Prop Firm Technology: Shaping the Future of Trading

Prop firm technology has revolutionized the world of trading, enabling firms to leverage cutting-edge tools and strategies to gain a competitive edge. From advanced trading platforms to sophisticated risk management […]

Prop firm technology has revolutionized the world of trading, enabling firms to leverage cutting-edge tools and strategies to gain a competitive edge. From advanced trading platforms to sophisticated risk management systems, technology plays a pivotal role in prop firm operations, driving efficiency, accuracy, and profitability.

This article delves into the fascinating world of prop firm technology, exploring the key aspects that shape its evolution and impact. We will examine the diverse range of technologies employed by prop firms, from powerful trading platforms to sophisticated data analytics tools, and explore how these innovations are transforming the trading landscape.

Prop Firm Technology

Prop trading firms, or proprietary trading firms, are financial institutions that trade securities using their own capital. They are distinct from traditional investment banks, which typically act as intermediaries between buyers and sellers. Prop firms rely heavily on technology to gain an edge in the competitive trading world.

Role of Technology in Prop Trading Firms

Technology plays a crucial role in the success of prop trading firms, enabling them to:

* Execute trades quickly and efficiently: High-frequency trading (HFT) algorithms and sophisticated order routing systems are essential for prop firms to execute trades at the best possible prices.

* Manage risk effectively: Prop firms use risk management systems to monitor and control their exposure to market volatility. These systems use advanced analytics to identify and mitigate potential risks.

* Analyze data and identify trading opportunities: Prop firms leverage data analytics tools to analyze vast amounts of market data, identify patterns, and generate trading signals. This helps them make informed trading decisions and capitalize on market opportunities.

* Automate trading processes: Automation helps prop firms streamline their operations, reduce manual errors, and increase efficiency. This includes automating tasks like order entry, trade execution, and risk monitoring.

* Improve communication and collaboration: Prop firms utilize collaboration platforms and communication tools to facilitate seamless communication and information sharing among their traders and analysts.

Key Aspects of Prop Firm Technology

Prop firm technology encompasses various tools and systems that enable efficient and profitable trading operations. Some key aspects include:

* Trading Platforms: Prop firms use specialized trading platforms that provide access to multiple markets, real-time market data, order execution capabilities, and advanced charting tools. These platforms are designed for speed, efficiency, and reliability, enabling traders to react quickly to market changes.

* Risk Management Systems: Risk management is paramount for prop firms, and sophisticated systems are employed to monitor and control risk exposure. These systems track positions, analyze market data, and implement risk mitigation strategies to minimize losses.

* Data Analytics Tools: Prop firms utilize data analytics tools to analyze vast amounts of market data, identify trends, and generate trading signals. These tools employ machine learning algorithms, statistical models, and other advanced techniques to extract valuable insights from data.

Examples of Successful Prop Firms and their Technological Innovations

Several prop firms have achieved success by leveraging cutting-edge technology. Some notable examples include:

* Renaissance Technologies: This firm is renowned for its use of quantitative analysis and machine learning algorithms to identify and exploit market inefficiencies. They have developed sophisticated trading models and algorithms that have generated significant returns.

* Jane Street: Known for its innovative use of technology, Jane Street has developed its own trading platform and infrastructure. They utilize advanced algorithms, high-frequency trading strategies, and sophisticated risk management systems.

* Two Sigma: Two Sigma is a quantitative hedge fund that heavily relies on data science and technology. They have built a team of data scientists, mathematicians, and engineers to develop advanced trading models and algorithms.

Trading Platforms and Infrastructure

Prop firms provide their traders with access to sophisticated trading platforms and infrastructure, which are essential for executing trades, managing risk, and accessing market data. The choice of trading platform significantly impacts a trader’s overall performance and success.

Comparison of Trading Platforms

Prop firms typically offer a range of trading platforms to cater to different trading styles and preferences. Some popular platforms include MetaTrader 4 (MT4), MetaTrader 5 (MT5), cTrader, and proprietary platforms developed by the prop firm itself. Each platform has its own strengths and weaknesses, and the best choice for a trader depends on their individual needs and trading strategy.

- MetaTrader 4 (MT4): A widely used platform known for its user-friendly interface, extensive customization options, and robust charting capabilities. MT4 is popular among scalpers and day traders due to its fast order execution and low latency. However, it lacks some advanced features found in newer platforms, such as algorithmic trading capabilities.

- MetaTrader 5 (MT5): An updated version of MT4 with improved functionality and features. MT5 offers more advanced charting tools, a wider range of technical indicators, and support for algorithmic trading. However, it can be more complex to use than MT4, and its adoption rate is still relatively lower.

- cTrader: A platform designed for professional traders, offering advanced features like order routing, real-time market data, and customizable charting. cTrader is particularly well-suited for scalpers and high-frequency traders due to its fast order execution and low latency. However, it may not be as user-friendly for beginners.

- Proprietary Platforms: Some prop firms develop their own trading platforms, tailored to their specific requirements and the needs of their traders. These platforms can offer unique features and functionalities not found in other platforms, but they may be less widely used and may require more training to learn.

Features and Functionalities of Advanced Trading Platforms

Advanced trading platforms are designed to provide traders with the tools and resources they need to make informed trading decisions and execute trades efficiently. Key features include:

- Order Routing: This feature allows traders to route their orders to different liquidity providers, ensuring they get the best possible price for their trades. It also helps reduce slippage and improve order execution speed.

- Real-Time Market Data: Access to real-time market data is crucial for traders to make informed decisions. Advanced platforms provide live quotes, charts, and news feeds, giving traders a comprehensive view of the market.

- Algorithmic Trading Capabilities: Algorithmic trading allows traders to automate their trading strategies, executing trades based on pre-defined rules. This can help improve efficiency, reduce emotional bias, and increase trading accuracy.

- Risk Management Tools: Advanced platforms offer risk management tools such as stop-loss orders, trailing stops, and position limits, helping traders control their risk exposure and protect their capital.

- Backtesting and Optimization: These features allow traders to test their trading strategies on historical data, identify potential weaknesses, and optimize their performance.

- Customizable Charts and Indicators: Advanced platforms provide traders with a wide range of charting tools and technical indicators, enabling them to analyze market data and identify trading opportunities.

- Trade Analysis and Reporting: These features help traders track their performance, analyze their trading activity, and identify areas for improvement.

Key Characteristics of Popular Prop Firm Trading Platforms

| Platform | Strengths | Weaknesses |

|---|---|---|

| MetaTrader 4 (MT4) | User-friendly interface, extensive customization options, robust charting capabilities, fast order execution, low latency. | Limited advanced features, such as algorithmic trading capabilities. |

| MetaTrader 5 (MT5) | More advanced charting tools, wider range of technical indicators, support for algorithmic trading. | More complex to use than MT4, lower adoption rate. |

| cTrader | Advanced features like order routing, real-time market data, customizable charting, fast order execution, low latency. | May not be as user-friendly for beginners. |

| Proprietary Platforms | Unique features and functionalities tailored to specific requirements, can offer better support and integration with prop firm services. | Less widely used, may require more training to learn. |

Risk Management and Compliance: Prop Firm Technology

Prop firms are in the business of managing risk, and they take this responsibility seriously. They employ a variety of risk management practices to protect both their own interests and the interests of their traders. These practices are essential for ensuring the financial stability of the firm and maintaining a safe and compliant trading environment.

Risk Management Practices

Prop firms employ a wide range of risk management practices to mitigate potential losses and ensure the financial stability of the firm.

- Position Limits: Prop firms set position limits to restrict the maximum size of trades that a trader can take. This helps to prevent traders from taking on excessive risk that could jeopardize the firm’s capital. Position limits are often determined by factors such as the trader’s experience, trading strategy, and the current market conditions.

- Margin Requirements: Prop firms require traders to deposit margin, which acts as a buffer against potential losses. Margin requirements are calculated based on the size of the trade and the volatility of the underlying asset. This helps to ensure that traders have sufficient funds to cover their losses if their trades go against them.

- Stop-Loss Orders: Stop-loss orders are automated orders that are placed to limit potential losses on a trade. When the price of an asset reaches a predetermined level, the stop-loss order is triggered, and the trade is automatically closed. This helps to prevent traders from incurring significant losses on a single trade.

- Risk Monitoring: Prop firms use sophisticated risk management software to monitor their traders’ positions and activities in real time. This software can identify potential risk exposures and alert the firm’s risk management team to take appropriate action. Risk monitoring is essential for ensuring that traders are adhering to the firm’s risk management policies and procedures.

- Stress Testing: Prop firms conduct stress tests to evaluate their risk management practices and identify potential weaknesses in their systems. Stress tests involve simulating extreme market conditions and analyzing the firm’s ability to withstand these scenarios. This helps to ensure that the firm’s risk management practices are robust and can effectively mitigate risk in a variety of market environments.

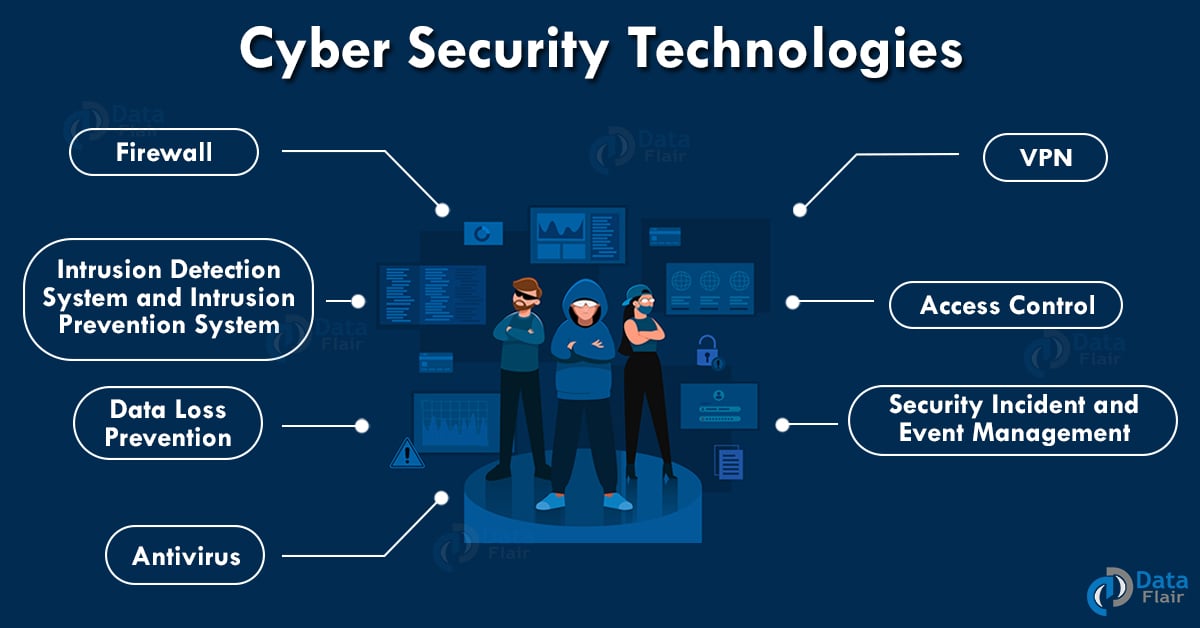

Technology in Risk Management, Prop firm technology

Technology plays a crucial role in risk management for prop firms. It allows them to automate many of their risk management processes, improve their efficiency, and gain a deeper understanding of their traders’ activities.

- Real-time Monitoring: Technology enables prop firms to monitor their traders’ positions and activities in real time. This provides them with a continuous view of their traders’ risk exposures and allows them to identify potential problems early on. Real-time monitoring is essential for ensuring that traders are adhering to the firm’s risk management policies and procedures.

- Automated Risk Management: Technology can be used to automate many of the firm’s risk management processes, such as setting position limits, calculating margin requirements, and executing stop-loss orders. This frees up the firm’s risk management team to focus on more strategic tasks. Automation can also help to improve the accuracy and consistency of risk management processes.

- Advanced Analytics: Prop firms use advanced analytics to identify patterns and trends in their traders’ activities. This data can be used to improve risk management practices, develop new trading strategies, and identify potential areas of risk. Advanced analytics can also help to ensure that the firm’s risk management practices are aligned with the latest market trends.

Regulatory Landscape and Compliance

Prop firms are subject to a variety of regulations and compliance requirements, which vary depending on the firm’s location and the types of financial products it offers.

- Anti-Money Laundering (AML) Regulations: Prop firms are required to comply with AML regulations to prevent money laundering and terrorist financing. This includes verifying the identity of their clients, monitoring their transactions, and reporting suspicious activity.

- Know Your Customer (KYC) Regulations: Prop firms are required to comply with KYC regulations to understand their clients’ financial profiles and trading activities. This includes collecting information about their clients’ identity, source of funds, and trading objectives.

- Financial Conduct Authority (FCA) Regulations: In the UK, prop firms are subject to the FCA’s regulations, which cover a wide range of topics, including capital adequacy, risk management, and client protection. The FCA’s regulations are designed to ensure that prop firms operate in a fair, transparent, and responsible manner.

- Securities and Exchange Commission (SEC) Regulations: In the US, prop firms are subject to the SEC’s regulations, which cover a wide range of topics, including securities trading, market manipulation, and insider trading. The SEC’s regulations are designed to protect investors and ensure that the securities markets are fair and efficient.

Data Analytics and Insights

Prop firms heavily rely on data analytics to gain a competitive edge in the financial markets. They utilize data-driven insights to enhance trading strategies, optimize risk management, and improve overall performance. This section delves into how prop firms leverage data analytics and the various types of data they collect.

Types of Data Collected

Prop firms collect a vast amount of data to fuel their analytical models and decision-making processes. This data can be categorized into three main types:

- Market Data: This includes real-time and historical data on various financial instruments, such as stock prices, exchange rates, interest rates, and commodity prices. Prop firms use this data to understand market trends, identify trading opportunities, and assess market volatility.

- Trade Data: Prop firms collect detailed information about their own trades, including order entries, execution times, trade sizes, and profit/loss data. This data is crucial for analyzing trading performance, identifying patterns, and optimizing trading strategies.

- Performance Data: This encompasses data on the overall performance of traders and trading strategies, including win rates, average profits, risk-adjusted returns, and drawdown periods. Prop firms use this data to evaluate trader performance, identify areas for improvement, and make informed decisions about resource allocation.

Data Analytics Applications

Prop firms utilize data analytics for various purposes, including:

- Market Analysis: By analyzing historical market data, prop firms can identify recurring patterns, seasonal trends, and correlations between different financial instruments. This knowledge allows them to anticipate market movements and develop more informed trading strategies.

- Risk Assessment: Data analytics helps prop firms quantify and manage trading risks. They use historical data to calculate risk metrics such as volatility, correlation, and drawdown, which inform their risk management policies and trading limits.

- Performance Optimization: Prop firms leverage data analytics to continuously improve the performance of their trading strategies. They analyze trade data and performance data to identify areas where strategies can be refined, risk can be mitigated, and profitability can be maximized.

Examples of Data Analytics in Prop Firms

Here are some specific examples of how prop firms utilize data analytics:

- Algorithmic Trading: Prop firms develop and deploy sophisticated algorithms that automate trading decisions based on real-time market data. These algorithms can identify and execute profitable trading opportunities at high speeds, surpassing human capabilities.

- Sentiment Analysis: Prop firms use natural language processing (NLP) techniques to analyze news articles, social media posts, and other forms of text data to gauge market sentiment. This information can provide valuable insights into potential market movements.

- Machine Learning for Risk Management: Prop firms employ machine learning models to predict market volatility and identify potential risk events. These models can help them adjust trading positions and manage risk more effectively.

Last Word

As technology continues to advance, prop firms are poised to embrace even more innovative solutions. From the adoption of artificial intelligence and machine learning to the integration of blockchain and cloud computing, the future of prop firm technology holds immense potential for further growth and disruption. By harnessing these advancements, prop firms can continue to optimize their operations, enhance their trading strategies, and navigate the ever-evolving financial markets with greater precision and efficiency.

Prop firm technology is constantly evolving, seeking to provide traders with the tools and infrastructure they need to succeed. One company that plays a crucial role in this field is trane technologies panama city fl , which provides innovative HVAC solutions that ensure optimal performance and efficiency in prop firm offices, creating a conducive environment for traders to focus on their craft.