crucial sector within the insurance industry, dedicated to mitigating the ever-growing risks associated with technology advancements. These companies offer specialized insurance products designed to protect businesses from cyberattacks, data breaches, and other technological mishaps. The National Association of Insurance Commissioners (NAIC) plays a vital role in regulating this sector, ensuring consumer protection and financial stability.

The NAIC’s oversight extends to various aspects of technology insurance, including licensing, capital requirements, and consumer complaint resolution. This regulatory framework aims to maintain a fair and transparent market, encouraging responsible practices among technology insurance companies.

Key Considerations for Technology Insurance Companies: Technology Insurance Company Inc Naic

Technology insurance companies face a unique set of challenges in today’s rapidly evolving technological landscape. They must navigate the complexities of insuring emerging technologies, adapting to changing risk profiles, and staying ahead of the curve in a highly competitive market. This section explores the key considerations for technology insurance companies, analyzing the impact of emerging technologies and the evolving risk profiles of technology companies.

Impact of Emerging Technologies on Technology Insurance

The emergence of artificial intelligence (AI) and blockchain technology has significantly impacted the technology insurance landscape. These technologies introduce new risks and opportunities, requiring insurers to adapt their products and services.

AI, for example, has the potential to revolutionize the insurance industry by automating processes, improving risk assessment, and enhancing customer experiences. However, it also presents challenges related to data privacy, algorithmic bias, and the potential for AI-driven cyberattacks.

Blockchain technology offers a secure and transparent way to record and track transactions, potentially reducing fraud and improving efficiency in insurance operations. However, its complex nature and lack of standardized regulations pose challenges for insurers.

- AI-driven Risk Assessment: AI algorithms can analyze vast amounts of data to assess risk more accurately and efficiently, potentially leading to more personalized and dynamic pricing models. This can benefit both insurers and policyholders, but it also raises concerns about data privacy and algorithmic bias. For example, if an AI algorithm is trained on biased data, it could result in discriminatory pricing or coverage decisions.

- Cybersecurity Risk: The increasing reliance on AI and blockchain technologies exposes technology companies to new cybersecurity risks. AI systems are vulnerable to hacking and manipulation, while blockchain networks are susceptible to attacks that could compromise the integrity of data and transactions.

- Data Privacy and Security: AI and blockchain technologies often rely on large datasets, raising concerns about data privacy and security. Insurers must ensure that they comply with data protection regulations and implement robust security measures to protect sensitive information.

The Future of Technology Insurance

The technology insurance sector is undergoing a rapid transformation, driven by advancements in technology, evolving risk profiles, and changing customer expectations. As technology continues to evolve, so too will the risks associated with it, demanding innovative approaches to risk assessment and coverage.

Adapting to Changing Market Conditions, Technology insurance company inc naic

Technology insurance companies must adapt to the evolving market landscape to remain competitive and relevant. This requires a proactive approach to understanding emerging trends, developing new products and services, and embracing digital transformation.

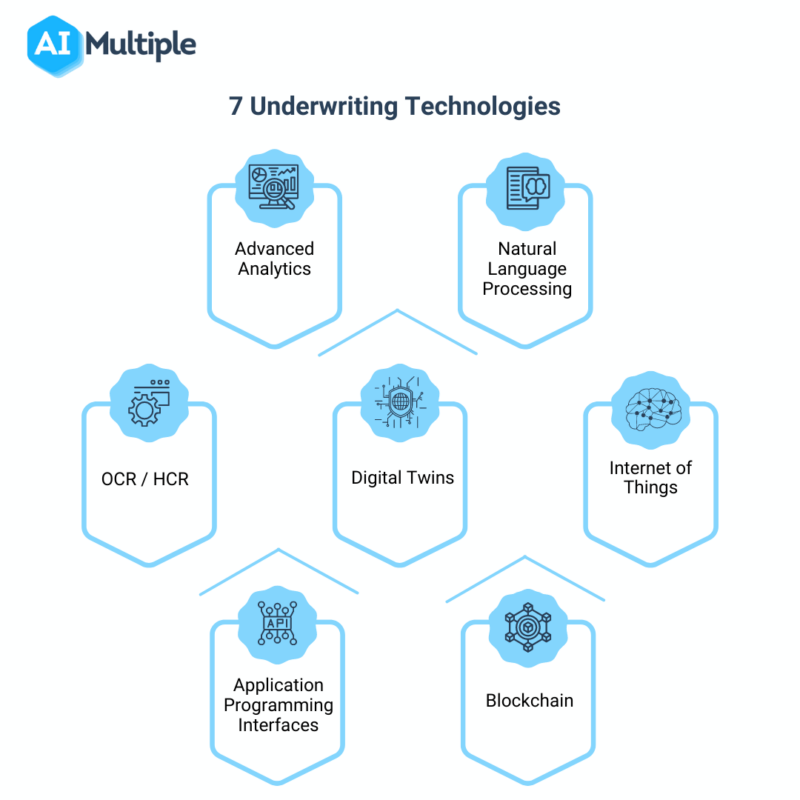

- Embrace Digital Transformation: Technology insurance companies should leverage digital technologies to streamline operations, improve customer experience, and enhance risk assessment capabilities. This includes adopting automation, artificial intelligence (AI), and data analytics to optimize processes and make data-driven decisions. For example, AI-powered risk assessment tools can help insurers analyze vast amounts of data to identify emerging risks and assess the potential impact on their clients.

- Develop Innovative Products and Services: Technology insurance companies should focus on developing products and services tailored to the unique needs of businesses operating in the digital age. This includes offering coverage for emerging technologies such as blockchain, artificial intelligence, and the Internet of Things (IoT). For instance, cyber insurance policies can be customized to cover specific cyber risks, such as data breaches, ransomware attacks, and system failures.

- Strengthen Risk Management Capabilities: As technology evolves, so too do the risks associated with it. Technology insurance companies must enhance their risk management capabilities to stay ahead of emerging threats. This involves developing expertise in areas such as cyber security, data privacy, and emerging technologies. By investing in training and resources, insurers can equip themselves to assess and manage the complex risks associated with the digital world.

Current and Future State of Technology Insurance

The following table compares the current and future state of technology insurance, highlighting key factors such as product offerings, risk assessment, and the regulatory landscape:

| Factor | Current State | Future State |

|---|---|---|

| Product Offerings | Traditional coverage for hardware, software, and data loss. Limited offerings for emerging technologies. | Expanded coverage for emerging technologies such as blockchain, AI, and IoT. Specialized products for cyber risks, data breaches, and system failures. |

| Risk Assessment | Reliance on traditional methods, often lacking comprehensive understanding of emerging risks. | Increased use of data analytics, AI, and machine learning to assess risks and predict future trends. Enhanced understanding of emerging technologies and their associated risks. |

| Regulatory Landscape | Evolving regulations related to data privacy, cybersecurity, and emerging technologies. | More stringent regulations and compliance requirements for technology insurance companies. Increased focus on data security, privacy, and responsible use of emerging technologies. |

Wrap-Up

As technology continues to evolve at an unprecedented pace, the role of technology insurance companies and the NAIC’s regulatory framework will only become more critical. By understanding the complexities of the digital risk landscape, both companies and consumers can make informed decisions to protect their interests. The future of technology insurance lies in innovation, adaptability, and a commitment to safeguarding against emerging threats.

Technology Insurance Company Inc. NAIC is a crucial player in the insurance market, offering protection for businesses and individuals against potential risks associated with technological advancements. Their coverage can extend to new technologies, such as those found in the new technology ac sector, ensuring that businesses have the necessary financial support in case of unforeseen events.

By understanding the unique challenges posed by rapidly evolving technologies, Technology Insurance Company Inc. NAIC helps mitigate risks and foster innovation.