Securities Technology: Transforming Finance

Securities technology sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. The securities […]

Securities technology sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. The securities industry, once characterized by manual processes and paper-based transactions, has undergone a dramatic transformation driven by technological advancements. This evolution has ushered in a new era of efficiency, transparency, and accessibility, profoundly impacting how securities are traded, regulated, and analyzed.

From the advent of electronic trading platforms to the emergence of blockchain and artificial intelligence, technology has revolutionized every aspect of the securities landscape. This exploration delves into the key technologies shaping the industry, examining their impact on trading practices, regulatory frameworks, and the future of finance.

Securities Regulation and Technology: Securities Technology

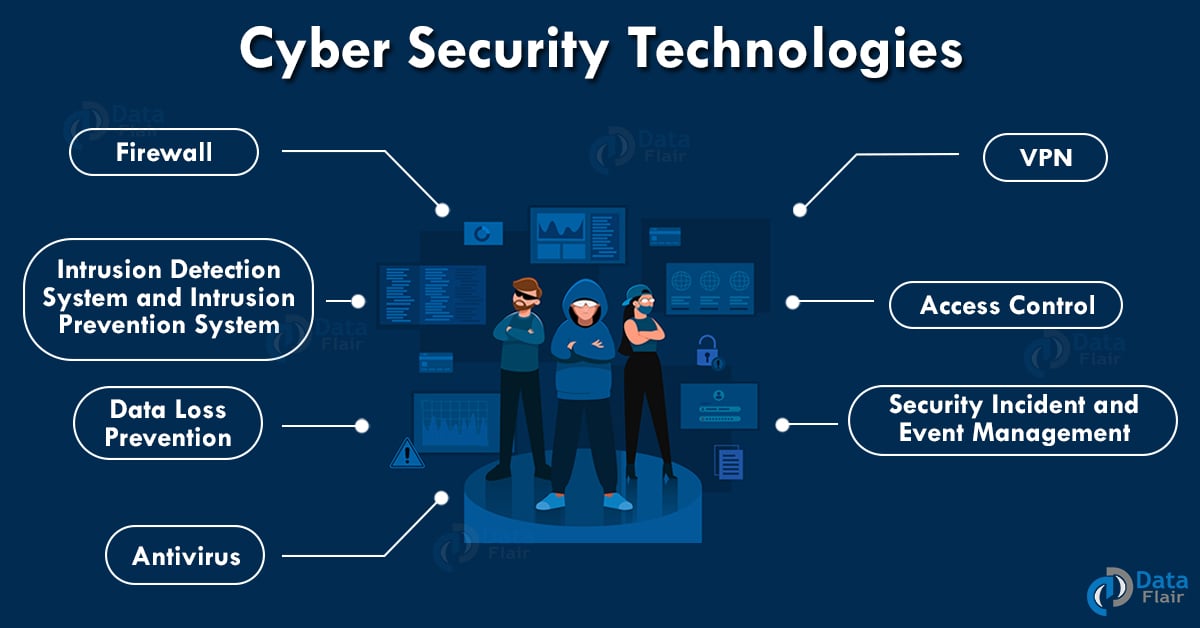

The rapid evolution of technology has significantly impacted the securities industry, necessitating a corresponding adaptation of regulatory frameworks. This section delves into how securities regulations are evolving in response to technological advancements, particularly in areas like cybersecurity, data privacy, and market surveillance. It also examines the role of regulatory technology (RegTech) in streamlining compliance processes and enhancing regulatory oversight, and analyzes the impact of technology on the enforcement of securities laws and regulations.

Evolution of Securities Regulations

The intersection of technology and securities regulation is a dynamic landscape, driven by the need to balance innovation with investor protection. Traditional regulatory frameworks are being challenged by the emergence of new technologies, requiring a proactive approach to adapt and evolve. This evolution is evident in various aspects of securities regulation:

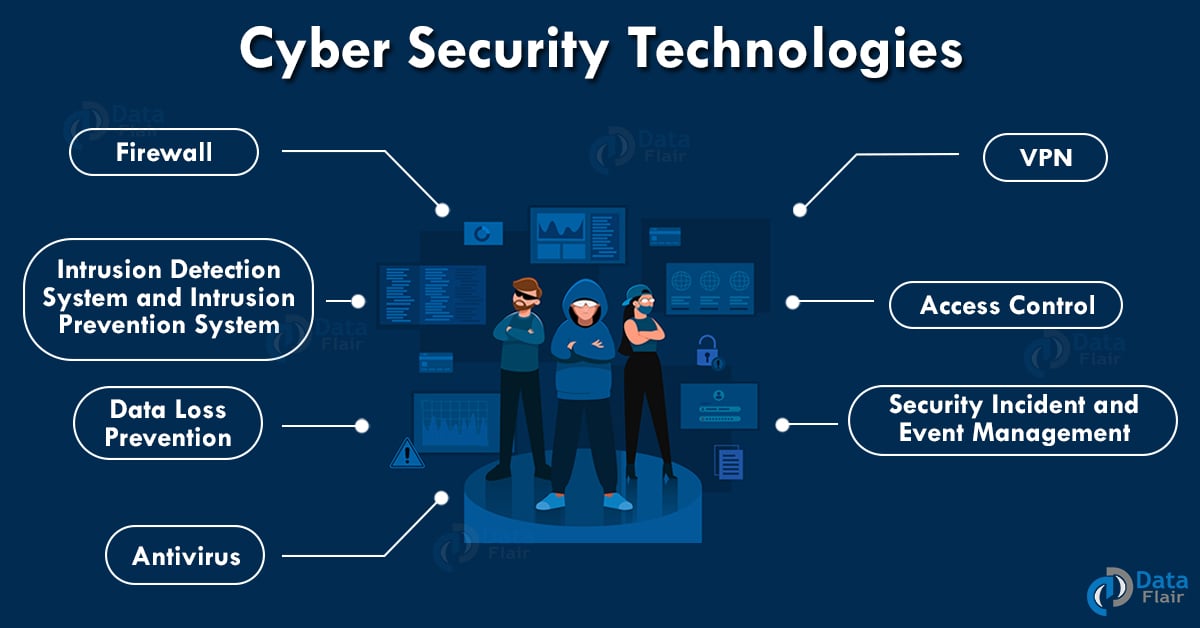

- Cybersecurity: The increasing reliance on digital platforms and data storage in the securities industry has heightened the risk of cyberattacks. Regulatory bodies are implementing stricter cybersecurity standards and regulations to mitigate these risks. This includes mandates for robust cybersecurity infrastructure, incident reporting requirements, and increased oversight of third-party service providers.

- Data Privacy: The collection, storage, and use of personal data by financial institutions have become critical aspects of securities trading and investment management. Regulations like the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) in the United States have imposed stringent data privacy requirements, impacting how securities firms handle sensitive information.

- Market Surveillance: Technological advancements have led to the emergence of new trading venues and algorithms, making it more challenging for regulators to monitor market activity for potential manipulation or fraud. To address this, regulators are employing advanced analytics and artificial intelligence (AI) tools to enhance market surveillance capabilities. This includes real-time monitoring of trading patterns, detection of suspicious transactions, and the ability to analyze large datasets for anomalies.

Future Trends in Securities Technology

The securities industry is undergoing a period of rapid transformation driven by technological advancements. Emerging technologies are poised to revolutionize market structure, trading practices, and investor behavior, shaping the future landscape of the industry.

Decentralized Finance (DeFi)

Decentralized finance (DeFi) is a rapidly growing segment of the financial services industry that leverages blockchain technology to create open, transparent, and accessible financial applications. DeFi platforms enable users to access a range of financial services, including lending, borrowing, trading, and insurance, without the need for intermediaries.

- Smart Contracts: DeFi platforms utilize smart contracts, self-executing agreements stored on a blockchain, to automate financial transactions, eliminating the need for intermediaries and reducing costs.

- Tokenization: DeFi allows for the tokenization of assets, representing ownership of real-world assets on a blockchain. This enables fractional ownership, increased liquidity, and new investment opportunities.

- Transparency and Security: Blockchain technology provides a transparent and immutable record of transactions, enhancing security and trust in DeFi platforms.

DeFi’s impact on the securities industry is expected to be significant. DeFi platforms could provide alternative venues for trading securities, enabling investors to access new markets and investment opportunities. The use of smart contracts could streamline and automate processes, reducing costs and increasing efficiency. Furthermore, DeFi’s focus on transparency and security could enhance investor confidence and trust in the financial system.

Tokenization

Tokenization involves representing real-world assets, such as securities, as digital tokens on a blockchain. This process enables fractional ownership, increased liquidity, and enhanced accessibility for investors.

- Fractional Ownership: Tokenization allows investors to purchase fractional ownership of assets, providing access to investments that were previously only available to high-net-worth individuals.

- Increased Liquidity: By representing assets as digital tokens, tokenization can enhance liquidity, making it easier to buy and sell securities.

- New Investment Opportunities: Tokenization opens up new investment opportunities, enabling investors to access a wider range of assets, including real estate, art, and commodities.

Tokenization has the potential to transform the securities industry by creating a more efficient and accessible market for investors. It could lead to the development of new trading platforms, facilitate the creation of innovative investment products, and increase the overall efficiency of capital markets.

Quantum Computing, Securities technology

Quantum computing is a rapidly evolving field that leverages the principles of quantum mechanics to solve complex problems that are beyond the capabilities of traditional computers. Quantum computers have the potential to revolutionize various industries, including finance.

- Risk Management: Quantum computing can enhance risk management by enabling more accurate and efficient modeling of complex financial instruments and markets.

- Portfolio Optimization: Quantum algorithms can optimize investment portfolios by identifying optimal asset allocations based on complex risk and return parameters.

- Fraud Detection: Quantum computing can enhance fraud detection capabilities by analyzing large datasets and identifying anomalies that traditional methods might miss.

While still in its early stages, quantum computing has the potential to transform the securities industry by enabling more sophisticated and efficient financial modeling, risk management, and fraud detection.

Hypothetical Scenario: The Securities Industry in 2030

In the next decade, the securities industry is likely to be significantly different due to technological advancements. DeFi platforms could become mainstream, offering a wide range of financial services to investors. Tokenization could revolutionize the trading of securities, making it more efficient and accessible. Quantum computing could enhance risk management, portfolio optimization, and fraud detection capabilities.

- Decentralized Exchanges: DeFi platforms could become the dominant trading venues for securities, offering lower costs, increased transparency, and faster settlement times.

- Tokenized Securities: Securities could be predominantly tokenized, enabling fractional ownership, increased liquidity, and new investment opportunities.

- AI-Powered Investment Management: AI and machine learning algorithms could play a significant role in investment management, automating tasks, providing personalized investment advice, and enhancing portfolio optimization.

- Enhanced Security and Compliance: Blockchain technology could enhance security and compliance in the securities industry, providing a transparent and immutable record of transactions.

This hypothetical scenario highlights the potential impact of emerging technologies on the securities industry. These advancements could lead to a more efficient, transparent, and accessible financial system, benefiting both investors and institutions.

End of Discussion

As we navigate the ever-evolving landscape of securities technology, one thing is certain: innovation will continue to drive the industry forward. The integration of cutting-edge technologies like blockchain, AI, and quantum computing promises to further enhance market efficiency, reduce costs, and empower investors. The future of securities technology holds immense potential, and its impact on the financial world will be nothing short of transformative.

Securities technology is constantly evolving, driven by the need for faster and more efficient transactions. A key area of innovation is in the realm of gate technologies , which play a crucial role in managing the flow of information and orders within financial markets.

These technologies ensure the integrity and security of trades, ultimately contributing to a more robust and reliable securities ecosystem.