Brokerage Technology: Revolutionizing Finance

Brokerage technology has taken center stage in the financial world, transforming how investors interact with markets and manage their portfolios. From the days of traditional stockbrokers and physical trading floors, […]

Brokerage technology has taken center stage in the financial world, transforming how investors interact with markets and manage their portfolios. From the days of traditional stockbrokers and physical trading floors, the industry has undergone a dramatic evolution, driven by advancements in computing power, connectivity, and software development.

This evolution has led to a new era of online brokerage platforms, offering investors a wide range of tools and services previously inaccessible to the average individual. These platforms empower investors with real-time market data, sophisticated analysis tools, and automated trading capabilities, democratizing access to financial markets and making investing more accessible and efficient than ever before.

Impact of Technology on Brokerage Services

The advent of technology has revolutionized the brokerage industry, making financial markets more accessible and efficient than ever before. Technology has empowered individual investors, improved transparency, and reduced costs, transforming the landscape of investment services.

Democratization of Financial Markets, Brokerage technology

Technology has played a pivotal role in democratizing access to financial markets. Prior to the widespread adoption of online platforms, investing was often restricted to high-net-worth individuals or those with access to traditional brokerage firms. However, the rise of online brokerages and mobile trading apps has lowered barriers to entry, allowing individuals with limited capital to participate in the market.

- Online platforms offer user-friendly interfaces, educational resources, and access to a wide range of investment products, empowering individuals to manage their investments independently.

- Mobile trading apps have further extended accessibility, enabling investors to trade on the go, anytime, anywhere.

- The availability of fractional shares, which allow investors to purchase small portions of stocks, has made investing in high-priced companies more attainable for individuals with limited funds.

Efficiency, Transparency, and Cost-Effectiveness

Technology has significantly improved the efficiency, transparency, and cost-effectiveness of brokerage services.

- Automated processes, such as order execution and portfolio management, have streamlined operations, reducing manual errors and processing time.

- Real-time market data and analysis tools provide investors with immediate access to information, enabling them to make informed investment decisions.

- Online platforms have increased transparency by providing investors with access to detailed account information, trade history, and performance metrics.

- The competition among online brokerages has driven down trading commissions and fees, making investing more affordable for individuals.

Innovative Services Enabled by Technology

Technology has paved the way for innovative brokerage services that cater to diverse investor needs and preferences.

- Robo-advisors, powered by algorithms, provide automated investment advice and portfolio management services, particularly appealing to investors seeking a hands-off approach.

- Algorithmic trading, which utilizes computer programs to execute trades based on predefined rules, enables investors to capitalize on market opportunities with speed and precision.

- Fractional shares, as mentioned earlier, allow investors to buy portions of stocks, expanding investment options and reducing entry barriers.

Future Trends in Brokerage Technology

The brokerage industry is constantly evolving, driven by technological advancements that are transforming the way investors interact with financial markets. Emerging trends are shaping the future of brokerage services, offering investors greater accessibility, efficiency, and personalized experiences.

Artificial Intelligence (AI) and Machine Learning

AI and machine learning are revolutionizing brokerage services by automating tasks, providing data-driven insights, and enhancing the overall investor experience.

- Algorithmic Trading: AI-powered algorithms can execute trades at lightning speed, based on pre-defined parameters and real-time market data, potentially optimizing returns and minimizing risks.

- Personalized Investment Recommendations: AI algorithms can analyze an investor’s financial profile, risk tolerance, and investment goals to provide personalized recommendations, tailoring investment strategies to individual needs.

- Fraud Detection and Prevention: AI algorithms can identify suspicious activities and potential fraud attempts, enhancing security measures and protecting investors from financial losses.

Blockchain and Cryptocurrency Trading

Blockchain technology is gaining traction in the financial industry, offering a secure and transparent platform for cryptocurrency trading.

- Decentralized Exchanges: Blockchain-based exchanges eliminate the need for intermediaries, allowing investors to trade cryptocurrencies directly with each other.

- Smart Contracts: Automated contracts on the blockchain can facilitate seamless and secure transactions, eliminating the need for manual verification and reducing the risk of errors.

- Tokenized Securities: Blockchain technology enables the tokenization of traditional assets, such as stocks and bonds, allowing for fractional ownership and increased liquidity.

Personalized Financial Advice and Robo-Advisory Services

Robo-advisory services utilize AI and algorithms to provide automated financial advice and portfolio management, making investment accessible to a wider audience.

- Automated Portfolio Management: Robo-advisors use algorithms to create and manage investment portfolios based on an investor’s risk tolerance, goals, and financial situation.

- Cost-Effective Solutions: Robo-advisory services often have lower fees compared to traditional financial advisors, making investment more affordable for individuals with smaller portfolios.

- 24/7 Accessibility: Robo-advisors provide access to financial advice and portfolio management services anytime, anywhere, through online platforms.

Enhanced Security and Fraud Prevention Measures

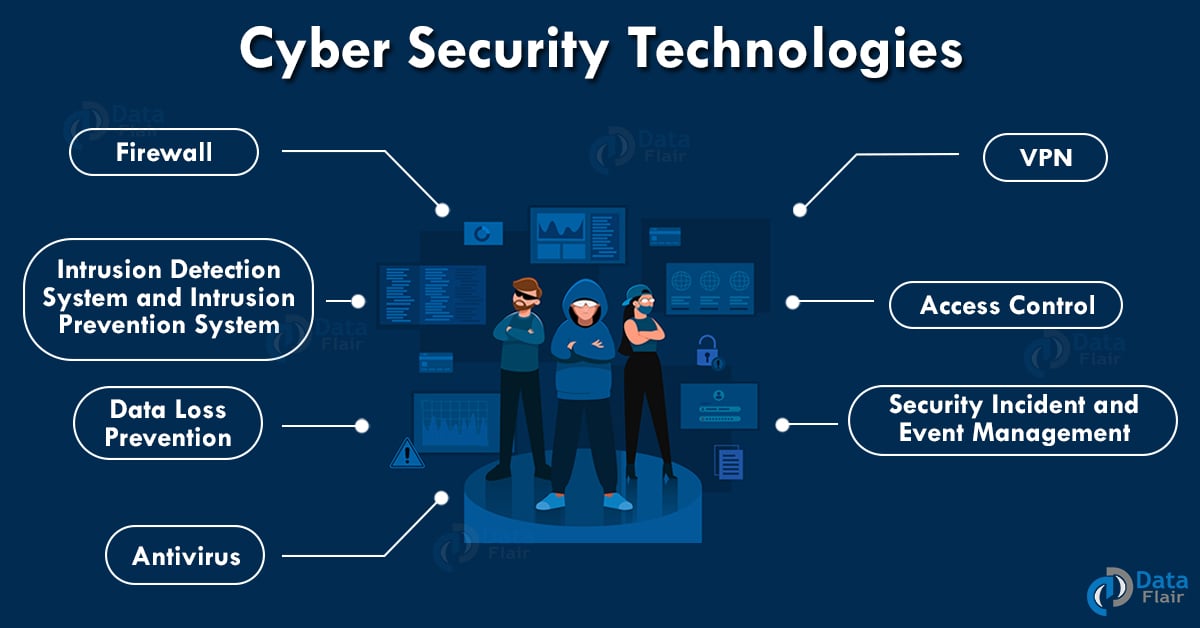

As the financial landscape becomes increasingly digital, brokerage platforms are implementing advanced security measures to protect investors from cyber threats and fraud.

- Multi-Factor Authentication: Requiring multiple forms of authentication, such as passwords, biometrics, and one-time codes, strengthens account security.

- Encryption: Encrypting sensitive data, such as personal information and financial transactions, ensures privacy and protects against unauthorized access.

- Real-Time Monitoring: Advanced monitoring systems can detect suspicious activities and potential fraud attempts, allowing for prompt intervention and mitigation of risks.

Future-Proof Brokerage Platform Concept

A future-proof brokerage platform should seamlessly integrate these emerging trends to provide a comprehensive and innovative investment experience.

- AI-Powered Personalized Recommendations: Leverage AI algorithms to analyze individual investor profiles and provide tailored investment recommendations, taking into account risk tolerance, financial goals, and market trends.

- Blockchain-Enabled Cryptocurrency Trading: Offer a secure and transparent platform for cryptocurrency trading, utilizing smart contracts and decentralized exchanges to enhance efficiency and reduce costs.

- Robo-Advisory Services: Provide automated portfolio management services, offering cost-effective and accessible investment solutions for individuals with varying financial backgrounds.

- Enhanced Security and Fraud Prevention: Implement robust security measures, including multi-factor authentication, encryption, and real-time monitoring, to protect investor data and prevent unauthorized access.

- Seamless User Experience: Design an intuitive and user-friendly platform that provides a seamless and personalized experience across all devices.

Challenges and Opportunities in Brokerage Technology

The integration of technology into brokerage services presents a myriad of challenges and opportunities. While technology offers immense potential for efficiency, innovation, and growth, it also introduces complexities that require careful consideration and strategic implementation. This section delves into the challenges and opportunities that brokerage firms face in navigating the evolving technological landscape.

Challenges in Adopting and Integrating New Technologies

The adoption and integration of new technologies pose significant challenges for brokerage firms. These challenges stem from various factors, including the need for robust infrastructure, cybersecurity concerns, regulatory compliance, and the ever-changing technological landscape.

- Infrastructure Requirements: Implementing new technologies often requires significant investments in upgrading existing infrastructure, including hardware, software, and network connectivity. This can be a substantial financial burden for smaller brokerage firms, especially those with limited resources. Moreover, maintaining and updating infrastructure to keep pace with rapidly evolving technologies can be a continuous challenge.

- Cybersecurity Risks: As brokerage firms increasingly rely on technology, they become more vulnerable to cybersecurity threats. Data breaches and cyberattacks can result in significant financial losses, reputational damage, and legal liabilities. This necessitates robust cybersecurity measures, including firewalls, intrusion detection systems, and employee training, which can be expensive and complex to implement and maintain.

- Regulatory Compliance: The financial services industry is heavily regulated, and regulatory compliance is a crucial aspect of brokerage operations. New technologies can introduce new compliance challenges, requiring firms to adapt their processes and systems to meet evolving regulations. Keeping abreast of changing regulations and ensuring compliance can be a time-consuming and resource-intensive process.

- Adapting to Technological Advancements: The rapid pace of technological advancements creates a constant need for brokerage firms to adapt their systems and processes. Staying ahead of the curve requires continuous investment in research and development, employee training, and the ability to quickly adopt new technologies. This can be a significant challenge for firms with limited resources and expertise.

Opportunities for Innovation and Growth

Despite the challenges, technology presents numerous opportunities for innovation and growth in the brokerage industry. These opportunities can lead to increased efficiency, improved customer experiences, and expanded market reach.

- Automated Trading and Investment Management: Advancements in artificial intelligence (AI) and machine learning (ML) have enabled the development of automated trading platforms and robo-advisors. These technologies can help investors make informed decisions, manage their portfolios more effectively, and reduce trading costs. For example, robo-advisors can provide personalized investment recommendations based on an individual’s risk tolerance, financial goals, and investment horizon.

- Enhanced Customer Experience: Technology can enhance the customer experience by providing greater accessibility, personalized services, and real-time information. Mobile apps, online portals, and chatbots allow investors to access their accounts, trade securities, and receive personalized financial advice from anywhere at any time. This convenience and personalized service can attract new clients and increase customer satisfaction.

- Data Analytics and Insights: Technology enables brokerage firms to collect and analyze vast amounts of data, providing valuable insights into market trends, customer behavior, and investment strategies. This data-driven approach can help firms identify opportunities, manage risk, and develop innovative products and services. For instance, data analytics can be used to identify emerging investment themes, assess market sentiment, and personalize investment recommendations.

- Expansion into New Markets: Technology can help brokerage firms expand their reach into new markets and customer segments. Online platforms and mobile apps can provide access to investors in geographically dispersed locations, enabling firms to tap into new markets and expand their client base. For example, online brokerage platforms have made it easier for investors in emerging markets to access global investment opportunities.

Regulatory Landscape and its Impact

The regulatory landscape plays a significant role in shaping the development and adoption of brokerage technology. Regulators are constantly evolving their rules and regulations to address the challenges and opportunities presented by new technologies.

- Cybersecurity Regulations: Regulators are increasingly focusing on cybersecurity, requiring brokerage firms to implement robust security measures to protect customer data and prevent cyberattacks. For example, the General Data Protection Regulation (GDPR) in the European Union imposes strict data protection requirements on companies handling personal data.

- Financial Technology (FinTech) Regulations: Regulators are developing specific rules and regulations for FinTech companies, including those operating in the brokerage industry. These regulations aim to balance innovation with consumer protection and financial stability. For instance, the Securities and Exchange Commission (SEC) in the United States has issued guidance on the use of robo-advisors and other FinTech platforms.

- Data Privacy and Security: Regulators are emphasizing data privacy and security, requiring brokerage firms to implement measures to protect customer data from unauthorized access and use. This includes complying with regulations like the California Consumer Privacy Act (CCPA) and the European Union’s GDPR.

Final Review

The future of brokerage technology is brimming with exciting possibilities, with artificial intelligence, blockchain, and personalized financial advice poised to further revolutionize the industry. As these technologies mature and become more widely adopted, investors can expect even greater transparency, efficiency, and personalized experiences, ushering in a new era of financial empowerment. The impact of brokerage technology on the financial landscape is undeniable, and its evolution promises to continue shaping the future of investing for years to come.

Brokerage technology has evolved significantly, offering sophisticated tools for traders and investors. This evolution extends beyond traditional financial instruments, encompassing even the seemingly unrelated field of aroma technologies. For example, the integration of scent-based data into trading algorithms could potentially provide insights into consumer behavior and market trends, further enhancing the power of brokerage technology.