Private Equity and Technology: A Growing Intersection

Private equity and technology are increasingly intertwined, creating a dynamic landscape where traditional investment strategies meet the rapid pace of innovation. The rise of technology has fundamentally reshaped the private […]

Private equity and technology are increasingly intertwined, creating a dynamic landscape where traditional investment strategies meet the rapid pace of innovation. The rise of technology has fundamentally reshaped the private equity industry, driving a shift towards investments in software, artificial intelligence, and other cutting-edge sectors.

This convergence has been fueled by several factors, including the rapid advancement of technology, the growing demand for digital solutions, and the emergence of new business models that rely heavily on technology. As a result, private equity firms are actively seeking opportunities to capitalize on the transformative power of technology, investing in companies that are driving innovation and shaping the future of various industries.

The Intersection of Private Equity and Technology

Private equity and technology have been converging for several years, creating a powerful force in the global economy. This convergence is driven by a confluence of factors, including the rapid pace of technological innovation, the increasing digitization of businesses, and the emergence of new technology-driven industries.

The Growing Influence of Technology in Private Equity

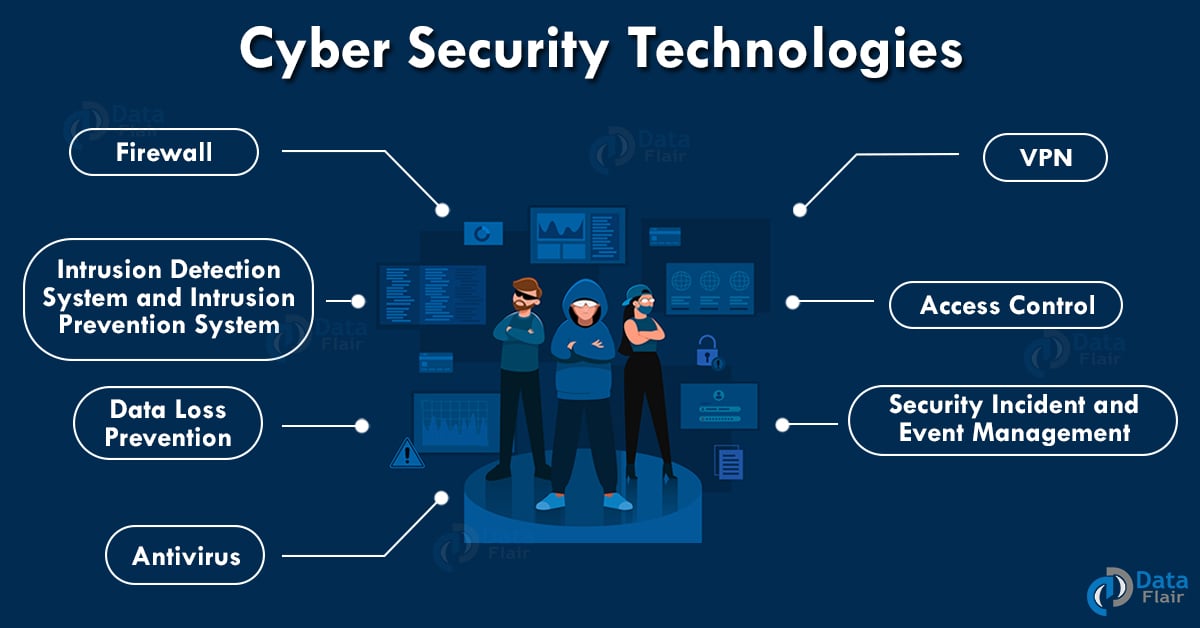

Technology has become a critical factor in the private equity landscape, influencing investment strategies, deal sourcing, portfolio management, and exit strategies. Private equity firms are increasingly focusing on technology-enabled businesses, recognizing the potential for high growth and returns. This shift has led to a surge in investments in technology sectors such as software, e-commerce, artificial intelligence, and cybersecurity.

Key Drivers of the Convergence

- Technological Advancements: The rapid pace of technological innovation, particularly in areas like artificial intelligence, cloud computing, and data analytics, is creating new opportunities for businesses and investors. Private equity firms are actively seeking investments in companies that leverage these advancements to disrupt traditional industries or create new markets.

- Digital Transformation: Businesses across all sectors are undergoing digital transformation, adopting new technologies to improve efficiency, enhance customer experiences, and gain a competitive advantage. Private equity firms are capitalizing on this trend by investing in companies that are leading the digital transformation journey.

- Emergence of New Industries: The rise of new technology-driven industries, such as fintech, e-commerce, and ride-sharing, has created a fertile ground for private equity investments. These industries are characterized by rapid growth, innovation, and disruption, attracting significant capital from private equity firms.

Impact of Technology on Private Equity Operations

The private equity industry has witnessed a significant transformation fueled by technological advancements. From deal sourcing to portfolio management, technology has become an indispensable tool for private equity firms seeking to optimize operations, enhance efficiency, and gain a competitive edge.

Data Analytics and Artificial Intelligence in Deal Sourcing

Data analytics and artificial intelligence (AI) have revolutionized deal sourcing by enabling private equity firms to identify and evaluate potential investments more effectively. Data analytics tools can sift through vast amounts of data, including market trends, company financials, and industry reports, to identify promising investment opportunities. AI algorithms can further enhance the process by analyzing patterns and identifying potential risks and rewards associated with specific deals. For instance, AI-powered tools can analyze historical data to predict future market trends, allowing private equity firms to make informed decisions about which sectors to target.

Data Analytics and AI in Due Diligence

Technology has significantly streamlined the due diligence process, enabling private equity firms to conduct thorough investigations and mitigate risks more efficiently. Data analytics tools can analyze large datasets, including financial statements, legal documents, and industry data, to identify potential red flags and assess the financial health of target companies. AI algorithms can further enhance due diligence by automating tasks such as document review and contract analysis, freeing up time for analysts to focus on more strategic aspects of the process. For example, AI-powered tools can analyze thousands of contracts to identify potential clauses that could pose risks or liabilities, allowing private equity firms to negotiate better terms or avoid potential pitfalls.

Technology in Portfolio Management

Technology has transformed portfolio management by providing private equity firms with real-time insights into the performance of their investments. Data analytics tools can track key performance indicators (KPIs), such as revenue growth, profitability, and market share, to monitor the progress of portfolio companies. AI algorithms can further enhance portfolio management by identifying potential risks and opportunities, allowing private equity firms to make proactive decisions to optimize returns. For example, AI-powered tools can analyze real-time data to identify early warning signs of potential financial distress, allowing private equity firms to intervene early and mitigate losses.

Technology in Exit Strategies

Technology has also played a crucial role in optimizing exit strategies for private equity firms. Data analytics tools can analyze market trends and identify potential buyers for portfolio companies, while AI algorithms can predict the optimal timing for an exit based on various factors, such as market conditions and company performance. For instance, AI-powered tools can analyze historical data on mergers and acquisitions (M&A) activity to identify potential buyers and predict the likelihood of a successful transaction, allowing private equity firms to negotiate better terms and maximize returns.

Impact of Technology on Risk Management and Regulatory Compliance

Technology has enabled private equity firms to strengthen their risk management and regulatory compliance frameworks. Data analytics tools can monitor market risks, such as changes in interest rates or economic conditions, allowing private equity firms to adjust their investment strategies accordingly. AI algorithms can further enhance risk management by identifying potential fraud and compliance violations, allowing private equity firms to take proactive steps to mitigate risks and ensure compliance with relevant regulations. For example, AI-powered tools can analyze transaction data to identify potential instances of insider trading or money laundering, allowing private equity firms to take appropriate action to prevent such activities.

Challenges and Opportunities

The intersection of private equity and technology is a dynamic and rapidly evolving landscape, presenting both significant challenges and exciting opportunities. While the potential for high returns is undeniable, investors must carefully navigate the unique risks inherent in this sector.

Key Risks Associated with Investing in Technology

Understanding the key risks associated with technology investments is crucial for informed decision-making. These risks can be broadly categorized as:

- Rapid Technological Obsolescence: The rapid pace of innovation in technology can quickly render investments obsolete. A product or service that is cutting-edge today may be outdated tomorrow, leading to significant financial losses. For example, the rise of smartphones and mobile apps rapidly displaced traditional personal computers and software, impacting the value of investments in these sectors.

- Intense Competition: The technology sector is highly competitive, with numerous startups and established players vying for market share. This intense competition can make it difficult for new entrants to gain traction and achieve profitability. The rise of cloud computing platforms, such as Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform, has led to fierce competition among these giants, impacting the profitability of smaller players.

- Cybersecurity Threats: Cybersecurity threats are a constant concern in the technology sector, as data breaches and cyberattacks can result in significant financial losses, reputational damage, and regulatory scrutiny. The recent increase in ransomware attacks, targeting critical infrastructure and businesses, highlights the growing vulnerability of technology-driven systems.

Case Studies

Private equity investments in technology companies have played a pivotal role in shaping the industry, driving innovation, and creating significant value. By analyzing notable examples, we can gain insights into the impact of these investments on both the companies themselves and the broader technology landscape.

Examples of Private Equity Investments in Technology Companies

The following table showcases notable examples of private equity investments in technology companies, highlighting the industry, investment year, investment size, and key outcomes:

| Company Name | Industry | Investment Year | Investment Size | Key Outcomes |

|---|---|---|---|---|

| Dell Technologies | Computer hardware and software | 2013 | $25 billion | Dell went public in 2018, achieving a successful exit for the private equity investors. |

| Cloudera | Data analytics and cloud computing | 2014 | $1.3 billion | Cloudera went public in 2017, demonstrating the growth potential of the data analytics market. |

| Black Knight, Inc. | Mortgage technology and software | 2016 | $2.7 billion | Black Knight went public in 2017, highlighting the increasing importance of technology in the financial services industry. |

| MongoDB | NoSQL database technology | 2017 | $300 million | MongoDB went public in 2017, showcasing the growth of the database market and the demand for modern database solutions. |

| Zoom Video Communications | Video conferencing and collaboration | 2019 | $200 million | Zoom experienced rapid growth during the COVID-19 pandemic, demonstrating the potential of remote work technologies. |

Impact of Private Equity Investments on Technology Companies, Private equity and technology

Private equity investments have significantly impacted technology companies in various ways, including:

– Growth and Expansion: Private equity firms provide capital for companies to expand their operations, enter new markets, and develop new products and services.

– Strategic Guidance: Private equity firms often bring valuable expertise and strategic guidance to portfolio companies, helping them navigate complex market dynamics and make informed decisions.

– Operational Improvements: Private equity firms may implement operational improvements, such as cost optimization, process streamlining, and talent acquisition, to enhance efficiency and profitability.

– Increased Competition: Private equity investments can increase competition in the technology sector, driving innovation and forcing companies to adapt and evolve.

– Exit Strategies: Private equity firms typically have a defined exit strategy, which may involve taking a company public, selling it to another company, or merging it with another entity.

Impact of Private Equity Investments on the Broader Technology Landscape

Private equity investments have also had a significant impact on the broader technology landscape, influencing trends and shaping the industry:

– Accelerated Innovation: Private equity investments have fueled innovation in the technology sector by providing capital for research and development, supporting the creation of new technologies and solutions.

– Increased Investment in Emerging Technologies: Private equity firms have actively invested in emerging technologies, such as artificial intelligence, blockchain, and cloud computing, driving growth and adoption in these areas.

– Consolidation and Restructuring: Private equity investments have led to consolidation and restructuring in the technology sector, creating larger, more efficient companies with greater market reach.

– Increased Private Market Activity: Private equity investments have contributed to the growth of the private market, providing alternative investment opportunities for investors.

Future Trends

The intersection of private equity and technology is constantly evolving, with new trends emerging that are shaping the industry’s future. These trends are driven by advancements in technology, changing investor preferences, and evolving market dynamics. This section will explore some of the most prominent trends, including the impact of blockchain, quantum computing, and the metaverse on the industry.

Impact of Blockchain Technology

Blockchain technology has the potential to revolutionize private equity operations, offering greater transparency, efficiency, and security.

- Enhanced Transparency and Traceability: Blockchain’s immutable ledger can track all transactions and activities related to private equity investments, providing a transparent and auditable record. This increased transparency can improve investor confidence and reduce the risk of fraud.

- Streamlined Deal Execution: Smart contracts, which are self-executing agreements stored on the blockchain, can automate key processes in private equity deals, such as fund administration, capital calls, and distributions. This automation can significantly reduce transaction costs and accelerate deal execution.

- Improved Security and Risk Management: Blockchain’s decentralized nature and cryptographic security features can enhance the security of private equity transactions and protect sensitive data from cyber threats. This can reduce the risk of data breaches and improve overall risk management.

Examples of blockchain applications in private equity include:

- Tokenized Equity: Private equity firms can issue tokens representing ownership in their funds or portfolio companies on a blockchain, facilitating fractional ownership and increasing liquidity.

- Digital Asset Management: Blockchain platforms can streamline the management of digital assets, such as intellectual property and royalties, for private equity portfolio companies.

- Fundraising and Investor Relations: Blockchain can enhance fundraising efforts by providing a secure and transparent platform for investor communication and capital allocation.

Quantum Computing’s Potential

Quantum computing, with its ability to perform complex calculations at an unprecedented speed, holds immense potential for private equity.

- Enhanced Portfolio Optimization: Quantum algorithms can analyze vast datasets and identify complex patterns, allowing private equity firms to optimize their portfolio allocation and risk management strategies.

- Accelerated Due Diligence: Quantum computing can significantly reduce the time and resources required for due diligence, enabling faster deal evaluation and decision-making.

- Improved Fraud Detection: Quantum algorithms can detect anomalies and patterns in data, enabling private equity firms to identify potential fraud risks and mitigate financial losses.

While quantum computing is still in its early stages of development, its potential impact on private equity is significant. As quantum computers become more powerful and accessible, they are expected to revolutionize various aspects of the industry.

The Metaverse and Its Implications

The metaverse, a virtual reality environment where users can interact and participate in a digital world, is emerging as a new frontier for private equity.

- Investment Opportunities: The metaverse presents new investment opportunities in areas such as virtual real estate, digital assets, and immersive experiences.

- Portfolio Company Transformation: Private equity firms can support portfolio companies in leveraging the metaverse to enhance customer engagement, create new revenue streams, and develop innovative products and services.

- Operational Efficiency: The metaverse can offer opportunities for private equity firms to improve their operational efficiency by creating virtual workspaces, conducting remote meetings, and streamlining communication.

As the metaverse continues to evolve, it is expected to have a profound impact on private equity, creating new investment opportunities and transforming the way businesses operate.

Final Summary: Private Equity And Technology

The intersection of private equity and technology is a complex and dynamic landscape, presenting both challenges and opportunities for investors and entrepreneurs alike. While navigating the rapid pace of technological change and managing the inherent risks associated with emerging technologies are key considerations, the potential for growth and innovation in this space is undeniable. As technology continues to evolve, we can expect to see even more innovative investment strategies and disruptive business models emerge, further solidifying the symbiotic relationship between private equity and technology.

Private equity firms are increasingly investing in technology, recognizing the potential for disruptive innovation. This includes the healthcare sector, where the adoption of technology is rapidly changing the landscape. If you’re interested in a career in this exciting field, consider pursuing a degree in ivy tech health information technology , which will equip you with the skills needed to thrive in the evolving world of healthcare technology.

As the demand for skilled professionals in this space continues to grow, private equity firms will be looking for individuals with the expertise to lead the way in the digital transformation of healthcare.