Fleetcor Technologies Operating Co LLC: A Leader in Payment Solutions

Fleetcor Technologies Operating Co LLC is a global leader in payment solutions, specializing in streamlining business expenses for a wide range of industries. Founded in 1999, Fleetcor has grown rapidly […]

Fleetcor Technologies Operating Co LLC is a global leader in payment solutions, specializing in streamlining business expenses for a wide range of industries. Founded in 1999, Fleetcor has grown rapidly through strategic acquisitions and organic expansion, becoming a trusted partner for businesses seeking to optimize their payment processes and control costs.

The company offers a comprehensive suite of payment solutions, including fuel cards, corporate cards, and virtual payment solutions. These products cater to various sectors, such as transportation, hospitality, and retail, providing tailored solutions that address specific industry needs. Fleetcor’s business model revolves around providing value-added services, including fraud prevention, expense management tools, and data analytics, which contribute to its strong revenue streams and consistent profitability.

Company Overview

Fleetcor Technologies Operating Co LLC is a leading provider of fuel cards and payment solutions for businesses worldwide. Founded in 1986, the company has grown significantly through strategic acquisitions and organic growth, becoming a global leader in its industry. Fleetcor’s mission is to empower businesses to control and manage their fuel and other expenses effectively, enabling them to optimize their operations and improve profitability.

Core Business Activities

Fleetcor’s core business activities revolve around providing innovative payment solutions that simplify and streamline the management of various business expenses. The company’s offerings include:

- Fuel Cards: Fleetcor provides fuel cards that enable businesses to control and track fuel expenses for their fleets. These cards offer various features, including fuel price discounts, detailed reporting, and fraud prevention measures.

- Expense Management: The company offers expense management solutions that help businesses automate and manage their employee expenses. These solutions include online expense reporting, expense tracking, and automated reconciliation.

- Gift Cards: Fleetcor provides gift card solutions for businesses looking to incentivize employees, reward customers, or offer employee benefits. These gift cards can be used at a wide range of retailers and merchants.

- Other Payment Solutions: Fleetcor offers a range of other payment solutions, including prepaid cards, mobile payments, and virtual cards, catering to specific business needs.

Target Markets and Value Propositions

Fleetcor’s target markets are diverse and include:

- Transportation and Logistics: Fleetcor provides fuel cards and expense management solutions to trucking companies, transportation providers, and logistics firms, helping them manage fuel costs, optimize routes, and improve operational efficiency.

- Retail and Hospitality: The company offers gift card solutions to retailers and hospitality businesses, enabling them to drive sales, increase customer loyalty, and enhance brand awareness.

- Government and Public Sector: Fleetcor provides payment solutions to government agencies and public sector organizations, streamlining procurement processes and ensuring compliance with regulations.

- Small and Medium Businesses (SMBs): Fleetcor offers tailored payment solutions to SMBs, enabling them to manage expenses effectively, improve cash flow, and focus on their core business activities.

Fleetcor’s value proposition is centered around providing innovative and cost-effective payment solutions that simplify expense management, improve efficiency, and enhance profitability for businesses. The company’s solutions offer several benefits, including:

- Cost Savings: Fleetcor’s fuel cards and expense management solutions help businesses reduce fuel costs and streamline expense processes, leading to significant cost savings.

- Improved Efficiency: The company’s solutions automate and simplify expense management, freeing up time for businesses to focus on their core operations.

- Enhanced Security: Fleetcor’s payment solutions include robust security features, such as fraud prevention measures and data encryption, protecting businesses from financial risks.

- Increased Control: Businesses can gain real-time visibility into their expenses and track spending patterns, enabling them to make informed decisions and control costs effectively.

Business Model

Fleetcor’s business model is based on a subscription and transaction-based revenue model. The company generates revenue from:

- Subscription Fees: Fleetcor charges subscription fees for its fuel cards, expense management solutions, and other payment products. These fees are typically based on the number of cards issued, the volume of transactions, or the features included in the solution.

- Transaction Fees: Fleetcor also earns transaction fees on each transaction processed through its payment platform. These fees are typically a percentage of the transaction amount.

- Interest Income: The company generates interest income from the balances held in its merchant accounts and from its investments.

Fleetcor’s profit margins are generally high, reflecting its focus on providing value-added services and its efficient operating model. The company’s revenue growth has been consistently strong, driven by organic growth and strategic acquisitions.

Market Analysis: Fleetcor Technologies Operating Co Llc

Fleetcor Technologies operates in the rapidly growing global payments industry, specifically focusing on fuel, travel, and expense management solutions. The company caters to a diverse clientele, including businesses of all sizes, government agencies, and individuals. This section analyzes the market landscape for Fleetcor Technologies’ industry, including its size, growth potential, and key trends. Additionally, it examines the company’s major competitors, their strengths and weaknesses, and the regulatory environment and potential challenges that Fleetcor Technologies faces.

Market Size and Growth Potential

The global payments industry is a massive and rapidly growing market, driven by factors such as the increasing adoption of digital payments, the rise of e-commerce, and the growth of the global economy. According to Statista, the global payments market size was valued at USD 151.92 billion in 2022 and is projected to reach USD 266.35 billion by 2028, growing at a CAGR of 9.3% during the forecast period. Fleetcor Technologies operates within this growing market, benefiting from the increasing demand for fuel, travel, and expense management solutions. The company’s focus on providing efficient and cost-effective solutions has positioned it well to capitalize on the growth opportunities within the payments industry.

Key Trends

The payments industry is constantly evolving, with new technologies and trends emerging regularly. Some of the key trends shaping the industry include:

- Increased adoption of digital payments: Consumers and businesses are increasingly adopting digital payment methods, such as mobile wallets and online payment platforms. This trend is driven by the convenience and security offered by digital payments.

- Growth of e-commerce: The rise of e-commerce has led to an increased demand for secure and efficient payment solutions. Fleetcor Technologies is well-positioned to benefit from this trend, as its solutions are designed to facilitate online payments and transactions.

- Focus on data analytics: Businesses are increasingly relying on data analytics to optimize their operations and make better decisions. Fleetcor Technologies leverages data analytics to provide insights into spending patterns and identify areas for improvement.

- Rise of mobile payments: Mobile payments are becoming increasingly popular, as consumers and businesses are adopting smartphones and other mobile devices for transactions. Fleetcor Technologies offers mobile payment solutions that cater to this growing trend.

- Increased focus on security: Security is a major concern for businesses and consumers alike. Fleetcor Technologies prioritizes security and employs advanced technologies to protect sensitive data.

Major Competitors

Fleetcor Technologies faces competition from a range of companies operating in the payments industry. Some of its major competitors include:

- WEX Inc.: WEX is a leading provider of fuel, travel, and expense management solutions, with a strong focus on fleet cards and corporate payments. The company has a wide range of products and services, a strong brand reputation, and a global reach.

- Concur Technologies (now part of SAP): Concur is a leading provider of expense management solutions, offering a comprehensive suite of products and services that automate the expense reporting process. The company has a large customer base and a strong reputation for innovation.

- Expensify: Expensify is a cloud-based expense management platform that simplifies the expense reporting process for businesses and individuals. The company offers a user-friendly interface and mobile app, making it a popular choice for small businesses and startups.

- American Express: American Express is a global financial services company that offers a wide range of payment solutions, including corporate cards and expense management services. The company has a strong brand reputation and a vast network of merchants.

- Visa and Mastercard: Visa and Mastercard are global payment networks that process billions of transactions annually. They offer a range of payment solutions, including corporate cards and expense management services, and have a strong presence in the market.

Regulatory Environment and Potential Challenges

The payments industry is subject to a complex regulatory environment, with regulations varying by country and region. Some of the key regulatory challenges that Fleetcor Technologies faces include:

- Data privacy and security regulations: The company is subject to data privacy and security regulations, such as the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) in the United States. These regulations require companies to protect sensitive customer data and ensure compliance with specific privacy requirements.

- Anti-money laundering (AML) and know your customer (KYC) regulations: Fleetcor Technologies is required to comply with AML and KYC regulations to prevent money laundering and other financial crimes. These regulations require companies to verify the identity of their customers and monitor transactions for suspicious activity.

- Payment card industry (PCI) compliance: The company is required to comply with PCI standards to protect cardholder data and ensure the security of payment transactions. These standards require companies to implement security measures to protect sensitive information.

- Tax regulations: Fleetcor Technologies is subject to tax regulations in the countries where it operates. These regulations can vary significantly, and the company must ensure compliance with all applicable tax laws.

Financial Performance

Fleetcor Technologies has consistently demonstrated strong financial performance, driven by its diverse business model, global reach, and focus on innovation. The company’s revenue growth, profitability, and cash flow have been impressive, reflecting its ability to capitalize on the growing demand for payment solutions in the fuel and expense management sectors.

Revenue Growth and Profitability

Fleetcor’s revenue has grown steadily over the years, driven by both organic growth and acquisitions. The company’s revenue is generated from various segments, including fuel cards, corporate payments, and prepaid programs. Fleetcor’s profitability is also strong, with high operating margins and net income margins. This is attributed to its efficient operations, low operating costs, and effective management of its diverse portfolio of businesses.

Key Financial Ratios

Fleetcor’s financial performance can be further analyzed by examining key financial ratios:

Return on Equity (ROE)

ROE measures a company’s profitability relative to its shareholder equity. Fleetcor’s ROE has consistently been above the industry average, indicating its ability to generate high returns for its shareholders.

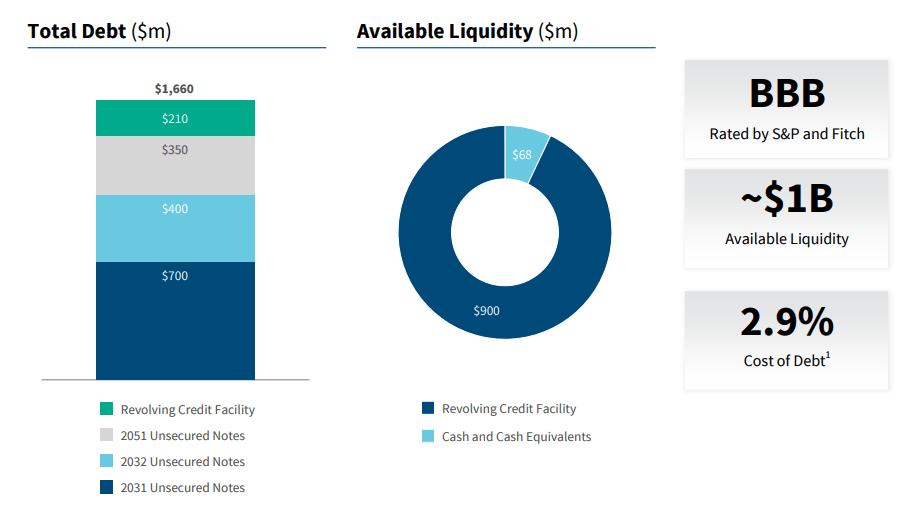

Debt-to-Equity Ratio

This ratio reflects the company’s financial leverage. Fleetcor maintains a low debt-to-equity ratio, suggesting a conservative approach to financing its operations. This strategy helps to mitigate financial risk and maintain a strong financial position.

Working Capital Turnover

This ratio measures how efficiently a company manages its working capital. Fleetcor’s working capital turnover has been consistently high, indicating efficient management of its assets and liabilities.

Investment Strategy

Fleetcor’s investment strategy focuses on organic growth, strategic acquisitions, and research and development. The company invests in expanding its product offerings, entering new markets, and enhancing its technological capabilities. These investments have contributed significantly to Fleetcor’s financial performance and growth trajectory.

Growth Strategies

Fleetcor Technologies employs a multifaceted growth strategy that focuses on organic expansion, strategic acquisitions, and product development. These strategies are designed to drive long-term growth and profitability, ensuring the company’s continued success in the rapidly evolving payments industry.

Expansion Plans

Fleetcor’s expansion plans encompass both geographical and market segment expansion. The company seeks to capitalize on the global demand for fuel and expense management solutions, particularly in emerging markets with growing economies and increased commercial activity.

- Geographical Expansion: Fleetcor has successfully expanded its operations into new regions, including Latin America, Asia-Pacific, and Europe. This expansion is achieved through strategic acquisitions, partnerships, and organic growth initiatives. For instance, the company’s acquisition of Fuelcard Services in 2016 significantly expanded its footprint in the UK market.

- Market Segment Expansion: Fleetcor is continuously exploring new market segments within the payments industry. The company has expanded its offerings to include solutions for healthcare, hospitality, and transportation industries. For example, the acquisition of Comdata in 2016 provided Fleetcor with a strong presence in the North American commercial transportation market.

Product Development Initiatives

Fleetcor’s product development strategy focuses on creating innovative solutions that address the evolving needs of its customers. The company invests heavily in research and development to enhance its existing products and develop new offerings.

- Technology Integration: Fleetcor is leveraging advanced technologies, such as artificial intelligence (AI) and big data analytics, to enhance its product offerings. This includes developing personalized solutions that provide real-time insights and data-driven recommendations to customers. For instance, the company’s AI-powered fraud detection system helps prevent unauthorized transactions and protect customer funds.

- Digitalization: Fleetcor is embracing digital transformation by developing mobile-first solutions and online platforms that provide customers with greater convenience and flexibility. This includes mobile apps that allow customers to track expenses, manage accounts, and receive real-time notifications. For example, Fleetcor’s mobile app enables drivers to track fuel usage, locate nearby fueling stations, and receive alerts for maintenance reminders.

Acquisitions, Fleetcor technologies operating co llc

Acquisitions play a crucial role in Fleetcor’s growth strategy, enabling the company to expand its market reach, enhance its product portfolio, and enter new markets.

- Strategic Acquisitions: Fleetcor has a proven track record of successful acquisitions, targeting companies that complement its existing business and provide access to new markets, technologies, or customer segments. For instance, the acquisition of The Fuelcard Company in 2019 strengthened its position in the European market.

- Acquisition Integration: Fleetcor prioritizes the smooth integration of acquired companies, ensuring that the benefits of the acquisition are realized quickly. This includes retaining key personnel, leveraging existing infrastructure, and aligning acquired operations with Fleetcor’s overall strategy.

Effectiveness of Growth Strategies

Fleetcor’s growth strategies have been highly effective, driving significant revenue growth and market share gains. The company’s focus on innovation, strategic acquisitions, and global expansion has positioned it as a leading player in the payments industry.

- Revenue Growth: Fleetcor has consistently achieved strong revenue growth, driven by both organic expansion and acquisitions. The company’s revenue has grown at a compound annual growth rate (CAGR) of over 20% in recent years.

- Market Share Gains: Fleetcor has gained significant market share in its core markets, fueled by its innovative products, strong customer relationships, and effective growth strategies.

Risks and Opportunities

While Fleetcor’s growth strategies have been successful, the company faces certain risks and opportunities that could impact its long-term sustainability.

- Competition: The payments industry is highly competitive, with a large number of players vying for market share. Fleetcor faces competition from traditional financial institutions, fintech companies, and other specialized payment providers.

- Technological Disruption: The rapid pace of technological innovation could disrupt the payments industry, creating new opportunities and challenges for Fleetcor. The emergence of new technologies, such as blockchain and cryptocurrency, could potentially impact the company’s business model.

- Regulatory Environment: The payments industry is subject to a complex and evolving regulatory environment, which can impact Fleetcor’s operations and profitability. The company must navigate these regulations effectively to ensure compliance and maintain its competitive advantage.

- Economic Conditions: Global economic conditions can impact Fleetcor’s business, particularly in industries such as transportation and logistics. Economic downturns can lead to reduced spending on fuel and other expenses, impacting the company’s revenue.

- Integration Challenges: Successfully integrating acquired companies can be challenging, requiring careful planning and execution. If integration is not handled effectively, it can lead to disruptions and impact the benefits of the acquisition.

Corporate Social Responsibility

Fleetcor Technologies recognizes its responsibility to operate ethically and sustainably, contributing positively to the communities and environment it serves. The company’s commitment to corporate social responsibility (CSR) is reflected in its policies, practices, and initiatives, which aim to create a positive impact on its stakeholders.

Environmental Sustainability

Fleetcor Technologies is committed to reducing its environmental footprint through various initiatives.

- The company actively promotes energy efficiency in its operations, including the use of renewable energy sources, reducing paper consumption, and implementing recycling programs.

- Fleetcor is also committed to reducing its carbon emissions through initiatives such as promoting fuel-efficient driving practices and investing in green technologies.

Ethical Business Conduct

Fleetcor Technologies operates with the highest ethical standards, adhering to a strong code of conduct that emphasizes integrity, transparency, and accountability.

- The company has implemented robust compliance programs to ensure ethical business practices across all its operations, including anti-bribery and anti-corruption policies.

- Fleetcor Technologies also emphasizes diversity and inclusion in its workforce, creating a welcoming and equitable environment for all employees.

Community Engagement

Fleetcor Technologies actively engages with its local communities through various initiatives.

- The company supports charitable organizations and non-profits that align with its values, focusing on areas such as education, healthcare, and social development.

- Fleetcor also encourages its employees to volunteer their time and skills to local community projects, fostering a culture of giving back.

Future Outlook

Fleetcor Technologies is well-positioned for continued growth in the coming years, driven by several key factors. The company’s focus on providing innovative and essential payment solutions for businesses, coupled with its strong financial performance and strategic acquisitions, sets the stage for a promising future.

Growth Trajectory

Fleetcor Technologies is expected to continue its growth trajectory, driven by the increasing adoption of digital payments and the expansion of its product offerings. The company’s focus on niche markets and its ability to develop innovative solutions will further contribute to its growth. The company is also expanding its global reach, with a particular focus on emerging markets.

Competitive Landscape

Fleetcor Technologies operates in a competitive landscape, with several players vying for market share. However, the company has a strong brand reputation, a diversified product portfolio, and a robust financial position, which gives it a competitive edge. The company’s focus on innovation and customer satisfaction will be crucial in maintaining its market leadership.

Industry Trends

The payments industry is undergoing significant transformation, driven by technological advancements, changing consumer preferences, and the rise of digital commerce. Fleetcor Technologies is well-positioned to capitalize on these trends by leveraging its expertise in payment processing, data analytics, and customer relationship management.

Key Factors Impacting Future Performance

- Economic Conditions: The company’s performance is sensitive to economic conditions, particularly in its core markets. A slowdown in economic activity could negatively impact demand for its products and services.

- Competition: The emergence of new competitors and the increasing competition from established players could put pressure on Fleetcor Technologies’ market share and profitability.

- Regulatory Changes: Changes in regulations, particularly those related to data privacy and security, could impact the company’s operations and costs.

- Technological Advancements: The rapid pace of technological advancements could create new opportunities for Fleetcor Technologies but also pose challenges in keeping up with the latest trends.

- Cybersecurity Threats: The company is exposed to cybersecurity threats, which could disrupt its operations and damage its reputation.

Long-Term Prospects

Despite the challenges, Fleetcor Technologies has a strong foundation for long-term growth. The company’s focus on innovation, customer satisfaction, and strategic acquisitions will enable it to navigate the evolving payments landscape and capitalize on emerging opportunities. The company’s commitment to corporate social responsibility and its positive brand image will also be important in attracting and retaining customers and investors.

End of Discussion

Fleetcor Technologies’ commitment to innovation, coupled with its robust business model and focus on customer satisfaction, positions the company for continued growth and success in the evolving payment solutions landscape. As businesses increasingly seek to optimize their operations and manage costs effectively, Fleetcor’s comprehensive suite of products and services is well-positioned to meet these demands. The company’s dedication to corporate social responsibility further enhances its reputation and reinforces its commitment to sustainable and ethical business practices.

Fleetcor Technologies Operating Co LLC is a leading provider of payment processing solutions, but their expertise extends beyond just financial transactions. They understand the importance of efficient operations, which is why they might even recommend looking into solutions like universal lighting technologies ballast for energy-saving and long-lasting illumination.

After all, a well-lit environment can contribute to a more productive workforce, ultimately benefiting Fleetcor’s clients and their bottom line.