Trading Technologies Pricing: A Comprehensive Guide

Trading technologies pricing has become increasingly complex as the financial markets evolve and new technologies emerge. This guide delves into the factors influencing pricing, explores different types of trading technologies […]

Trading technologies pricing has become increasingly complex as the financial markets evolve and new technologies emerge. This guide delves into the factors influencing pricing, explores different types of trading technologies and their cost structures, and provides insights into emerging trends shaping the future of this dynamic landscape.

From the early days of manual trading to the sophisticated algorithms and automated platforms of today, the evolution of trading technologies has been driven by innovation and the constant pursuit of efficiency. This guide examines the key factors that determine the pricing of these technologies, including the complexity of the technology, market data requirements, customization options, and the pricing models employed by various providers.

The Evolution of Trading Technologies

The evolution of trading technologies has been a fascinating journey, driven by innovation and a relentless pursuit of efficiency and speed. From the early days of manual trading to the sophisticated algorithms and high-frequency trading of today, the trading landscape has been transformed by technological advancements. Understanding this evolution is crucial for grasping the complexities and opportunities within the modern financial markets.

Early Trading Technologies and Their Limitations, Trading technologies pricing

Early trading technologies were primarily manual, relying on physical communication and human intervention. The first organized exchanges emerged in the 17th century, providing a platform for traders to meet and conduct transactions. These exchanges relied on open outcry systems, where traders would verbally announce their bids and offers, and physical hand signals were used to indicate price movements.

- Open Outcry Systems: Open outcry systems were the primary method of trading for centuries. They were characterized by verbal communication and hand signals, often resulting in confusion and delays. This manual approach was susceptible to human error, manipulation, and limitations in information dissemination.

- Telegraph and Telephone: The invention of the telegraph and telephone in the 19th century revolutionized communication, enabling traders to connect over long distances. This facilitated faster information dissemination and price discovery, but it was still limited by the speed of transmission and the reliance on human operators.

- Ticker Tapes: Ticker tapes, introduced in the late 19th century, provided real-time updates on stock prices. This innovation allowed traders to monitor market movements more closely, but the information was still limited and often delayed due to the mechanical nature of the system.

Types of Trading Technologies and Their Pricing

Trading technologies encompass a wide range of software and tools designed to streamline and enhance the trading process. These technologies are crucial for financial institutions, brokers, and individual investors alike, offering a variety of features and functionalities that can significantly impact trading outcomes. Understanding the different types of trading technologies and their associated pricing models is essential for making informed decisions about the tools that best suit your needs and budget.

Trading Technology Categories and Pricing

The pricing of trading technologies can vary significantly depending on the type of technology, the provider, and the specific features and functionalities offered. Here’s a breakdown of some common categories of trading technologies and their pricing structures:

Order Management Systems (OMS)

Order management systems (OMSs) are software applications that facilitate the management and execution of trades. They provide a centralized platform for managing orders, tracking their status, and monitoring market data.

| Feature | Functionality | Pricing Range |

|---|---|---|

| Order Routing | Directly routing orders to different exchanges or brokers | $10,000 – $100,000+ per year |

| Order Execution | Executing orders based on pre-defined criteria or algorithms | $5,000 – $50,000+ per year |

| Order Management | Tracking order status, managing order modifications, and cancellations | $5,000 – $50,000+ per year |

| Market Data | Providing real-time market data and analytics | $5,000 – $50,000+ per year |

| Reporting and Analytics | Generating reports and analyzing trading performance | $5,000 – $50,000+ per year |

The pricing of OMSs is often based on a subscription model, with fees calculated based on factors such as the number of users, the volume of trades, and the specific features and functionalities required. Some OMS providers also offer tiered pricing plans based on the level of service and support provided.

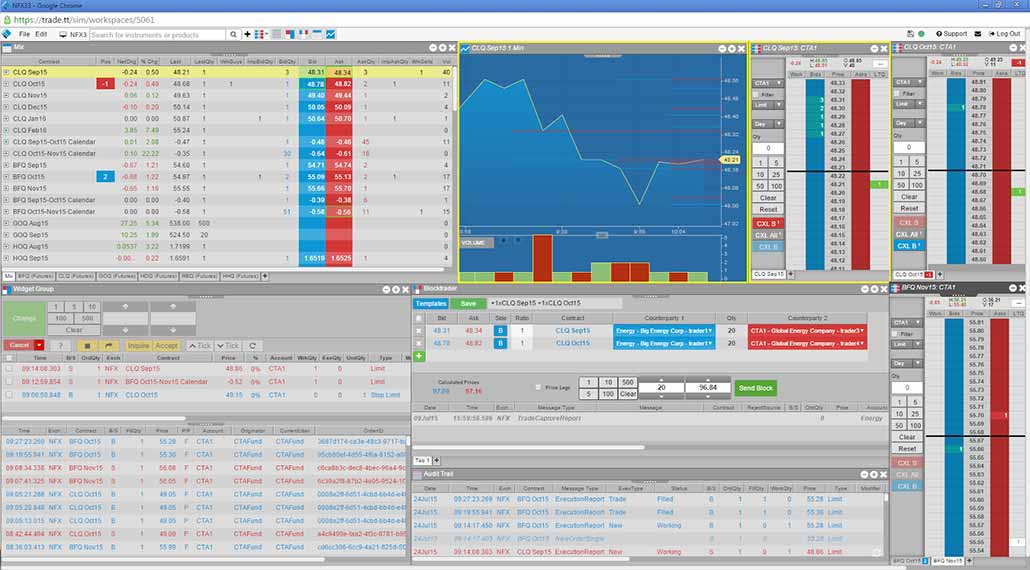

Execution Platforms

Execution platforms are specialized software applications that facilitate the execution of trades. They offer features such as order entry, order management, and real-time market data. Execution platforms can be used by both individual investors and institutional traders.

| Feature | Functionality | Pricing Range |

|---|---|---|

| Order Entry | Placing orders with specific parameters | $100 – $1,000+ per month |

| Order Management | Tracking order status, managing order modifications, and cancellations | $100 – $1,000+ per month |

| Market Data | Providing real-time market data and analytics | $100 – $1,000+ per month |

| Charting and Analysis | Providing charting tools and technical analysis indicators | $100 – $1,000+ per month |

| Automated Trading | Enabling the execution of trades based on pre-defined algorithms | $100 – $1,000+ per month |

Execution platforms are often priced on a subscription basis, with fees ranging from a few hundred dollars to several thousand dollars per month. Some providers offer tiered pricing plans based on the level of service and support provided, while others charge per-trade fees.

Risk Management Tools

Risk management tools are designed to help traders assess and manage risk. They provide features such as portfolio monitoring, position sizing, and risk analysis.

| Feature | Functionality | Pricing Range |

|---|---|---|

| Portfolio Monitoring | Tracking portfolio performance and risk exposure | $1,000 – $10,000+ per year |

| Position Sizing | Calculating optimal position sizes based on risk tolerance and market conditions | $1,000 – $10,000+ per year |

| Risk Analysis | Providing risk metrics and reports to assess potential losses | $1,000 – $10,000+ per year |

| Stress Testing | Simulating market scenarios to assess portfolio resilience | $1,000 – $10,000+ per year |

| Compliance Reporting | Generating reports to meet regulatory requirements | $1,000 – $10,000+ per year |

The pricing of risk management tools is typically based on a subscription model, with fees calculated based on the number of users, the complexity of the tools, and the level of support provided. Some providers offer tiered pricing plans based on the level of service and support required.

Cost-Benefit Analysis for Trading Technologies: Trading Technologies Pricing

Implementing trading technologies involves a significant investment, making it crucial to perform a thorough cost-benefit analysis to determine the financial viability and potential return on investment. This analysis helps in evaluating the potential benefits against the associated costs, enabling informed decision-making regarding technology adoption.

Benefits of Trading Technologies

Trading technologies offer numerous benefits that can significantly impact a firm’s financial performance.

- Improved Efficiency: Automated trading systems streamline order execution, reduce manual errors, and free up traders to focus on higher-value tasks like market analysis and strategy development.

- Reduced Risk: Advanced risk management tools help identify and mitigate potential risks, such as market volatility and counterparty defaults, improving overall portfolio stability.

- Increased Profitability: Trading technologies enable faster execution speeds, improved market access, and more informed trading decisions, leading to increased trading profits.

- Enhanced Compliance: Trading technologies ensure compliance with regulatory requirements and industry standards, reducing the risk of penalties and reputational damage.

- Competitive Advantage: Adopting cutting-edge trading technologies can provide a competitive edge by enabling quicker responses to market changes and improved execution capabilities.

Costs Associated with Trading Technologies

Implementing trading technologies involves significant costs, including:

- Software Licensing: The cost of acquiring and maintaining trading software licenses, which can vary depending on the features and functionalities offered.

- Implementation Costs: Costs associated with integrating the trading technology into existing infrastructure, including hardware upgrades, data migration, and system customization.

- Training Costs: Costs associated with training staff on how to use the new trading technology, including software tutorials, workshops, and ongoing support.

- Maintenance Costs: Ongoing costs for system updates, bug fixes, and technical support to ensure smooth operation and optimal performance.

- Data Costs: Costs associated with acquiring and storing market data required for trading analysis and decision-making.

Examples of Successful Trading Technology Implementations

Numerous financial institutions have successfully implemented trading technologies, resulting in significant improvements in their financial performance.

- High-Frequency Trading Firms: High-frequency trading firms utilize advanced algorithms and high-speed networks to execute trades at lightning speed, capitalizing on fleeting market opportunities. This has led to substantial profits for these firms, highlighting the potential of trading technologies in maximizing returns.

- Investment Banks: Investment banks have adopted trading technologies to automate order execution, manage risk, and improve compliance. These technologies have enabled them to optimize trading strategies, reduce operational costs, and enhance their competitive advantage in the market.

- Hedge Funds: Hedge funds employ sophisticated trading technologies to develop and implement complex trading strategies, including quantitative analysis and algorithmic trading. These technologies have allowed them to achieve higher returns and manage risk more effectively.

Calculating the Return on Investment

A crucial step in the cost-benefit analysis is calculating the return on investment (ROI) for trading technologies. This involves:

- Quantifying the benefits: Measuring the financial impact of the benefits, such as increased trading profits, reduced risk, and improved efficiency.

- Estimating the costs: Accurately determining the total costs associated with acquiring, implementing, and maintaining the trading technology.

- Calculating the ROI: Dividing the net benefits by the total costs to determine the return on investment.

The ROI formula is: ROI = (Net Benefits / Total Costs) x 100%

A positive ROI indicates that the benefits outweigh the costs, making the investment in trading technologies financially viable.

Emerging Trends in Trading Technologies Pricing

The landscape of trading technology pricing is undergoing a significant transformation, driven by the emergence of powerful new technologies and evolving market demands. This shift is shaping how traders access and utilize advanced tools, leading to new pricing models and influencing the overall cost structure of trading operations.

Impact of Cloud Computing, Artificial Intelligence, and Blockchain

The integration of cloud computing, artificial intelligence (AI), and blockchain technology is fundamentally altering the cost dynamics of trading technologies. Cloud-based platforms offer scalability and flexibility, enabling traders to access powerful computing resources on demand, reducing the need for substantial upfront investments in hardware and infrastructure. This shift towards pay-as-you-go models is making advanced trading technologies more accessible to a wider range of market participants.

AI algorithms are increasingly being deployed in trading systems, automating tasks, optimizing strategies, and enhancing decision-making. The development and deployment of AI-powered trading solutions can involve significant costs, but the potential returns on investment are attracting both established financial institutions and emerging fintech companies.

Blockchain technology, with its inherent transparency, security, and efficiency, is gaining traction in financial markets. Its application in areas such as settlement, clearing, and asset management is likely to reshape trading workflows and potentially lead to cost reductions through automation and streamlining of processes.

Rise of Subscription-Based Models and Pay-as-You-Go Options

Subscription-based models are becoming increasingly prevalent in the trading technology space. These models offer traders access to a suite of tools and services for a recurring fee, providing predictable and manageable costs. Subscription models often include regular updates and upgrades, ensuring that traders have access to the latest features and capabilities.

Pay-as-you-go options, similar to cloud computing models, allow traders to pay only for the resources they actually consume. This approach can be particularly beneficial for traders with fluctuating trading volumes or those who require access to specific tools or functionalities on an ad-hoc basis.

Potential Future Trends in Trading Technologies Pricing

The future of trading technology pricing is likely to be characterized by further innovation and diversification. The following trends are expected to shape the landscape:

- Increased use of micro-pricing: Trading technology providers may offer more granular pricing options, allowing traders to pay for specific features or functionalities on a per-use basis. This approach provides flexibility and cost control, enabling traders to tailor their technology subscriptions to their specific needs.

- Integration of AI-powered pricing models: AI algorithms could be employed to dynamically adjust pricing based on factors such as market volatility, trading volume, and user behavior. This could lead to more personalized pricing schemes that reflect the unique requirements of individual traders.

- Emergence of blockchain-based pricing mechanisms: Blockchain technology could be used to create transparent and auditable pricing systems, potentially leading to increased trust and efficiency in the trading technology market.

The implications of these trends for traders are significant. Increased access to affordable and flexible trading technologies can empower a wider range of market participants, fostering greater competition and innovation. However, it is crucial for traders to carefully evaluate the cost-benefit analysis of different pricing models and select the options that best align with their trading strategies and risk profiles.

Closing Summary

Understanding the pricing of trading technologies is crucial for any financial institution or individual trader seeking to optimize their operations and stay ahead of the curve. By carefully considering the cost-benefit analysis, staying abreast of emerging trends, and selecting the right technologies for their specific needs, market participants can leverage the power of technology to enhance their trading strategies and achieve their financial goals.

Trading technologies pricing can be complex, with factors like market data, risk management, and execution capabilities influencing costs. However, one key component often overlooked is the integration with treasury technology , which can streamline workflows and reduce operational costs. Ultimately, understanding the interplay between these areas is crucial for making informed decisions on trading technology investments.