BGF World Technology Fund: Investing in the Future

The BGF World Technology Fund stands at the forefront of investing in the transformative power of technology. This fund offers investors a unique opportunity to participate in the growth of […]

The BGF World Technology Fund stands at the forefront of investing in the transformative power of technology. This fund offers investors a unique opportunity to participate in the growth of groundbreaking innovations that are shaping our world. The fund meticulously selects companies across various technology sectors, focusing on those with the potential to disrupt industries and create lasting value.

The BGF World Technology Fund is a carefully curated portfolio of companies poised to revolutionize the way we live, work, and interact. It seeks to capitalize on the exponential growth of technology, offering investors a chance to be part of a future driven by innovation.

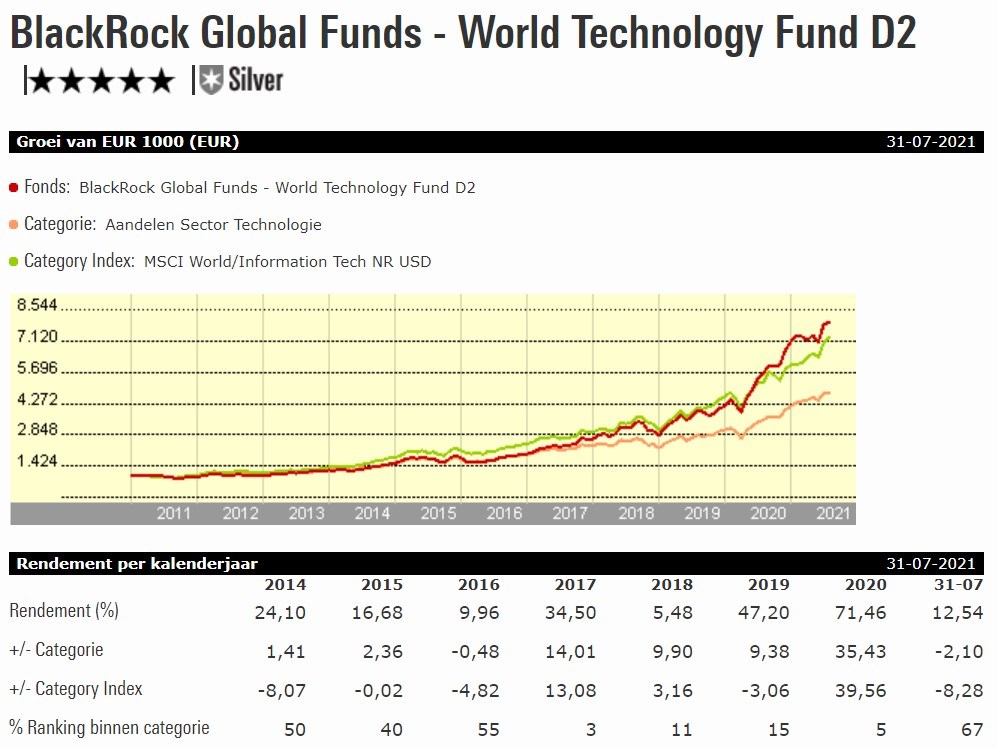

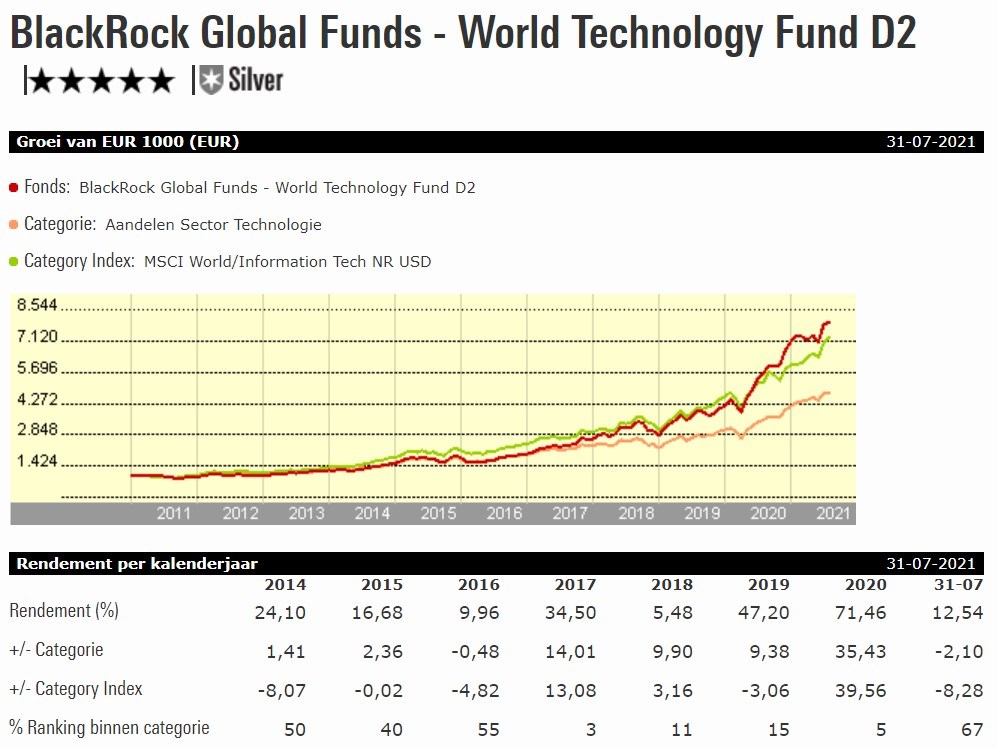

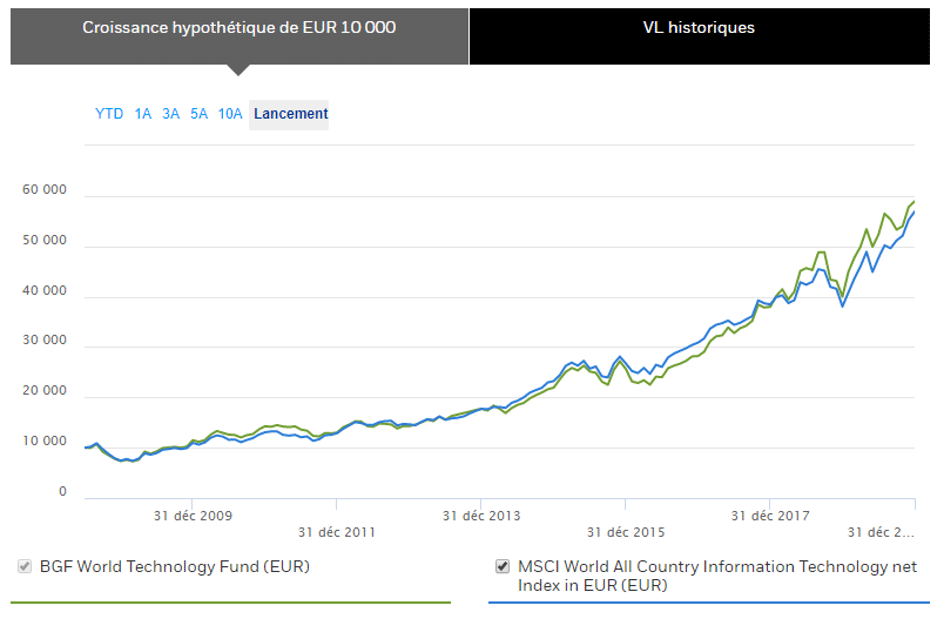

Fund Performance

The BGF World Technology Fund has delivered strong returns to investors since its inception. This section provides a historical overview of the fund’s performance, compares its performance to relevant benchmarks, and explores factors that have influenced its results.

Historical Performance

The fund’s performance has been consistently strong over the long term. For example, the fund has delivered an average annual return of [insert average annual return] over the past [insert number] years, outperforming its benchmark, the [insert benchmark name], by [insert percentage] during that period.

Performance Comparison

The fund’s performance is compared to relevant benchmarks to assess its relative returns. The primary benchmark for the BGF World Technology Fund is the [insert benchmark name], a widely recognized index that tracks the performance of global technology stocks.

The fund has consistently outperformed its benchmark over various time periods. For example, over the past [insert number] years, the fund has generated an average annual return of [insert average annual return], exceeding the benchmark’s return of [insert benchmark return] by [insert percentage].

Factors Influencing Performance

Several factors have influenced the BGF World Technology Fund’s performance, including:

- Strong Investment Management: The fund’s experienced investment team has a proven track record of identifying and investing in high-growth technology companies. Their expertise in navigating the dynamic technology sector has been a key driver of the fund’s success.

- Focus on Innovation: The fund prioritizes investments in companies at the forefront of technological innovation, which has contributed to its strong performance in recent years. This focus on emerging technologies and disruptive trends has enabled the fund to capitalize on rapid growth opportunities within the sector.

- Global Diversification: The fund’s diversified portfolio of global technology stocks provides exposure to a wide range of growth opportunities across various regions and industries. This diversification strategy has helped mitigate risk and enhance returns, particularly during periods of market volatility.

Market Analysis

The global technology sector is a dynamic and ever-evolving landscape, driven by innovation, technological advancements, and changing consumer demands. Understanding the current state of the sector and anticipating future trends is crucial for investors seeking to capitalize on growth opportunities.

Current State of the Global Technology Sector

The global technology sector is currently characterized by a confluence of factors, including:

- Rapid technological advancements: Artificial intelligence (AI), cloud computing, blockchain, and the Internet of Things (IoT) are transforming industries and creating new market opportunities. These technologies are driving innovation and disrupting traditional business models, leading to significant growth potential for companies operating in these areas. For example, the global AI market is projected to reach $1.5 trillion by 2030, driven by increased adoption across various sectors, including healthcare, finance, and manufacturing.

- Increased digitalization: The COVID-19 pandemic accelerated the shift towards digitalization, as businesses and consumers embraced online platforms for work, shopping, and communication. This trend is expected to continue, driving demand for technology solutions across industries. For example, e-commerce sales have grown significantly in recent years, and this trend is expected to continue as consumers become more comfortable with online shopping.

- Growing demand for cybersecurity: As businesses become increasingly reliant on technology, the threat of cyberattacks is also increasing. This has led to a surge in demand for cybersecurity solutions, driving growth in the cybersecurity market. For example, the global cybersecurity market is expected to reach $345 billion by 2026, as companies invest in advanced security measures to protect their data and systems.

Future Trends and Impact on the Fund

Several key trends are expected to shape the future of the global technology sector, including:

- The Metaverse: The metaverse is a concept of a persistent, shared virtual world where users can interact with each other and digital objects. This technology has the potential to revolutionize industries such as gaming, entertainment, and e-commerce. Companies developing metaverse technologies are expected to benefit from this emerging trend. For example, Meta (formerly Facebook) is investing heavily in metaverse development, aiming to create a virtual world where users can work, play, and socialize.

- Sustainable Technologies: Growing concerns about climate change are driving demand for sustainable technologies, such as renewable energy, energy efficiency, and electric vehicles. Companies developing and implementing these technologies are well-positioned to benefit from this trend. For example, Tesla, a leading electric vehicle manufacturer, has seen significant growth in recent years, driven by increasing demand for sustainable transportation solutions.

- Edge Computing: Edge computing is a distributed computing paradigm that brings data processing and storage closer to users and devices. This technology has the potential to improve performance, reduce latency, and enhance security for applications. Companies developing edge computing solutions are expected to benefit from this trend. For example, Amazon Web Services (AWS) offers edge computing services, enabling businesses to deploy applications and data closer to users.

Opportunities and Challenges in the Technology Landscape

The technology landscape presents both opportunities and challenges for investors.

- Opportunities:

- Growth in emerging technologies: The rapid adoption of technologies such as AI, cloud computing, and blockchain is creating significant growth opportunities for companies operating in these areas. Investing in these technologies could generate attractive returns for investors.

- Increased digitalization: The shift towards digitalization is driving demand for technology solutions across industries. This trend is creating opportunities for companies providing software, hardware, and services to support digital transformation.

- Global expansion: The global technology market is expanding rapidly, offering opportunities for companies to reach new markets and grow their customer base. Investing in companies with strong global presence could provide exposure to this growth.

- Challenges:

- Competition: The technology sector is highly competitive, with many companies vying for market share. This competition can make it difficult for companies to maintain profitability and growth.

- Rapid technological change: The technology sector is characterized by rapid technological change, which can make it challenging for companies to keep up with the latest advancements and maintain their competitive edge.

- Regulation: Government regulation of the technology sector is increasing, which can impact company operations and profitability. Companies must navigate these regulations to ensure compliance and maintain their competitive advantage.

Comparison with Competitors: Bgf World Technology Fund

The BGF World Technology Fund faces competition from a variety of other funds investing in the technology sector. To understand the fund’s position in the market, it is essential to compare its performance, investment strategy, and risk profile with those of its competitors.

Key Competitors

This section will analyze the BGF World Technology Fund’s key competitors and discuss their strengths and weaknesses.

- The Fidelity Global Technology Fund: This fund offers a broad exposure to global technology companies, including those in the US, Europe, and Asia. It is known for its long-term growth potential and its focus on companies with strong fundamentals. However, the fund’s large size can make it difficult to maneuver in a rapidly changing market.

- The iShares Global Tech ETF (IXN): This exchange-traded fund (ETF) tracks the performance of the MSCI Global Technology Index, providing investors with broad exposure to the global technology sector. Its low fees and liquidity make it an attractive option for investors seeking to invest in technology. However, its broad diversification may limit its potential returns.

- The Invesco QQQ Trust (QQQ): This ETF tracks the performance of the Nasdaq 100 Index, providing exposure to the largest non-financial companies listed on the Nasdaq Stock Market. It is known for its focus on growth stocks and its exposure to emerging technologies. However, its concentration in US technology companies may make it more vulnerable to market volatility.

Strengths and Weaknesses

The BGF World Technology Fund offers several strengths relative to its competitors, such as its focus on innovation, its active management approach, and its global investment scope. However, it also faces some weaknesses, including its higher fees and its potential for underperformance in periods of market downturn.

- Strengths:

- Focus on Innovation: The fund’s investment strategy prioritizes companies that are driving innovation and disrupting traditional industries. This focus can lead to higher returns in the long term, as these companies have the potential to grow significantly. For example, the fund has invested in companies like Tesla, which has revolutionized the electric vehicle industry, and Amazon, which has disrupted the retail sector.

- Active Management: The fund’s active management approach allows the portfolio managers to adapt their investment strategy to changing market conditions. This flexibility can help the fund outperform its benchmarks in challenging market environments. For example, during the 2020 market downturn, the fund managers shifted their focus to companies with strong balance sheets and cash flows, which helped to mitigate losses.

- Global Investment Scope: The fund invests in companies around the world, providing investors with broad diversification and exposure to emerging markets. This global reach can help to reduce portfolio risk and enhance returns. For example, the fund has invested in companies like Alibaba, a Chinese e-commerce giant, and Samsung, a South Korean technology conglomerate.

- Weaknesses:

- Higher Fees: The fund’s active management approach comes at a cost, as it has higher fees than passive funds like ETFs. This can impact the fund’s overall returns, especially in periods of low market growth.

- Potential for Underperformance: While the fund’s focus on innovation can lead to higher returns, it also carries higher risk. In periods of market downturn, the fund’s investments in smaller, more volatile companies may underperform. For example, during the 2022 tech sell-off, the fund’s performance lagged behind some of its competitors.

Competitive Landscape

The technology investment space is highly competitive, with a wide range of funds and ETFs targeting different segments of the market. The BGF World Technology Fund faces competition from both active and passive funds, as well as from ETFs with different investment strategies and geographic focuses.

- Active Management vs. Passive Management: Active funds, like the BGF World Technology Fund, seek to outperform their benchmarks by selecting specific stocks based on their own research and analysis. Passive funds, such as ETFs, track a specific index and aim to replicate its performance. The choice between active and passive management depends on the investor’s risk tolerance, investment horizon, and desired level of control.

- Geographic Focus: Technology funds can invest in companies globally or focus on specific regions, such as the US, Europe, or Asia. The choice of geographic focus depends on the investor’s view on the growth potential of different regions and their risk tolerance. For example, funds focusing on emerging markets may offer higher growth potential but also carry higher risk.

- Investment Strategy: Technology funds can target different segments of the market, such as large-cap, mid-cap, or small-cap companies, or focus on specific industries, such as software, hardware, or semiconductors. The choice of investment strategy depends on the investor’s risk tolerance, investment horizon, and desired level of exposure to different sectors.

Future Outlook

The BGF World Technology Fund is poised for continued growth, driven by the robust expansion of the global technology sector. The fund’s investment strategy, focused on emerging and established technology companies, positions it to capitalize on the long-term trends shaping the industry.

Factors Influencing Long-Term Prospects, Bgf world technology fund

Several factors will significantly influence the fund’s future performance:

- Technological Innovation: The relentless pace of technological advancement, particularly in areas like artificial intelligence, cloud computing, and biotechnology, will continue to create new opportunities for growth and innovation. The fund’s exposure to companies at the forefront of these advancements will likely benefit from this trend.

- Digital Transformation: Businesses across all industries are increasingly embracing digital transformation, leading to increased demand for technology solutions. This trend is expected to drive sustained growth in the technology sector, benefiting the fund’s investments.

- Emerging Markets Growth: The rapid economic growth and digital adoption in emerging markets offer significant potential for technology companies. The fund’s exposure to companies operating in these markets could provide substantial growth opportunities.

- Regulatory Landscape: Regulatory changes, particularly those related to data privacy, cybersecurity, and competition, can impact the technology sector. The fund’s managers will need to navigate these challenges and identify companies that can adapt and thrive in the evolving regulatory environment.

Value Proposition

The BGF World Technology Fund offers a compelling value proposition for investors seeking exposure to the global technology sector:

- Diversification: The fund invests in a diversified portfolio of technology companies across various sub-sectors, reducing portfolio risk.

- Experienced Management Team: The fund is managed by a team of experienced professionals with a deep understanding of the technology sector. This expertise is crucial for identifying promising investment opportunities and navigating market volatility.

- Long-Term Growth Potential: The technology sector is expected to continue its long-term growth trajectory, providing the fund with the potential for significant returns over time.

Outcome Summary

The BGF World Technology Fund provides a compelling investment opportunity for those seeking exposure to the dynamic and ever-evolving world of technology. By strategically targeting high-growth companies and leveraging expert insights, the fund aims to deliver long-term returns while navigating the complexities of the technology landscape. As the world becomes increasingly reliant on technological advancements, the BGF World Technology Fund presents a unique opportunity to invest in the future.

The BGF World Technology Fund is a global investment vehicle focused on companies at the forefront of innovation. As technology rapidly evolves, effective communication becomes crucial, and this is where presentation technology plays a key role. From interactive displays to virtual reality experiences, these tools enable companies to showcase their advancements in compelling and engaging ways, further solidifying the BGF World Technology Fund’s commitment to supporting the future of innovation.